| 19-3-2019 | Carlo de Meijer | treasuryXL

Though blockchain is not yet well understood by many treasury people, and tangible real-world applications for the corporate treasurer’s day-to-day activities are still scarce, this technology is getting increased interest in the treasury world.

In August 2016 I wrote a blog in Finextra named “The Corporate Treasurer and Blockchain”. My conclusions at that time were that blockchain had the potential to fundamentally change the treasury function at corporates. For some it would even going to be a game-changer for treasury. The change might not be here yet, but it is coming, and treasurers need to take a long view on it.

But that is changing rapidly. The focus of blockchain developers is now turning from proof of concept projects to the creation of more practical, treasury-focused blockchain solutions. Recently we have seen a number of blockchain-based treasury trials that are worthwhile looking at. Last December R3 announced the completion of testing on a new blockchain-based KYC proof-of-concept, which was facilitated in collaboration with the French Association of Corporate Treasurers and a number of French banks.

One of the solutions that triggered me most is Smart Treasury by Boston-based fintech Adjoint, that is aimed to enable real-time gross settlement and continuous reconciliation and improve the liquidity management of the corporate treasurer. Main question is, could Adjoint’s solution be a break-through for blockchain in the corporate treasury world?

It is always interesting – and I am a very curious person – to see new initiatives in the blockchain scene and what they could bring for corporates esp. the treasury department.

So let’s have a deeper dive.

Complex treasury environment

Internationally operating corporates have undergone many transformations in their finance and treasury organisations triggered by technology innovations, regulatory initiatives and changed client behaviours. As a result today’s business environment for these corporates is highly complex from a treasury point of view.

In the digital era, real-time insight into a company’s global cash positions and managing credit facilities across all bank accounts of the group and the ability to move money intraday to where and when it is needed is increasingly needed to support this changing business environment.

Key challenge is to obtain consolidated information of group-wide multi-currency positions across a fragmented banking network in a timely manner. Today’s model of international correspondent banking however does not easily facilitate the ability to manage cash in a real-time environment.

Corporate treasurers are urgently looking for new ways to provide cash management with up to date – and if possible real time – information on cash positions and cash forecasts faster and with deeper insight, allowing corporate treasurers to better react to the company’s current cash and working capital needs.

In this context, they are significantly increasing their spending on treasury technology and innovations, to speed up and streamline their company’s cash, liquidity, risk and working capital management, in order to gain greatest visibility over their business critical function and reach greater strategic control.

Adjoint’s Smart Treasury: what does it bring for corporate treasurers?

Adjoint’s Smart Treasury solution, that was launched last year, contains a number of unique specifics that makes it very interesting for corporate treasures.

Smart Treasury should be seen as a multi-bank, multi-currency virtual account platform for real-time gross settlement and continuous reconciliation. This should allow corporate treasurers to untap liquidity in their various subsidiaries’ bank account.

Adjoint has combined blockchain technology with related smart contracts and APIs (or application programming interfaces) to create a solution that aims to dramatically speed up settling intercompany transactions in a secured way while significantly reducing the costs.

Most important features of this Smart Treasury solution are the following:

Distributed ledger: Auto reconciliation

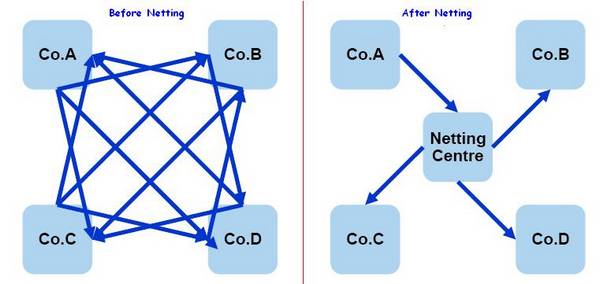

Smart Treasury uses distributed ledger technology to auto-reconcile transactions information, thereby eliminate netting processes and improve FX management to provide treasurers with streamlined efficiency and improved, real-time visibility on cash positions.

Virtual accounts

Another interesting feature is that it enables a limitless number of virtual or “sub-accounts” for reconciling customer and suppliers payments. Companies can thereby consolidate costly, physical bank accounts into a selected number of blockchain virtual accounts. Smart Treasury thereby enables “purposed drive allocation”, thereby using smart contracts to designate how much and where digitised cash can be spent from these virtual accounts.

“Money can then be debited or credited among those accounts as needed, using smart contracts and APIs to make the necessaire FX translations, apply interest on intercompany loans and similar calculations.” Somil Goyal chief operating officer at Adjoint

In-house self-service bank

Smart Treasury consists of an “always-on” in-house self-service bank with “pre-established” rules for automated intra-company transactions. Here you could think of limits on how much can be automatically borrowed by entities based on pre-established interest rates. Nowadays, intercompany transactions, often conducted via an in-house bank, have become essential for multinational corporations. They seek to leverage internal resources more effectively. However, the overnight batch systems most companies use to settle transactions, can limit the transparency into subsidiaries’ account balances.

Smart Treasury Dashboard: access

The solution allows corporate treasury departments to operate their own private distributed ledger. This may enable them to choose which internal corporate entities and third parties including customers and suppliers may have access to the network via their Smart Treasury Dashboard and settle transactions directly with them in real time, rather than overnight or even longer.

But also regulators could be added on the platform which may help notional pooling in jurisdictions with currency controls, while improving the regulatory reporting process by automatically updating records and centralising all information in the ledger.

Smart contracts

Another key feature of Smart Treasury is the use of smart contracts. The tool’s Smart Contracts System uses blockchain to help teams define and set pre-configured rules that securely enable automated, real time transactions. These may include key corporate treasury functions such as regulatory and corporate compliance requirements including KYC; account opening or transactions such as intercompany loans, FX and netting, manage liquidity in multiple currencies, transfers among any approved entities etc. so lowering the costs of booking transactions between subsidiaries.

API integration with corporate ERP and TMS systems

Smart Treasury offers a nearly real-time API-based integration with organisation’s existing systems. Instead of replacing systems such as enterprise resource planning (ERP) and Treasury management system (TMS), Smart Treasury works with current systems as an easy-to-be-integrated overlay, preventing duplicate entries. In fact Smart Treasury complement these, improving the way they interact by speeding up intercompany transaction settlement. Through using smart contracts, all transaction information is auto-reconciled and automatically posted into treasury management systems in real-time.

“With Adjoint’s solution this takes place much faster, at a much lower cost, and it will actuality accept feed from the banks using APIs, which then feed the ERP – again using API – and it carries all of the information necessaire through smart contracts”.Daniel Blumen, Partner of Treasury Alliance

API integration with banks

Smart Treasury also offers a real-time API-based integration with banks for transactions outside the organisation. The solution allows the use of APIs for real-time intra-day bank transactions processing as opposed to end of day batch processing. They enable the transfer of critical information and data between corporate entities and their banks and data providers, as well as between corporate entities within the corporate.

Read the full article of our expert Carlo de Meijer on LinkedIn

Carlo de Meijer

Economist and researcher

Netting is mainly used by global operating companies with a large number of subsidiaries; the reach of netting can however also include smaller company structures and save a lot of handling and costs.

Netting is mainly used by global operating companies with a large number of subsidiaries; the reach of netting can however also include smaller company structures and save a lot of handling and costs.

Jan Meulendijks – Cash management, transaction banking and trade professional

Jan Meulendijks – Cash management, transaction banking and trade professional Spreadsheets, every treasurer knows how to work them. Spreadsheets are deeply embedded in treasury operations and they seem hard to eliminate. We have read multiple articles on this subject lately and we decided to ask our community: Why do treasurers still rely on spreadsheets? (source:

Spreadsheets, every treasurer knows how to work them. Spreadsheets are deeply embedded in treasury operations and they seem hard to eliminate. We have read multiple articles on this subject lately and we decided to ask our community: Why do treasurers still rely on spreadsheets? (source:

Op 26 mei jongstleden was ik uitgenodigd om de door

Op 26 mei jongstleden was ik uitgenodigd om de door