| 26-03-2019 | treasuryXL | Cashforce | Nicolas Christiaen

Cash is often labeled as the lifeblood of an organization as it enables a company to function. However, when it comes to forecasting cash, most companies face various challenges. Afterall, it starts with the uncertainty of the future, but more factors are at play. Decisions about risk vs reward, the essence of business, can be difficult. To learn more about the complexity of the topic from first-hand data, we initiated the first Cash Forecasting Survey together with the Financial Executives Consulting Group. This survey was focused on senior financial and treasury executives. The 225 respondents are active across a variety of industries (manufacturing, energy, retail, telecommunications, health care, …) that range from smaller businesses (35% under $50 million revenue) to big corporations (28% over $1 billion revenue).

This survey aims to dig a little bit deeper into the challenges that companies are currently facing, the underlying causes of these difficulties, as well as possible future trends and technologies that could ease these challenges. The results of the survey will be discussed in-depth during a webinar on the 27st of March, 2019 (11am EST / 4pm CEST). To lift the veil slightly we’ve distilled our top 5 key insights below.

1. CASH FORECASTING REMAINS THE TOP ISSUE

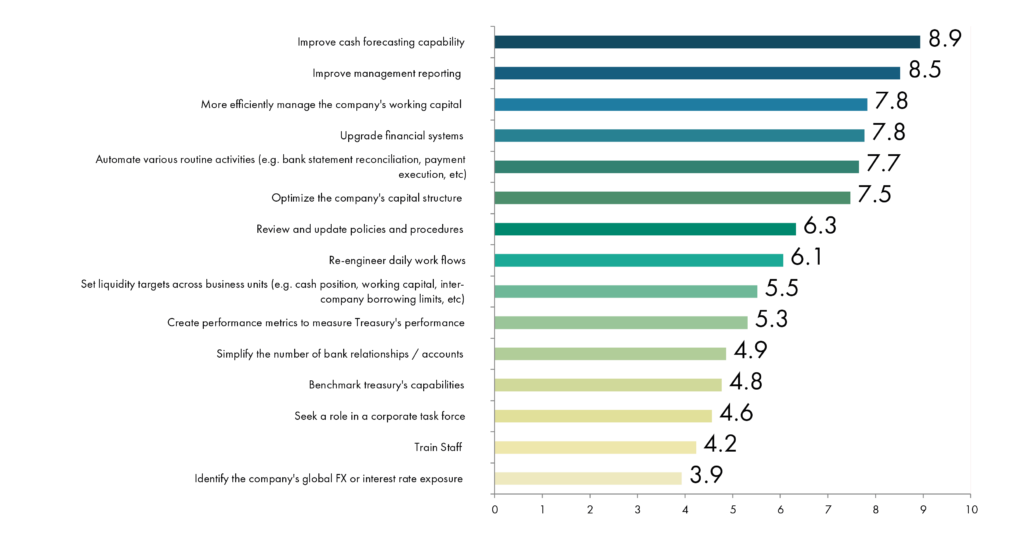

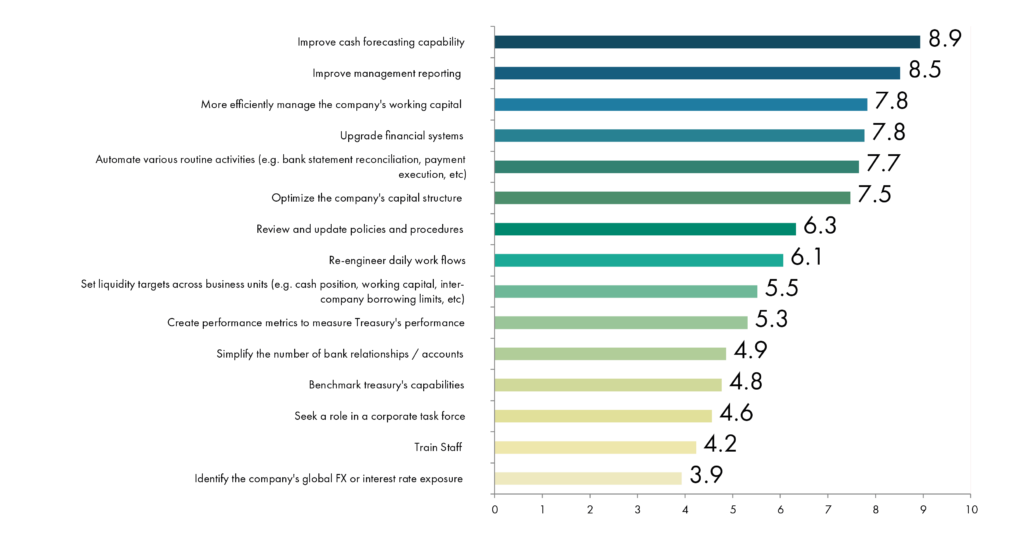

A company’s ability to forecast the future with any degree of certainty is determined by external factors (i.e. competitor’s actions, market conditions such as interest rates and local tax rates) or internal factors (availability of funds, staff available, technology in use, access to data etc.). Regardless of whether one is a pessimist or an optimist there should be very little to argue about the fact that cash forecasting is one of the central pillars of treasury, and therefore has been on the radar for improvement for many companies for a decade. The graph below hints at the current focus: Given the opportunity to rank the most important issues over the next year, “cash forecasting” comes out on top (34%). Furthermore, we see in the answers that there is a big focus on the outcome as such, as well as on improving the current processes that are at play (such as management reporting, upgrading financial systems).

WHAT IS THE MOST IMPORTANT ISSUE FOR YOUR COMPANY OVER THE NEXT YEAR?

2. TIME IS MONEY

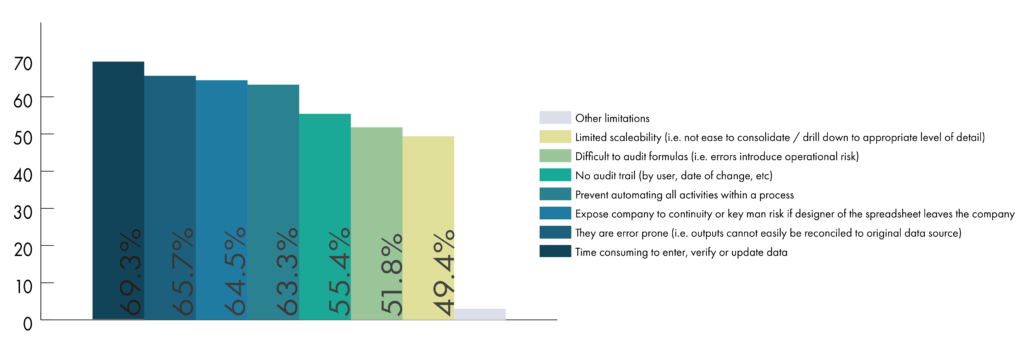

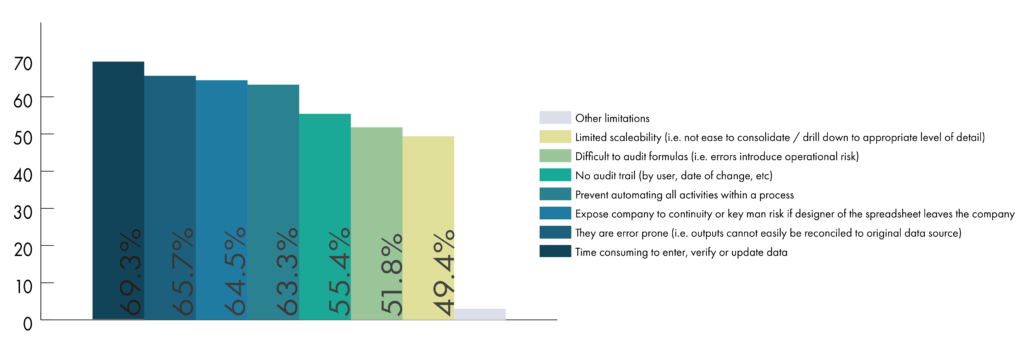

For the past decades, Excel has been integral to businesses everywhere. It’s embedded in countless processes throughout the company, including within finance and treasury departments. While spreadsheets remain popular as a tool to accomplish many tasks, even their users admit that they are error prone. Moreover, maintaining data integrity within spreadsheets can be a cumbersome and manual task since this type of technology was never meant to be an integrated solution to business issues (i.e. data from one spreadsheet almost never flows seamlessly into another spreadsheet).

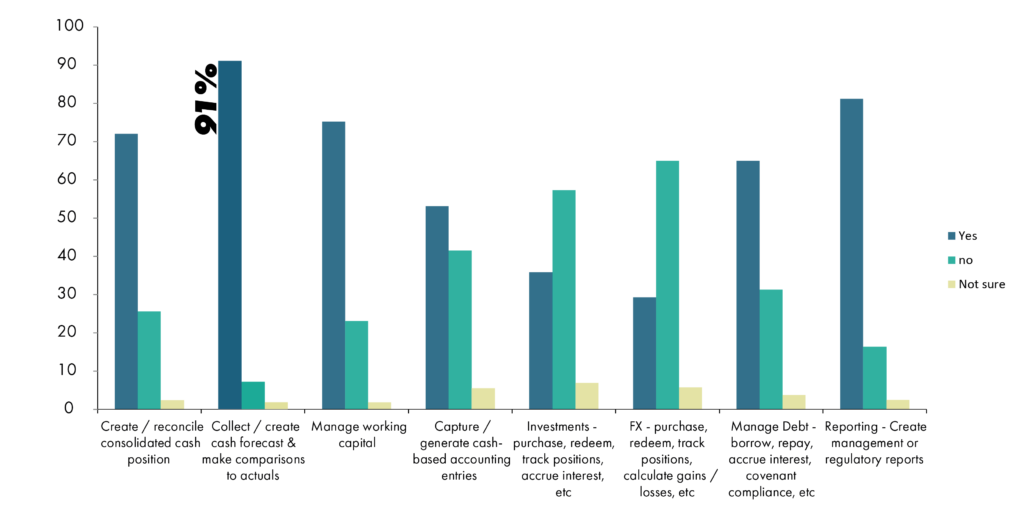

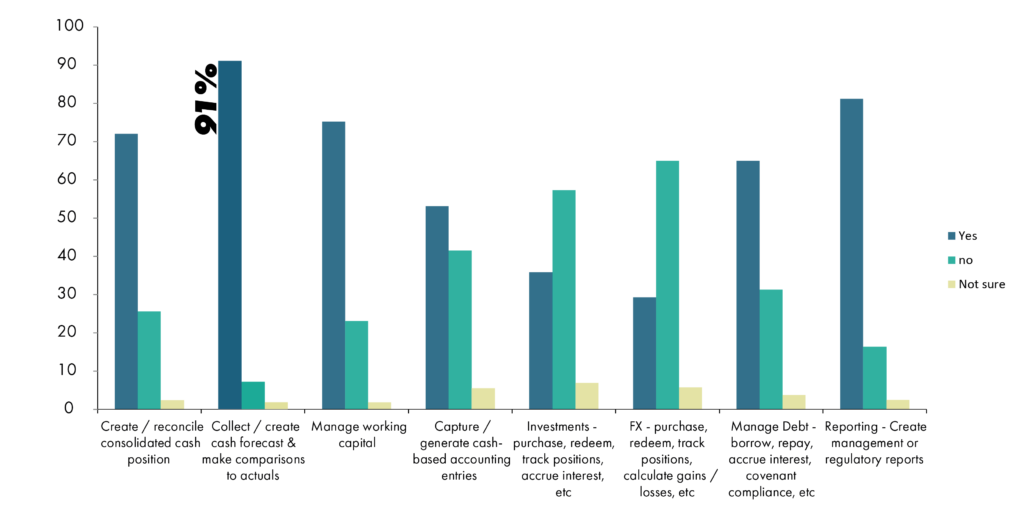

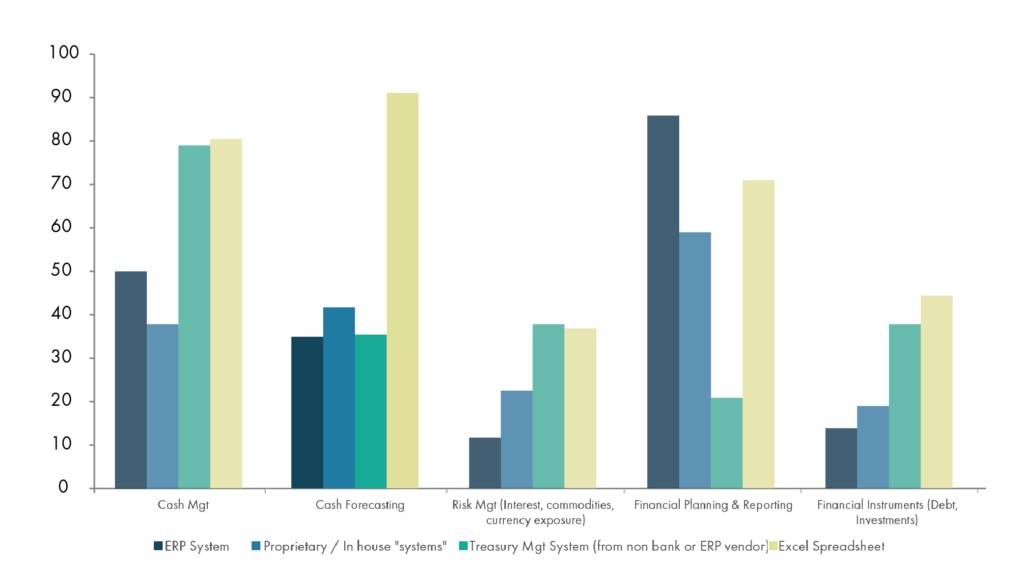

Nonetheless, as the graphic below lays out, more than 9 out of 10 respondents continue to use spreadsheets for collecting/creating cash forecasts & making comparisons to actuals. 69% of respondents however find the process too time consuming. On top of that, the graph clearly shows that this is the case in all surveyed treasury/finance areas. Overall, we can state there is still a great over reliance on spreadsheets, from cash forecast generation to debt management. Combined, these insights indicate a dire need for a better solution in the area of cash forecasting and treasury management.

DO YOU USE EXCEL SPREADSHEETS FOR THE FOLLOWING TASKS?

WHAT ARE THE LIMITATIONS OF USING SPREADSHEETS TO PERFORM?

3. PROCESSING AGAINST THE CLOCK

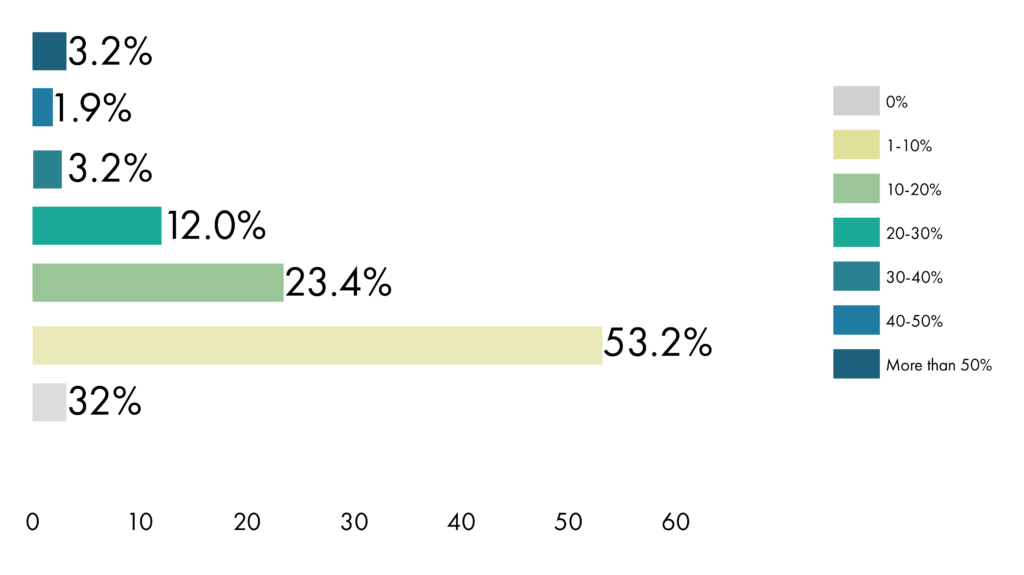

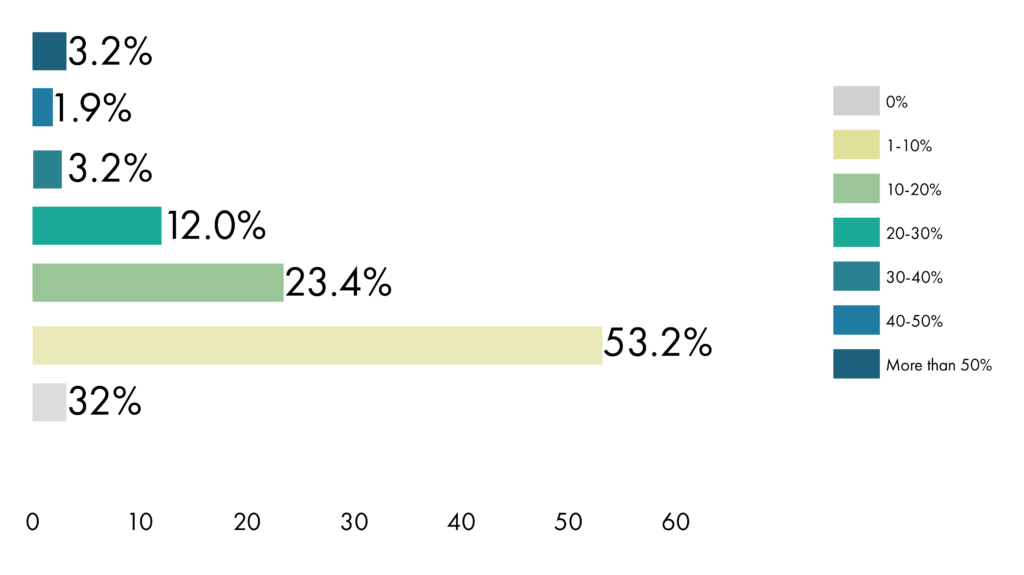

The following graph further illustrates how frustratingly long any spreadsheet driven forecast process can be. If we look at the distribution of respondents that spent more than 10% of their resources on creating/updating cash forecasts, we can see that 43% of respondents spend more than 2 hours a day on average on creating/updating cash forecasts. Naturally, with only limited resources available for processing, forecasts will be less than “perfect” until conditions are changed. Investing in “better” technology has been shown to help the forecasting process, but technology alone (i.e. working faster) is not a substitute for working smarter (i.e. more strategically) as the following survey observation makes clear.

WHAT PERCENTAGE OF STAFF RESOURCES ARE SPENT ON CREATING/UPDATING CASH FORECASTS?

4. A TMS IS NOT MADE FOR CASH FORECASTING

It cannot be said with certainty what the “perfect” allocation of resources devoted to processing vs planning / analysis should be in the forecasting process. As mentioned earlier there is a continued reliance on a disparate set of 1980s technology (i.e. spreadsheets) perhaps because they are easy to use and offer a certain degree of flexibility. However, basing your forecasting on technology that offers little in the way of scenario planning, ability to sum up / drill down through an organization or track change by date, user, etc. may constrain a company’s ability to measure its success.

In response to the weaknesses of spreadsheet driven forecasts many companies over the last decade have implemented a large number of Treasury Management Systems (TMS). Yet, the adoption of a TMS for forecasting purposes has been slow to occur. As the survey results show, more than 9 out of 10 respondents still use spreadsheets for cash forecasting, even when using a TMS. It is a surprising statistic and may indicate that a TMS maybe better at processing (e.g. cash positions, payment execution, cash accounting, etc.) than at planning / forecasting.

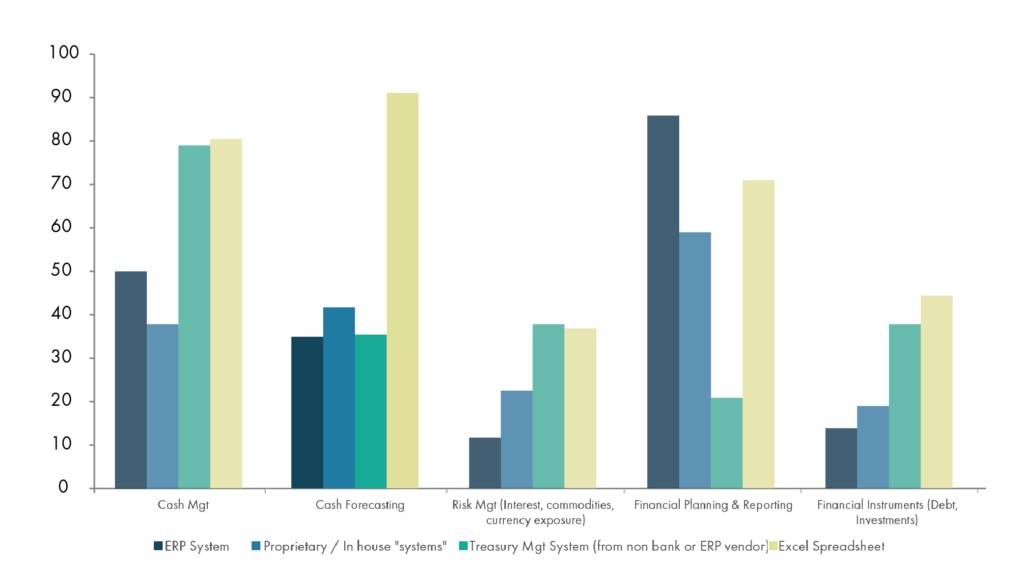

WHAT FINANCIAL SYSTEMS ARE USED WHEN PERFORMING THE FOLLOWING FUNCTIONS?

5. NO PROPER REWARD STRUCTURE BASED ON CASH FLOW

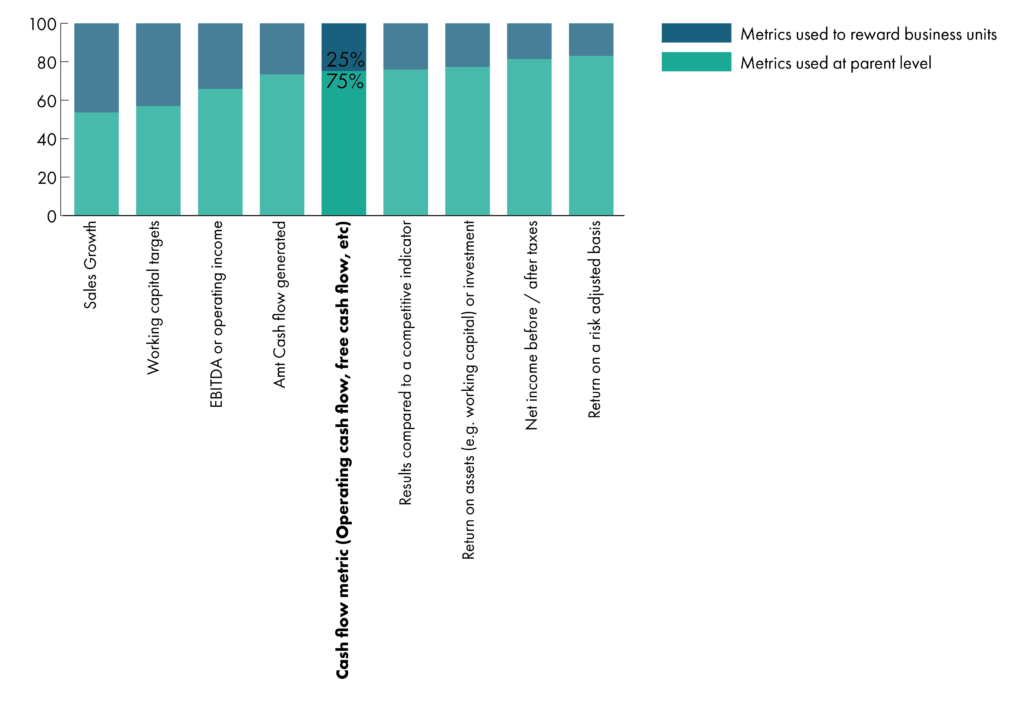

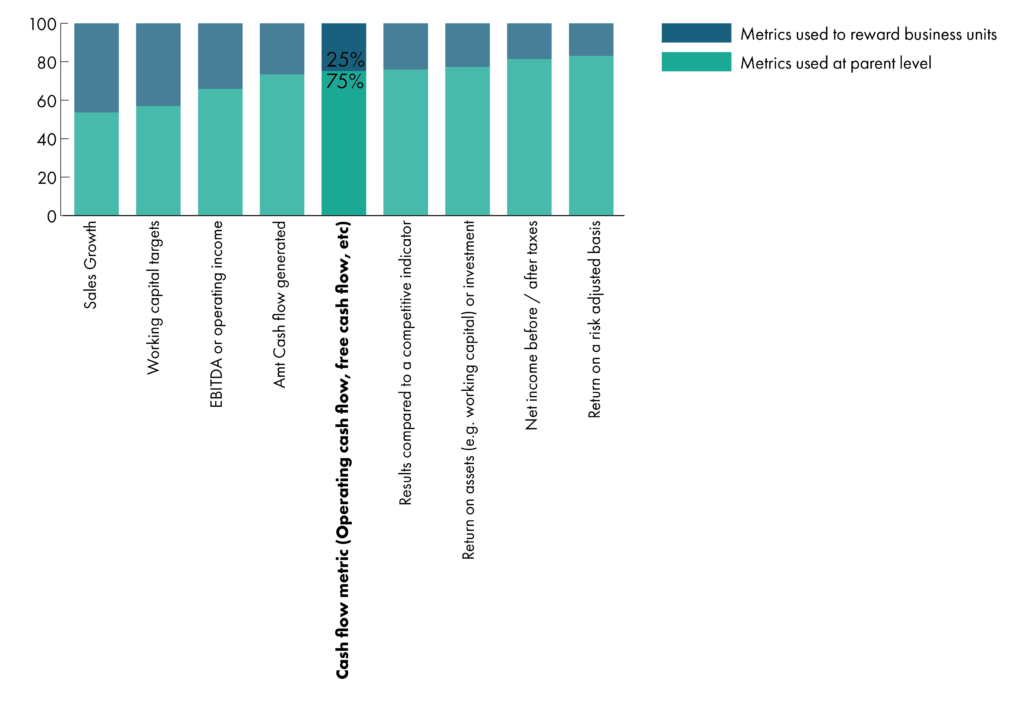

As seen in previous paragraphs, the processes involved in cash forecasting are mostly done manually and with error-prone tools and processes. As a result, companies frequently struggle to foresee unexpected occurrences that impact the livelihood of their business. Bridging these gaps can pose considerable risks and can be very costly to overcome. Consequentially, one would expect companies to put rewards in place for their business units in order to draw out valuable insights when it comes to cash flow. Yet, 3 out of 4 companies don’t reward their business units based on cash flow. Even among the large companies (i.e. revenue > 500MM) only 33% of companies reward their business units based on cash flows. It prompts the question: If cash forecasting ranks as the number one issue, how come it is rewarded as a by-product rather than a focal point?

WHICH METRICS BELOW DOES YOUR COMPANY USE AND WHICH ONES ARE USED TO REWARD ITS BUSINESS UNITS?

CONCLUSION

As the survey shows, cash flow forecasting is an important tool used by businesses to peer into the future and work towards accomplishing previously set profitability, liquidity and risk goals.

Unfortunately, all forecasts will be “wrong” as the future is uncertain and forces companies to navigate through a seemingly infinite sea of scattered data that only increases over time and becomes prone to human error as it accumulates up and down the organization.

Though no forecast will be perfect, any forecast requires a certain amount of dedicated resources (e.g. staff time throughout the company, integrated sets of data and the technology to turn data into information). If too many resources are devoted to processing then there will be less time remaining, possibly reducing the quality of actual decisions made. Few companies should base their strategic decisions based mostly on time left over as it may harm, not benefit the company. Depending on the size of the company, the following trends can be seen:

- At many large companies treasury departments have taken the lead on cash forecasting by beginning to replace their spreadsheets with more purpose-built applications such as a TMS, but even this type of system appears to have limitations, perhaps because it had its origins in processing transactions rather than comparing alternative futures and lacks real “what if” features.

- At small to medium sized companies FP & A areas are often responsible for cash forecasting, but, as the survey shows, spreadsheets are not the best forecasting tool and ERP systems contain only historical data that is difficult to extract and project into the future.

There is no definite answer to what mix of resources should be employed to achieve success, but relying on the current mix of disparate technologies doesn’t seem to be the answer. Fortunately, advances in new technology available to users through out a company are paving the way towards a clearer future, one driven by analytics, visualization, automation and transparency of data across an entire company.

Curious about additional findings from our survey? Be sure to register here for the webinar on the 27st of March, 2019 (11am EST / 4pm CEST) where we will discuss these and other findings and learn more about the challenges and solutions of Cash Forecasting.

[button url=”https://www.treasuryxl.com/contact/” text=”Contact us” size=”small” type=”primary” icon=”” external=”1″]

[separator type=”” size=”” icon=””]

It is a question that many companies have been asking themselves for the past few years. Innovative, dedicated technologies may be very exciting, but the question remains: Are they worth the investment?

It is a question that many companies have been asking themselves for the past few years. Innovative, dedicated technologies may be very exciting, but the question remains: Are they worth the investment? Cashforce

Cashforce