What future role for CSDs in blockchain post-trade environment?

| 05-04-2018 | Carlo de Meijer |

Blockchain technology enables real-time settlement finality in the securities world. This may mean the end of a number of players in the post trade area. For a long time, central securities depositories (CSDs), as intermediators in the post-trade processing chain, were expected to become obsolete. CSDs, but also other existing players in the post-trade environment, are however changing their mind on these new technologies and on their future position in the blockchain world. Increasing regulation, legacy systems and costs pressures, are drivers for CSDs to at least embrace some aspects of blockchain. They are increasingly considering them as enabler of more efficient processing of existing and new services, instead of a threat to their existence. It is interesting to see that some of these actors – who could be potentially big losers in a distributed ledger technology (DLT) or blockchain system – are open to innovation with blockchain and willing to invest in DLT. Last January SWIFT and seven CSDs worldwide agreed on a Memorandum of Understanding to explore the use of blockchain technology in the post trade process esp. e-proxy voting.

Blockchain technology enables real-time settlement finality in the securities world. This may mean the end of a number of players in the post trade area. For a long time, central securities depositories (CSDs), as intermediators in the post-trade processing chain, were expected to become obsolete. CSDs, but also other existing players in the post-trade environment, are however changing their mind on these new technologies and on their future position in the blockchain world. Increasing regulation, legacy systems and costs pressures, are drivers for CSDs to at least embrace some aspects of blockchain. They are increasingly considering them as enabler of more efficient processing of existing and new services, instead of a threat to their existence. It is interesting to see that some of these actors – who could be potentially big losers in a distributed ledger technology (DLT) or blockchain system – are open to innovation with blockchain and willing to invest in DLT. Last January SWIFT and seven CSDs worldwide agreed on a Memorandum of Understanding to explore the use of blockchain technology in the post trade process esp. e-proxy voting.

Where do CSDs stand now?

Complex and fragmented post-trade infrastructure

The current post-trade infrastructure is highly complex and fragmented, crowded with intermediaries, and dealing with outdated legacy systems and technologies. Much of the complexity and fragmentation of the post-trade world is the result of the various participants (custodians, issuers, registrars, CSDs) holding their own, separate ledgers in order to carry out the processes. Consequently, they spend much time and resources on reconciliation and risk management, in order to ensure that transactions can be (and are) appropriately carried out. The completion of securities transactions is as a result a costly and risky business. This has important consequences, efficiency-wise.

Situated at the end of the post-trading process, CSDs are systemically important intermediaries. In the post-trade process the CSDs play a special role both as a depository, involving the legal safekeeping and maintenance of securities in a ‘central depository’ on behalf of custodians, in materialised or dematerialised form; and for the, involving the issuance of further securities by issuers, and their onboarding onto CSDs’ platforms.

Is there a future for CSDs in a disruptive blockchain world?

Blockchain: disruption in securities post-trade

DLT has the potential to heavily disrupt existing post-trade processes in financial services, impacting the business model of a number of intermediaries. This raises significant questions for the present actors in the post-trade world as their role may change dramatically or even disappear. For some actors in the post-trade world, DLT could completely replace their businesses or even make them obsolete. And others should question what will be their added-value within future DLT services.

With blockchain, that is linking trading partners directly, everything will be in place in the ledger at the time of the transaction. Institutions will no longer have to maintain their own databases in the future with DLT, as there will be only one database for all participants in the transaction.

With DLT, all of the complex systems and processes to transfer cash and equities from one account to another are not required. Everything can be embedded into the blockchain. Buyers and sellers can match transactions in seconds and all parties are aware a transaction has been done. This will heavily ease the reconciliation process. Blockchain could ultimately become the standard for financial transactions and real-time settlements, increasing transparency and efficiency in a highly fragmented industry.

Read the full article of our expert Carlo de Meijer on LinkedIn

Economist and researcher

Almost a year ago I wrote my blog “Blockchain and the Ripple effect: did it Ripple?”. Now twelve months later we may conclude it did. And even more than that. Ripple is making many waves. A lot happened both in broadening their offerings and in enlarging their network. A growing number of banks and payment providers, increasingly join RippleNet, Ripple’s decentralized global network, to “process cross-border payments efficiently in real time with end-to-end tracking and certainty”. By using the growing set of Ripple solutions they are able to expand payments offerings into new markets that are otherwise too difficult or too expensive to reach. The focus of Ripple therefor has especially moved towards emerging markets.

Almost a year ago I wrote my blog “Blockchain and the Ripple effect: did it Ripple?”. Now twelve months later we may conclude it did. And even more than that. Ripple is making many waves. A lot happened both in broadening their offerings and in enlarging their network. A growing number of banks and payment providers, increasingly join RippleNet, Ripple’s decentralized global network, to “process cross-border payments efficiently in real time with end-to-end tracking and certainty”. By using the growing set of Ripple solutions they are able to expand payments offerings into new markets that are otherwise too difficult or too expensive to reach. The focus of Ripple therefor has especially moved towards emerging markets. On Tuesday 13th March 2018, RTL Z – a television channel – broadcast a “Cryptoshow” to explain how the Blockchain works and what it could mean for the future. They attempted to make the technology and information as simple as possible to show what uses the Blockchain could have in the world for consumers and businesses. One of the main areas of interest relates to Smart contracts. What are they? What are the advantages and disadvantages? What changes can they bring?

On Tuesday 13th March 2018, RTL Z – a television channel – broadcast a “Cryptoshow” to explain how the Blockchain works and what it could mean for the future. They attempted to make the technology and information as simple as possible to show what uses the Blockchain could have in the world for consumers and businesses. One of the main areas of interest relates to Smart contracts. What are they? What are the advantages and disadvantages? What changes can they bring? Long-time regulators world-wide took a wait-and-see attitude towards the non-regulated markets for Bitcoin and cryptocurrencies. But that is changing rapidly. With the growing popularity of the crypto market, the large number of unregulated cryptocurrencies (more than 1300, greater attention is now being paid by Governments and other stakeholders around the world.

Long-time regulators world-wide took a wait-and-see attitude towards the non-regulated markets for Bitcoin and cryptocurrencies. But that is changing rapidly. With the growing popularity of the crypto market, the large number of unregulated cryptocurrencies (more than 1300, greater attention is now being paid by Governments and other stakeholders around the world. There are various signals that a number of corporates are moving their blockchain projects towards production. We recently have seen the announcement of the IBM – Maersk project, to create a blockchain based corporate. If accepted in a sufficient way by the various players in the shipping industry supply chain that could mean a real breakthrough for blockchain and other distributed ledger technologies. “The big thing that is missing from this industry to digitize and unleash the potential of the technology is really to create a form of utility that brings standards across the entire ecosystem,” Maersk’s Chief Commercial Officer Vincent Clerc.

There are various signals that a number of corporates are moving their blockchain projects towards production. We recently have seen the announcement of the IBM – Maersk project, to create a blockchain based corporate. If accepted in a sufficient way by the various players in the shipping industry supply chain that could mean a real breakthrough for blockchain and other distributed ledger technologies. “The big thing that is missing from this industry to digitize and unleash the potential of the technology is really to create a form of utility that brings standards across the entire ecosystem,” Maersk’s Chief Commercial Officer Vincent Clerc. Payments is increasingly seen as an area that is ripe for disruption, having the potential to enhance payment processing. To overcome the current structural weaknesses in the payments area including low speed, high expenses, financial institutions are increasingly adopting the idea of blockchain or distributed ledger technology (DLT). This in order to offer (near) instant cross-border payments at lower costs, higher security and more reliability. Up till recently most of these trials have been non-interoperable stand-alone solutions. But that may change!

Payments is increasingly seen as an area that is ripe for disruption, having the potential to enhance payment processing. To overcome the current structural weaknesses in the payments area including low speed, high expenses, financial institutions are increasingly adopting the idea of blockchain or distributed ledger technology (DLT). This in order to offer (near) instant cross-border payments at lower costs, higher security and more reliability. Up till recently most of these trials have been non-interoperable stand-alone solutions. But that may change! Having spent my working life in international finance, I have patiently listened to all the news about the Bitcoin over the last few years. During 2017 whilst the Bitcoin was on a spectacular price rise, my interest was awakened in this new phenomenon – is this the future? I attended seminars, read articles, learnt the difference between the Bitcoin and the Blockchain, searched and investigated via the web, and tried to form an opinion. These are my findings:

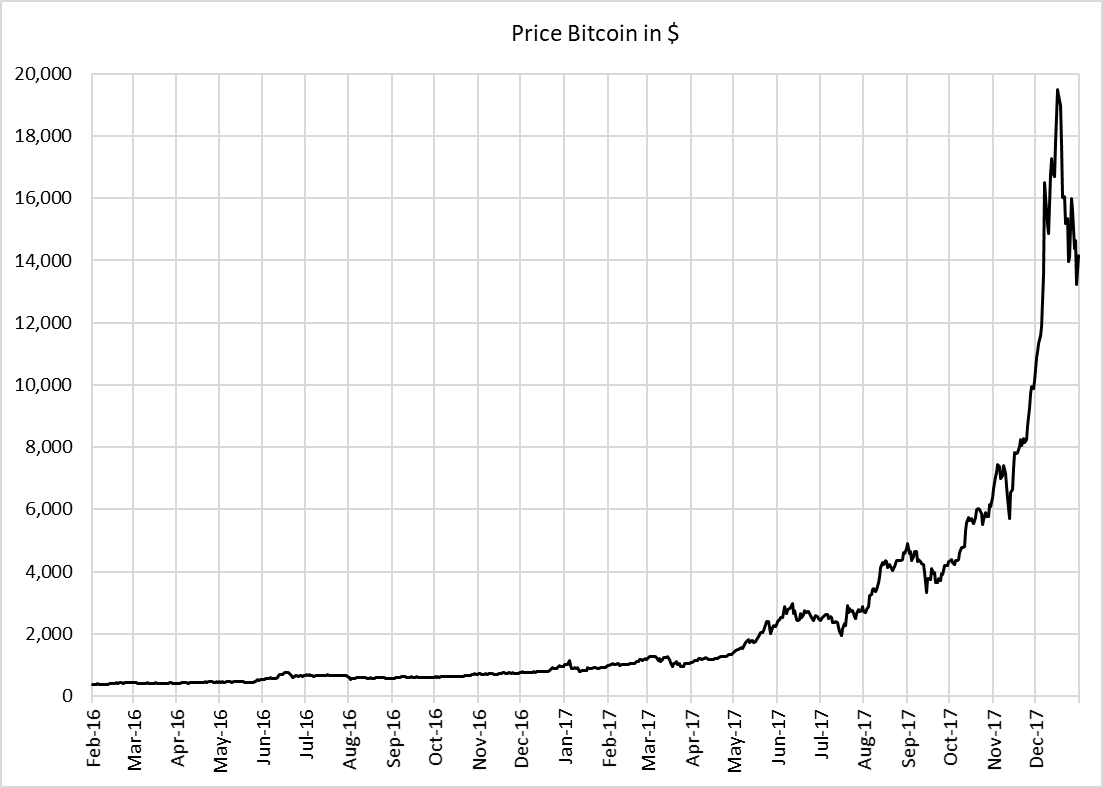

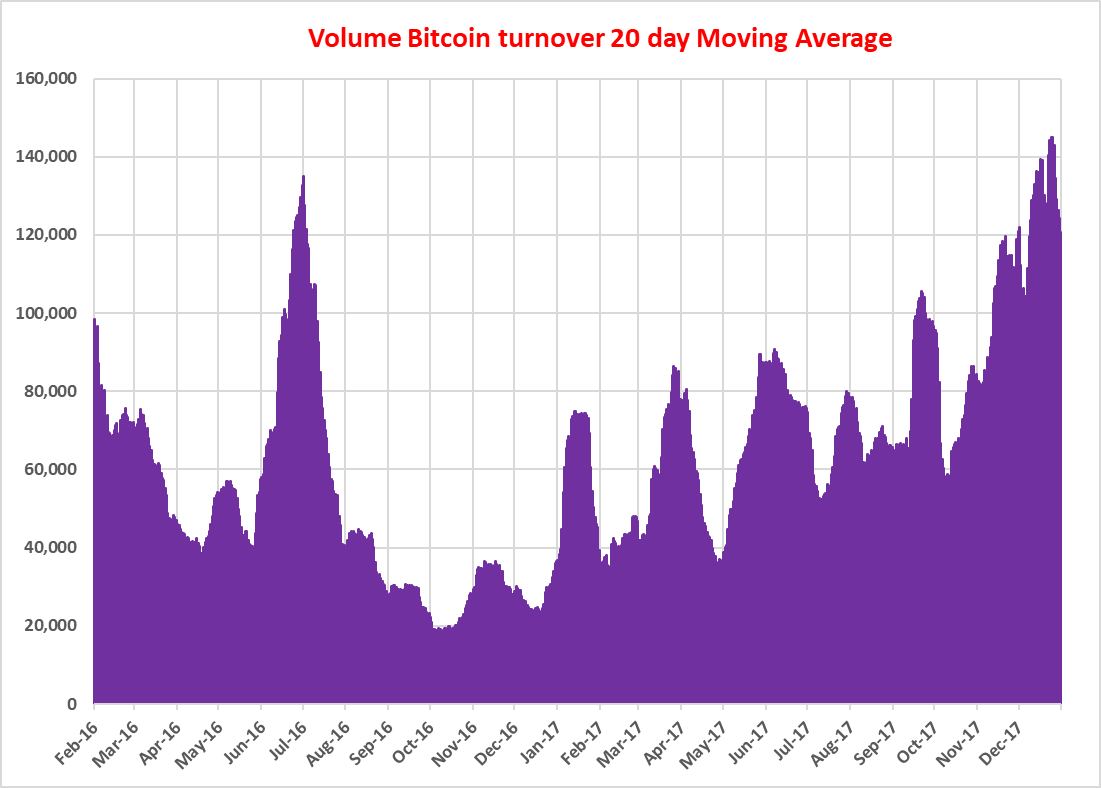

Having spent my working life in international finance, I have patiently listened to all the news about the Bitcoin over the last few years. During 2017 whilst the Bitcoin was on a spectacular price rise, my interest was awakened in this new phenomenon – is this the future? I attended seminars, read articles, learnt the difference between the Bitcoin and the Blockchain, searched and investigated via the web, and tried to form an opinion. These are my findings: Such a stellar performance should mean that the trade volume has increased dramatically.

Such a stellar performance should mean that the trade volume has increased dramatically. The daily volume in September 2017 when the price was about $4,000 was the same as the start of February 2016 when the price was about $400. I had to create this chart as all the data I could find related to the $ value of turnover – which was phenomenal – and not the actual number of Bitcoins traded. Normally, when an asset sees a huge increase in price, this goes together with a corresponding increase in turnover. Clearly this has not happened with Bitcoin – why?

The daily volume in September 2017 when the price was about $4,000 was the same as the start of February 2016 when the price was about $400. I had to create this chart as all the data I could find related to the $ value of turnover – which was phenomenal – and not the actual number of Bitcoins traded. Normally, when an asset sees a huge increase in price, this goes together with a corresponding increase in turnover. Clearly this has not happened with Bitcoin – why?

During our stay in South Africa I was reading an article in Die Burger (newspaper for Afrikaners) where a spokesman of Cape town-based PWC gave his ideas on the recent rise of Bitcoin and the future of Blokketting (Afrikaans for Blockchain). This inspired me to write this blog. Since I started writing about blockchain I categorically refused to use the term Bitcoin. But this time it is different. As Bitcoin nears the end of a record-breaking year, it seems an appropriate time to dive into this – by many traditional players said – over-hyped thing. Others describe this fascination for Bitcoins as a “speculative mania”. The broader public has discovered this phenomenon. I will not say it is (already) the end of the rise in Bitcoins or other crypto currencies. But let me be clear: Bitcoin is a lot not!

During our stay in South Africa I was reading an article in Die Burger (newspaper for Afrikaners) where a spokesman of Cape town-based PWC gave his ideas on the recent rise of Bitcoin and the future of Blokketting (Afrikaans for Blockchain). This inspired me to write this blog. Since I started writing about blockchain I categorically refused to use the term Bitcoin. But this time it is different. As Bitcoin nears the end of a record-breaking year, it seems an appropriate time to dive into this – by many traditional players said – over-hyped thing. Others describe this fascination for Bitcoins as a “speculative mania”. The broader public has discovered this phenomenon. I will not say it is (already) the end of the rise in Bitcoins or other crypto currencies. But let me be clear: Bitcoin is a lot not! In May this year, fintech start-up R3 raised $107 million from a consortium of the world’s top banks. The New York-based blockchain company that works in collaboration with more than 90 banks and other financial organizations world-wide, plans to use the money to invest in further developing the Corda platform (see my blog: Corda: distributed ledger ….. not blockchain! April 6, 2016) as well as “encouraging entrepreneurs to start building on the platform though training videos and hackathons”.

In May this year, fintech start-up R3 raised $107 million from a consortium of the world’s top banks. The New York-based blockchain company that works in collaboration with more than 90 banks and other financial organizations world-wide, plans to use the money to invest in further developing the Corda platform (see my blog: Corda: distributed ledger ….. not blockchain! April 6, 2016) as well as “encouraging entrepreneurs to start building on the platform though training videos and hackathons”.