Refinitiv Corporate Treasury Data Insights | April 2021

21-04-2021 | treasuryXL | Refinitiv |

Andrew Hollins, Director of Corporate Treasury Proposition at Refinitiv, brings you the April 2021 round-up of the latest Corporate Treasury Data Insights. We will learn about what an increase in inflation will mean for treasurers’ FX hedging plans – and how best to protect your company’s position. Moreover, an update is provided on the Suez Canal traffic jam, and the impact on trade flows, freight movement and prices in the coming months. Plus, some insights on metal prices, ESG, LIBOR and mobile FX trading are shared.

Are inflation fears justified?

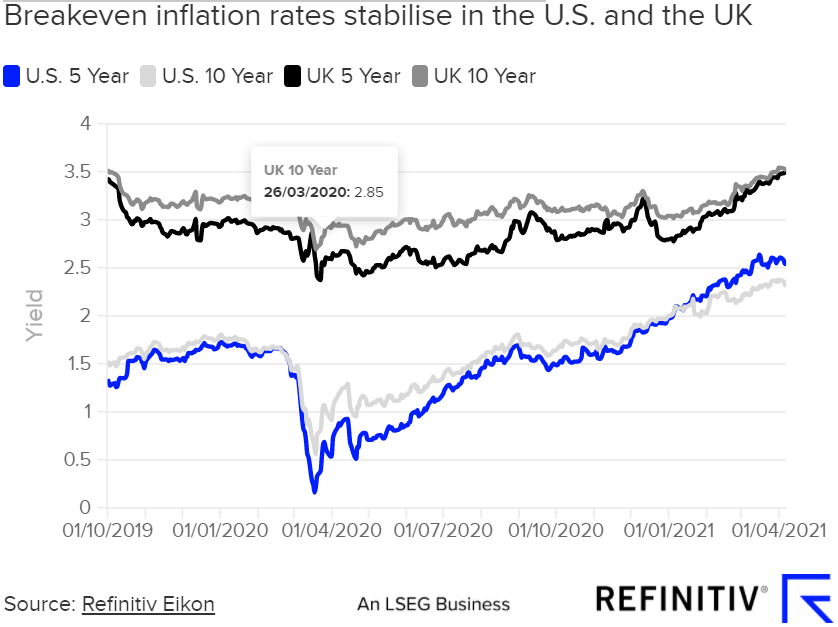

While expectations of inflationary pressures have risen significantly over the past six months, reflected in the chart above, the market points to moderating price pressures in the medium-term as revealed by the breakeven yield curve for inflation linked bonds.

Expectations of an inflation spike in the U.S. and elsewhere, perhaps peaking in 18 months to two years, are likely to impact treasurers’ FX hedging plans.

Take the best performing G10 currency so far this year – GBP. While the outlook into H2 2021 and beyond remains uncertain with possible Brexit-linked fallout and a potential separatist supermajority in the Scottish elections on 6 May, continued success on the vaccine front should deliver the dividend of an accelerated economic recovery in the UK.

FX hedging strategy

Corporates with FX exposures may consider a Forward Extra as part of their hedging strategy – an FX option which protects from downside risk but also allows for some upside gains.

Treasurers can use Refinitiv Eikon to manage currency exposure:

- Price a Forward Extra using the FX Options Calculator (FXOC), employing key events like the Scottish elections in May as reference points.

- Analyse volatility relative value using Currency Performance (FXPT).

- Analyse volatility skew and an implied probability distribution chart in FX Volatility Explorer (FXVE).

- Keep a close eye on inflation forecasts with Reuters Polling (POLLS), which forecasts a rise in U.S. inflation to 2.4 percent for the year until March 2021, and Rates Views Inflation Screen (RVIN) to monitor breakeven rates.

Emerging market currencies and stocks struggle

While vaccine progress is supporting the position of both GBP and USD, emerging market currencies are telling a different story.

Steering the post-pandemic recovery

Reuters newsmaker with Christine Lagarde, President of the European Central Bank. After taking radical steps to combat the recession, global policymakers now face the task of ensuring recovery takes hold. Lagarde joins Reuters for an exclusive Newsmaker to discuss the best policies to prevent COVID-19 from scarring economies, how and when policy support might be withdrawn, whether rate setters might be facing a major shift in the inflation regime and the challenges that are unique to the euro zone.

Suez traffic jam clears, but what’s the impact?

Satellite data from Eikon’s Interactive Map, pictured below on 29 March, shows the Suez Canal blockage beginning to ease. However, treasurers should expect more volatility in the coming months.

The freight derivative markets for dry bulk carriers are seeing heavy traded volume in 2021 due to high volatility, potentially exacerbated by the Suez incident.

Data from the Baltic Exchange for the week ending 19 March 2021 show a record of 78,059 lots of Dry FFA (Freight Forward Agreement) traded, a record not set since 2008.

Will gold remain bullish in 2021?

Gold is seen as a hedge against uncertainty and hence we witnessed a drastic increase in pricing during the pandemic. However, will vaccine rollouts and stimulus measures cause this precious metal to bottom out?

Watch – Refinitiv Metals Outlook 2021: Gold

How Mercuria proactively manages commodities exposure

Mercuria is a global energy and commodity group, with business lines covering a diverse range of commodities trading, as well as large scale infrastructure assets. Discover how they manage exposures in FX, FI and commodities markets, as well as credit terms with trading counterparties.

Sustainability and ESG: what role should you play?

Today, no two treasury teams are alike when it comes to sustainable finance roles and responsibilities. However, will upcoming regulatory and political change result in clearer and globalised standards and benchmarks? And what should treasurers be watching out for?

Join us, the ACT and two leading treasurers from Page Group and Optivo next week to discuss these significant developments – and how treasurers can support future growth ambitions, sustainably.

LIBOR: What you need to know about fallback and transition data

To prepare for the oncoming LIBOR transition and IBOR reform, hear from Trang Chu Minh and Fausto Marseglia as they discuss fallback and transition data in relation to your bonds portfolio, and the main aspects of ISDA fallback rates.

Watch – Refinitiv Perspectives LIVE: The LIBOR Transition: Fallback & Transition Data

Refinitiv Corporate Treasury Newsbeat

Refinitiv’s Taking FX Trading Mobile: responding to the shift to remote working – with mobile trading apps predicted to be the most influential technology shaping the future of trading – Refinitiv is working with partners to develop a seamless end-to-end FX workflow, accessible by mobile app.

LSEG Automates $7bn Debt Capital Transaction: last month, London Stock Exchange Group (LSEG) successfully priced a landmark syndicated multi-tranche and multi-currency offering, raising $7bn equivalent across nine tranches.

Key transaction steps were conducted on Flow, a digital platform driving end-to-end automation in primary debt markets, developed in partnership with Nivaura.

This is the most complex transaction to use a primary debt capital markets digitisation platform, and a milestone for LSEG, as its largest bond and first USD Reg S/ Rule 144A issuance. Find out more about the landmark transaction.