Rapid changes in trading are taking place. Are you keeping pace?

05-05-2022 | treasuryXL | Refinitiv | LinkedIn | Automation doesn’t make FX, equities and fixed income traders unnecessary, but it does make them more efficient – which ultimately can lead to better profits.

The only constant is change and traders around the world find themselves having to adapt quickly to new and emerging technologies supported by automation. This evolution is occurring across asset classes – and the globe – and is reshaping expectations for market change going forward.

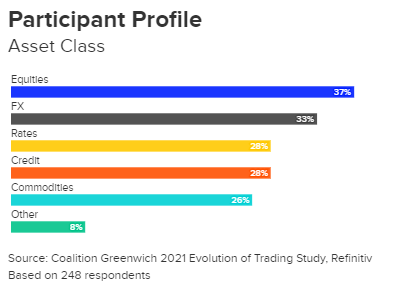

To further our understanding of what this means for the future, Refinitiv, an LSEG business, have teamed up with Coalition Greenwich to produce a three-part report series called ‘The Evolution of Trading.’

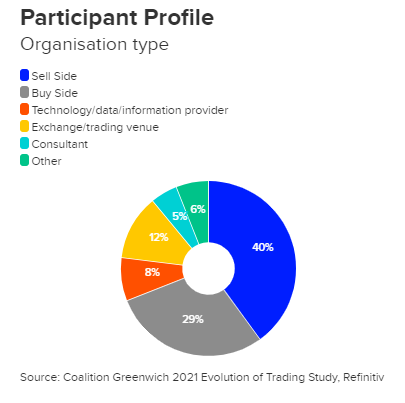

The findings in the series come from an online survey of close to 250 market professionals, globally, and are analysed across asset classes, regions and organisation type. The results not only highlight changes at the market level, but also dive into the nuanced impacts these technology developments can have on equity, fixed income and FX markets.

Download the Evolution of Trading report series, and find out:

- What firms are doing as regulatory reporting becomes more demanding across the globe.

- Why data management and cloud are just two of the strategies FX desks will increasingly adapt to improve workflows.

- Why close to 70% of equities respondents will be spending more time automating processes over the next 1-3 years.

- Why the question of vendor consolidation has become more and more important as firms decide to buy or build.

- Where the next phase of automation will focus on in the fixed income market.

- Plus, what the most important skills will be on the trading desk as we continue to evolve.

Get access to the reports