How important is it for you that someone has a well-known Treasury degree?

31-10-2022 | treasuryXL | LinkedIn |

The fifth edition in which we discuss the latest poll, is available for your reading. We show how treasurers voted to express their opinions on a current issue, and several of our treasury experts will talk about their perspectives.

How important is it for you that someone has a well-known Treasury degree?

There are plenty of education and training courses in treasury, with the aim of obtaining treasury certificates. We wanted to explore how important you think this is, in the job market or for other things. There was a very good participation in the poll, resulting in a record 113 votes. Thank you everyone for actively participating, and join us in voting for the poll that is currently live and let’s try break the record votes right away!

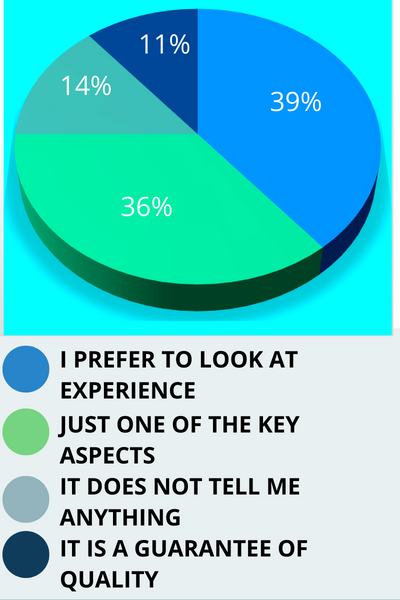

Question: How important is it for you that someone has a well-known Treasury degree? On the job market or for other things?

How do treasures think of a treasury degree?

We see a considerable spread of votes. A large proportion of treasurers value expertise more than a degree. On the other hand, a large proportion considers a treasury degree minimally of high importance. Some of our treasuryXL experts from different backgrounds explained their views on the subject.

View of treasuryXL experts

Konstantin voted for the option that a treasury degree is a guarantee of quality.

” Specific, treasury-focused education certainly makes sense.”

From the perspective of a recruitment manager who has conducted a number of interviews, I find that a standard academic programme does not focus enough on the topics relevant to the treasury function.

For example, I note that too many candidates for treasury positions find it difficult to understand or don’t know FX forward pricing (relationship between interest rate differential, spot and forward pricing), or don’t understand the difference/relationship between net income and cash flows, etc.

And, of course, these are only general topics; other topics – like cash pooling or hedge accounting are just not part of the regular curriculum. Therefore, specific, treasury-focused education certainly makes sense.

Arnoud voted for the option that a treasury degree is just one of the key aspects.

” There are also elements that you can never learn from a book”

A treasury degree is a great start to a career in treasury. But after having interviewed many candidates in my life, I am also convinced that practice is also a very good learning opportunity. There are also elements that you can never learn from a book. You must have done that. But a treasury degree is a nice theoretical framework to start with.

In treasury you have to think in terms of cash flows and risks. In addition, you still need some understanding of financing, how to price it in relation to the risk that the bank runs on your company.

I don’t have a treasury degree myself, but I am completely self-made man. After 25 years in dealing rooms of banks and then 9 years as a treasury consultant, I think I have seen all facets of the profession.

François voted for the option that a treasury degree is a guarantee of quality.

” It is key to ensure that both the candidates and the current treasury staff keep their treasury knowledge updated”

Within Finance, Treasury is a fast-moving activity, which requires in addition to the soft skills a lot of technical skills and competencies. We are in the war for talent, and we experience more and more staff rotation. Hence it is key to ensure that both the candidates and the current treasury staff keep their treasury knowledge updated.

Several programs have been developed, the most well known being the ACT Certificate in Treasury Fundamentals. In the Netherlands NIVE also organizes the QCM (Qualified Cash manager) and QT (Qualified Treasurer) training. In Luxembourg, ATEL organizes with the House of Training the Certificate in International Treasury Management and Corporate Finance, with a Fundamentals version and an Advanced version.

Some treasury associations partnering with universities to provide treasury certification. In France, the AFTE has teamed up with the university of Paris Sorbonne, the university of Rennes and the University of Lille to develop a full master program in Treasury Management.

We also have in the Netherlands the Vrije Universiteit Amsterdam who organizes the postgraduate Executive Treasury Management & Corporate Finance program combining two finance disciplines which largely overlap and are inextricably connected: Treasury Management and Corporate Finance. It has now been running for more than 20 years.

Beside this we have a lot of other treasury trainings organized by organizations such as Van Groningen, Finsiders Academy, Orchard Finance, etc. However, they do not offer a certification.

In an ever more sophisticating environment, and in view of the increased regulations, it is for me key to look at certified trainings to build a solid background in a Treasury Management field. It enables to meet other talented treasurers and teachers. In addition, thanks to the certification, based upon an examination and/or end paper, you can get a additional quality label, which can be very useful in your career.

In this respect, I wish to share my personal experience in a completely different area. I am currently looking for Board Mandates and realized that there also a certification can be useful. Hence I have started the Guberna programme to become a Guberna Certified Director.

In the event that due to circumstances, you cannot follow certified trainings, you can also get a certification thanks to the Treasurer Test developed by treasuryXL.