Getting Granular: A Tool to dig deeper and Improve Cash Forecasts

03-02-2021 | Cashforce | treasuryXL |

Covid-19 shook the foundations of Cash Flow forecasting and Working Capital Management for companies facing uncertainty about revenues, vendor payments, appropriate inventory levels and adequate cash reserves.

- At a recent NeuGroup virtual interactive session, one participant impressed others by describing how a Fintech solution provided by Cashforce a year earlier allowed his company to dig into the weeds of business operations, examining line-item details of cash flows to prepare for and absorb shocks to liquidity.

- That ability helped treasury provide real value to the company when the internal spotlight landed on the team during the pandemic.

Digging into details: Cashforce opened a window to a more accurate cash picture by revealing what was going on across the business and how various moving ‘levers’ were rapidly changing, the treasurer said.

- The technology tracked the granular details of cash flows and highlighted respective drivers that helped identify areas of business behaving normally and those under greater stress from delays in customer receipts.

- The resulting insights facilitate setting baseline expectations and seeing potential roadblocks so that treasury teams can have productive conversations with operations teams about changes, new products, etc. so that business intelligence is layered into forecasts appropriately.

The velocity and veracity of data. Covid-19 has called more attention to the need for banking APIs and the harmonization of data feeds into a single analytical source. Real-time mandates are now the norm: Everyone wants payment information in real time, with consolidated cash positions at the press of a button. This greater level of urgency has driven the need for cash flow forensics and analytics.

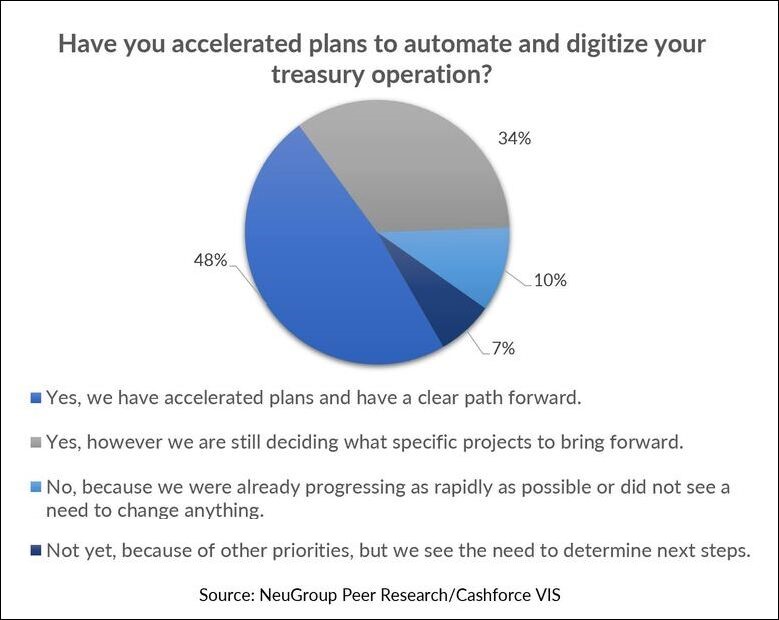

- 82% of participants polled have accelerated plans to automate and digitize treasury operations since the pandemic (see chart above for details).

- Cashforce stressed that all processes surrounding cash flow and working capital optimization must be revisited to accomplish real-time goals. Across companies, they are seeing an emergence of a cash culture away from the heavy focus solely on earnings.

This shift requires links to AI models so treasury practitioners can determine cash flow drivers not easily spotted by the human eye because they are in the weeds of massive amounts of data.

The data is there; why can’t we get to it? Simply put by one member: Most treasury management systems (TMSs) are not designed to house the magnitude of transaction-level data nor provide the analytic capabilities needed for transparent cash forecasting and best-in-breed working capital analytics.

- For example, not all TMSs are able to take in various data streams or extrapolate trends to build cash flow patterns into a cash forecast. For companies with multiple ERPs, the complexity and volume of data becomes exponentially difficult to manage and impossible to analyze manually.

- Algorithms designed to roll up your sleeves for you and dig into transaction-level detail to predict trends and flag anomalies provide a structure for cash optimization and a safeguard for deviations that threaten liquidity.

- Measure KPIs to move the needle. Automated calculations and daily reporting on key indicators through Cashforce tools allow for expedited metrics that enable smart decision making and facilitate improving working capital through analytics.

Wedded bliss: Marrying short-term direct to long-term indirect cash forecasts! Treasury and FP&A forecast disconnects are common sources of reconciliation tension across companies.

- Cashforce uses a “rules engine” that takes ERP data to transform the indirect P&L components into direct cash flow drivers and calculate timing parameters based on historical trends.

- One member inquired about the possibility of forecasting by purchase order and was pleased to hear that once the purchase order details were transferred into the system, algorithms calculate cash amounts and timing for both “open ended or closed” purchase orders, taking the headache out of what is often a guessing game.