| 28-10-2016 | Hans de Vries | PowertoPay |

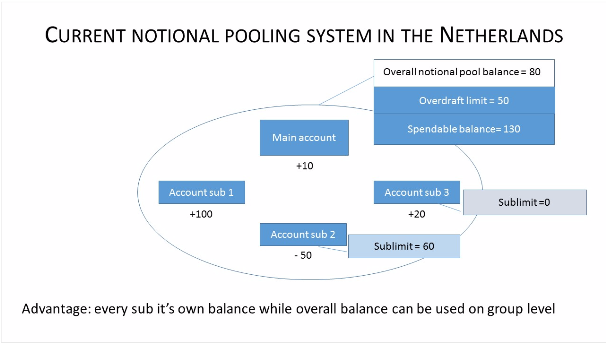

Until recently, the Dutch Banks offered their corporate clients a unique cash pool service in which a number of individual accounts were treated as a single account by “virtual” netting the positions of all underlying accounts. An ideal cash pool mechanism without any physical movement of funds. This system was used for the daily approval by the bank of outgoing flows (fiat) and the quarterly assessment of the interest per account and the overall net interest position. This article gives insight into the consequences of employing zero balancing as an alternative and how the Treasurer can still achieve his goals in the post notional pooling era while taking into consideration the autonomy of the corporates subsidiaries.

Due to the new regulations of the Dutch Central Bank, the unique Dutch Notional Pooling system (rente- en fiatstelsel) can no longer be offered to the corporate clients in the Netherlands as from 2017.

Especially for companies with numerous subsidiaries and accounts, this “Rente- en Fiatstelsel” was an ideal vehicle to virtual concentrate the total position from a cash management/ treasury perspective, while seemingly leaving some autonomy with the subsidiaries since there was no need for physical movement of balances between the accounts involved.

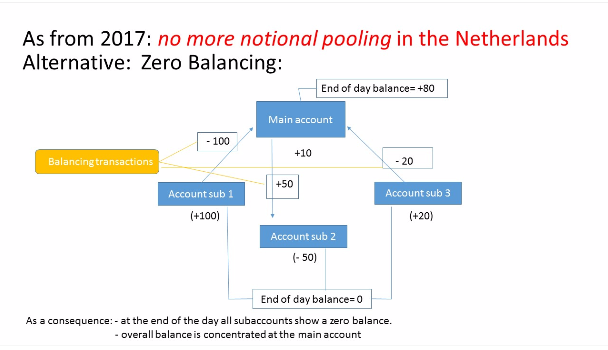

As stated earlier, the Dutch notional pooling era is about to come to an end and therefore Treasurers have to consider other ways to concentrate their cash. The most obvious alternative in order to achieve cash concentrating will be by using Zero Balancing, a technique commonly used outside the Netherlands and already supported by most Dutch banks. Basically, this technique implies the daily clearing of all subaccounts at the end-of the working day, by funding the debit balances on the subaccounts from the Master account and sweeping the credit balances from the subaccounts to the Master account. There are a number of variations on this theme like target and trigger balancing.

Coming from a notional pooling set-up, the Treasurer needs to cope with a number of issues such as:

- the Intercompany Loan administration,

- the subsequent interest calculation and distribution,

- the administrative recording of the revolving credit arrangements with the subsidiaries involved,

- setting up interest rates at arm’s length;

The setting-up of intraday limits

Another issue that needs to be faced by the Treasurer is the setting up of Intraday bank limits. In the former (rente- fiatstelsel) situation all sub-accounts had access to the overall balance position of all accounts that were participating in the notional pool. In some cases the banks were able to limit the debit position on individual accounts by providing sub-limits on account level in order to prevent excessive use of the total position by certain subsidiaries.

In the new ZB situation, all sub-accounts have a daily opening balance of zero. In some cases, the subaccounts will need to have an intraday limit in place to enable their outgoing transactions. It will take quite some effort to get the right amounts in place looking at the subsidiary’s needs, the bank’s restrictiveness and the company’s own risk management.

Day to day reporting on intercompany (debit) position

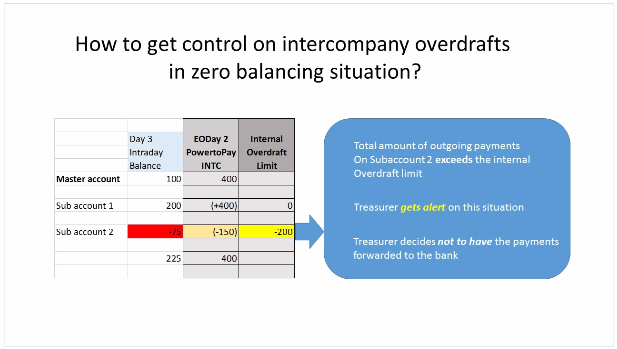

After having arranged the administrative implications of the new Zero Balancing set-up and the banks systems are in place (with the intraday limits), the information on the individual subs position needs a lot of consideration by the Treasurer. A number of Treasury Management Systems (TMS) are able to cover the above mentioned functionalities to some extent. Nevertheless, the Treasurer will still feel the need to also daily control the outgoing flows on the sub-accounts in a situation where there is no more reporting on the actual (overdraft) balance position of the individual accounts by the banks.

Although the TMS system will be able to show the position, in most cases there are no controls in place to monitor the outgoing transaction flows. As a result of this situation there will still be a need for a system that will daily show the subsidiary’s position as though the actual Zero Balancing did not take place.

In other words, a system that will daily show the intercompany balance of each subsidiary and will also guard the actual debit position of the sub. Since the daily bank statement will only mention a zero opening balance for each subsidiary account, the Treasurer has no means available to control the extent to which the subsidiary uses the overall position of the group on a day to day basis.

Control on outgoing flows by implementing virtual overdraft limits

What the Treasurer therefore needs is a cash management tool that controls all outgoing flows, not only from a validation and authorization perspective, but also from a cash management position point of view. This implicates that this tool should monitor all outgoing flows per account, in reference to the actual intercompany balance on the account and the permitted overdraft on the account. If the total amount of outgoing flows exceeds the overdraft limit, the Treasurer then will be able to stop the outgoing transactions. With such a tool in place, the “Notional Pooling” situation can be revived again in a more or less virtual setting. This means that the subsidiaries still have maximum visibility on their individual accounts while the treasurer has a clear view on his daily position and can control the outgoing flows per subsidiary according to the internal agreed boundaries.

In order to develop such a tool, the information on all outgoing flows should be daily combined with the incoming statement files as provided by the banks. PowertoPay, already provider of a bank agnostic connection platform, is in the ideal situation of adding the Virtual Pool Module to its Corporate Payment Hub. This module will provide the treasurer all control that is needed to steer and to control the cash management of the company while also providing the subs with all information needed to support their actions.

Please contact me if you need more information on this tool or have a look at our website.

Sales consultant PowertoPay