Cross-Border Payments: Moving Money Across Borders

The cross-border payments market refers to financial transactions that occur between parties located in different countries. Cross-border payments involve the transfer of funds or assets from one country to another, typically through banks and/or other financial institutions

Sending money across countries keeps global trade alive. Whether a small business pays a supplier overseas or a worker sends earnings home, cross-border payments bridge economies. These transactions involve moving funds between banks, businesses, or individuals in different nations, often requiring currency exchanges. Their role in connecting markets and enabling international commerce makes them vital. Key players include banks, payment processors and networks like SWIFT.

Market Trends

According to FXCIntelligence¹, the global B2B cross-border payments market was estimated at USD 194,6 trillion in 2024, and is projected to reach USD 320 trillion in 2032.

“The cross-border payments sector is undergoing big changes in 2025.”

New technologies, (including API-connectivity²) shifting regulations, the SWIFT ISO 20022 migration³, the demand for real-time payments and a growing demand for smooth transactions are impacting how money moves around the world. Real-time payments, closer connections between national systems, and blockchain-powered networks are central to this shift. Automation and tighter compliance rules are eliminating inefficiencies and boosting trust in the process.

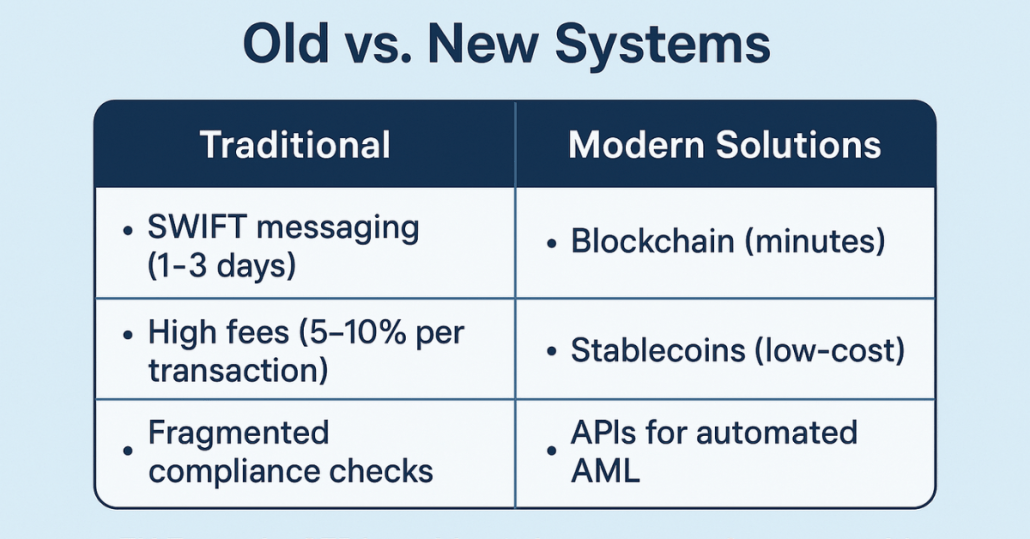

How Cross-Border Payments Work: Old vs. New Systems

Traditional methods rely on correspondent banks and networks like SWIFT. If a U.S. company pays a German vendor, the payment might pass through multiple banks, each taking fees and adding processing time. SWIFT messages coordinate transfers between institutions but don’t move money directly. This could take days, with fees piling up for currency conversion and intermediary charges.

Modern systems aim for speed and lower costs. Fintechs like Embat offer innovative cross-border payment solutions that streamline transactions and reduce reliance on traditional banking routes. Blockchain-based services such as Ripple settle transactions in minutes by using digital assets as bridges between currencies. Central bank digital currencies (CBDCs) are also being tested for instant cross-border settlements.

EU Example: SEPA enables 1-day euro transfers across 36 countries, but non-euro transactions still rely on correspondent banks⁴.

Challenges: Costs, Delays, and Rules

Cross-border transactions face friction. Fees can be unpredictable: a $1,000 transfer might lose up to 5-10% to bank charges, currency spreads, and middlemen. Processing times vary; some arrive in hours, others take a week. Regulatory checks for anti-money laundering (AML) or sanctions compliance add delays. Small businesses often struggle with these hurdles, eating into profits.

Currency volatility complicates the pricing. A payment agreed in euros might cost more dollars by the time it’s sent. Countries also have unique rules. For example, In the UK, anti-money laundering regulations require documentation for transfers over €10,000 to help prevent fraud and money laundering.

Solutions: SWIFT, SEPA, and New Tools

SWIFT remains central. Over 11,000 banks use its messaging system to coordinate transfers. While slow, it’s universal.

Swift launched some years ago the SWIFT GPI program, which have enabled a traceability of the payments and a faster settlement. Over 3,500 Financial Institutions currently use SWIFT GPI.

The Eurozone’s SEPA (Single Euro Payments Area) standardizes euro transfers, making them as easy as domestic ones within 36 countries. Transactions clear in one day, or even less for Instant credit transfer, with low fees.

Blockchain is also gaining ground. Blockchain technology enables faster settlements, reduced transaction cost and enhanced security. Stablecoins (cryptocurrencies pegged to fiat currencies like the Euro or the US Dollar) offer near-instant transfers without banks. Central banks are exploring shared systems. Some Central Bank are working on multi-currency CBCD (Central Bank Digital Currency) projects. France and Switzerland collaborate on blockchain trials for cross-border settlements between central banks.

How Embat Cuts Through Cross-Border Payment Friction

Embat makes international payments faster and more cost-effective by replacing fragmented banking systems with a single, unified interface. See how payments work on Embat’s Payments page. Everything runs through one platform where you can initiate, approve and track both domestic and international transactions—no hopping between portals or manual uploads.

Automation plays a big role: AI-driven matching of payments to accounting entries and bank statements slashes reconciliation times and speeds up month-end closes – learn more under “Accounting and reconciliation with AI” on Embat’s feature overview. Direct connections to over 15,000 banks worldwide give you a live view of cash positions across every account, so liquidity decisions happen in real time.

And because Embat supports payments in more than 50 currencies, you can often pay in local currency – avoiding extra conversion steps and fees. All this adds up to lower FX costs, fewer manual errors and faster settlements.

Why Multi-Currency Accounts Make a Difference

Holding and managing different currencies in one place helps businesses avoid unnecessary conversions. That alone can cut FX costs significantly. It also allows faster payments in many cases, because funds can move through local payment rails.

Managing all currencies on one platform is easier than juggling accounts across multiple banks and countries. It’s also more transparent- cash positions across the board are clear at a glance.

Having different currencies on hand helps balance exchange rate risks without complex hedging strategies. And it opens the door to working with international partners without needing a separate bank account in every country.

How Embat Helps Manage and Optimise These Payments

Embat’s platform is built to support international operations from a single hub. Payments can be routed and approved through customised workflows. AI handles reconciliation, syncing transactions with bank and accounting systems without manual work.

There’s full visibility into balances across all accounts and currencies, which supports more confident, data-driven decisions. Cash flow forecasting tools help teams predict currency needs ahead of time, so they can plan FX conversions better and reduce borrowing when possible.

Beyond payments, Embat offers treasury tools that connect cash management with investment and debt planning, giving a full picture of the company’s financial position across all currencies and accounts. Learn more about Embat here.

- https://www.fxcintel.com/research/press-releases/new-data-cross-border-payments-market-now-worth-over-194tn-and-is-forecast-to-reach-320tn-by-2032

- https://www.jpmorgan.com/insights/payments/cross-border-payments/three-megatrends-disrupting-cross-border-payments

- https://www.electronicpaymentsinternational.com/news/real-time-cross-border-payments-see-widespread-adoption-amid-g20-challenges-says-globaldata/

- https://www.ecb.europa.eu/press/pubbydate/2019/html/ecb.cardpaymentsineu_currentlandscapeandfutureprospects201904~30d4de2fc4.en.html