Option Tales : Cheap Options part IIII

| 07-06-2016 | Rob Söentken |

Today in the closing part of Rob Söentken’s Option Tales: When buying options it is tempting to see if the premium expenses can be minimized. A number of solutions are possible, which I’ve discussed in four articles. You can read about choosing the average rate option (ARO) and the conditional premium option in my previous article. In this closing part I will discuss the Reverse Knock Out (RKO) option.

Reverse Knock Out (RKO) option

One of the most common options used as alternative to a vanilla option is the Reverse Knock out option. It is a vanilla option which ceases to exist after the underlying reference rate has traded through a certain level, the ‘trigger’ or ‘KnockOut’. This trigger event determination can be either

- only at maturity (‘European’ trigger monitoring),

- during the entire tenor (‘American’ trigger monitoring),

- during on or more parts of the tenor (‘window’ trigger monitoring), or

- on specific moments during the tenor (‘Parisian’ trigger monitoring)

The term ‘Reverse’ means that the option has been ITM before the trigger was hit. Just when the option was starting to make money it ceases to exist after the market touches the trigger. Unlike a vanilla option the value of an RKO is capped by a potential trigger event. Therefor RKOs are a usually a lot cheaper than vanilla options which have unlimited value potential.

In diagram 6 an example is given of a 12-months USD call option costing 1.5%. Alternatively, one could consider buying an RKO option with same tenor and strike, with a European Knock Out trigger at 12.4% OTM. This costs 0.9%. There is only 8% chance the market is below the trigger at maturity. (The Delta of a vanilla option is 8%, which is also the chance of being below the strike at maturity). Therefor there is only 8% chance that the RKO expires worthless. Which could be a dramatic result for a hedge, especially considering the USD has appreciated by more than 12.4%, making the actual hedging cost showing a big loss. For a premium saving of only 0.6%.

So, to minimize premium expenses when buying options there are seven solutions to think about:

1. Choose Out of The Money strike (OTM)

2. Choose Shorter Tenor

3. Choose Longer Tenor

4. Compound Option

5. Average Rate Option (ARO)

6. Conditional Premium Option

7. Reverse Knock Out option (RKO)

Ex-derivatives trader

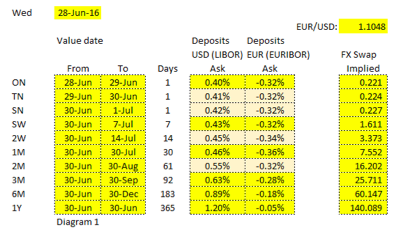

Now if we would consider exchanging a USD deposit versus a EUR deposit for 1 year the cash flows would be as follows:

Now if we would consider exchanging a USD deposit versus a EUR deposit for 1 year the cash flows would be as follows: e are looking at a single day FX swap, the annualized rate could swing a lot.

e are looking at a single day FX swap, the annualized rate could swing a lot.

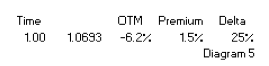

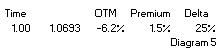

(1.5%, see diagram 5) by the chance it will be exercised (Delta, in this case 25%), ie 1.5% : 25% = 6%. It could be a very disappointing to find that if this Conditional Premium option is only marginally ITM at maturity, because the premium of 6% still has to be paid.

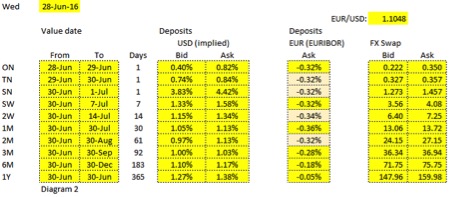

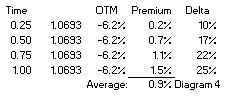

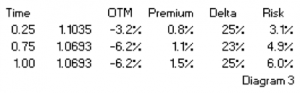

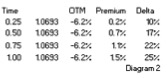

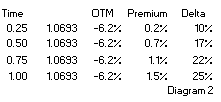

(1.5%, see diagram 5) by the chance it will be exercised (Delta, in this case 25%), ie 1.5% : 25% = 6%. It could be a very disappointing to find that if this Conditional Premium option is only marginally ITM at maturity, because the premium of 6% still has to be paid. bought the option for 1.5%, we could sell it after 3 months at 1.1% and buy the USD through an outright forward transaction. This approach shows that the net cost of option protection would be only 0.4% (1.5% – 1.1%). Which would be cheaper than the premium of a 3-month option with the same Delta. Also, because the option has a higher Delta than a 3-month option with the same strike (25% vs 10%, see diagram 2), it will follow the spot market much better. The bottom line of paragraph 3 is that a longer dated option can be bought with the intention to sell it again at some point, the net cost being less than buying a shorter dated option. While it serves as a hedge against price changes.

bought the option for 1.5%, we could sell it after 3 months at 1.1% and buy the USD through an outright forward transaction. This approach shows that the net cost of option protection would be only 0.4% (1.5% – 1.1%). Which would be cheaper than the premium of a 3-month option with the same Delta. Also, because the option has a higher Delta than a 3-month option with the same strike (25% vs 10%, see diagram 2), it will follow the spot market much better. The bottom line of paragraph 3 is that a longer dated option can be bought with the intention to sell it again at some point, the net cost being less than buying a shorter dated option. While it serves as a hedge against price changes. buy the 1-year option in diagram 2 for 1.5%. Alternatively we could consider buying a right to buy this option for 0.4% in 3 months time. At that time the 1-year option will only have 9 months remaining, but the strike and 1.5% premium are fixed in the contract. On the expiry date of the compound option we can decide if we want to pay 1.5% for the underlying option. Alternatively, assuming nothing has changed, we could buy a 9 month option in the market for 1.1% (see diagram 2). In such a case we wouldn’t exercise the compound option.

buy the 1-year option in diagram 2 for 1.5%. Alternatively we could consider buying a right to buy this option for 0.4% in 3 months time. At that time the 1-year option will only have 9 months remaining, but the strike and 1.5% premium are fixed in the contract. On the expiry date of the compound option we can decide if we want to pay 1.5% for the underlying option. Alternatively, assuming nothing has changed, we could buy a 9 month option in the market for 1.1% (see diagram 2). In such a case we wouldn’t exercise the compound option.

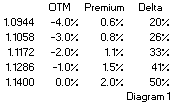

Should we need to exercise the option to get our USD, it still means a combined hedging cost of 3.8%. Which is more than if we had bought the ATM option for 2% premium. Conclusion: Buying an OTM option reduces the up-front cost versus buying an ATM option. But ex-post hedging with an OTM option could result in total hedging cost which are higher than an ATM option.

Should we need to exercise the option to get our USD, it still means a combined hedging cost of 3.8%. Which is more than if we had bought the ATM option for 2% premium. Conclusion: Buying an OTM option reduces the up-front cost versus buying an ATM option. But ex-post hedging with an OTM option could result in total hedging cost which are higher than an ATM option. option is exercised, or the USD must be purchased from the market at the prevailing rate.

option is exercised, or the USD must be purchased from the market at the prevailing rate.