It’s India, you stupid

| 26-01-2018 | Rob Beemster |

In our daily business, we attend to corporations and institutions in their foreign activities. We notice among our clients more and more attention and interest in India. Several of our clients have invested in factories, what can be economically seen as Foreign Direct Investment in India. Others are increasing their sales and we also notice many newcomers who are firstly orientating on the country.

The policy of Prime Minister Modi is clearly opening the eyes of the international economic community. Indian corporates see chances of doing business abroad. These new economic partners built bridges to learn from each other, resulting in rising economic flows.

Many of our clients are active on the higher end of the agricultural value chain. They produce machines for vegetable processing, storage, cooling etc. India is known for its large waste of vegetable products; the government sees this as a big problem and it has to be eliminated. Collaboration of the Indians with institutions like the Worldbank and countries with decent knowledge in agriculture (like Holland ) are bound to find solutions to this waste issue. This “opening of doors” has resulted in the increase of Dutch corporate turnover with India.

And… there is a lot more to come. The spin-off from the agricultural segment to other segments can be enormous. India has tremendous opportunities for European corporations. The Dutch Embassy and the “Landbouwraad” in Delhi, are very active to help the Dutch in opening markets in India.

Non-Deliverable Forward

India has a much-regulated monetary system. Reserve Bank of India wants (full) control and insight on currency moves to or out of India. Hereby it has installed a so called non-deliverable forward system for off-shore rupee exchange. Currency hedging can be done, but not with regular forward contracts, where underlying amounts are bought and sold. At the end date of an NDF, the difference of the NDF price and the fixing is exchanged.

Currency risk

Very often the pricing in a tender and invoicing is done in Euro. So, one could say that currency risk is only ran by the Indian investor. “The European participants do not suffer due to eventual currency movements of Indian Rupee against the Euro”. One has to realize that if counterparty runs the full currency risk, there is still an indirect risk position for the supplier. So even the Euro receivers have to take a defensive stance.

Volatility

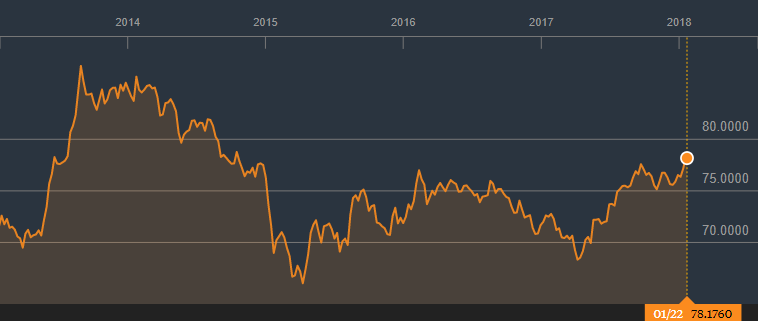

The necessity of taking care of the currency risk is because of the large volatility of the EUR/INR. It is dangerous to put all the risk at the Indian partner. Orders can be cancelled due to big swings in the value of the currencies. Profit margins of your client can diminish, which may end the relationship. The graph shows the rate moves of EUR/INR of the last five years. Even on short periods, large differences can be noticed. This should assure businesses to take full control of the currency risk. Rate changes of more than 10% within half a year have occurred several times.

Your guide in India

Transactional risk can be avoided by a good hedging structure. Economic currency risk on your long-term investment is another issue and has to be thoughtfully considered. Barcelona can help to make the hedging transparent. As said, hedging can be done but needs accurate and professional advice. Due to our experience in the Indian business of our clients, we are able to find the best solution for each trade or investment.

Owner of Barcelona valuta experts BV

Currency volatility is a well-known uncertain component of international business. In the pre-euro era one could suffer severely by currency movements of its European neighbours. Corporations, dealing within euro countries, have diminished the currency exposure.

Currency volatility is a well-known uncertain component of international business. In the pre-euro era one could suffer severely by currency movements of its European neighbours. Corporations, dealing within euro countries, have diminished the currency exposure.

The Indian rupee has suffered in September severely. In our report we name the issues resulting to the weakening. International companies in India and those trading with India face severe danger from these currency moves. This article will give you an insight how to handle this.

The Indian rupee has suffered in September severely. In our report we name the issues resulting to the weakening. International companies in India and those trading with India face severe danger from these currency moves. This article will give you an insight how to handle this.