Blockchain and the Hyperledger project: beyond the hype

| 27-09-2016 | Carlo de Meijer |

Who is not yet convinced of the potential of blockchain? Here is another example that shows blockchain is beyond the hype. Early September, the Hyperledger Project, a collaborative cross-industry effort to advance blockchain technology, announced that 17 new companies and organisations have joined, bringing the total number of members to more than 80. And expectations are that this number will see a further growth, to beyond 100 at the end of 2016.

Who is not yet convinced of the potential of blockchain? Here is another example that shows blockchain is beyond the hype. Early September, the Hyperledger Project, a collaborative cross-industry effort to advance blockchain technology, announced that 17 new companies and organisations have joined, bringing the total number of members to more than 80. And expectations are that this number will see a further growth, to beyond 100 at the end of 2016.

Let’s have a look how this collaboration platform performed! But first, what is the Hyperledger Project, and what is their goal?

What is the Hyperledger Project?

As they describe themselves on their website:

“The Hyperledger project is an open source collaborative effort created to advance blockchain technology by addressing important features for a cross-industry open standard for distributed ledgers. It is a global collaboration including leaders in finance, banking, Internet of Things, supply chains, manufacturing and Technology. The Linux Foundation hosts Hyperledger Project as a Collaborative Project under the foundation”.

Goal

Main goal is to build an enterprise grade, open source distributed ledger framework and code base to drive blockchain innovation. This should enable organisations to build and run robust industry-specific applications, platforms and hardware systems to support their individual business transactions. All of these innovations will work with an open-source code and distributed ledger architecture.

Through the creation of a framework that integrates different components for different use cases, the consortium is seeking to bring cohesion to a number of independent blockchain efforts that are in the process of developing protocols and standards. The collaboration should help identify and address important features and currently missing requirements for a cross-industry open standard for distributed ledgers.

Codebases

The Hyperledger Project is made up of different codebases donated to the Linux Foundation, contributed by several of its members including IBM, Digital Asset Holdings, Blockstream, Ripple and others to further the Project goals. IBM alone donated 44.000 lines of codes. In total, there are now 160 code contributors (including individuals that may not be working on behalf of any company). It provides a vehicle for companies to collaborate on features.

Members

The Hyperledger Project has gained a lot of industry support in advancing blockchain technology. Since its formal launch in February this year, with original 30 founding members, this number jumped to 80 in a half year time.

New Hyperledger members thereby come from all over the world, including Europe, the US and Asia. They have joined a rapidly growing and diverse group across various industries, including finance, banking, trade finance, supply chain management, manufacturing, technology etc.

The Hyperledger Project has backing from many big corporates. Amongst its members there are a large number of established names from technology giants like IBM, Intel, Cisco, Accenture; to financials with names as JP Morgan, BNY Mellon, ANZ Bank, HSC, Wells Fargo; exchanges such as London Stock Exchange, Deutsche Borse, organisations like SWIFT, CLS, DTCC, Digital Asset Holdings, as well as the bank-backed blockchain consortium R3CEV.

Incentives

Why are they all joining the Hyperledger Project?

There are various motivations and reasons why companies are joining this Project. But in general, Hyperledger is seen by many as being “at the cutting edge of blockchain”. Major institutions are increasingly viewing the Hyperledger Project as a venue for further engagement. International collaboration cross-industry, organised effort plus local experience are thereby looked at as key to ensuring the scalability and the adoption of distributed ledger technology.

For them the Hyperledger Project is uniquely positioned to foster the collaborative approach needed in order to advancing the blockchain ecosystem and promoting blockchain’s extensive application to serve as the future credible infrastructure. They hope, by working with this growing community, to further Hyperledger’s vision and open blockchain development efforts. This by sharing ideas, experiences, expertise and knowledge in an effort to bring blockchain’s emerging technology to market

“A key factor of the project’s success will be member expertise and guidance” – Brian Behlendorf

Recent developments

The Hyperledger project has been rapidly moving forward since the start. Next to the announcement of a growing number of organisations joining their collaborative platform, we have seen a number of interesting developments surrounding the Hyperledger Project.

Election Technical Steering Committee

The governance structure has been further strengthened. The Hyperledger Project recently elected a new Technical Steering Committee (TSC) consisting of 11 members. The members include representatives from names like R3CEV (the other blockchain consortium), Digital Asset Holdings, IBM, London Stock Exchange, and DTTC. The composition of this TSC reflects the importance of these players in the Hyperledger Project, from both a technology as well as a business point of view.

Hyperledger Project and SIBOS Innotribe

Hyperledger Project announced it will sponsor the Innotribe Networking event at Sibos 2016, on Wednesday, September 28. The conference will be held on September 26-29 at PALEXPO in Geneva. As the world’s premier event for financial services, Hyperledger Project is looking forward to discussing open source distributed ledger technology and its potential to transform the industry with leading companies and experts.

Trade Finance Proof of Concept

The Hyperledger Project as well as the bank-backed blockchain consortium R3CEV announced initiatives to develop blockchain prototypes for trade finance innovation on the same day. Both initiatives were exploring how distributed ledger technology could streamline the existing old-fashioned, paper-based and expensive world of trade finance, using letters of credit. They thereby tried to tackle trade financing challenges via this technology.

Hyperledger Project trade finance proof of concept

The Hyperledger Project trade finance proof of concept comprised HSBC, Bank of America Merrill Lynch and IDA (Singapore). Aim of the various parties was to use a blockchain prototype to streamline global trade. The application mirrors a paper-intensive letter of credit (LC), whereby participants could execute a trade deal automatically through a series of digital smart contracts. They thereby used the open source Hyperledger Project blockchain fabric, thereby supported by IBM Research and IBM Global Business Services.

R3CEV blockchain trade finance initiative

R3CEV and 15 of its blockchain consortium members have “successfully” completed two prototypes using distributed ledger technology for smart contracts. The banks designed and used so-called smart contracts on R3’s Corda distributed ledger platform to process accounts receivable (AR) purchase transactions, invoice financing or factoring, and Letter of Credit (LC) transactions.

The involved member banks in the trials include: Barclays, BNP Paribas, Commonwealth Bank of Australia, Danske Bank, ING Bank, Intesa Sanpaolo, Natxis, Nordea, Scotiabank, UBS, UniCredit, US Bank and Wells Fargo.

Competition or collaboration?

HSBC, involved in the Hyperledger Project trade finance PoC, but also member of the bank consortium R3CEV, asked if there was no duplication, and if so, expressed the view that “we will all have to come together, because this has to be industry-led”.

According to HSBC “… now we need to get the technical teams together to understand the pros and cons, because part of what we have learned is also the technical limitations of distributed ledgers, in terms of the number of nodes you can have or the quantity of data you can have on it. So now may be the time to share those and see how we can put our heads together to take this to next level.”

“R3 is a member of the Hyperledger initiative and as such we will continue to explore ways to utilise the code being developed by its open source community in the real-world products we are developing with our consortium members”, said HSBC.

Hyperledger hackaton Amsterdam

ABN Amro, IBM, Holland FinTech and Linux Foundation are to run the first-ever Hyperledger hackaton, inviting coders to develop new financial applications capable of running on distributed ledgers. This one-and-a-half day hackaton will take place on 11-12 October in Amsterdam and is open to developers, tech students and fintech companies that are experimenting with blockchain technologies.

Hyperledger Project to address academic lecture ISITC

Leading members of the Hyperledger blockchain Project will address the European branch of ISITC, the International Securities Association for Institutional Trade Communication. The academic lecture to be held at the London Metropolitan University is intended to give the members an idea of what differentiates the Hyperledger Project from other blockchain projects.

This event that will be held in London is the latest effort by ISITC’s newly formed Blockchain DLT Working Group to lay the foundation for a global effort to standardize distributed ledger technology. The DLT Working Group that emerged earlier this year was invited to create a list of 10 blockchain standards for future development. It has changed its task slightly to focus on a cross-industry framework from which a modified list of benchmarks might eventually emerge. The Working Group prioritised working with other standards bodies and consortia like the Hyperledger Project to minimise overlap.

Hyperledger Project “ Blockchain Explorer “

As more companies like Bank of America and HSBC begin to unveil proofs-of-concept (PoC) using the Hyperledger protocol, a more standardised way to search its data is just part of what it will take to scale. Even beyond building out standards, creating common codes may allow organisations to focus on creating industry-specific blockchain applications.

The Hyperledger Project is now building an open-source tool that will let anyone explore the distributed ledger projects being created by its members. Instead of overlapping efforts and of launching competing open source services, unified effort emerged the blockchain explorers being developed by the likes as IBM, Intel and DTCC. The joint project has been named the “Hyperledger Explorer”. Creating common code will allow organizations to focus on creating industry-specific applications that enhance the value of this technology.

This tool would make it easier to learn about Hyperledger from the inside, while still protecting the privacy. When completed, the Hyperledger Explorer is expected to give Hyperledger developers and non-technical users access to block information, transaction data, network information (such as a list of nodes) and chain codes or transaction families. The Board and the recently newly formed Technical Steering Group will be working on these code proposals in the coming period.

Standardisation

The Hyperledger Project thinks it is still too early to strive for a technical standard for a general purpose inter-chain communication protocol (or even data format). Instead, they would like to encourage the different ongoing proposals to converge towards common architectures and or/even common tech stacks or set of reusable modules. This could serve as the starting point for the development of standard APIs, enabling the inter-chain communication and thus start the discussion around the technical realisation of such a protocol. Parts of this common code could also be reused by other projects, thus contributing to a standardisation of the blockchain technology overtime.

Economist and researcher

Afgelopen week stuitten we op het bericht dat ruim 20 miljard aan liquide middelen vast zit in het werkkapitaal van toonaangevende organisaties in Nederland en België. PwC deed een werkkapitaal onderzoek en ontdekte dat er nog genoeg mogelijkheden zijn om de werkkapitaal situatie van deze organisaties te verbeteren.(Bron:

Afgelopen week stuitten we op het bericht dat ruim 20 miljard aan liquide middelen vast zit in het werkkapitaal van toonaangevende organisaties in Nederland en België. PwC deed een werkkapitaal onderzoek en ontdekte dat er nog genoeg mogelijkheden zijn om de werkkapitaal situatie van deze organisaties te verbeteren.(Bron:

De treasurer en de controller zouden twee handen op dezelfde buik moeten zijn, maar de vraag is of dat in alle, of zelfs de meeste, gevallen wel zo is. Enkele uitzonderingen daargelaten, zijn de verschillen groter dan de overeenkomsten.

De treasurer en de controller zouden twee handen op dezelfde buik moeten zijn, maar de vraag is of dat in alle, of zelfs de meeste, gevallen wel zo is. Enkele uitzonderingen daargelaten, zijn de verschillen groter dan de overeenkomsten.

Na de vakantie is het tijd om de eerste stappen te zetten voor het budget voor het volgend jaar. Toevallig kwam budget ook aan de orde in de discussie over CF Planning. Kosten overschrijdingen in het budget verstoren de CASH. De CF Planning is grotendeels op het budget gebaseerd. Het banksaldo moet aansluiten op de gebudgetteerde balans, want maak niet alleen een budget op W & V niveau, maar ook op Balans niveau. Denk daarbij ook aan uw Investeringsbudget voor de balans, investeringen, desinvesteringen en afschrijvingen.

Na de vakantie is het tijd om de eerste stappen te zetten voor het budget voor het volgend jaar. Toevallig kwam budget ook aan de orde in de discussie over CF Planning. Kosten overschrijdingen in het budget verstoren de CASH. De CF Planning is grotendeels op het budget gebaseerd. Het banksaldo moet aansluiten op de gebudgetteerde balans, want maak niet alleen een budget op W & V niveau, maar ook op Balans niveau. Denk daarbij ook aan uw Investeringsbudget voor de balans, investeringen, desinvesteringen en afschrijvingen. Maarten Verheul – Treasury Consultant

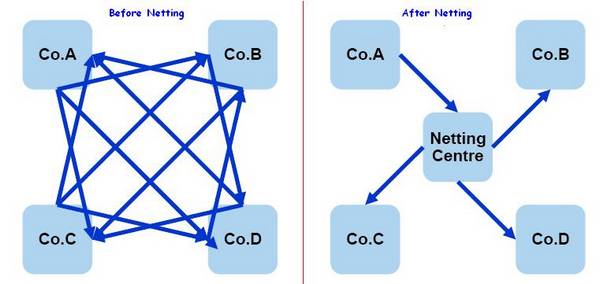

Maarten Verheul – Treasury Consultant Netting is mainly used by global operating companies with a large number of subsidiaries; the reach of netting can however also include smaller company structures and save a lot of handling and costs.

Netting is mainly used by global operating companies with a large number of subsidiaries; the reach of netting can however also include smaller company structures and save a lot of handling and costs.

Jan Meulendijks – Cash management, transaction banking and trade professional

Jan Meulendijks – Cash management, transaction banking and trade professional In my earlier

In my earlier

Afgelopen weken hebben er verschillende artikelen in de internationale kranten gestaan over de lening die het IMF aan Egypte wil verstrekken. Daarbij zagen we ook de Egyptische minister van landbouw Nederland bezoeken om te leren van de Nederlandse expertise op het gebied van land- en tuinbouw. De ontwikkelingen op de financiële markt in Egypte krijgen ook meer aandacht, dus we kunnen concluderen dat het interessant is om even stil te staan hoe de lokale valuta daar is georganiseerd. Na een eerdere devaluatie in maart van dit jaar, wordt er nu alweer een volgende verwacht.

Afgelopen weken hebben er verschillende artikelen in de internationale kranten gestaan over de lening die het IMF aan Egypte wil verstrekken. Daarbij zagen we ook de Egyptische minister van landbouw Nederland bezoeken om te leren van de Nederlandse expertise op het gebied van land- en tuinbouw. De ontwikkelingen op de financiële markt in Egypte krijgen ook meer aandacht, dus we kunnen concluderen dat het interessant is om even stil te staan hoe de lokale valuta daar is georganiseerd. Na een eerdere devaluatie in maart van dit jaar, wordt er nu alweer een volgende verwacht. René Schilder – Co Owner 2FX Treasury BV

René Schilder – Co Owner 2FX Treasury BV