02-04-2020 | treasuryXL | XE |

It’s safe to say that we all have a lot on our minds right now. Unfortunately, whenever there’s a situation that causes people to feel uneasy and panicked, there will be fraudsters and criminals who take advantage.

We have recently seen a surge in demand for our services, and in that surge there have also been vulnerable customers that have been manipulated by opportunists. In addition, the recent uptick in fully remote and online work has also opened doors for online scam and fraud attempts.

At XE, keeping our customers and their personal information safe is our greatest priority. We want to help you to protect yourself from fraud attempts. Take a few minutes to familiarize yourself with some of the most common online scams, and read through our tips to keep yourself and your loved ones safe from fraudulent activity.

Phishing emails

Last year, Microsoft reported that phishing attacks were the greatest online security threat by far, having increased by 250 percent since their previous report.

Usually coming by email, these attacks encourage you to click on a link or attachment and download malicious software, which attacks your device and hacks access to your files. You may also receive an email from someone posing as a trusted figure (such as your employer or a reputable company) and asking you to provide sensitive information.

How to handle these: Verify everything. Reach out to the sender or the company and confirm that this email did come from them. It takes just a few moments, but it can have a huge impact.

Banking and online account scams

Take extra caution when reading an email from a bank. Many scammers send emails or texts that appear to be sent from your bank, highlighting a problem with your account. Often, they will request a verification of your details to resolve the problem. Once they have your details…you can imagine the rest.

How to handle these: Call your bank directly to clarify the issue. Never submit your personal details to this email, or to any email. Most reputable providers will not ask you for sensitive information over email, so that should be an immediate red flag.

Online shopping was already on the rise, and now that people are taking the majority of their shopping online, scams in this area have become more prevalent. Scams include selling faulty products, attempting to sell a product to gain bank details, and promising goods at a low price (only for those goods to never arrive and the site to close down after taking your money).

How to handle these: Use your head. If it’s a site or store that you’ve never heard of, research the company and see if you can find verified reviews from other customers. Ask yourself: “Does this seem too good to be true?” If it does, then proceed with caution.

Lottery, competition and inheritance schemes

Say you receive emails stating that you have won monetary prizes in competitions you did not enter, or messages from people overseas claiming that you have inherited money. These are just attempts to obtain your personal details.

How to handle these: Ask yourself, “Did I enter a competition? Do I know these people?” As much as we’d like to believe the fairy tales, winning or inheriting money completely out of the blue is not likely to happen. Once again: if it sounds too good to be true, it probably is.

Charity scams

Scams that take advantage of good-natured individuals often make a special appearance around the holiday season, but these could be active at any time of the year. Scammers will pretend to work for a charitable cause and may even exploit news of a current crisis. Scams surrounding COVID-19 are already in circulation, and seek to prey on people’s fears.

How to handle these: Do your research. If you plan to make a donation, make sure you know who you’re donating to and what your donation will be used for. If possible, make donations only through reputable organizations’ secure sites.

How can you avoid future scams?

When it comes to avoiding online scams, there are some key precautions that everyone should take. Pass these along to your friends, family, and clients, and take a critical eye in your own online habits.

- Read every email carefully. Emails are the most common scam vehicle. One way to check whether the message is from a reputable source is by checking the URL before you click. Extra characters and misspellings could both point to a suspicious link. If you’re still not sure, treat it as you would any other scam email. If it’s a sender who claims to know you, check with them before sending money or information.

- Never agree to send money to anyone you have only met online. Sending money online is not something you should take chances on. Don’t send anyone money unless you know them personally and are certain that they are legitimate.

- Never make a financial decision based on a phone call you receive from a person posing as a relative of someone in prison. This is a common scam that relies on you panicking and rushing to send money as quickly as possible. Take a second to consider the situation. Odds are, it won’t make sense once you think about it. If you’re still unsure, verify the situation with another relative or friend.

- Never share login credentials with anyone online. No matter what they promise to do for you in return. No reputable organization will ask you for this information.

- Be wary of unsolicited contact. If you don’t know the person or organization who has just contacted you, be cautious while you verify who they are. Don’t respond or provide them with anything until you know they’re legitimate.

- Update your devices. If you haven’t been doing this regularly, now is definitely the time to ensure that all of your devices are updated with the latest security measures.

We hope this information helps you and your loved ones to stay safe online. If you need anything, our team is here to help.

Neville Lacey

Global Risk and Compliance Director at XE

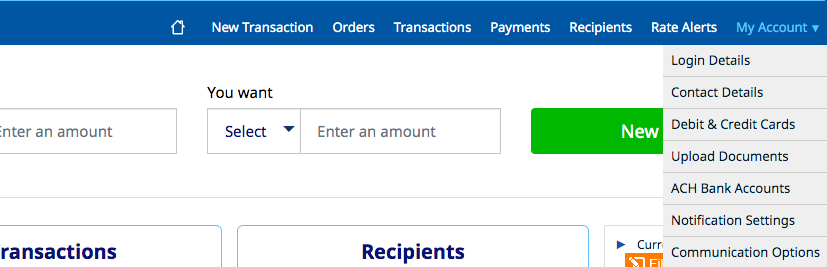

Get in touch with XE.com

About XE.com

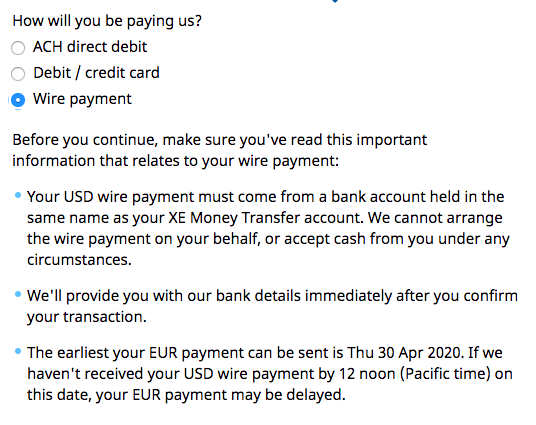

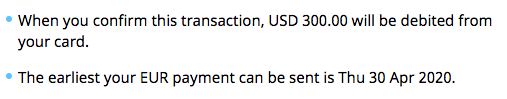

XE can help safeguard your profit margins and improve cashflow through quantifying the FX risk you face and implementing unique strategies to mitigate it. XE Business Solutions provides a comprehensive range of currency services and products to help businesses access competitive rates with greater control.

Deciding when to make an international payment and at what rate can be critical. XE Business Solutions work with businesses to protect bottom-line from exchange rate fluctuations, while the currency experts and risk management specialists act as eyes and ears in the market to protect your profits from the world’s volatile currency markets.

Your company money is safe with XE, their NASDAQ listed parent company, Euronet Worldwide Inc., has a multibillion-dollar market capitalization, and an investment grade credit rating. With offices in the UK, Canada, Europe, APAC and North America they have a truly global coverage.

Are you curious to know more about XE?

Maurits Houthoff, senior business development manager at XE.com, is always in for a cup of coffee, mail or call to provide you detailed information.

Visit XE.com

Visit XE partner page