23-07-2020 | treasuryXL | XE |

When there’s a lot you need to save, it can seem daunting, and you might not know where to start. We want to help you with your savings plan.

Most of our purchases are pretty mundane. Think about the purchases you’ve made this week. They were probably more along the lines of swiping your card at the gas pump and paying your bills online than the lines of booking an extravagant trip or buying a new vehicle, right? But every so often, we will make those larger purchases.

Whether it’s a solid investment for your family and lifestyle (like a home) or a well-deserved bit of fun (like a hot tub), these purchases won’t be as easy. You may have enough saved up to make this purchase right now, but it’s more likely that this purchase is going to require a bit of saving.

When there’s a lot you need to save, it can seem daunting, and you might not know where to start. We wanted to share some of our tips to simplify the saving process for your next exciting purchase.

1. Figure out your timeline and use it to create your savings plan

Depending on the type of purchase that you’re making, there may be a specific date by which you’ll need to make your purchase. Even if you aren’t working towards a set deadline, it’s a good idea to set one for yourself so you can determine how much you want to save each month.

If there’s no rush, you can base your savings plan on how much you can comfortably put away each month, without having to make any changes to your current spending habits. But if you have a target date for your purchase or you’d prefer to shorten the process, read on to see how you can save more each month.

2. Make a separate savings account for this purchase

You may already have a general savings account (and if you don’t, try to open one as soon as possible). But creating a new savings account just for this purchase has a few benefits:

-

You can visualize how much you’ve saved more quickly and easily;

-

You won’t be tempted to pull from your emergency savings or other important savings (and vice versa);

-

You can utilize accounts, tools, and services that you might not be using with your current savings account.

When you open this new savings account, take advantage of this opportunity to shop around your bank’s offerings or even other banks’ accounts. Some banks offer financial planning tools that can help you with your savings, or you could find a bank or account that will generate greater interest on what you’ve saved. Don’t just go with the first option available; take time to find the one that best suits your goals.

3. Reassess your budget

In general, you should revisit your budget on an annual basis, or any time you experience a change in your life or financial circumstances (such as starting or losing a job or combining finances with a spouse). Creating a savings plan is another time when you should take another look at your current spending. Determine how much you could comfortably put away each month, and how long it would take you to save at that rate. If you’re not happy with that timeline, try making a few changes to your budget to improve the efficacy of your savings.

There are some expenses that you can’t cut from your budget. Even when you’re saving up for a big purchase, you’ll still need to pay your bills, buy groceries, and put gas in your car in the meantime. But look at the subscriptions you pay for and the non-essentials that you buy and consider whether you need to budget for them

Even for the essential purchases, small changes like switching from name brands to generic, buying used, or comparison shopping online can add up to increased savings.

Need another currency for your purchase? Consider an Xe money transfer

You could be purchasing property in another country, or you could be making an investment. In these cases, your payment would. Sure, you couldjust make a card payment and let the exchange sort itself out in the payment process, or you could make a wire transfer. But when it comes to large purchases, there are a few unique advantages to using money transfer for your transaction.

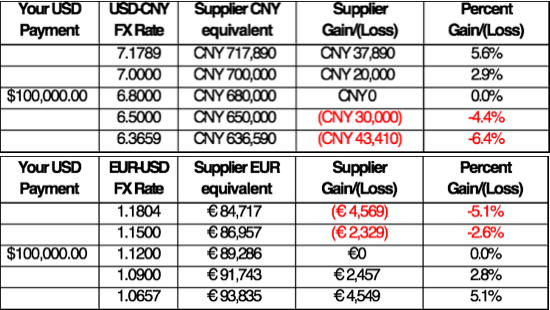

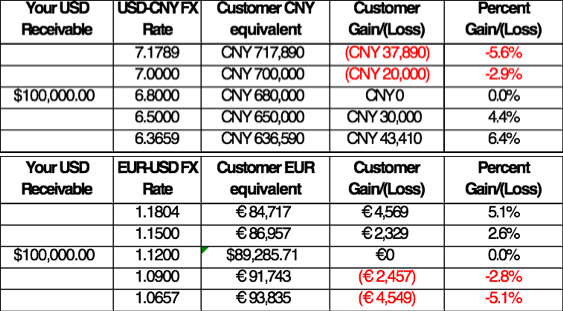

When you’re exchanging a large amount of currency, the exchange rate can make a big difference in how much you need to provide. If you pay with your card or make a bank or wire transfer, your transfer will be made at their exchange rate. These exchange rates often come with hidden margins or are designed to favor the provider over you, meaning that you won’t get as much bang for your buck.

If you make your transaction through a money transfer provider, on the other hand, you can check the rates ahead of time and get a rate that you know you’ll be happy with. If you transfer money with Xe, you can guarantee that you’ll get a fair, honest exchange rate that comes from the live currency markets, with no hidden margins.

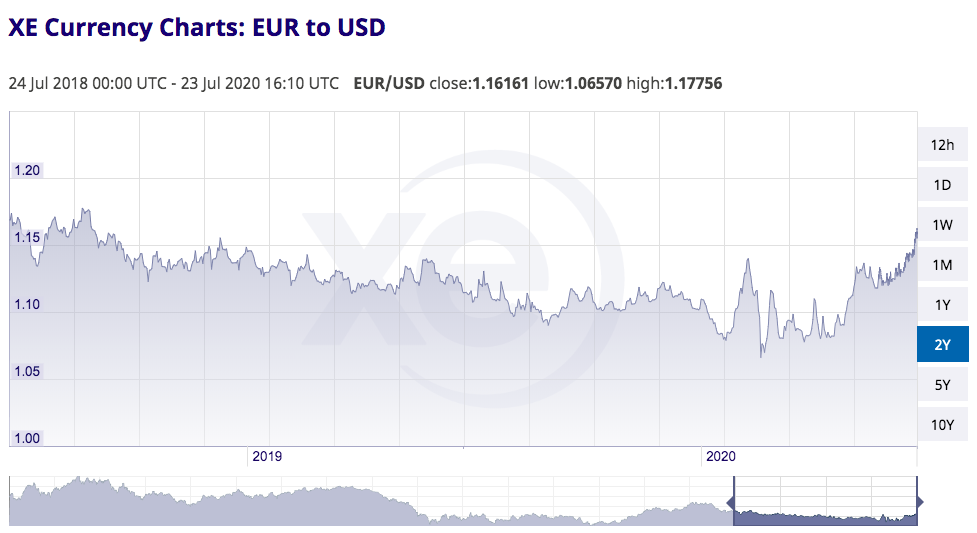

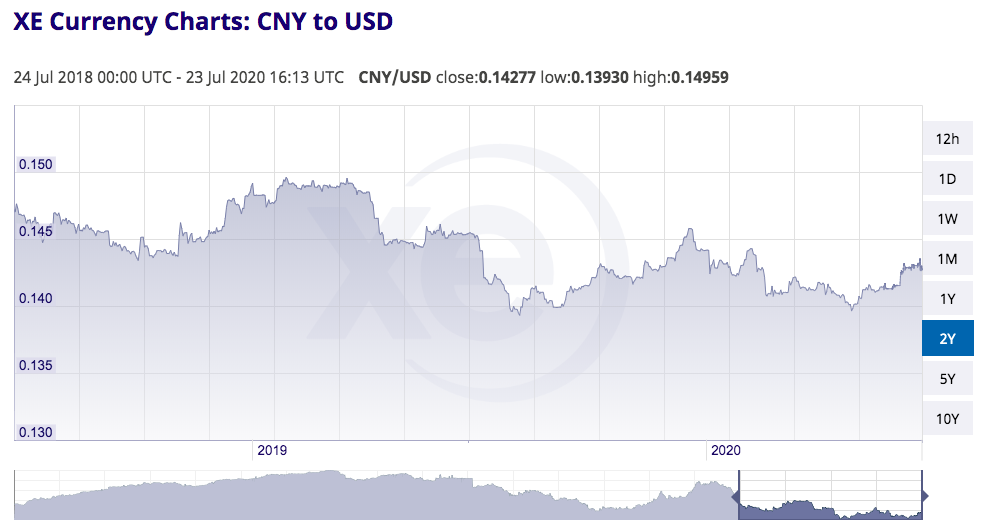

If you’re not on a time limit, there are a few tools you can take advantage of to ensure that you’ll get the best rate possible for your transfer. You can set a Rate Alert that will let you know as soon as your desired rate is live, or if you have the funds you can set a Market Order that will automatically purchase your currency when your ideal rate is live.

Or, if the rates are currently in your favor but you lack the funds or don’t want to make your purchase right away, a Forward Contract will allow you to lock in the current exchange rate and make your exchange or purchase at a future date.

Get in touch with XE.com

About XE.com

XE can help safeguard your profit margins and improve cashflow through quantifying the FX risk you face and implementing unique strategies to mitigate it. XE Business Solutions provides a comprehensive range of currency services and products to help businesses access competitive rates with greater control.

Deciding when to make an international payment and at what rate can be critical. XE Business Solutions work with businesses to protect bottom-line from exchange rate fluctuations, while the currency experts and risk management specialists act as eyes and ears in the market to protect your profits from the world’s volatile currency markets.

Your company money is safe with XE, their NASDAQ listed parent company, Euronet Worldwide Inc., has a multi billion-dollar market capitalization, and an investment grade credit rating. With offices in the UK, Canada, Europe, APAC and North America they have a truly global coverage.

Are you curious to know more about XE?

Maurits Houthoff, senior business development manager at XE.com, is always in for a cup of coffee, mail or call to provide you detailed information.

Visit XE.com

Visit XE partner page