Cash Management in the Digital Age: Redefining Visibility & Control

15-02-2022 | Ernie Humphrey | treasuryXL | LinkedIn |

Access to cost-effective technology and greater data availability are redefining best practices in cash management. Many cash management pain points that were common even a few years ago are no longer causing treasury professionals headaches and sleepless nights.

On paper, effective cash management has always appeared simple. You need to have visibility and control of cash. Cash visibility means knowing current available balances, what happened and when it happened relative to all cash inflows and outflows for all bank accounts.

Cash visibility means having access to all balances and activity in your bank accounts. Historically, this has been a huge challenge. It required direct interaction with each bank to give you assess to the information you needed either through a bank portal or having the bank send you the information in a standard formatted message, an MT940 message for example. Imagine even 10 banks with a few being international banks and this task was difficult at best. I know this because I was involved in cash management at a company that had over 60 accounts in 12 different countries back in the early 2000’s. The best-case scenario for a treasury professional was to have to carry around many bank tokens and get IT resources allocated to manage any messaging from banks.

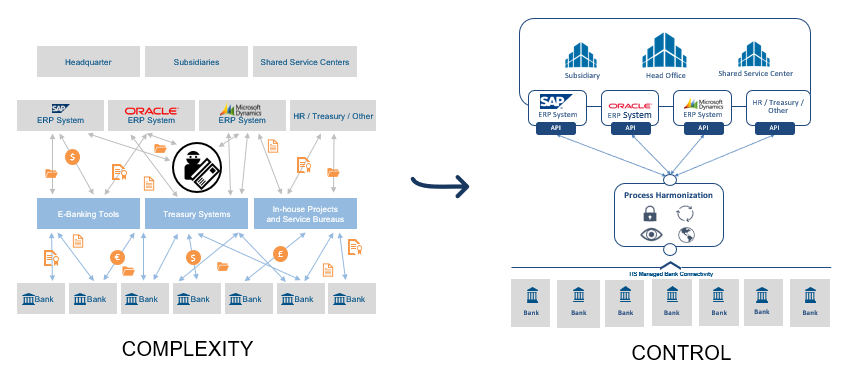

The good news is that there are now providers of cost-effective treasury management systems (TMS) that take on the challenges of gathering all information from your banks and getting relevant information to you in a timely manner in an easy-to-read dashboard. The following is a “Then vs. Now” illustration relative to the task of establishing visibility of cash in bank accounts courtesy of TIS, a leading TMS provider.

Control of cash means that informed decisions are being made relative to when and how payments are made, and cash is received. Payments and receipts are not just being scheduled and received based on the preferences of suppliers, customers, or at the convenience of accounts payable, accounts receivable, and/or treasury staff. Establishing control of cash means understanding how and why cash movements are taking place, and then optimizing the timing and types of payments and receipts (check, ACH, corporate cards)

Historically this has been challenging as accounts payable and accounts receivable were often run in silos, and there was limited visibility into what was going on and why for treasury professionals. Furthermore, accounts payable and accounts receivable were reporting up to the controller, and not up through to the Treasurer. Treasury professionals were handcuffed to a great degree in managing the cash conversion cycle.

Given more focus of investors on free cash flow and advances in technology relative to accounts payable and accounts receivable management, CFOs have given more attention to accounts payable and accounts receivable. This has meant that accounts payable and accounts receivable are no longer allowed to run in silos or viewed as purely back-office functions. At many companies, accounts payable and accounts receivable are collaborating much more with treasury professionals, and in some cases reporting up to treasury leaders.

Given more focus of investors on free cash flow and advances in technology relative to accounts payable and accounts receivable management, CFOs have given more attention to accounts payable and accounts receivable. This has meant that accounts payable and accounts receivable are no longer allowed to run in silos or viewed as purely back-office functions. At many companies, accounts payable and accounts receivable are collaborating much more with treasury professionals, and in some cases reporting up to treasury leaders.

Cloud-based accounts payable solutions are providing companies with visibility into all aspects of accounts payable, facilitating better relationships with suppliers, improving the productivity of those involved in the accounts payable process, giving companies more control of when and how they pay suppliers, and vastly improving the forecasts of payments.

Cloud-based accounts receivable solutions are providing companies with visibility into all aspects of accounts receivable, facilitating better relationships with customers, improving the productivity of those involved in the accounts receivable process, giving companies more control of when and how they get paid, and vastly improving the forecasts of receipts.

Advances in technology have turned what used to be cash management nightmares into dreams of optimizing all cash movements (how and when) which, frankly, can be a reality at companies of all sizes with the right people, processes, and systems.

Thank for reading!

Ernie Humphrey

Seasoned Treasury Expert

& CEO Treasury Webinars