Pinpointing oil and gas sector Risks

14-12-2020 | treasuryXL | Refinitiv |

-

Screening and related due diligence tools are essential in the oil and gas sector for pinpointing and exposing potential risks early in the game.

-

In the highly regulated upstream industry of exploration and drilling, risks include sanctions violations, bribery, corruption, and environmental crime.

-

Refinitiv’s World-Check Risk Intelligence database comprises over four million structured records, enabling robust and accurate screening of both entities and individuals.

The oil and gas sector has been on the receiving end of some of the largest regulatory fines on record in recent years. Our Expert Talk, Drilling down: Oil and gas supply chain risk, written by Refinitiv’s Renata Galvao, takes a look at the sector and its unique challenges.

One of the highest profile was the US$853.2 million levied in 2018 against Brazilian state oil company, Petróleo Brasileiro SA, under the U.S. Foreign Corrupt Practices Act in the so-called Car Wash bribery scandal. While figures such as these are eye-wateringly high, the reputational fallout of any association with financial or environmental crime can be far more devastating. It is therefore imperative that organizations operating in the oil and gas sector take adequate measures to screen for, and mitigate, the wide range of risks to which they may be exposed within often vast, global supply chains.

Oil and gas sector risks

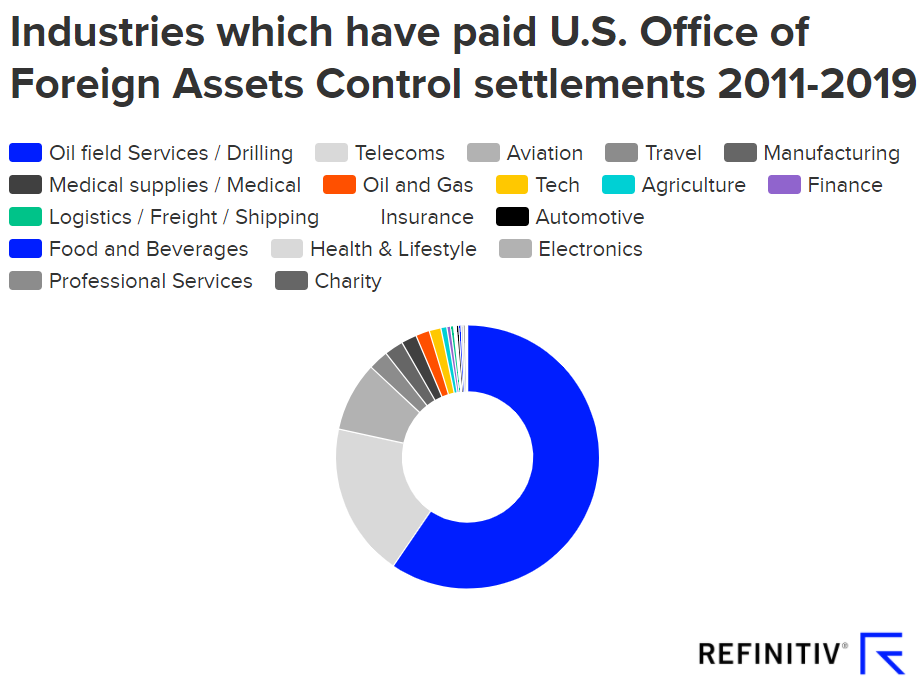

Organizations in the oil and gas sector — whether they are involved in upstream, midstream or downstream activities — face a range of risks and challenges. The highly regulated upstream industry — incorporating exploration and drilling — paid the largest share of all settlements for breaching Office of Foreign Assets Control sanctions in the period 2011-2019. Many oil-rich territories are situated in jurisdictions characterized by political uncertainty, and consequently organizations must contend with high levels of risk relating to bribery and corruption. There is also exposure to a number of hidden risks, such as those related to terrorism financing and engagement with armed rebel groups.

The midstream industry — including transportation, storage and wholesale marketing — also faces a range of risks, including the financial, regulatory and reputational fallout associated with accidents such as spills, explosions, and leaks. Environmental regulations governing such issues are stringent, with penalties including both fines and imprisonment where criminal charges are brought against negligent individuals. Moreover, midstream organizations using sea transportation must be able to verify the beneficial ownership of all vessels used, as any links to criminal activity such as smuggling at sea, the illicit transportation of contraband and narcotics, or human trafficking must be identified.

The downstream industry — refining, processing, marketing and distribution — in turn is exposed to significant third-party risk from both the upstream and midstream industries. Oil theft is becoming a growing concern, and therefore understanding the source of crude and the legitimacy of the product are fundamental areas of focus for this sector. Downstream companies are also subject to growing environmental controls, with ever-more stringent national regulations monitoring and restricting the levels of pollution that refineries are allowed to emit.

Mitigating risk in global supply chains

Given this vast range of potential risks, screening and related due diligence are widely regarded as key tools to pinpoint and expose potential risk early in the game.

Refinitiv’s market-leading World-Check Risk Intelligence database can provide invaluable support to compliance teams by enabling them to conduct robust and accurate screening of both entities and individuals. World-Check One, our essential screening platform, further offers a range of specific opt-in tools, including:

- Media Check to enable targeted searching for negative news and web articles, both current and historical, relating to individuals and entities.

- UBO Check, which allows users to identify the ultimate beneficial owners of entities and then screen them against World-Check Risk Intelligence on a single platform.

- Vessel Check, which reveals potential risk related to sanctioned or embargoed vessels and sea ports.

Additionally, where heightened risk is suspected, our Enhanced Due Diligence reports deliver targeted insights into potential business relationships, enabling companies to form a holistic view of potential risk before entering a new market or beginning a new relationship.

By investing in the right screening tools and technology, companies in the oil and gas sector can pinpoint, expose and mitigate risk in global supply chains, and in so doing protect themselves from the ever-growing threat of severe financial, regulatory and reputational fallout that has dogged the sector in the recent past.