Cobase

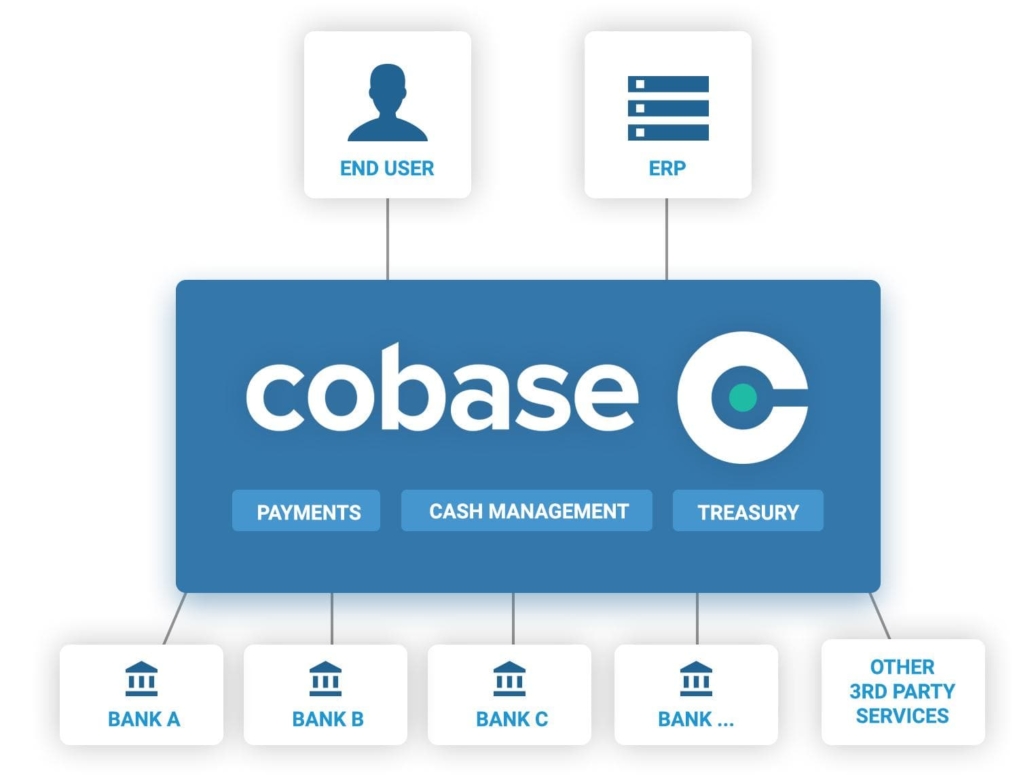

Our story began with a belief: Corporate banking can – and should – be more straightforward and efficient. Today, we’re proud to offer an innovative multibank platform that seamlessly combines the services of Payment Hubs, Service Bureaus, and Treasury Management Systems into one comprehensive solution.

At Cobase, we empower CFOs, Treasurers, Cash Managers, Financial Controllers, Accounts Payable and Receivable departments, and other financial functions. Our easy-to-use platform allows our users to connect with nearly 15,000 banks worldwide using technologies like SWIFT, H2H, EBICS, and APIs. With more than 500+ bank connections spanning across 80+ countries, our network is ever-expanding and diverse.

Our Software as a Service (SaaS) model offers businesses a solution with minimal IT impact, thus reducing total cost of ownership. We manage all the complexity of bank connectivity, delivering a streamlined experience through our secure cloud environment.

Cobase is part of Alpha Group International plc, listed on the London Stock Exchange (LON:ALPH) and trading through its wholly owned subsidiaries Alpha FX Limited (Company Registration No. 05108142) and Alpha FX Europe Limited (Company Registration No. C 96623). Cobase is ISO27001 certified by BSI under certificate number ISC 276 and has received an ISAE 3402 statement and SOC2 attestation.

Basic yet powerful integration between a company’s cloud based ERP system and banks. Bank accounts are connected in a secure way to send payment files and receive electronic bank statements.

Powerful solution for companies that need extensive bank connectivity. Connect ERP systems and manage bank accounts via one central portal with one central user administration and flexible workflows.

All functionality of the Payment Hub plus optional modules for efficient day-to-day treasury management such as FX management, liquidity forecasting, in-house banking and cash pooling.

VIDEO

WEBINARS

Cobase regularly organizes webinars for those who are interested in their solution. In just one hour they give an introduction, present a live demo and share their product roadmap.

During the online webinar, you can ask questions as you need or just watch if you prefer. For any further information after the webinar, you can simply request a 1:1 meeting or demo, to discuss your specific requirements.

Register now for one of the webinars!

Follow Cobase

TEAM MEMBERS

Jorge Schafraad

CEO & Founder

Jack Gielen

COO/CFO

Matthias Varenkamp

Marketing Manager

Frans Kaan

Sales Manager

Building a platform for success

11-01-2023 | Cobase | treasuryXL | LinkedIn | Banks provide solutions to connect and integrate corporate ERP systems, most of which are based upon batches of data being exchanged between the accounting platforms of the company and the bank. However, these are bank and country-specific and not a scalable solution fit for future growth or […]

Making the most of automation

04-01-2023 | Cobase | treasuryXL | LinkedIn | We have previously identified automating critical workflows as one of the key components of intelligent treasury management. Source There are many aspects of the treasury function where automation frees up time for the treasurer to focus on higher value tasks. Skills that are expected to be less […]

Recording | The Future of APIs webinar 13 December 2022 | treasuryXL & Cobase

29-12-2022 | Cobase | treasuryXL | LinkedIn | Are you unsure about the discussion surrounding APIs and Treasury, or do you want to learn more? If so, you should definitely watch the recording of the joint webinar together with Cobase on the future of APIs to get more information. This webinar is not just for […]

Making cash management processes work for business

28-12-2022 | Cobase | treasuryXL | LinkedIn | Cash management strategies have come under intense scrutiny of late as a result of various geopolitical and economic factors. Industry surveys point to corporates becoming more risk-averse and seeking to increase their cash balances as the specter of recession looms large. Source In the first in a […]

The ultimate guide for achieving efficient and safe multibank cash visibility and payments

19-12-2022 | Cobase | treasuryXL | LinkedIn | To optimise cash management processes you need to apply a number of key principles to increase the level of insight into how cash moves into and out of your organisation. Source We have listed these key principles in ‘The ultimate guide for achieving efficient and safe multibank […]

Question: What are Treasurers expecting from Open Banking? Part 4

30-11-2022 | Cobase | treasuryXL | LinkedIn | Not sure what all the talk about APIs and Treasury is about, or wondering if you need to know more? Then it is definitely a good idea to attend the live session together with Cobase on the future of APIs on December 13 at 10 CET. Join […]