With an IBAN-Name Check, you can also prevent salary payment fraud

By SurePay

Fraudsters are certainly not only targeting the world of big fast money. They can also cause widespread damage in ‘simple’ salary payments. Here, employees have a responsibility to double-check account information and that can be cumbersome. But, there is a solution to that.

Employers should take immediate action to combat salary fraud and errors because they can cause significant damage. The Labour Market Fraud Act requires employers to ensure employees have their own bank accounts, and failure to do so can result in fines. Checking bank accounts is necessary to avoid errors during onboarding and prevent salary fraud, which is increasingly common in large organizations. Salary fraud involves fraudsters posing as employees and changing account details to redirect payments.

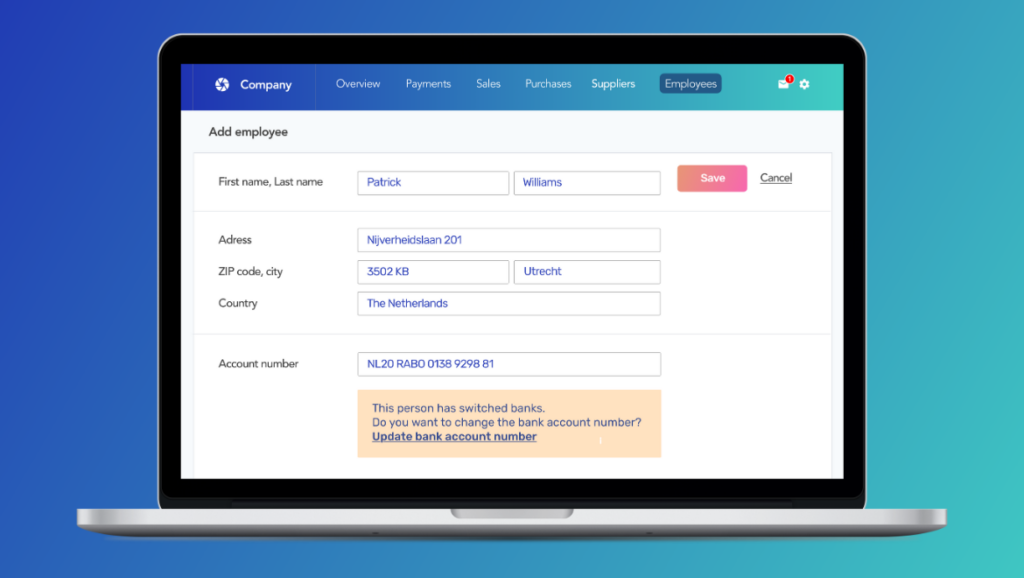

Implementing the IBAN-Name Check, an automated solution that verifies account ownership, can prevent errors and reduce the burden on employees. There are three ways to prevent invoice fraud and incorrect transfers.

Click and Scroll! Here are more articles that you might like…

https://treasuryxl.com/wp-content/uploads/2023/03/Treasurer-Search-Logo.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-07-01 10:25:252025-07-01 10:35:38Specialist Trade Finance (m/w/d) – Hessen

https://treasuryxl.com/wp-content/uploads/2023/03/Treasurer-Search-Logo.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-07-01 10:25:252025-07-01 10:35:38Specialist Trade Finance (m/w/d) – Hessen https://treasuryxl.com/wp-content/uploads/2024/07/Embat.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-07-01 10:15:442025-07-01 10:15:44Treasury Success Specialist @ Embat

https://treasuryxl.com/wp-content/uploads/2024/07/Embat.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-07-01 10:15:442025-07-01 10:15:44Treasury Success Specialist @ Embat https://treasuryxl.com/wp-content/uploads/2023/03/Treasurer-Search-Logo.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-07-01 10:13:582025-07-01 10:37:38Senior Treasury Manager – Around Utrecht

https://treasuryxl.com/wp-content/uploads/2023/03/Treasurer-Search-Logo.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-07-01 10:13:582025-07-01 10:37:38Senior Treasury Manager – Around Utrecht https://treasuryxl.com/wp-content/uploads/2021/04/Philips.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-07-01 09:36:542025-07-01 09:36:55Internship: Treasury Middle Office (Accounting) @ Philips

https://treasuryxl.com/wp-content/uploads/2021/04/Philips.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-07-01 09:36:542025-07-01 09:36:55Internship: Treasury Middle Office (Accounting) @ Philips https://treasuryxl.com/wp-content/uploads/2023/03/Treasurer-Search-Logo.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-07-01 09:34:392025-07-01 10:38:24Treasurer (m/w/d) – Raum Köln @ Treasurer Search

https://treasuryxl.com/wp-content/uploads/2023/03/Treasurer-Search-Logo.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-07-01 09:34:392025-07-01 10:38:24Treasurer (m/w/d) – Raum Köln @ Treasurer Search https://treasuryxl.com/wp-content/uploads/2016/04/Logo-NIBC-500x500-e1468925504363.jpg

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-07-01 09:32:262025-07-01 09:32:26Product Owner Treasury IT @ NIBC

https://treasuryxl.com/wp-content/uploads/2016/04/Logo-NIBC-500x500-e1468925504363.jpg

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-07-01 09:32:262025-07-01 09:32:26Product Owner Treasury IT @ NIBC https://treasuryxl.com/wp-content/uploads/2023/09/Lely.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-07-01 09:23:592025-07-01 09:25:59Stage: Treasury @ Lely

https://treasuryxl.com/wp-content/uploads/2023/09/Lely.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-07-01 09:23:592025-07-01 09:25:59Stage: Treasury @ Lely https://treasuryxl.com/wp-content/uploads/2024/10/Embat-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-07-01 07:00:142025-06-30 15:41:57Data + innovation + strategy, the challenge of the CFO

https://treasuryxl.com/wp-content/uploads/2024/10/Embat-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-07-01 07:00:142025-06-30 15:41:57Data + innovation + strategy, the challenge of the CFO https://treasuryxl.com/wp-content/uploads/2025/06/VU-program-200-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-06-30 09:00:162025-06-30 14:20:47Online Info Session: Cash & Treasury Operations

https://treasuryxl.com/wp-content/uploads/2025/06/VU-program-200-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-06-30 09:00:162025-06-30 14:20:47Online Info Session: Cash & Treasury Operations