With an IBAN-Name Check, you can also prevent salary payment fraud

By SurePay

Fraudsters are certainly not only targeting the world of big fast money. They can also cause widespread damage in ‘simple’ salary payments. Here, employees have a responsibility to double-check account information and that can be cumbersome. But, there is a solution to that.

Employers should take immediate action to combat salary fraud and errors because they can cause significant damage. The Labour Market Fraud Act requires employers to ensure employees have their own bank accounts, and failure to do so can result in fines. Checking bank accounts is necessary to avoid errors during onboarding and prevent salary fraud, which is increasingly common in large organizations. Salary fraud involves fraudsters posing as employees and changing account details to redirect payments.

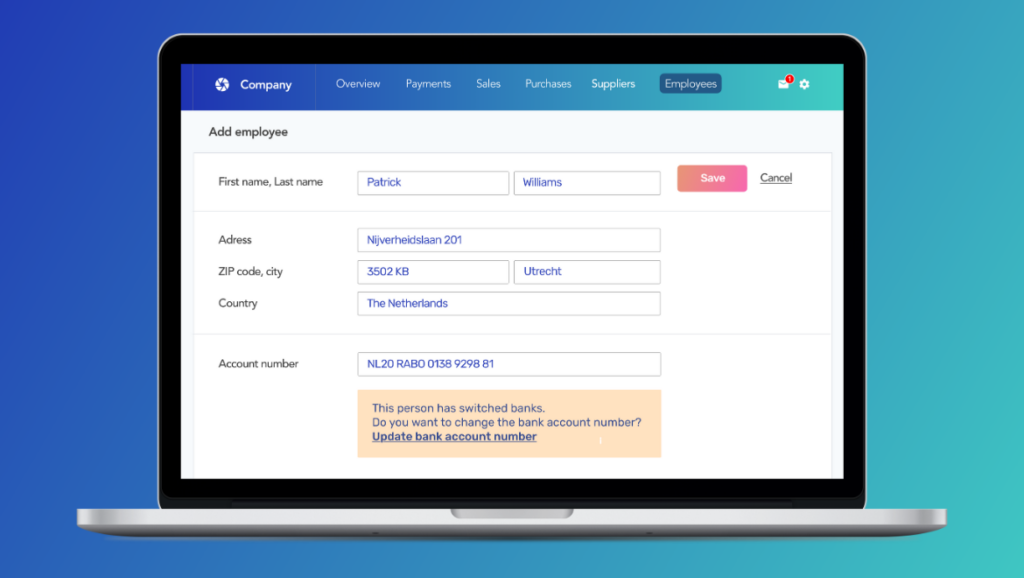

Implementing the IBAN-Name Check, an automated solution that verifies account ownership, can prevent errors and reduce the burden on employees. There are three ways to prevent invoice fraud and incorrect transfers.

Click and Scroll! Here are more articles that you might like…

https://treasuryxl.com/wp-content/uploads/2025/09/Featured_Treasurer-Search-3.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-16 09:31:512025-09-16 09:31:51Inside Germany’s 2025 Treasury Job Market

https://treasuryxl.com/wp-content/uploads/2025/09/Featured_Treasurer-Search-3.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-16 09:31:512025-09-16 09:31:51Inside Germany’s 2025 Treasury Job Market https://treasuryxl.com/wp-content/uploads/2025/09/Live-Session-Panax-8.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-16 07:00:432025-09-15 13:40:39Recap & Recording: Entering a New Age of Cash Management: Opportunities and Risks of AI

https://treasuryxl.com/wp-content/uploads/2025/09/Live-Session-Panax-8.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-16 07:00:432025-09-15 13:40:39Recap & Recording: Entering a New Age of Cash Management: Opportunities and Risks of AI https://treasuryxl.com/wp-content/uploads/2025/09/Conferenzia-World-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-15 07:00:572025-09-12 07:44:05Banking 4.0 and Banking Innovation Conference

https://treasuryxl.com/wp-content/uploads/2025/09/Conferenzia-World-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-15 07:00:572025-09-12 07:44:05Banking 4.0 and Banking Innovation Conference https://treasuryxl.com/wp-content/uploads/2024/01/Template_VACANCY-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-12 07:00:262025-09-12 12:43:09Vacancy In-house Treasury Advisor

https://treasuryxl.com/wp-content/uploads/2024/01/Template_VACANCY-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-12 07:00:262025-09-12 12:43:09Vacancy In-house Treasury Advisor https://treasuryxl.com/wp-content/uploads/2024/05/NEWS-featured_TD.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-11 07:00:072025-09-11 09:17:10Treasury Delta Transacts Innovative Corporate Cash Management RFPs

https://treasuryxl.com/wp-content/uploads/2024/05/NEWS-featured_TD.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-11 07:00:072025-09-11 09:17:10Treasury Delta Transacts Innovative Corporate Cash Management RFPs https://treasuryxl.com/wp-content/uploads/2024/02/Featured_Treasurer-Search.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-10 07:00:472025-09-09 12:58:05Why Niche Recruiters Are Still Worth Their Weight in Coffee Beans

https://treasuryxl.com/wp-content/uploads/2024/02/Featured_Treasurer-Search.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-10 07:00:472025-09-09 12:58:05Why Niche Recruiters Are Still Worth Their Weight in Coffee Beans https://treasuryxl.com/wp-content/uploads/2025/09/Leeuwarden.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-09 10:04:042025-09-11 10:01:37Assistant Treasurer (Volunteer) @ Samen Leeuwarden

https://treasuryxl.com/wp-content/uploads/2025/09/Leeuwarden.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-09 10:04:042025-09-11 10:01:37Assistant Treasurer (Volunteer) @ Samen Leeuwarden https://treasuryxl.com/wp-content/uploads/2024/10/Embat-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-09 08:06:422025-09-09 08:06:42Grundsätze für ein effizientes Schuldenmanagement von Unternehmen und dessen Auswirkungen auf die Finanzstrategie

https://treasuryxl.com/wp-content/uploads/2024/10/Embat-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-09 08:06:422025-09-09 08:06:42Grundsätze für ein effizientes Schuldenmanagement von Unternehmen und dessen Auswirkungen auf die Finanzstrategie https://treasuryxl.com/wp-content/uploads/2025/09/Live-Session-Panax-3.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-08 12:44:462025-09-08 12:53:06Live Session: Entering a New Age of Cash Management: Opportunities and Risks of AI

https://treasuryxl.com/wp-content/uploads/2025/09/Live-Session-Panax-3.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-08 12:44:462025-09-08 12:53:06Live Session: Entering a New Age of Cash Management: Opportunities and Risks of AI