Treasurers at Zimmer Biomet and TechnipFMC highlight why FX strategy must start with a clear purpose. From structural fixes to selective hedging, they share how treasury teams are adapting to today’s currency challenges.

In practice, many FX hedging programs remain in place long after their original rationale has faded. Designed with good intentions, they often become routine—rarely questioned, seldom adapted. For treasury teams facing growing currency volatility, that’s a risk in itself.

“I always ask, what problem are we solving?” said Pradipto Bagchi, Treasurer at Zimmer Biomet, an American medical device company . “It’s surprising how easily that gets lost.”

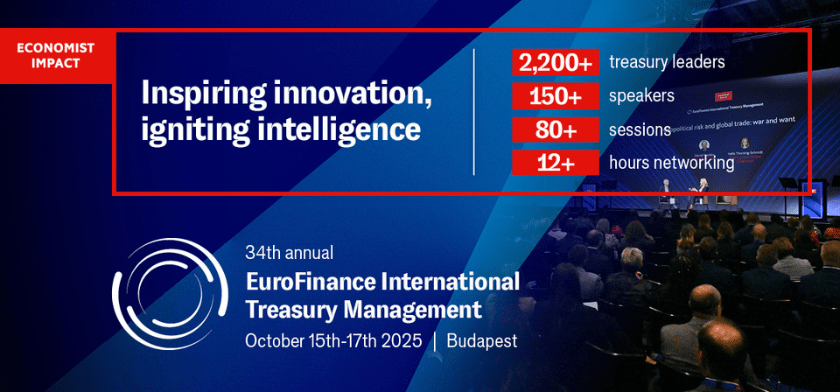

At EuroFinance’s International Treasury & Cash Management Summit Miami, Bagchi and Fred Schacknies, Vice president and treasurer at TechnipFMC, a technology provider company, discussed how they’ve restructured FX strategies to stay aligned with business realities—from setting risk priorities and navigating local pushback to managing exposures in markets where hedging isn’t an option. Their message was consistent: FX strategy doesn’t begin with products—it begins with purpose.

Rebuilding FX strategy around priorities

For Schacknies, clarity meant tearing down and rebuilding. Over the past two years, TechnipFMC has redefined its FX strategy by focusing on five dimensions of risk: value at risk, liquidity, earnings, margin, and tax risk.

“It sounds like a lot,” he admitted, “but FX touches all of these. Our projects are large—sometimes half a billion dollars in exposure. We had to design a model that reflects the real economic risks we’re running, not just one-size-fits-all hedging.”

The goal wasn’t to eliminate volatility entirely—it was to align treasury activity with what mattered most. “At the end of the day, our job is to support cash distribution to shareholders, with predictability and cost discipline.”

Policy vs. practicality

Bagchi offered a candid story from his own experience. In Turkey, the business faced significant exposure to the lira, and corporate mandated full hedging, with costs charged to the local profit and loss. But the country manager pushed back.

“He said, ‘My competitor doesn’t hedge. You’re putting me at a cost disadvantage.’ And he was right,” Bagchi recalled. “For him, hedging wasn’t protecting margin—it was damaging competitiveness.”

The bigger issue? The manager had no control over the hedge design, but bore the cost. “He told us, ‘If you’re charging me, I want to decide what levels to hedge at, when, and even which banks to use.’ It became a totally unproductive conversation.”

Eventually, Bagchi’s team won an exception: the local business was shielded from FX charges, while corporate continued to hedge to protect consolidated earnings. “We aligned on the objective,” he said. “We stopped forcing policy where it didn’t make sense—and that made the strategy effective again.”

Managing the ‘Unhedgeables’

In some markets, traditional hedging isn’t even an option. Schacknies pointed to TechnipFMC’s operations in Angola—where no reliable hedging instruments exist—as a case in point.

“There’s no derivative solution,” he said. “Eventually, if you’re holding unhedgeable currency, you’re going to get burned. So we focused on minimising the time we held that risk.”

The fix didn’t come from the treasury alone. “We changed how we contract, how we invoice, how we collect. It became a tax, legal, commercial, and FinOps project. And we materially shrank the notional exposure.”

It was a reminder that treasury isn’t always the hero—it’s part of a broader operational puzzle. “Sometimes the best FX strategy isn’t hedging. It’s structural,” said Schacknies.

AI and forecasting

Both treasurers were cautious about the current use of AI. Schacknies said, “We’re not doing anything in the AI space yet. FX is incredibly data-intensive, but the biggest win is just getting position data you can trust.”

That doesn’t mean AI is off the table. He sees future potential in project forecasting. “Our projects are huge and unpredictable. But we also have years of history. AI could help calendarize exposure across projects—but only once the data’s clean.”

Bagchi agreed forecasting is the likely entry point. “AI can handle complex, multidimensional thinking,” he said. “If trained on good data, it can improve FX and cash flow forecasts significantly.”

But he flagged a key risk: pattern recognition. “AI struggles to distinguish between a one-time event and a trend. Over time, models will improve—but we’re not there yet.”

Why judgment still matters

Asked where human judgment fits in a tech-enabled world, both treasurers were emphatic: it’s not going anywhere.

Bagchi said it comes down to the cost of failure. “For low-stakes tasks, sure—delegate to automation. But when the risks are meaningful, you need experienced people who’ve been burned before. Judgment only comes from time and mistakes.”

Schacknies offered a similar view. “I hired someone into FX who had never done FX before,” he said. “He brought new thinking. He asked the kinds of questions I hadn’t thought about in years. That drove better judgment for both of us.”

He also introduced a practical mental model: the “uncertainty triangle.” “When data is imperfect—and it always is—you need more time, or more cushion. You can’t get away from that. Whether it’s FX, liquidity, or credit, that trade-off is always there.”

What’s next?

When asked to look five years into the future, Bagchi expressed concern that markets might grow less open.

“For decades, we’ve assumed more currencies would become tradable and hedgable,” he said. “But I worry that it may reverse. More restrictions, more capital controls. That would fundamentally change how we manage FX.”

Schacknies, while less concerned about market mechanics, cautioned treasurers not to default to rigid policies. “Don’t treat hedging as an always-or-never proposition,” he said. “Find the metrics that matter to your company, and optimise for those. Strategy starts with the why.”

How is your treasury adapting its FX strategy to today’s market realities through structural change, selective hedging, or something entirely different?