The year’s second edition features a discussion on the newest treasuryXL poll results, including a review of treasurer voting patterns and expert perspectives on effective currency management.This item is set up regarding the webinar together with Kantox. You can watch the recording at this link.

The year’s second edition features a discussion on the newest treasuryXL poll results, including a review of treasurer voting patterns and expert perspectives on effective currency management.This item is set up regarding the webinar together with Kantox. You can watch the recording at this link.

Poll Results

Currency management is critical for corporate treasurers as it impacts a company’s financial stability and profitability. Effective management of foreign exchange risks can help ensure consistent cash flow and reduce exposure to volatile currency markets. It is an essential aspect of corporate finance and a top priority for treasurers. So what tools do treasurers use to achieve effective currency management?

The latest poll saw a record number of 178 votes cast from treasurers. It is encouraging to see so many voices being heard. Keep an eye on treasuryXL as a new poll is expected soon!

Question: Which tool do you currently use to manage your currencies?

First observation

The results of the poll show that 40% use a Treasury Management System (TMS), 37% use spreadsheets, 12% use currency management software, and 11% use an Enterprise Resource Planning (ERP) system. It is interesting to note that TMS is the most widely used tool, with spreadsheets being a close second. Meanwhile, currency management software and ERP systems appear to be used by a smaller proportion of respondents. Let’s discover what two panellists from the recent webinar think about the topic.

View of treasuryXL experts

Pieter de Kiewit (Treasurer Search)

Pieter voted for the option Treasury Management System.

“The main takeaway for me is that the success of any currency management strategy relies on the smooth coordination of activities and decision-making among different departments and stakeholders”

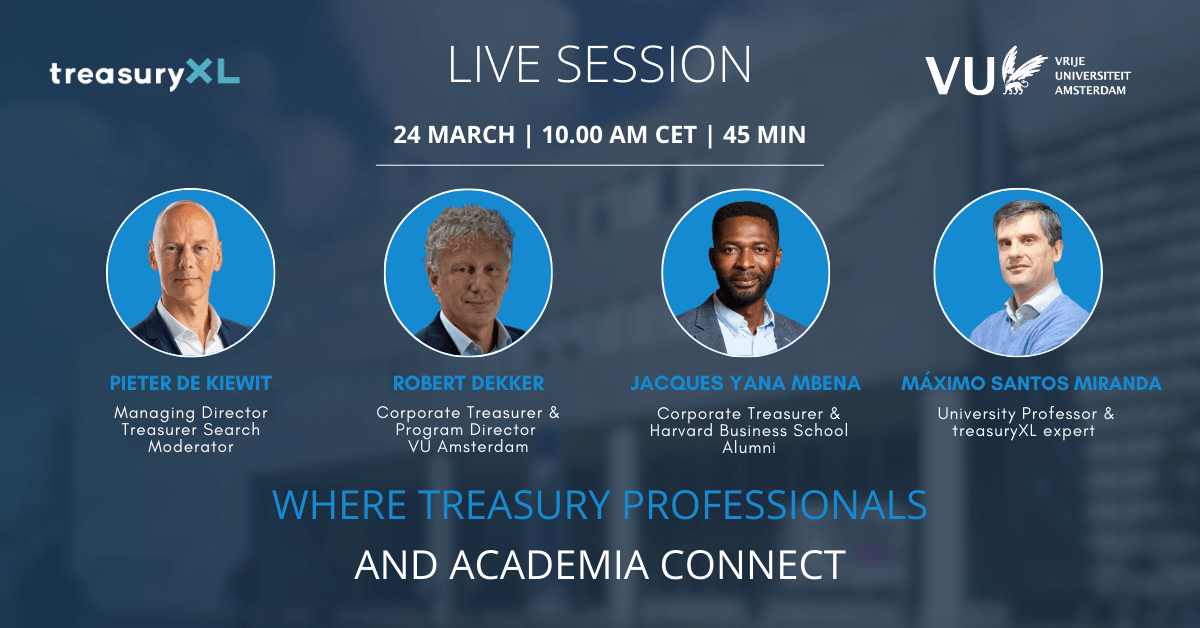

Recently I moderated a well-attended webinar about currency management in corporate (treasury) environments. I was joined by two industry experts, Maurice Fischer and Jesper Nielsen and by Kantox founder Toni Rami. The main takeaway for me is that the success of any currency management strategy relies on the smooth coordination of activities and decision-making among different departments and stakeholders.

Effective communication is the backbone of successful currency management within a company and its corporate treasury in particular. It allows for the smooth coordination of activities and decision-making among different departments and stakeholders, both internal and external. A corporate treasury professional must have strong communication skills and the ability to understand the needs and concerns of all stakeholders to be successful. Remember the quote goes, “The single biggest problem with communication is the illusion that it has taken place.”

————————————————————————————————————

Toni voted for the option Currency Management System.

“The counterpoint between the purely ‘technical’ treasurer and the treasurer who takes a ‘holistic’ view of currency management was striking”

The results of the treasuryXL poll show no big surprises. It looks like the use of TMS is gaining momentum vs. spreadsheets, which in broad terms is a positive sign, as it shows more commitment for currency automation.

TMSs have imperfections when it comes to pricing with an FX rate or capturing the relevant exposure to currency risk, and others. In that sense, we expect firms to turn to more specific tools like Currency Management Automation software that can cover the end-to-end FX workflow in the coming years.

Of course, Kantox recently held the Expert-Led conversation with treasuryXL, in which we discussed the future of currency management. The counterpoint between the purely ‘technical’ treasurer and the treasurer who takes a ‘holistic’ view of currency management was striking. All in all, participants agreed that more interaction with the business is the way to go.