How can Exchange rate movements affect your business?

11-03-2021 | treasuryXL | XE |

Does your business:

- Make income from overseas operations?

- Import or export goods and services from abroad?

- Pay overseas invoices?

- Or interact with foreign currencies in any way?

If so, your business can be impacted by exchange rate movements. Whether you’re a sole proprietor or a large corporation, in manufacturing or healthcare, you will face some level of foreign exchange risk when making international payments.

What is foreign exchange risk?

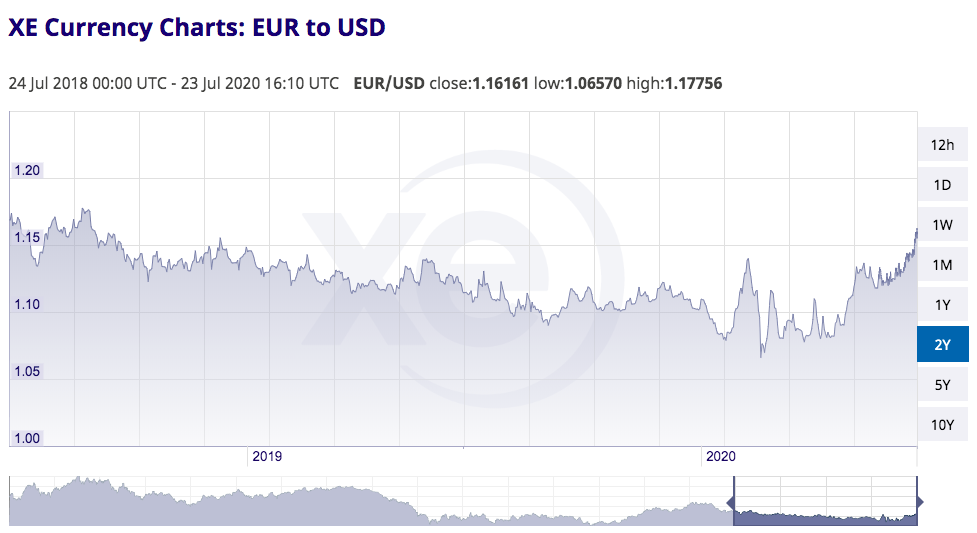

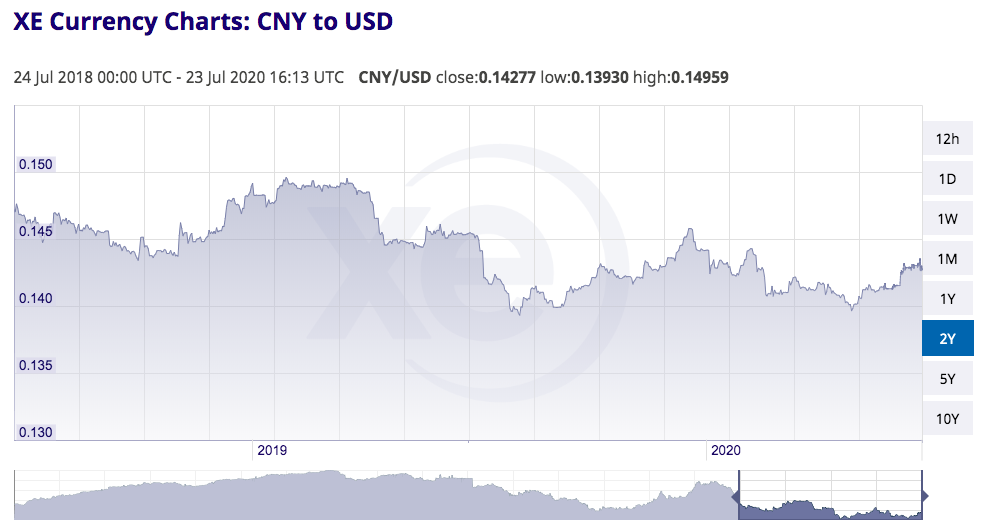

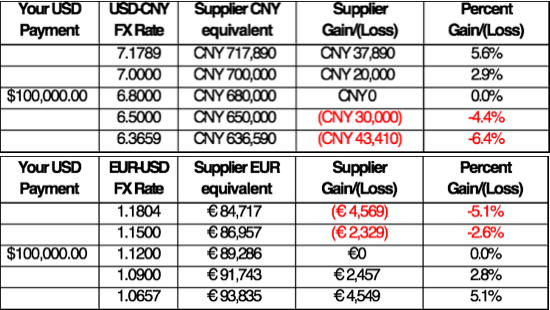

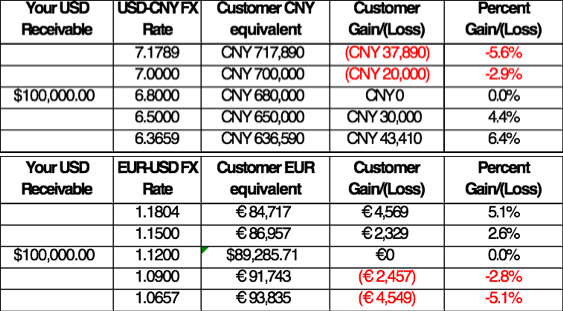

It’s exactly what it sounds like: it’s the possibility that a business’s financial position or performance could be negatively impacted by fluctuations in exchange rates in the foreign currency markets. As the saying goes, the markets never sleep. Exchange rates are prone to fluctuations at any given moment, and while experts can forecast where they think currency values might go, you can’t predict where the rates could go—or what it could mean for your business. Let’s take a look at a few examples.

How does a falling domestic exchange rate affect your business?

A falling domestic exchange rate can:

- Increase costs for importers and potentially reduce their profitability.

- Make domestically produced products more competitive against imported products.

- Increase the cost of capital expenditure (for example, if it includes the importation of capital equipment).

- Increase the cost of servicing foreign currency debt.

- Improve exporter competitiveness.

- Make a business a more attractive investment proposition for foreign investors.

- Increase the costs of investing in overseas operations.

How does a rising domestic exchange rate impact your business?

On the other hand, a rising domestic exchange rate can:

- Make exports less competitive, reducing exporter profitability.

- Decrease the value of investment in foreign subsidiaries and monetary assets (when translating the value of such assets into the domestic currency).

- Reduce foreign currency income from investments.

- Reduce the cost of foreign raw materials, giving importers a competitive advantage.

- Reduce the value of foreign currency liabilities and hence the cost of servicing these liabilities.

- Reduce the cost of capital expenditure (for example if it includes the importation of capital equipment).

- Make a business less attractive to foreign investors.

Did you notice anything? No matter which direction the exchange rate is moving, it could have the potential to impact your business—and your bottom line.

How can you protect your business from market volatility?

No one can predict how the markets will move, but a knowledgeable FX provider can give your business the guidance and solutions to help you to make informed decisions to minimize the impact of market motion.

Are you curious to know more about XE?

Maurits Houthoff, senior business development manager at XE.com, is always in for a cup of coffee, mail or call to provide you detailed information.

Visit XE.com

Visit XE partner page