| 07-03-2018 | Lionel Pavey | treasuryXL | LinkedIn

When entering into a financial transaction you need to be aware of the settlement dates. If you have a contract that states that you must pay on the 1st day of every month what do you do when that date is a non-working day? Furthermore, to be able to calculate the interest owed on a loan, you also need to know what the denominator is – the number of days in a year for the particular product and contract. When a payment cannot take place on a particular date – because it is not a recognised business day, you need to know the convention that the bank uses to adjust the payment date. Here is an overview of the most commonly used business day conventions (which determine how non-business days are handled) and calculation bases.

When entering into a financial transaction you need to be aware of the settlement dates. If you have a contract that states that you must pay on the 1st day of every month what do you do when that date is a non-working day? Furthermore, to be able to calculate the interest owed on a loan, you also need to know what the denominator is – the number of days in a year for the particular product and contract. When a payment cannot take place on a particular date – because it is not a recognised business day, you need to know the convention that the bank uses to adjust the payment date. Here is an overview of the most commonly used business day conventions (which determine how non-business days are handled) and calculation bases.

Business day conventions | Modified Following

Preceding – the first preceding day that is a business day

Following – the first following day that is a business day

Modified Following – the first following day that is a business day, unless the days falls in the next calendar month, in which case the date will be the first preceding day that is a business day

Furthermore reference will be made to the applicable currency calendar for determining non-working days. For EUR this would mean TARGET, for GBP this would mean London, for euro USD this would mean London and New York.

Calculation basis

Actual/360 (Money Market) – the coupon payment is calculated using the exact number of days in the period divided by 360. The start date is included in the calculation, but not the last day.

Actual/365 (Fixed) – the coupon payment is calculated using the exact number of days in the period divided by 365. The start date is included in the calculation, but not the last day

Actual/Actual (ISDA) – the coupon payment is calculated using the exact number of days, with the portion of days belonging in a non-leap year divided by 365 and the portion of days belonging in a leap year divided by 366. The start date is included in the calculation, but not the last day.

Actual/Actual (ISMA) – the coupon payment is calculated using the exact number of days divided by the length of the year, where the length of the year is equal to the number of days in the coupon period multiplied by the number of coupon periods in the year.

30/360 (Bond basis) – the coupon is calculated over 30 days for every full calendar month and the actual number of days for the remaining fraction of a month, divided by 360.

30/360E (Eurobond basis) – the coupon is calculated on the basis of a year of 360 days with 12 30-day months, unless the end date is the last day of February, which is not lengthened to a 30-day month.

Coupon calculation conventions

Adjusted – Interest is calculated on the effective payment date adjusted for the business day

Unadjusted – Interest is calculated on the theoretical payment date, regardless of the effective payment date.

If you are interested to know what the effect of these changes can be on a coupon payment and calculation, please contact us for more detailed information.

Lionel Pavey

Cash Management and Treasury Specialist

When entering into a financial transaction you need to be aware of the settlement dates. If you have a contract that states that you must pay on the 1st day of every month what do you do when that date is a non-working day? Furthermore, to be able to calculate the

When entering into a financial transaction you need to be aware of the settlement dates. If you have a contract that states that you must pay on the 1st day of every month what do you do when that date is a non-working day? Furthermore, to be able to calculate the

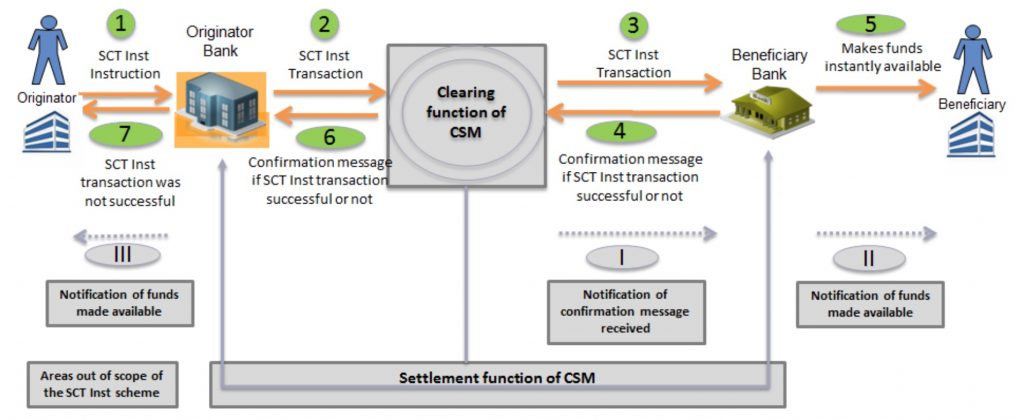

At the end of last year the SEPA Instant Payments requirements from the European Payments Council have been published. Consequently the Dutch requirements 3.0 from the Dutch Payments Association were published last month.

At the end of last year the SEPA Instant Payments requirements from the European Payments Council have been published. Consequently the Dutch requirements 3.0 from the Dutch Payments Association were published last month.