| 05-12-2017 | treasuryXL |

In the financial industry an option is an instrument, based on financial derivatives, that enable the buyer of the option to obtain the right, but not the obligation, to buy or sell an underlying product/asset at an agreed price on or before a certain date in the future. As simple descriptions go, this requires a lot of understanding about different subjects. It is the intention of this article to clearly explain all the terms mentioned above.

In the financial industry an option is an instrument, based on financial derivatives, that enable the buyer of the option to obtain the right, but not the obligation, to buy or sell an underlying product/asset at an agreed price on or before a certain date in the future. As simple descriptions go, this requires a lot of understanding about different subjects. It is the intention of this article to clearly explain all the terms mentioned above.

Financial derivative

The value of an option is specifically linked to the price of an asset – referred to as the underlying instrument. This could be a share, bond, currency pair, interest rate etc.

Right, but not the obligation

When you purchase an option, this gives you the right in the future to exercise the option with the counterparty. However, you are not obligated to exercise your right.

If you have bought an option with the right to buy an asset, but the price of the asset at maturity is lower than the agreed price on the option, you are not obligated to buy the asset as it would be cheaper to buy the asset in the open market at the lower price. However, the seller of the option always has the obligation to sell to you if you exercise your option

Agreed price

This is called the strike price – it is a fixed price. If you purchase an option that gives you the right to buy the underlying instrument at EUR 65 and the market price rises to EUR 75, then you would exercise your right under the option to receive the underlying instrument at EUR 65 and either hold or immediately sell at EUR 75 for a profit (as long as the premium was smaller than EUR 10).

Buy or Sell/Call or Put

If you want the right to buy an asset in the future you purchase a Call option.

If you want the right to sell an asset in the future you purchase a Put option.

Agreed date

This is called the expiration date and means that after that date no future transaction can be derived from the option – the option expires on that date.

Premium – the cost

When you purchase an option, the seller receives a financial settlement upfront. This is called the premium. As an option can be compared to an insurance policy, the premium on an option is similar to the premium paid upfront on an insurance policy.

Premium – the price

Major components used to determine an option price include interest rates, time to expiry, volatility, intrinsic value and the current asset price. Interest rates are used to determine the time value of money between now and the expiry date. Volatility is a measure of the dispersion of the price as in statistical analysis – volatility is another word for uncertainty. The more uncertainty there is, the greater the effect on the option price. Intrinsic value is the difference between an asset’s current price and the strike price.

The underlying

This refers to the specific asset that is being traded. Normally trading is an agreed lot size. 1 option would represent 100 shares for example.

Secondary market

If options are traded with an exchange, then there is a secondary market. You could buy an option, see the price rise, but consider it would not reach the strike price. Your option could then be sold to a third party via the exchange for a higher price than the premium you paid.

If you trade privately (over-the-counter) then your option can not be sold to a third party.

Types of Options

American – can be exercised on any day before or on expiring date

European – can only be exercised on the expiry date

More exotic variations like Bermudan, Binary and Exotic

Why trade Options?

Options give you exposure to an underlying asset at the cost of the premium as opposed to the full face value. This means your position can be leveraged for the same sum of money. If you hold an asset, you can also write the underlying option – a strategy called covered option. You own the asset and receive the premium reducing the cost of the asset. But if exercised, you must deliver the asset.

You could be looking at an acquisition – by purchasing options you would have the opportunity to buy the underlying at agreed prices before the market moved up. If the acquisition fell through, it would only cost you the premium.

Options that you did not know you had bought

Early repayment of a mortgage without a penalty is a form of embedded option.

Bonds that have a convertible character – exchange at a pre-agreed price for stock

If you have arranged a credit facility via a bank for an agreed period of time, you have paid for the option to drawdown against the agreed line of credit.

Who wins?

Studies show that 75% of all options that are purchased expire without being exercised. Obviously, the winners are the writers of options as they receive the premium but are not obligated to perform. This is mostly due to changes in the market or the timing being wrong. If you purchase a call option, then you must add the premium to the strike price to obtain your gross purchase price. Only if the price rises above the gross price is it rewarding to exercise the option.

Lionel Pavey – Cash Management and Treasury Specialist

Lionel Pavey – Cash Management and Treasury Specialist

[button url=”https://www.treasuryxl.com/community/experts/lionel-pavey/” text=”View expert profile” size=”small” type=”primary” icon=”” external=”1″]

[separator type=”” size=”” icon=””]

Whenever entering into transactions with banks, both parties need to know and understand what they are trading. A relatively simple transaction like a FX spot has few terms – you buy one currency against selling another currency at an agreed rate and an agreed settlement date. The only other major factor relates to where the settlement has to take place – on what bank account are you receiving and to what bank account do you have to pay the counter currency.

Whenever entering into transactions with banks, both parties need to know and understand what they are trading. A relatively simple transaction like a FX spot has few terms – you buy one currency against selling another currency at an agreed rate and an agreed settlement date. The only other major factor relates to where the settlement has to take place – on what bank account are you receiving and to what bank account do you have to pay the counter currency.  In the financial industry an option is an instrument, based on financial derivatives, that enable the buyer of the option to obtain the right, but not the obligation, to buy or sell an underlying product/asset at an agreed price on or before a certain date in the future. As simple descriptions go, this requires a lot of understanding about different subjects. It is the intention of this article to clearly explain all the terms mentioned above.

In the financial industry an option is an instrument, based on financial derivatives, that enable the buyer of the option to obtain the right, but not the obligation, to buy or sell an underlying product/asset at an agreed price on or before a certain date in the future. As simple descriptions go, this requires a lot of understanding about different subjects. It is the intention of this article to clearly explain all the terms mentioned above. Lionel Pavey – Cash Management and Treasury Specialist

Lionel Pavey – Cash Management and Treasury Specialist In december 2016 hebben we deze vragen al eerder gesteld: Hoe interessant is beleggen in bedrijfsobligaties met een hoge rente? Hoe aantrekkelijk is deze financieringsoptie voor ondernemingen? In ons

In december 2016 hebben we deze vragen al eerder gesteld: Hoe interessant is beleggen in bedrijfsobligaties met een hoge rente? Hoe aantrekkelijk is deze financieringsoptie voor ondernemingen? In ons  Annette Gillhart – Community Manager treasuryXL

Annette Gillhart – Community Manager treasuryXL

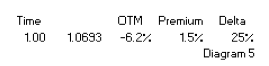

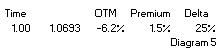

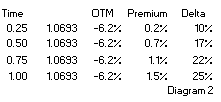

(1.5%, see diagram 5) by the chance it will be exercised (Delta, in this case 25%), ie 1.5% : 25% = 6%. It could be a very disappointing to find that if this Conditional Premium option is only marginally ITM at maturity, because the premium of 6% still has to be paid.

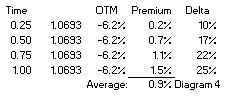

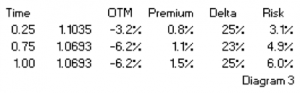

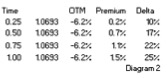

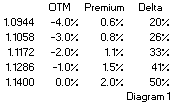

(1.5%, see diagram 5) by the chance it will be exercised (Delta, in this case 25%), ie 1.5% : 25% = 6%. It could be a very disappointing to find that if this Conditional Premium option is only marginally ITM at maturity, because the premium of 6% still has to be paid. bought the option for 1.5%, we could sell it after 3 months at 1.1% and buy the USD through an outright forward transaction. This approach shows that the net cost of option protection would be only 0.4% (1.5% – 1.1%). Which would be cheaper than the premium of a 3-month option with the same Delta. Also, because the option has a higher Delta than a 3-month option with the same strike (25% vs 10%, see diagram 2), it will follow the spot market much better. The bottom line of paragraph 3 is that a longer dated option can be bought with the intention to sell it again at some point, the net cost being less than buying a shorter dated option. While it serves as a hedge against price changes.

bought the option for 1.5%, we could sell it after 3 months at 1.1% and buy the USD through an outright forward transaction. This approach shows that the net cost of option protection would be only 0.4% (1.5% – 1.1%). Which would be cheaper than the premium of a 3-month option with the same Delta. Also, because the option has a higher Delta than a 3-month option with the same strike (25% vs 10%, see diagram 2), it will follow the spot market much better. The bottom line of paragraph 3 is that a longer dated option can be bought with the intention to sell it again at some point, the net cost being less than buying a shorter dated option. While it serves as a hedge against price changes. buy the 1-year option in diagram 2 for 1.5%. Alternatively we could consider buying a right to buy this option for 0.4% in 3 months time. At that time the 1-year option will only have 9 months remaining, but the strike and 1.5% premium are fixed in the contract. On the expiry date of the compound option we can decide if we want to pay 1.5% for the underlying option. Alternatively, assuming nothing has changed, we could buy a 9 month option in the market for 1.1% (see diagram 2). In such a case we wouldn’t exercise the compound option.

buy the 1-year option in diagram 2 for 1.5%. Alternatively we could consider buying a right to buy this option for 0.4% in 3 months time. At that time the 1-year option will only have 9 months remaining, but the strike and 1.5% premium are fixed in the contract. On the expiry date of the compound option we can decide if we want to pay 1.5% for the underlying option. Alternatively, assuming nothing has changed, we could buy a 9 month option in the market for 1.1% (see diagram 2). In such a case we wouldn’t exercise the compound option. Should we need to exercise the option to get our USD, it still means a combined hedging cost of 3.8%. Which is more than if we had bought the ATM option for 2% premium. Conclusion: Buying an OTM option reduces the up-front cost versus buying an ATM option. But ex-post hedging with an OTM option could result in total hedging cost which are higher than an ATM option.

Should we need to exercise the option to get our USD, it still means a combined hedging cost of 3.8%. Which is more than if we had bought the ATM option for 2% premium. Conclusion: Buying an OTM option reduces the up-front cost versus buying an ATM option. But ex-post hedging with an OTM option could result in total hedging cost which are higher than an ATM option. option is exercised, or the USD must be purchased from the market at the prevailing rate.

option is exercised, or the USD must be purchased from the market at the prevailing rate.