Global Political Risks by ICC Consultants

| 15-10-2018 | ICC Consultants | treasuryXL |

In deze blog worden de internationale politieke ontwikkelingen geanalyseerd die impact kunnen gaan hebben op de financiële markten en de mate waarin. De visie van ICC Consultants is gebaseerd op een groot netwerk binnen de wereldwijd toon-aangevende researchhuizen en 40 jaar ervaring in de financiële markten. Middels de weblink onderaan deze blog kunt u meerdere rapporten van ICC Consultants downloaden.

Iranian brake vs Saudi and Russian spigots

US president Trump has been trying to have his oil cake and eat it. On the one hand, the mercurial leader has been tightening the screws on Iran thereby keeping hundreds of thousands of barrels of oil from the market. On the other hand, the American president has been ripping into oil producers for being responsible – in his eyes – for high prices: “We protect the countries of the Middle East, they would not be safe for very long without us, and yet they continue to push for higher and higher oil prices! We will remember. The OPEC monopoly must get prices down now!” Trump’s Russian counterpart Putin said last week: “We had a very good meeting with President Trump in Helsinki. But if we had talked about [oil], I would tell him that if he wants to find the culprit for the surge in prices, ‘Donald, then you need to look in the mirror.’”

The main question keeping oil traders and analysts at wake these days: will the fall in Iranian exports be compensated by Saudi Arabia and Russia pumping up more crude or will we see an impending supply crunch cause a further spike in the oil price? Already, Brent’s fifth consecutive quarterly increase makes it the longest streak since 2008. The magical $100 mark is getting mentioned more and more . September 2014 was the last time when Brent hit this level. US petrol prices have already been at the highest level since 2014 for quite some time.

November 4 is the US sanctions deadline for companies to stop buying Iranian oil. In anticipation of that cutoff date, Iranian oil exports have already fallen considerably. In June crude shipments from Iran totaled about 2.3 million barrels per day; last month those exports came to 1.5 mb/d.

Expectations for how much oil will be lost have steadily risen. Some analysts now even fear that Iranian exports could fall back all the way towards 500,000 b/d. Already, shipments to South Korea, France and Japan have halted.

Secret shortcuts?

The Economist Intelligence Unit describes six ways in which Teheran could and will try to keep crude flowing:

- Diplomacy: For example, Iran could offer China concessions when it comes to Beijing’s massive Belt and Road Initiative in return for a promise by the Chinese to keep buying Iranian crude. India wants to tighten its grip on the Iranian port of Chabahar. India has already committed significant political and diplomatic resources to the project, which it hopes will counter Pakistan’s Gwadar port, in which China has a significant stake.

- Ghost tankers: During previous rounds of sanctions Teheran still managed to get quite some oil out by ducking the roaming eye of Washington through turning off the system that allows traders to track the movements of tankers. Iran has already started with this tactic and most experts believe that Teheran has a fleet of ghost ships carrying oil and no longer sending out tracking signals.

- Cut prices: In August it became clear that Iran is offering discounts to its Asian customers. The regime could broaden the number of countries it is proposing these rebates to and it could bump up the discounts.

- Private sector: Iran could try and sell its oil on the Iranian bourse with the buyers then being allowed to export the crude oil.

- Trading in other currencies than the dollar: Teheran is trying to convince other nations to do deals in local currencies instead of the dollar. In this way, it could be able to circumvent American sanctions (which aim to punish financial institutions facilitating Iranian trade).

- Barter deals: the other way to avoid doing business in dollars. By trading goods for goods Iran could resume the scheme that it used to try to blunt the impact of previous sanctions between 2012 and 2016. Iran would probably accept agricultural products and medical equipment in exchange for its crude.

Through these various methods Iran will be able to at least get some oil out to customers. However, from next month onwards, the number of barrels Teheran manages to export will no doubt decrease further.

No end in sight

A deal between the US and Iran is nowhere close as the International Court of Justice ruled against Washington in a case brought by Teheran whereby the judges ruled that the US is breaking the 1955 Treaty of Amity. Washington has replied by not accepting the ruling but by claiming it will withdraw from the treaty. Moreover, over at Washington the so-called NOPEC Act is getting a fresh look. This bill would remove the sovereign immunity that has long shielded OPEC members from legal action by the Americans. A version of NOPEC had managed to make it through Congress in 2007, but it was pulled after then president Bush threatened to veto it. This time also, the bill probably won’t make it, but it nevertheless makes clear that tensions between the US and (other) oil producers are on the rise. Another example of this is the Justice Against Sponsors of Terrorism Act (JASTA), which allows victims of the 9/11 attacks to sue Riyadh. The law is seen as key to why state-run Saudi Aramco was hesitant in publicly listing its shares on US markets in an IPO that has since been shelved.

In Iran, the political class and the mullahs could be prompted to continue their hardline by the results of a recent poll in which large majorities declare their support for the country’s current foreign policy.

Swing producers to the rescue?

It remains to be seen whether other suppliers will fill in the gap caused by the Iranian crisis. By this time, Saudi Arabia is producing at levels that amount to its highest on record: 10.7 mb/d. Some experts doubt whether the kingdom will be able to significantly raise its production numbers.

Russia is also closing in on its maximum production level, due to – among other things – the lack of international capital flowing in to finance domestic energy projects and the challenges importing essential equipment caused by sanctions Russia faces as a result of among other things its actions in Ukraine and Georgia and its spy adventures all over the west. Russia’s deputy energy minister claims that current potential for upping production is around 200,000-300,000 b/d up to the end of 2019 from the current level. Already, Russian oil production has risen to a post-Soviet record of 11.4 mb/d.

The other giant producer, the US itself, struggles with infrastructure bottlenecks. Drillers in the western parts of Texas have put too much pressure on the regions infrastructure. Thereby driving up costs and putting downward pressure on the price for a barrel of oil; if you don’t have the means of turning the crude to practical usage, the oil obviously becomes less valuable. The more so since pipelines are also in desperate need of upgrades and extensions.

The more Saudis and others pump up to compensate for Iranian (and for example Venezuelan) shortfalls, the more spare capacity disappears and the more already lingering doubts about how much more the big players can add to their production levels will build up.

Slowing world economy

Considering all of the above, it seems upward pressure on oil prices from the supply side is the most likely in the months to come. What about the demand side? According to BP, oil consumption in the developed markets has peaked. Therefore higher demand in the future will largely depend on the emerging markets. As Bloomberg columnist David Fickling put it: “When they sneeze, the global oil market may yet catch a cold.” And a cold seems to be doing the rounds lately within the EM. Fickling points out that for EM oil is already as expensive as it was during the peak in 2008. This as a result of the slump many EM currencies find themselves in. For example, the oil price in reals broke its 2008 record last March and is now 50% higher than its level ten years ago. So, from this perspective, we could see some downward pressure on oil prices as crude is simply becoming too expensive for many nations.

In addition, general economic worries are on the rise as IMF chief Lagarde attested to last week when see said: “For most countries, it has become more difficult to deliver on the promise of greater prosperity, because the global economic weather is beginning to change.” So as global financial conditions are becoming less forgiving – with rising interest rates, a strengthening dollar etc – high crude prices are inflicting even more pain on oil importing emerging countries in particular. They see their current account deficits growing. Usually you would expect a depreciation of the currency of such a country resulting in more exports that would make up for the increased costs of buying oil. Not now: growth of world trade is slowing and many of these countries have high dollar debts that have become a major burden due to the strong dollar.

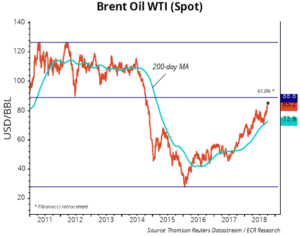

So demand side constraints are building up. In the short term supply side risks i.e. the kicking in of sanctions against Iran could drive the prices up a bit more, but world economic growth is to slow in 2019 and together with overly bullish long positions outnumbering bearish short ones by a ratio of more than 12:1 (the record was 14:1 back in April) we expect demand side factors to overtake worries about the supply side and causing a pullback of Brent towards $70-$80 levels in the months to quarters ahead.

Chart-technical analysis

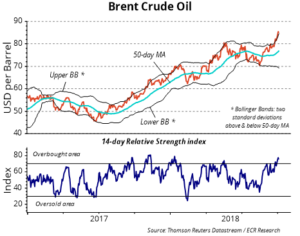

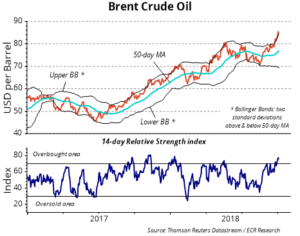

A large upward trend is already dominant since early 2016. Objective measures of trend direction – the price is above both the upward sloping 50-day and 200-day moving average – indicate the same. As such, the level of $89 – the 61.8% Fibonacci retracement level of the multi-year decline from 2014 – is the minimal technical target in the coming weeks and months.

Still, bear in mind that past weeks’ strong gains have left Brent crude oil very stretched as it is trading around two standard deviations above its 50-day moving average. Also, the 14-day Relative Strength index has reached overbought levels (above 70) that, in the past quarters, were accompanied by at least – temporary – top forming (see graph). All the above will likely set the stage at least a sideways consolidation or a pullback first to digest these strong gains.

Furthermore, market sentiment towards the oil complex is highly positive. For example, the Daily Sentiment Index (trade-futures.com) showed a vast amount of bulls (> 90%) for WTI crude oil last week. Moreover, the Commitment of Traders report shows that hedge funds & other speculators are still holding rather large net-long positions in both Brent and WTI crude oil. Such optimism also makes oil vulnerable for a setback. If so, we can expect a decline towards short-term support in Brent just above $80. Finally, prices below $80 to a significant degree will likely trigger a larger correction towards the next support area near $72.

Het rapport is geschreven door Andy Langenkamp, politiek analist bij ICC Consultants. Op de website van

ICC Consultants kunt u meer rapporten downloaden.