| 01-02-2018 | François de Witte |

The main objectives of the cash & liquidity management are to:

- Have the cash funds available to meet all known and unknown commitments

- In the right currency

- In the right place

- At the right time

- Optimize the return of the cash and/or minimize the cost of the short term financing

- Minimize external financing by using internal funding

One of the most important techniques to achieve a better utilization of the available cash is the “cash pooling” or, in other words, the concentration of the cash to make it centrally available. The commonly used techniques in the market are the following:

- Manual cash concentration: Intercompany payments

- Automated Cash Concentration: requires physical movement of funds

- Notional Pooling: without movement of funds

In the present article, we will outline the current types of cash management tools, their advantages and the attention points.

Manual cash concentration: Intercompany payments

For companies, who have only a limited number of accounts to overview, it is recommended to set up a manual cash pooling. In this case, the treasurer overviews daily or weekly the balances of the different accounts, and when there are important debit or credit positions, he will initiate manual payments to balance the positions, and or to concentrate them on the central treasury account. If during the day, important movements take place, the treasurer can make some additional intra-company payments to balance the debit and credit positions. In order to avoid float, it is recommended to use the urgent payments clearing.

The main advantages of the manual cash balancing are the following:

- The easy set up

- The possibility take into account the cash forecasting

- You do not always make daily movements, which facilitates the intercompany loan administration.

However there are some drawbacks / attention points:

- There is a daily / weekly need to make manual interventions. However some treasury software packages provide a solution to automate this process (bank independent cash pooling)

- The banks take additional charges for use of the urgent payments clearing, except if the payments are processed within the same bank

- The overdraft credit lines of the participants are qualified as full lending limits, and hence for the banks there is a higher capital weighting

- When different legal entities are involved, you create a lending /borrowing relationship between the participants. Hence there are legal and tax issues:

- You need to foresee a intra-group lending agreement

- There are possibly withholding tax, transfer pricing and thin capitalization issues

- Within your group, you need to manager the intercompany loan administration.

Automated cash concentration

The automated cash concentration, also called cash balancing, is a pooling technique requiring a physical transfer of funds to or from the participating accounts to concentrator account. The pooling movements are operated automatically by the bank

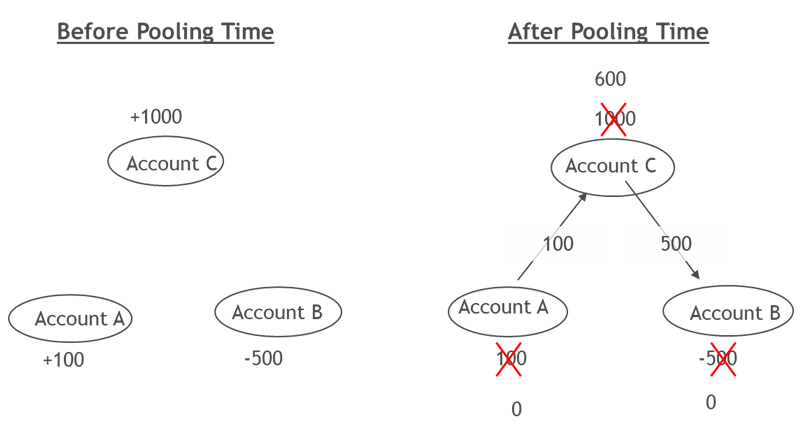

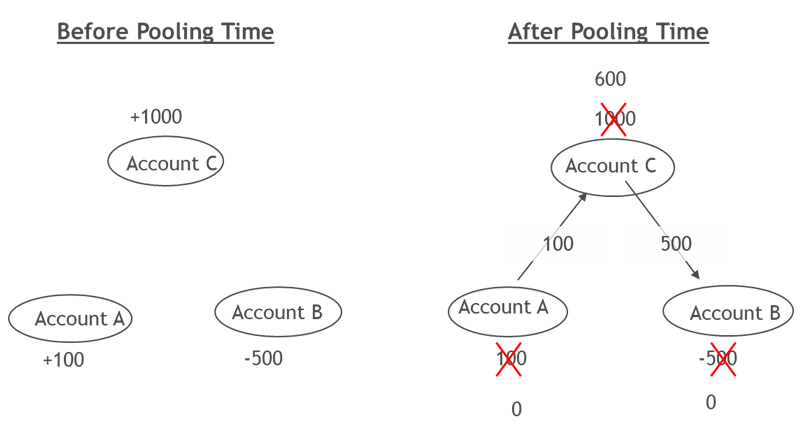

The most commonly used cash concentration is the zero balance cash balancing, as illustrated in the drawing down below. In this solution, the balances of the participants are daily or weekly swept to a concentrating account.

Figure 1: Outline of the zero balance cash balancing

There are also other forms of cash concentration:

There are also other forms of cash concentration:

- Target cash balancing, to keep a specific amount in each account

- Threshold cash balancing, to move funds only when an account moves in excess of a figure

- Trigger cash balancing, whereby the movements are only initiated if the balance of an account (debit or credit) exceeds a certain amount

- End-of-day or intraday cash balancing

- Domestic or cross-border cash balancing.

There are several advantages to this system, such as:

- There are no manual interventions, as the system is automated

- Several features are possible (multi-layer, domestic and cross-border, target balancing, …)

- There exist a possibility to integrate accounts from third banks

- The system discipline to participants

- With several banks, the intra-day lines, and the intra-day debit positions do not require a capital weighting.

However there are also drawbacks / attention points:

- For value-based cash balancing, there can occur reconciliation issues with ERP systems or treasury management systems, as they usually work on accounting balances

- The cash balancing works only within the same currency. When you manage different currencies, different physical cash balancing structures need to be set up for each currency

- When different legal entities are involved, you create a lending /borrowing relationship between the participants – see also point 2 hereabove

- The automated cash balancing can only work within the same currency (mono-currency).

Notional cash pooling

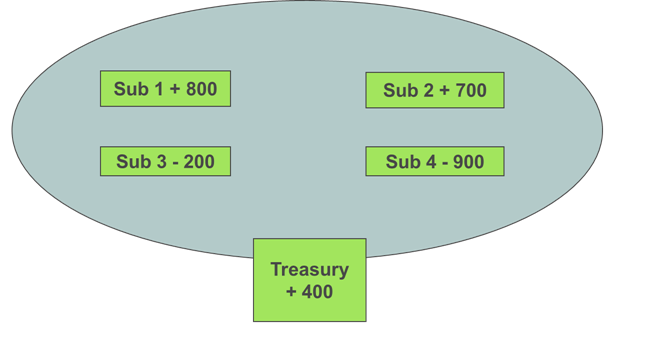

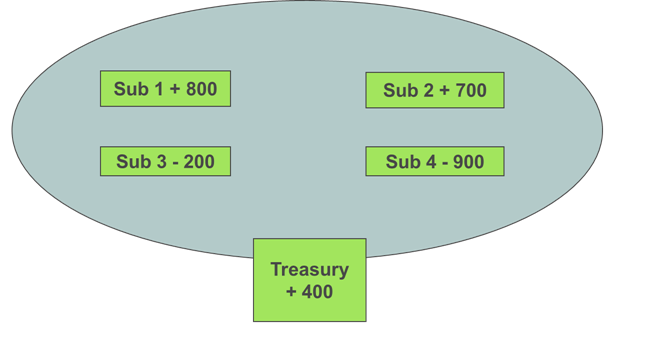

The Notional cash Pooling is a cash pooling where there is no movement of funds. In such a pooling the credit balances of the participants are offset against debit balances of the participants. Hence the net balance of the group is used to calculate the debit or credit interest paid or received.

The system has a flat structure, which means that all the participating Accounts are basically equal to each other. However usually corporates designate one account as the treasury Account, which is then used to manage the system.

Figure 2: Outline of the notional cash pooling

The main advantages of the notional pooling are the following:

- The notional pooling does not require to move funds, and hence:

- No intercompany loan administration

- Less legal and tax issues

- In some jurisdictions (e.g. the UK and NL) the notional pooling can, under certain conditions improve the balance sheet by offsetting surplus balances against group debt

- The notional pooling can include different currencies.

However there are also attention points:

- The full legal offset of debit and credit positions of different legal entities is an issue in several countries

- In some countries notional pooling is not allowed

- Basel III does not always allow that liquidity ratios are calculated by means of netting the outstanding balances of accounts in the notional pool. This means that banks must calculate their ratios based on the gross balances of the individual accounts. Hence they will also look to translate this cost in the pricing of the notional cash pooling.

Legal and tax aspects of cash pooling

Setting up a pooling requires some preparation, and some legal and tax issues need to be addressed, such as:

- Is automated cash pooling (cash balancing or notional) authorized ?

- For cash balancing with different entities

- Transfer pricing issues – Arm’s length rule

- Is debit interest an allowable deduction?

- Withholding tax issues

- Is thin capitalization an issue?

When setting up such structures, in particular when different countries are involved, you need to foresee a due diligence with legal/tax advisors and banks

For cash balancing with different legal entities, a requirement is also to be able to manage intercompany loan administration. There are banks and providers who come up with solutions in this area.

François de Witte

Founder & Senior Consultant at FDW Consult and Senior Expert – Product, Business development and sales manager at Isabel Group

There are also other forms of cash concentration:

There are also other forms of cash concentration:

The BEPS (base erosion and profit shifting) initiative is an OECD initiative, approved by the G20, to identify over a period to December 2015, ways of providing more standardised tax rules globally. Phases two and three involve implementation and monitoring (together with some remaining standard setting and clarification). BEPS is a term used to describe tax planning strategies that rely on mismatches and gaps that exist between the tax rules of different jurisdictions, to minimise the corporation tax that is payable overall, by either making tax profits “disappear” or shift profits to low tax operations where there is little or no genuine activity. In general BEPS strategies are not illegal; rather they take advantage of different tax rules operating in different jurisdictions, which may not be suited to the current global and digital business environment.

The BEPS (base erosion and profit shifting) initiative is an OECD initiative, approved by the G20, to identify over a period to December 2015, ways of providing more standardised tax rules globally. Phases two and three involve implementation and monitoring (together with some remaining standard setting and clarification). BEPS is a term used to describe tax planning strategies that rely on mismatches and gaps that exist between the tax rules of different jurisdictions, to minimise the corporation tax that is payable overall, by either making tax profits “disappear” or shift profits to low tax operations where there is little or no genuine activity. In general BEPS strategies are not illegal; rather they take advantage of different tax rules operating in different jurisdictions, which may not be suited to the current global and digital business environment. Time flies, it is August already. And, for most people, August means holiday time and taking time to read. Have you got your summer holiday reading list sorted yet? The perfect moment to provide you with some summer holiday reading material. These are the top 5 best read articles of treasuryXL from the start. Have a great summer!

Time flies, it is August already. And, for most people, August means holiday time and taking time to read. Have you got your summer holiday reading list sorted yet? The perfect moment to provide you with some summer holiday reading material. These are the top 5 best read articles of treasuryXL from the start. Have a great summer! How can the Cash Conversion Cycle (CCC) be optimized? The CCC measures the time the money is tied up in the sales and the production process before it’s converted into a cash in from customers. When translated in a formula this will be the DSO + DIO – DPO (Day’s Sales Outstanding + Day’s Inventory Outstanding – Day’s Payables Outstanding).

How can the Cash Conversion Cycle (CCC) be optimized? The CCC measures the time the money is tied up in the sales and the production process before it’s converted into a cash in from customers. When translated in a formula this will be the DSO + DIO – DPO (Day’s Sales Outstanding + Day’s Inventory Outstanding – Day’s Payables Outstanding).  Fastned’s growing and they’re giving investors the chance to directly buy and trade in certificates of shares via Nxchange. We’ve asked Fastned’s CFO Claire Tange to explain this type of financing.

Fastned’s growing and they’re giving investors the chance to directly buy and trade in certificates of shares via Nxchange. We’ve asked Fastned’s CFO Claire Tange to explain this type of financing.  For many people Treasury is, as they think, something that is not concerning. Because there are many items that could be mentioned and listed here, I chose to mention the items that have effect on our daily lives, even if we are not aware of the existence of the described item. I’ll call it the Treasury ABC for normal citizens.

For many people Treasury is, as they think, something that is not concerning. Because there are many items that could be mentioned and listed here, I chose to mention the items that have effect on our daily lives, even if we are not aware of the existence of the described item. I’ll call it the Treasury ABC for normal citizens.  An increasing number of bankers come to my recruitment desk wanting to make a transfer to corporate treasury. This transfer can be made successfully but there are a number of things to take into account. Below the 8 career hurdles, I hear most about, in a transfer from banking to corporate treasury.

An increasing number of bankers come to my recruitment desk wanting to make a transfer to corporate treasury. This transfer can be made successfully but there are a number of things to take into account. Below the 8 career hurdles, I hear most about, in a transfer from banking to corporate treasury.  Significant balances on your foreign bank accounts which are really of better use in the country where your operation is? Include them in an automated cash pooling scheme so that all your funds are available in The Netherlands and no more unnecessary interest is paid!

Significant balances on your foreign bank accounts which are really of better use in the country where your operation is? Include them in an automated cash pooling scheme so that all your funds are available in The Netherlands and no more unnecessary interest is paid!  Significant balances on your foreign bank accounts which are really of better use in the country where your operation is? Include them in an automated cash pooling scheme so that all your funds are available in The Netherlands and no more unnecessary interest is paid!

Significant balances on your foreign bank accounts which are really of better use in the country where your operation is? Include them in an automated cash pooling scheme so that all your funds are available in The Netherlands and no more unnecessary interest is paid!