| 3-1-2020 | Carlo de Meijer | treasuryXL

2019 was a remarkable year for blockchain technology. A lot of things, some unexpected, happened. But now it is time to bring our attention to the New Year 2020. Just like last year, and the year before, we try to predict what awaits the blockchain industry. So, let’s look at what does 2020 have in store. What are the most expected events that will shape the blockchain ecosystem in 2020 and beyond?

The year 2019

By all measures 2019 was a transformative year for the blockchain and crypto space with a more realistic approach. Overall, our 2019 predictions worked out pretty much as expected. It was the year where the blockchain industry translated the hype of previous years into more practical use cases and further advancements in the field of blockchain and distributed ledgers.

Both corporates and customers were significantly increasing their understanding of where blockchain technology makes sense and where it doesn’t in terms of a solution for real business problems. The most memorable thing about 2019 for the blockchain space was the speed and sustainability with which it has regained recognition and legitimacy in the eyes of governments and institutional players. We saw the birth of new blockchain alliances, new next generation blockchain start-ups entering the market, the introduction of new infrastructure projects and a plethora of blockchain protocols matured and expanded in growth.

More spectacular was what happened in the cryptocurrency markets. New cryptocurrency trading products were launched and we saw the growth in the number of stable coins. We have seen an increase in governments, regulators and central banks engaging with crypto in general. Many central banks are paying close attention to the benefits of blockchain and the need for their own digital currency. This was mainly triggered by Facebook’s plans to launch its Libra crypto currency.

Gartner Hyper Cycle

But before going into my own predictions it is interesting to look at the Gartner Hype Cycle. According to Gartner during 2019 blockchain has passed the ‘trough of disillusionment’. The industry has learned some tough lessons regarding the difficulties surrounding widespread adoption of this technology. It showed that they were much ahead of its technical and operational maturity. During this stage most enterprise efforts remain stuck in experimentation mode, with very few meaningful applications for blockchain in the real world. As a result, interest has waned as most experiments and implementations failed to provide expected results. As a result earlier start-ups were forced to end their operations.

We are now on the peak of the slope of enlightenment, when corporates and customers really learn and begin to use the technology for practical, useful purposes that will change how companies, applications and users interact. According to Gartner, the 2020s will be the decade when blockchain technology will leave small-scale proof-of-concept projects behind, and makes its way into the operational structure of multinational corporations. Over the next couple of years it will expand into a number of pragmatic use cases in payment processing, data sharing, equity trading and contract/document keeping and tracking. Blockchain will be fully scalable by 2023, according to Gartner.

What to expect for 2020

Looking forward to the New Year 2020, there are several notable trends and movements in the blockchain and crypto currency area to watch. Some of the key trends we outlined this year will persist in 2020. Users of blockchain and distributed ledger technology will further focus on operational matters, deployment flexibility and, interconnectivity. They will look for enhanced services and tool offerings that meet their business needs.

Blockchain will enter the stage of more realism

1. Many blockchain start-ups will not succeed

A first prediction is that in 2020 many blockchain start-ups will not succeed in the market race for their blockchain production projects. An ordinary start-up with the use of the blockchain will not be able to get as high support as it happened before. The race will be difficult and only a few will survive the stiff competition, failing to provide expected results.

The problem does not lie with blockchain itself. There is the lack of uniqueness by these start-ups. Many repeat similar projects during the implementation of the blockchain. They create another alternative, rather than something conceptually new. Many start-ups will be just a simple waste of money since enterprises will not invest in a platform they are not confident about. Specialists and large companies are aimed precisely at finding new business opportunities for blockchain deployment. They will take a wait-and-see attitude. So it will last until the best use of this technology appears.

2. The token market will be cleaned up

Another expectation for 2020 is that the market for tokens will be cleaned up. As exchanges are forced to increasingly professionalise and investors gradually shift their focus to quality, so-called ‘zombie tokens’ for projects that are far from market-fit will be more aggressively delisted. New tokens coming to market will be few and will all be more mature. It is expected that the majority of publicly listed tokens will be delisted and/or cease trading. So from existing 2500 tokens actively traded today not more than 1000 tokens will be remain by the end of 2020.

3. Blockchain technology will become more mature

Blockchain itself, however, is far from a failure. What we have seen in 2019 is the increased maturity of the technology. And this trend will continue in an accelerated way in 2020 and beyond. Next year will mark the start of more mature and usable networks creating decentralised applications, building an increasingly competitive landscape for projects to “battle it out” in order to become mainstream.

Going forward, in order for blockchain platforms and the apps built on top of them to stand a chance of making their mark, the focus should be much more on improving usability and finding product-market fit. 2020 will see the launch of multiple ‘third generation’ blockchain projects, with a greater variety and reach of applications being built on top of the DLT ecosystem. Multiple large chains will be releasing significant technology upgrades such as Ethereum with ETH2.0 and NEM with Catapult, both in early 2020.

4. More realism will enter the blockchain market place

More realism is expected coming into the market towards blockchain and its implementation. Those responsible for blockchain projects will take a more informed and strategic approach. The effect will be that in 2020 there will be a more realistic and pragmatic approach to blockchain projects. Enterprise DLT teams will thereby focus on realistic use cases that might deliver a particular benefit and bring existing projects closer to, or into, production.

We will see a shift away from so-called R&D-type exploratory proof-of-concepts (PoCs) run in isolation to a focus much more on the end-to-end process to which blockchain/DLT will apply. This means more emphasis on how frameworks perform and how well they integrate with existing systems and, potentially, each other. As a result of this approach we will see more successful implementations of blockchain technology, whereby there will be improved ties between blockchain and business management solutions. .

Growing blockchain adoption by enterprises

Though scepticism will remains (for the time being), and many enterprises will take a wait-and-see attitude towards blockchain adoption, the increased maturity of the blockchain technology will certainly trigger adoption in the coming year(s). More and more enterprises will understand the added value of distributed ledger technologies (DLT), including transparency, immutability, and decentralization.

A Deloitte report revealed that 34% of companies have already initiated a blockchain deployment, while 86% of leaders are confident that its mainstream penetration is inevitable – results which are clearly indicative of the continued maturation of the market. But before seeing real widespread adoption blockchain technology will need to mature further, not only technically but also as a part of a more complete ecosystem.

1. Finance industry will continue to lead blockchain adoption

Once blockchain overcomes the initial hurdles, it will be a game changer for many industries with finance expected to be the “leading takers” of the blockchain technology. Unlike other traditional businesses, the banking and finance industry will not be extremely reluctant in adopting blockchain.

According to a recent PWC report, by 2020, 77 % of financial institutes are expected to adopt blockchain technology as part of an in-production process. Financial corporations are more likely to embrace blockchain for more traditional banking operations owing to the plethora of advantages it has to offer. Blockchain will more quickly take root in financial services for security and management of identities – first for businesses and later for consumers.

2. Enterprises outside the financial sector are more reluctant

Enterprises outside the financial sector however show a more reluctant attitude towards blockchain adoption. But moving into 2020, they may change their attitude towards a more positive but realistic one. Over the next 12 months, these companies will first need to analyse their business models, and ask how (as opposed to whether) blockchain is going to disrupt their industries.

With the growing maturity of this technology blockchain will become another piece of enterprise technology that helps an organization become more secure and efficient, even enabling new business models that grow the business or enable net-new businesses (some completely decentralized). Positive measurements of the value derived from blockchain in enterprise production environments will encourage a much broader uptake. With giant companies such as Amazon or Microsoft committing to building services around blockchain, we will begin to see accelerated adoption by enterprises and customers as they tackle the issues that have long time being hurdles for mainstream adoption – with real world solutions coming into play from 2020.

3. Further government integration of blockchain

Although governments around the world remain centralized, there are opportunities for them to incorporate decentralization into certain aspects of their activities. There are several countries, including the US, Japan, Denmark and even Estonia, that are already practising blockchain implementation in government agencies. Countries such as China and Estonia are utilizing blockchain to manage citizens’ healthcare data and create digital identity systems respectively.

In 2020 we may expect other governments actually accepting blockchain advantages and begin to use it to optimize financial and public services. We will certainly see further government integration of blockchain technology in order to process large quantities of data between agencies, services and administrative bodies each having their own database. Distributed ledgers will be crucial to streamlining interaction and information sharing between these entities. The adoption of blockchain technology for effective data management and the introduction of a distributed registry will greatly simplify this procedure and will improve the functions of government sectors.

4. Battle between private and public blockchains

In 2020, the battle between private and public blockchains will further heat up and the debate will reach corporate executive teams. Though enterprises often prefer to operate in their permissioned blockchain network and at first will be sceptical of public ledgers, this stance will change over time. The permissioned versus public network debate will see blockchain/DLT-based applications falling into two main categories: a. consumer-focused DApps, which will usually use public (permissionless) blockchains; b. enterprise applications, built almost exclusively on private (permissioned) networks using enterprise DLT frameworks.

While it’s not realistic today to support complex enterprise use cases at scale on a public blockchain, concerns about interoperability between multiple chain silos have already resulted in discussions about the role of public blockchains in enterprise processes. With multiple networks already existing for some of the most popular use cases (such as supply chain or trade finance), proliferation will continue.

5. Enterprises will utilize hybrid blockchains

As the hype around blockchain cooled, and corporates turned back to a more realistic approach, non-technical challenges and interoperability hurdles have emerged. Permissioned blockchains, while great for B2B uses, don’t connect with consumers who need an open ledger accessible by any mobile device via an API.

For this reason, many companies are looking for ways to close that gap and make the best of the decentralization of public blockchain networks on one side and the additional security of private networks on the other. Tech companies such as IBM and blockchain platforms like Corda and Ripple, are already responding with enhanced offerings and will continue to build these out to meet enterprise demand.

The International Data Corporation (IDC) reports that it is time for hybrid cloud initiatives to focus on IT goals, in addition to business objectives. 2020 is expected to be the year when we will start to see growing offerings of so-called hybrid blockchains. Hybrid blockchains, are a combination of a private or permissioned blockchain and public blockchain. According to surveys it is expected that more than 80% of future blockchain deployments will be hybrid or multi-cloud — or both. Especially networks with stringent data sovereignty and confidentiality requirements will clearly have chosen frameworks that support hybrid or multi-cloud models.

6. Interoperability will move center stage

In 2020, enterprises will increasingly focus on operational matters, demanding deployment flexibility and interconnectivity between networks. In 2020 the call for interoperability between the many blockchain networks and the various (and also distinct) protocols that have been launched will intensify. We still see a lot of private PoCs, often testing different blockchain technologies for the same purpose: to weigh the pros and cons. Each blockchain has varying levels of security, performance and privacy.

We have witnessed the emergence of multiple networks addressing the same use case. Already several networks cover identical or similar functionality, including: trade finance, invoice factoring, shipping documentation. Participants in these networks are keen to understand whether, and how, these various chains will be able to interact. These are all reasons we predict that the future will involve more focus on getting these to interoperate.

As networks expand, nodes will distribute across multiple cloud providers. This will apply even if a network leverages its managed blockchain offering from a service provider. Cross-blockchains pilots are expected to see live in 2020. The move of Hyperledger Besu to Linux Foundation Hyperledger, should be seen as a “definite” sign that permissioned Blockchains might start to cross. There is a thorough research conducted on how digital assets on various chains might co-exist.

7. Growing competition between blockchain platforms

Progressing to 2019, many enterprises joined existing consortiums around the most popular use cases. Most of these consortiums are now looking to go into production in 2020, thereby solving specific use cases including identity and document management, supply chain management, trade finance, IoT applications, etc.

For 2020 we expect more customizable permissioned networks forming as well as growing competition between blockchain platforms. Not only between the main existing blockchain platforms, Corda, Hyperledger, Ethereum and others, but also from new comers that could upset the existing balance. Who will become the market leader is still open. We also expect several integrations with other blockchain frameworks. Such as Digital Asset that is now firmly focused on its smart contract modelling language, DAML, integrating it with other frameworks. We will a number of interesting combinations emerge.

Blockchain communities will increasingly recognize the importance of good governance and will prioritize it in order to stay competitive and stand out from an increasingly crowded field of competing platforms.

8. Internet of Blockchains

Another development, may be not yet for 2020, but certainly for the coming years is the development of an Internet of Blockchains, just like the existing Internet. The next generation of blockchains will be a flexible system of a multitude of independent/sovereign yet cooperative entities with different applications, philosophies, and validator. The ecosystem will be an open, sovereign, secure network of interconnected blockchains, that will be able to interoperate made possible by interoperability protocols like Inter-Blockchain Communication.

Continued crypto currency confrontation

1. First national digital currencies will be launched

The Facebook Libra announcement has provoked a lot of debate at central banks throughout the word. From a recent survey 80% of countries are concerned about the popularity of uncontrolled financial assets. There is a consensus around the world among central bank governors and governments at large that they want to maintain control of money and money supply. A number of countries have already come with plans for launching their own national digital currency.

In 2020 we will see the launch of the first national digital currencies. It is thereby very likely central banks will focus on the wholesale market leaving the retail market for regulated institutions. China is pursuing its the Digital Currency/Electronic Payment (DC/EP) initiative and next year we will see the People’s Bank of China roll out its digital yuan. Russia’s Central Bank is also considering possibilities of issuing its own crypto Rouble in the near future, which would take the status of a national cryptocurrency. In addition, the World Bank, and the International Monetary fund have recently launched a private blockchain and quasi-cryptocurrency. The digitization of national currencies will continue its momentum in the coming years as more central banks and governments warm to the idea. Experts assumed that by 2022 at least five countries will issue a cryptocurrency.

2. Crypto currency market will be regulated

In 2019, there has already been a lot of talk about regulation in the blockchain industry and this will continue in 2020. The industry is evidently ripe for regulation granted the number of projects operating in the space. But the urgency for regulation has intensified. Government leaders and regulators worldwide are now wrestling with how they will handle blockchain technology and crypto currencies as we enter a new decade. The possible launch of Facebook’s Libra in 2020 forced regulators to take cryptocurrency seriously, and triggered many regulators to come up with more stringent regulation for crypto currencies, but without frustrating innovation. In order for blockchain and crypto to mature, enterprises and individuals need to feel completely comfortable leveraging this technology, secure in the knowledge that their government and legal systems support them.

3. Crypto currency market revised

In 2019 we saw many crypto projects failed and stopped their activities. As the crypto ecosystem matures, every project needs to have a viable use case, strong funding, strong community, and an experienced leadership team to succeed. It is expected that in 2020, this “weeding out” of poorly executed crypto projects will continue. Some even predict that “98% of crypto projects and their currencies will go to zero or have no viable exit for their holders”. In 2020, we may expect mergers and acquisitions to accelerate in the cryptocurrency sector across both exchanges and technology. In order to achieve full compliance and trust in the industry, exchanges have to work diligently to regulate themselves. In a similar way, we do believe exchanges will work more harmoniously toward regulation and pricing.

The trend we saw from the last few years that issuers are tokenizing fiat currencies and using them as easier exchange mechanisms on cryptocurrency exchanges will continue. There will be a clearer distinction between forms of currencies as payment tokens, utility tokens, asset tokens and security tokens. We will also see increased adoption of stablecoins, mostly fiat-backed, and driven from trading on exchanges. Another development will be the shift of major altcoins from being just a utility token towards more high-value transactions, even as a store of value. We see this shift will increasingly noticeable in 2020 as altcoins mature and demonstrate additional use cases to stakeholders and the investment community.

4. Banks will enter the crypto currency market

After the tumultuous 2019, the digital asset market will mature and crypto currency prices will continue to stabilize. As a result of this increased maturity it is expected to see more and more institutional investors enter the crypto markets in 2020 as education around digital assets improves. In 2020 we will also start to see other cryptocurrency payment systems gain momentum that do not come from legacy banking institutions. It is expected more banks to enter the crypto currency market in 2020, partly in a move to defend their positions. In this regard, we will see more big names in the financial industry coming into the blockchain and cryptocurrency sector.

Earlier this year, the US-based J.P. Morgan already announced the launch of a proprietary digital coin JPM Coin during 2020. Other examples are Fnality’s stablecoin, while the Japanese bank Mizuho announced its own crypto launch already in early 2019.

Integration Blockchain with other technologies

In 2020 we will also see the further integration of blockchain with other technologies such as the Internet of Things (IoT) and Artificial Intelligence. According to the IDC, many IoT companies are already contemplating the implementation of blockchain technology. According to them more than 20 percent of IoT deployments enabled blockchain based services by 2019 and this process will continue in 2020 and beyond. The IDC suggests that global spending on AI will reach $57.6 billion by 2020 and 51% of businesses will be making the transition to AI with blockchain integration.

Firms will gain measurable benefits from blockchain in conjunction with IoT and AI. Blockchain technology provides a secure and scalable framework for communication between IoT devices. Blockchain conducts much faster transactions compared to other platforms owing to its distributed nature of work.

Forward looking

As we recap, 2020 is going to be a pretty exciting year for blockchain in enterprises. If all these predictions come through and will be realised it may become a historical year for both blockchain and the crypto currency market, improving the attitude to this technology by corporates and consumers alike.

The focus will shift to integration and interoperability, from irrational exuberance to realistic assessment. So it looks like it is about to be THE year for new opportunities and achieving goals in a decentralized manner.

Blockchain projects and digital assets are set to grow in adoption with the like hood of rising breakthroughs in mainstream use cases. Potentially we will start to see some new business models because of the technology.

The future of blockchain is thus promising but there will still be stumbling stones in the initial stages of its journey. But leaving behind the concerns related to this technology, it seems that this innovation will gain the community’s trust.

To ensure the longevity of the blockchain and crypto industry into the next decade and beyond, key players need to work together to prioritize education, ensuring adoption continues to occur on a wider scale.

By the way, I wish everybody a great 2020.

Carlo de Meijer

Economist and researcher

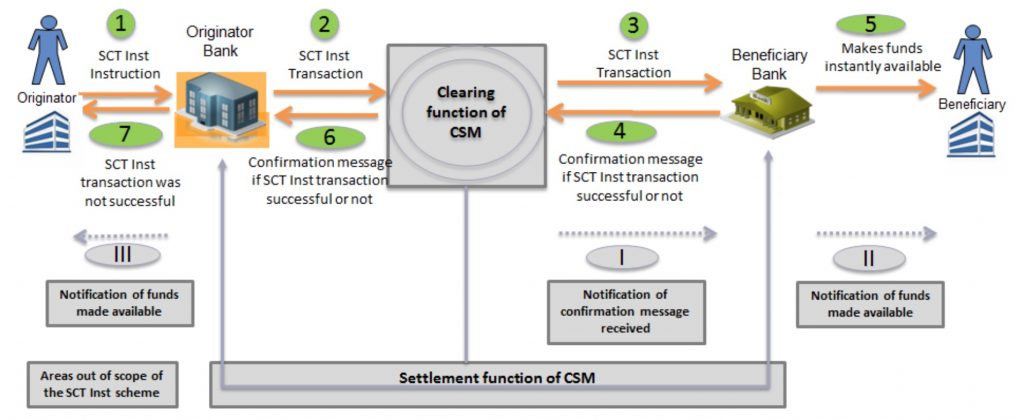

At the end of last year the SEPA Instant Payments requirements from the European Payments Council have been published. Consequently the Dutch requirements 3.0 from the Dutch Payments Association were published last month.

At the end of last year the SEPA Instant Payments requirements from the European Payments Council have been published. Consequently the Dutch requirements 3.0 from the Dutch Payments Association were published last month.