Treasury ABC – part I

| 08-07-2016 | Jan Doosje |

For many people Treasury is, as they think, something that is not concerning. Because there are many items that could be mentioned and listed here, I chose to mention the items that have effect on our daily lives, even if we are not aware of the existence of the described item. I’ll call it the Treasury ABC for normal citizens.

A is for Asset management

Asset management is the management of, amongst others, supervision and investing of and in (mostly) big portfolios of shares, obligations and other financial instruments. The goal is to increase the invested funds by making a high return. Pension funds depend on their return of investment to fulfill their commitment to participants of the pension fund. Bad results can affect your monthly income when you are entitled to pension.

B is for Bond

This is not only for James and his family. Bonds are issued by national governments to satisfy their need for funds. Depending the grade of a country, the return on a bond can vary. Be sure, if the interest rate is high, risk will also be high. Don’t jump into “junk bonds” because it can cost you a lot of money.

C is for Currency rate

A currency rate is the conversion rate between one currency and another. For example: USD/EURO. When the currency rate is > 1, you will get more dollars for your euros. When the currency rate is <1, you will get less dollars for your euros. Suppose the currency rate USD/EURO is 1,11 and you go shopping in New York. If the price is $ 100, you will see on our bank account a withdrawel of € 90,01.

D is for Dollar

The US Dollar was born on September 8th, 1775. Some people believe that the name comes from the Dutch (daalder) or from the German “Taler”. However, the USD still is the most important currency in the world despite the Yen, Euro or Chinese Yuan.

The price of the dollar is influenced by :

* Supply and demand factors

* Sentiment and market psychology

* Technical factors

E is for Euro

The Euro is a new currency, which was born in Maastricht while the treaty of 1993 was signed. Virtual the Euro came into existence in 1999 while the notes and coins came into circulation as of January 1st 2002. Before the Euro, the European countries were divided in their currencies. “We” had Austrian Schilling, Belgian Franc, Cypriot Pound, Dutch Guilder, Estonian Kroon, Finnish Markka, French Franc, German Mark, Greek Drachma, Irish Pound, Italian Lira, Latvian Lats, Lithuanian Litas, Luxembourg Francs, Maltese Lira, Monegaque Franc, Portuguese escudo, Sammarinese Lira, Slovak Koruna, Slovenian Tolar, Spanish Peseta and Vatican Lira. Imagine the lack of transparency before the Euro existed.

Next week we’ll proceed with part II of the treasury ABC for normal citizens.

Talking to our readers and contributors we have noticed that there are treasury related words with many different understandings. We’ve asked Jan Doosje to kick off a treasury ABC. Of course this is not binding and there are letters which can be connected to several treasury related words We need your input to make a complete treasury ABC. Would you like to contribute to the treasury ABC? Please contact our community manager Stephanie Derkse.[social_links size=”normal” align=”” email=”[email protected]”]

Owner of Fimterim Advies & Consultancy

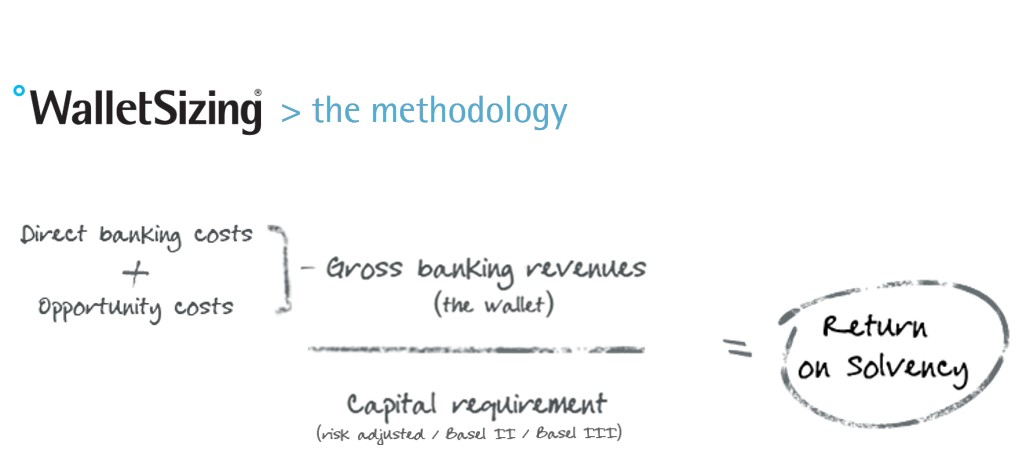

On april 13th of this year the Fintech innovation awards took place. Vallstein won the innovation award in treasury management with their Walletsizing® system. We asked Huub Wevers from Vallstein to give us an update on this new system. What’s new about it and who will benefit from using Walletsizing®?

On april 13th of this year the Fintech innovation awards took place. Vallstein won the innovation award in treasury management with their Walletsizing® system. We asked Huub Wevers from Vallstein to give us an update on this new system. What’s new about it and who will benefit from using Walletsizing®?

Huub Wevers is responsible for Corporate Solutions at Vallstein, the leading Bank Relationship Management specialist. Before joining Vallstein he has had eighteen years of experience in Banking at ABN AMRO and RBS, notably Transaction Banking. His responsibilities included Product Management, Account Management, Implementation and Operations, whereby his last role was the leadership of all Service & Operations in EMEA for RBS. At Vallstein Huub is responsible for building out the software solutions that Vallstein offers for corporates. Solutions that automate bank relationship management in order to assess the profitability that a corporate has for their banks, using all banking products and Basel III.

Huub Wevers is responsible for Corporate Solutions at Vallstein, the leading Bank Relationship Management specialist. Before joining Vallstein he has had eighteen years of experience in Banking at ABN AMRO and RBS, notably Transaction Banking. His responsibilities included Product Management, Account Management, Implementation and Operations, whereby his last role was the leadership of all Service & Operations in EMEA for RBS. At Vallstein Huub is responsible for building out the software solutions that Vallstein offers for corporates. Solutions that automate bank relationship management in order to assess the profitability that a corporate has for their banks, using all banking products and Basel III.