Singing from the same hymn sheet

| 26-4-2017 | Hubert Rappold | Sponsored content |

Hubert Rappold from TIPCO Treasury & Technology, puts the case for a treasury information platform (TIP), which acts as an information hub for the treasury department and reduces companies’ reliance on “Excel-based monstrosities” that are doomed to fail.

Hubert Rappold from TIPCO Treasury & Technology, puts the case for a treasury information platform (TIP), which acts as an information hub for the treasury department and reduces companies’ reliance on “Excel-based monstrosities” that are doomed to fail.

A typical treasury department runs a number of systems: a treasury management system for day-to-day operations, a trading platform, a market information system, electronic banking software and so on. So why on earth would you really need a separate treasury information platform (TIP)? After all, the data already exists in a multitude of other systems. Well, that is certainly true but also part of the challenge. If there is no single place where all the data can come together to create your reports at the press of a button, you will most likely be forced into a mediocre data warehouse solution also used by other departments or into a ‘handmade’ spreadsheet-based solution with all its drawbacks.

On top of that, even in an ideal world, when all your data is in a single system, there are circumstances where it is almost certain that you will need to integrate additional data. Just think about acquisitions. lt usually takes years before the systems are harmonised. So what do you do in the meantime?

Requirements of a TIP

A TIP needs to fulfil a range of requirements in order to satisfy the needs of treasury departments.

- lt needs to be easy to use

- lt needs to integrate existing data sources

- lt needs to have a flexible reporting engine

- lt needs to be easy to maintain

- lt needs to be extensible

What happens if these requirements are not fulfilled is quite easy to imagine. Your reporting will be cumbersome, error-prone and data quality will be poor. Ultimately, the reporting project will fail and a new generation of interns will develop yet another Excel-based monstrosity doomed to failure.

Let’s look at these requirements in greater detail:

- If it is not easy to use, it will not be accepted by your users, resulting in poor data quality and frustration. The benchmarks are spreadsheetbased solutions. If the handling is as easy as in these systems, then your users will be happy.

- If it does not integrate existing data sources, you force users to duplicate entries, resulting in frustration and hence in poor data quality. Of course this is not a one-way street. Think about the FX exposure captured by your subsidiaries as part of the forecasting process and locally contracted FX transactions. Your risk manager will be more than happy to have this information in his or her treasury management system. Think about payment advices. Collect this information and you can use it to optimise the funding of your cash pools. Your TIP will act as an information hub for the treasury department, passing data back and forth between various systems.

- If it does not provide a flexible reporting engine, you will not be able to react to everchanging requests from internal and external sources and will essentially resort to timeconsuming, cumbersome and error-prone spreadsheet reporting. Flexible not only means that it covers all functional aspects. lt also means that even without being an IT guru you should get meaningful information out of the system. However, be on your guard if you are told that you will be able to create sophisticated reports within minutes without any training. That only works well in promotional videos. Invest some time in proper training and be the master of your reports.

- If it is not easy to maintain, you will be frustrated by the administrative overhead of the system instead of working straight on the analysis of the data. lt needs to be straightforward to add new users, companies and company groups. Whether via manual input or interfaces, the data needs to end up in your reporting solution without delay, without reprogramming, and without any external expertise.

- If it is not extensible, you will be forced to install even more systems if a new function is required, such as cash flow forecasting, bank relationship management and guarantees. Therefore, think ahead. Before selecting a system, clearly state what you want it to do now and in the future.

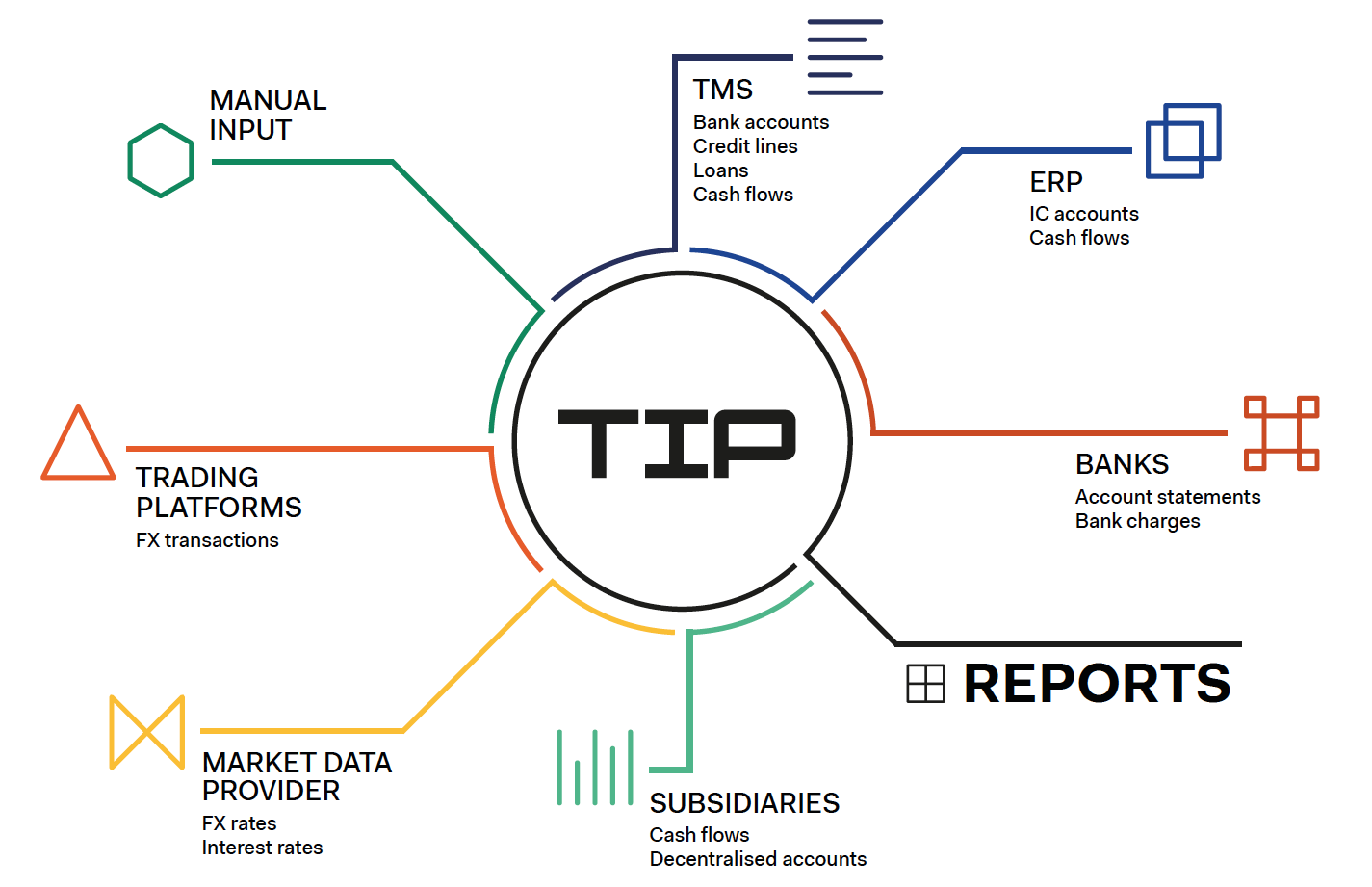

Outline of system architecture

Below, I have outlined how such a system could fit into your existing system environment and what the interactions are between these components.

The TIP acts as the information hub between the various systems. lt receives and passes on data to and from other systems. Based on this data, all the reports are created without any need for manual consolidation.

Benefits of a TIP

- The TIP receives the data from other systems and passes it on to other systems. This reduces the number of interfaces between systems and hence the overall complexity.

- The reports are created from a single common data source. There will never again be any more mismatches between different reports as they are all created from the same set of data.

- lt becomes less costly and less risky to replace components of your system architecture. If you need to replace one of the components, you can be sure of having a minimal impact on the overall system architecture. If you use a new treasury management system (TMS), you only need to replace a few interfaces between the TIP and the TMS. If you switch to a new market information provider – no problem, just replace the interface to the TIP. lt will pass on the data in the established way to all the other systems involved.

- lt becomes easier to add new functionality: If you require a new function, for example, cash flow forecasting, it is also easier to update or extend a lightweight TIP instead of relying on the next release cycle of your TMS provider.

- lt becomes easier to add acquisitions: Even if newly acquired companies are not integrated into your system infrastructure, they can use uploads or simple screens to provide their data.

Selecting a TIP

Usually, a TIP is selected because there is one burning issue that needs to be solved, for example, a group-wide overview of bank accounts or cash flow forecasting. If you select a TIP for any of these functionalities, always ask yourself what could be the next burning issue. These are usually identified by analysing the existing spreadsheet-based solutions. Any of these is a good candidate to be replaced by the TIP.

With this list in mind, look at the existing providers and make sure that they cover all your needs and not only the one that currently causes most of the pain. Also make sure that the system provider has treasury experience. Just think about cash flow forecasting. Most system vendors will tell you that planning is part of their system. However, a closer look will show you that basic functionality is missing; for example, the connection to the financial status as the starting point of the forecast or the display of credit facilities according to their maturity structure. Basic things, if you are treasurer, but a different world for the average system provider.

Also make sure that the system has an intuitive user interface, especially where large amounts of data are captured, for example, for the cash flow forecast. lt should be as easy as a spreadsheetbased solution in order to gain the acceptance needed. Interfaces should exist to all relevant standards and systems. Last and definitely not least, a large customer base that happily acts as references is a must. If this does not exist, the chances are high that the system provider will develop the system at your expense.

Look at your current treasury reporting. If you encounter lots of spreadsheet-based solutions, if you see files transferred via e-mail, if a lot of manual work is needed to create reports and if you find yourself tracking down differences between different reports time and again, you should consider a treasury reporting solution like TIP.

For more information please refer to TIPCO Treasury & Technology

Hubert Rappold – CEO at TIPCO Treasury & Technology

Hubert Rappold – CEO at TIPCO Treasury & Technology

[button url=”https://www.treasuryxl.com/community/experts/hubert-rappold/” text=”View expert profile” size=”small” type=”primary” icon=”” external=”1″]

[separator type=”” size=”” icon=””]