Segregation of Duties and Responsibilities

| 28-5-2018 | By Paul Stheeman |

Compliance is one of the most important factors when establishing and running a Treasury function nowadays. Increased regulatory requirements paired with concerns about fraud and cybercrime mean that CFOs want to ensure that functions and processes are aligned with the Board’s expectations and run according to recognised best practices.

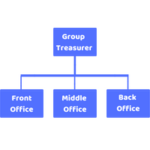

So, what would an ideal departmental structure for Treasury look like? The chart below illustrates the generally accepted best way of setting up a Treasury function.

Group Treasurer. The Group Treasurer maintains overall responsibility for the function and reports directly up to the CFO. This person will typically not be involved in the day-to-day Treasury activities.

Group Treasurer. The Group Treasurer maintains overall responsibility for the function and reports directly up to the CFO. This person will typically not be involved in the day-to-day Treasury activities.

Front Office. Front Office staff often have the not so glamourous title of dealer. These are the people who will execute transactions for the company. These will be FX transactions, but also investing or borrowing funds or executing commodity hedges.

Middle Office. People in the Middle Office are often called Treasury Controllers. Their role is to control the activities of the Front Office. They will check and confirm incoming confirmations, prepare and send outgoing ones and ensure that all transactions are done within prescribed limits and policies.

Back Office. Personnel working here are responsible for the settlement of transactions when due. They will make payments and ensure that expected incoming payments are correctly credited.

This is a rather simplified description and for several reasons will seldom reflect the actual setup at a corporate. Firstly, the activities of a Treasury function are nowadays considerably broader than just completing financial transactions, so that Treasury staff will have other responsibilities such as corporate financing or insurance. In such cases though the requirement for segregating duties is not so compelling.

A further issue is that many smaller or medium-sized companies simply do not need, nor do they have the number of staff required. Back-ups will be needed for the Front, Middle and Back Offices leading to a minimum total of 6 plus the Group Treasurer. Only large organisations with active Treasury functions can afford such a number. To solve that problem, the tasks of Middle and Back Office could be performed by the same persons. It is only the Front Office activities that really do need to be segregated.