Refinitiv Corporate Treasury Data Insights | June 2021

06-07-2021 | treasuryXL | Refinitiv |

Andrew Hollins, Director of Corporate Treasury Proposition at Refinitiv, brings you the June 2021 round-up of the latest Corporate Treasury Data Insights.

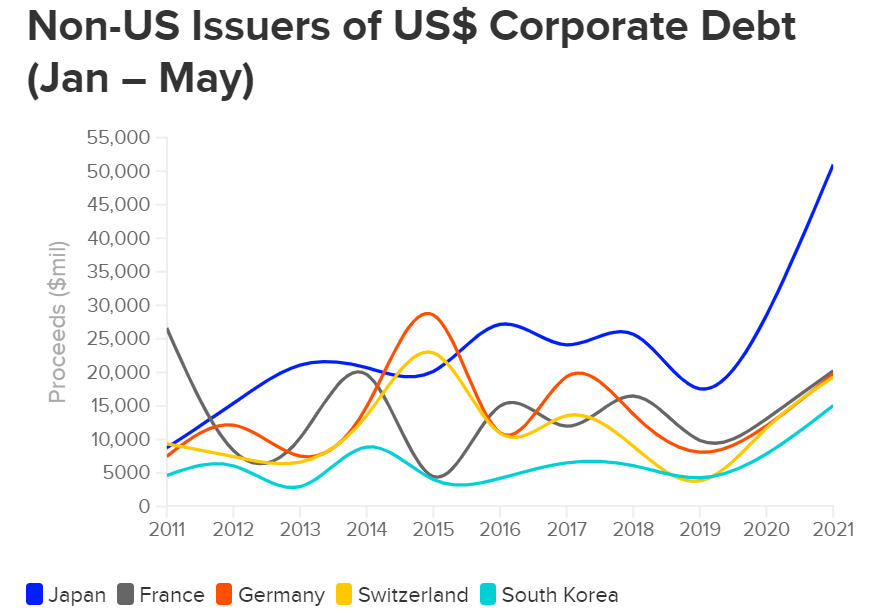

- Issuance of non-U.S corporate USD denominated debt has increased, and is most pronounced in Japan and driven by M&A.

- Sign-up to learn more about the rise of digital treasury in India and watch a video to observe how crypto trends are evolving.

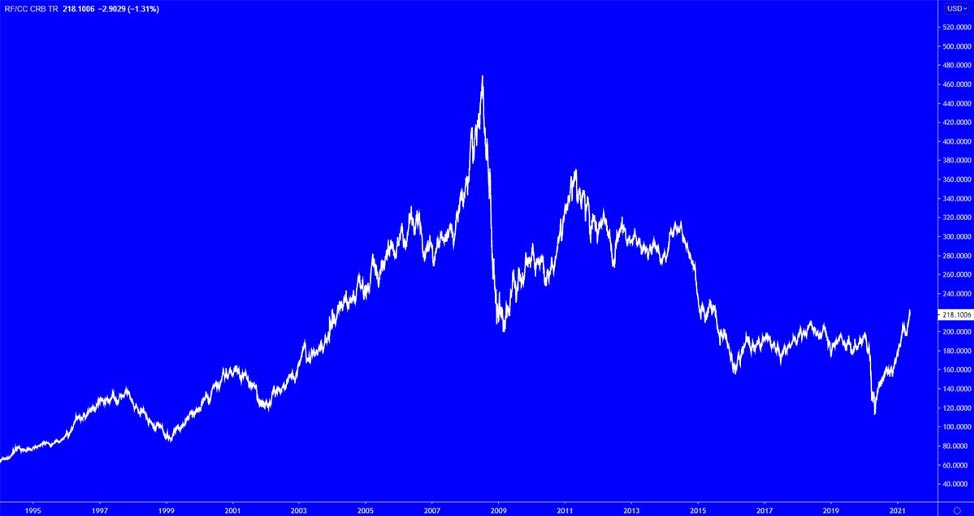

- Are we witnessing the start of a commodities supercycle? And watch a webinar to learn more about the impact of LIBOR on the need for USD cash market to have fallback rates.

Corporate Treasury Chart of the Month

M&A drives demand for the dollar

We are seeing a continued rise in non-U.S. corporates issuing US$ denominated debt this year, with Japanese companies in particular taking advantage of strong investor demand, favourable interest rates and healthy US$ liquidity (see chart below) to deliver an M&A-driven issuance boom.

For example, we recently saw 7-Eleven raising $10.9 billion to fund its $21 billion acquisition of Speedway, the U.S. convenience store operator.

Being a safe haven currency, 2020 was a period of JPY strength against the USD. However optimism of a strong post-pandemic recovery has seen the JPY give back most of these gains since Q1 2021. Corporates with USD liabilities can monitor market expectations of further JPY weakness using apps like FX Polls and the FX probability feature in Refinitiv Eikon.

USDJPY currency basis spreads narrowed during COVID-19 in response to decisive Federal Reserve monetary support and liquidity provision. You can view these spreads using the Refinitiv Eikon Chart app (CHT).

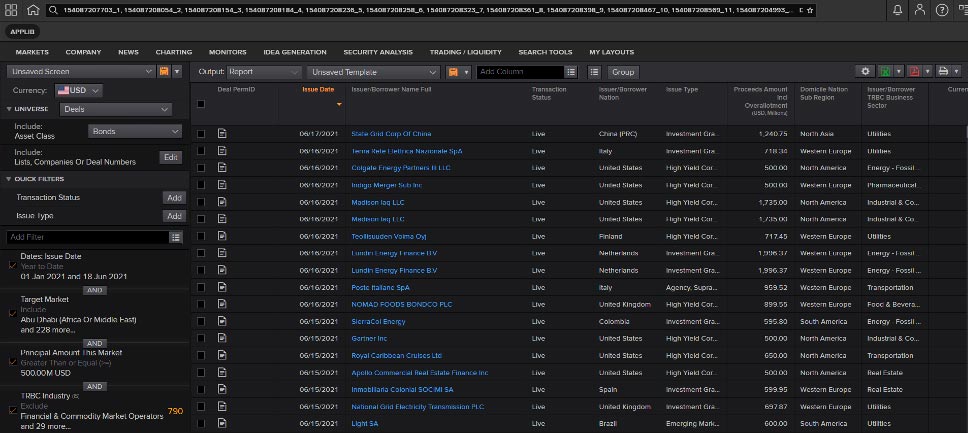

Get these issuance insights in Refinitiv Eikon

- Search for the ‘deals screener’ app ‘DSCREEN’

- Select ‘USD’ under the ‘currency’ dropdown

- Select ‘bonds’ under the ‘asset class’ dropdown

- Add ‘date’, ‘target market’, ‘principal amount’ and ‘industry’ filters

Secure your spot: the rise of digital treasury in India

As treasury evolves into a strategic centre for companies, the adoption of technology becomes pivotal to strengthen resilience and insight. Secure your spot at an event we are co-hosting on 24 June 2021 with our partner, leading TMS company IBSFINtech, and hear from a leading panel of experts, including the Country Head of SoftBank and the Head of Global Corporate Treasury at Wipro Enterprises.

Crypto trends

The world of crypto and decentralised finance is starting to broaden in terms of products and coin offerings. And many of the biggest crypto moves have been preceded by shifts in sentiment that can be picked up from social media sources. Watch this seven-minute video to see evolving cryptocurrency trends and how they can be tracked by analysing social media.

Watch the video: Tracking the Biggest Trends in Crypto – Data on the Data

The start of a commodities supercycle?

You can see the rebound of the Refinitiv/CoreCommodities CRB Index is gaining steam in a directional move comparable with the beginning of the last commodities supercycle in the 2000s.

However, the overlay of several cyclical upswings of different raw materials and the transition towards a low-carbon economy suggests something more complex is happening.

Access FX liquidity in Russia

LIBOR transition webinar: why does USD cash market need fallback rates?

Join us on Wednesday 14 July to discuss the USD cash market and the need for fallback rates with the Loan Syndications and Trading Association (LSTA), Wells Fargo and The U.S. Federal Reserve. Sign-up today.

On-demand event: COVID-19 recovery in U.S. power and gas markets

As more countries and markets open up after COVID-19 lockdowns, how will U.S. power and natural gas markets be impacted? Hear what our panel of experts from Refinitiv, IIR Energy and Yes Energy think.