View Recording

Cash is King, Visibility is Key

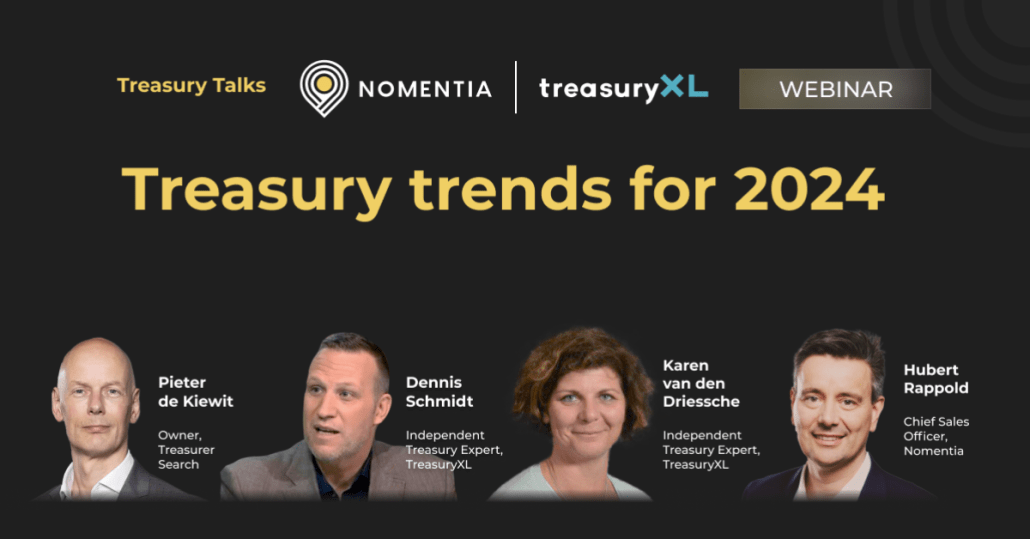

Karen kicked off the session. Her wisdom flowed as she emphasized the timeless importance of cash visibility, cash concentration, and access to funds. Despite being longstanding pillars in treasury discussions, Karen underscored their renewed significance in the context of rising interest rates and the need for cash efficiency metrics in 2024.

In her words,

“2024 will be around cash visibility, cash concentration, and exit access to those funds.”

Hot Topics in 2024

Dennis delved into the hot topics awaiting treasurers in 2024. Sustainability, cyber security, and the digital transformation of treasury operations emerged as the protagonists of this narrative.

Dennis emphasized,

“One of the key things I see is the whole sustainability part. It’s going to be one of the hot topics for 2024 and going forward.”

Treasury Tech Marvels

Hubert from Nomentia provided a glimpse into the future of technology in treasury. With a focus on simplicity and user-friendliness, Hubert envisioned a world where technology seamlessly integrates into treasury operations. From enhanced data utilization to streamlined processes and the burgeoning FinTech landscape, Hubert painted a picture of a tech-savvy treasury ecosystem.

Hubert stated,

“I see it in my responsibility to push that development, to enable treasurers to make their life easier.”

A Dynamic Discussion Unfolds: Balancing People, Processes, and Tech

As the panel engaged in a dynamic conversation, the delicate dance between people, processes, and technology became apparent. The trio agreed that while technology is a powerful enabler, simplicity is key, and treasurers should be strategic partners and leaders in innovation within their organizations.

Looking Ahead: ESG, Cybersecurity, and Treasurers as Trailblazers

The panel unanimously pointed to ESG as an enduring trend, emphasizing the need for treasurers to embed sustainability into their risk frameworks. Cybersecurity emerged as a critical concern, with technological advancements like AI and machine learning playing pivotal roles in fortifying defenses.

Dennis got straight to the point:

“It’s going to be an exciting time. There will be challenges, of course, but there will also be a lot of opportunities for treasurers to really make a difference in their organizations.”

A Call to Action: Treasurers, Tech, and Tomorrow

As the session wrapped up, the speakers extended a call to action. Treasurers were urged to step into the spotlight, embrace innovation, and harness the power of technology. The future, it seems, is not just about managing risks but driving the narrative of innovation within the realm of treasury.

The curtain fell on this insightful session, leaving treasurers and finance enthusiasts worldwide with a renewed sense of purpose and anticipation for the unfolding treasury landscape in 2024. The journey continues, and the world of treasury stands ready for the challenges and triumphs that lie ahead.

Thank you for taking the time to read our recap. Make sure to watch the recording for additional insightful knowledge on treasury in 2024.