Large companies with good credit standing can ask external rating agencies for a credit rating for their CP (ST financing) and on bonds & private placements (LT financing).

What is a Credit Rating?

A credit rating is an evaluation report of how a company is performing in absolute terms in a particular market or industry in terms of creditworthiness.

Such a report makes it possible to compare a company’s creditworthiness against other companies operating in similar markets or industries internationally.

The report is made up of both:

- Quantitative

- Qualitative information

Currently, there are 3 major credit rating agencies: Standard & Poors, Moody’s and Fitch.

These ratings are crucial for investors, creditors, and other market participants to evaluate the risk associated with lending money or investing in financial instruments issued by these entities. The investors of these instruments heavily rely on the credit ratings of external credit agencies.

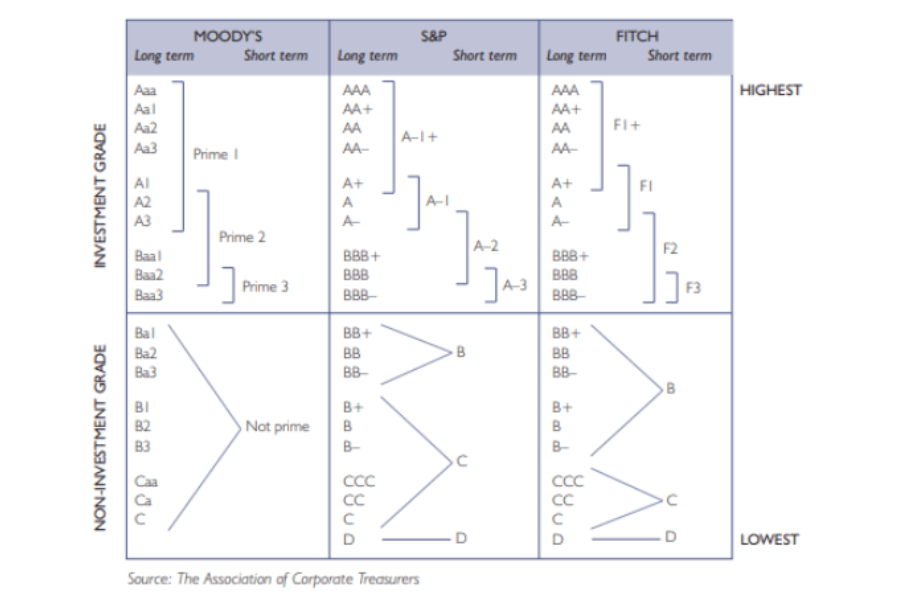

Overview of the Rating Tables

The table down (source: The Association of Corporate Treasurer) below shows the major credit agencies’ rating structure:

A borrower or an issuer’s credit rating is usually complemented by the rating outlook (positive, stable, negative, or developing), which is a directional evaluation of where the rating is likely to move over time.

For certain entities subject to announced or expected major corporate events (typically around M&A) can be placed on credit watch pending the outcome of the event, and in some circumstances the agency will give a view about what would happen to the rating under different outcomes.

Elements that Credit Agencies focus on

The credit rating process involves a comprehensive evaluation of the creditworthiness of an entity, such as a corporation, government, or financial instrument, to assess the likelihood of timely repayment of debt obligations. Credit rating agencies follow a systematic approach in their analysis, considering various financial and non-financial factors.

Usually, they will ask the rated entity for extensive financial and non-financial information. This information includes financial statements, cash flow projections, business plans, details about the company’s organization and management, industry and economic trends, and any other relevant data.

The credit rating agency conducts an initial assessment of the provided information to identify key credit risk factors. This may involve a review of historical financial performance, industry conditions, and the entity’s competitive position. Thereafter, they conduct meetings and interviews with the entity’s senior management and site visits, to gain a deeper understanding of its operations, strategies, and risk management practices.

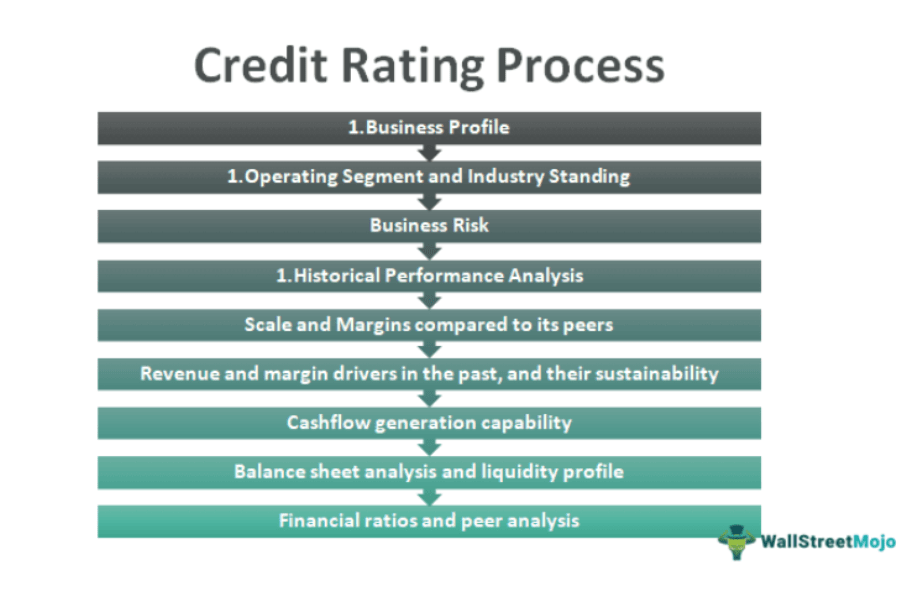

While specific methodologies may vary among rating agencies, the following outlines a typical credit rating analysis:

- Qualitative Analysis: will include the sector and the position of the entity in its market, country risk profile, management and corporate governance, business profile and financial transparency.

- Quantitative Analysis: evaluation of financial ratios, liquidity, leverage, profitability, the cash flow profile, financial flexibility and other financial metrics. They assess the entity’s ability to meet its debt obligations under various scenarios.

The table below illustrates this:

Source: Credit Rating Process (www.wallstreetmojo.com)

This information is analyzed and usually submitted to the rating agency committee, which then takes a position and communicates this to the company.

Thereafter the rating agency makes it publicly available. The credit rating helps investors and other market participants make informed decisions about the credit risk associated with the rated entity or financial instrument.

It is important to note that credit rating agencies periodically review and update ratings based on changes in the entity’s financial condition, industry dynamics, and other relevant factors. Additionally, rating agencies may provide ongoing monitoring (watch) to monitor the creditworthiness of rated entities between formal rating reviews.

The business model of the 3 major credit agencies (Moody’s, Fitch Ratings and Standard and Poor’s) is one where the corporate entity is their client and ask them to provide a credit rating. The rating agency charges a fee for this rating service.

In summary

Credit rating agencies play an important role in financial markets, providing investors with information on the creditworthiness of issuers and their debt. In particular, external credit ratings provide a common language for investors to compare the credit risk of different debt instruments, such as bonds or securities.

Good credit ratings are usually also a prerequisite to access the bond and the CP market. Credit ratings are also important for the pricing of bonds and CP. The higher the credit rating, the lower will be the cost of funding.

Investors often base part of their decision to buy a corporation’s bonds, or even the stock, on the credit rating of the company’s debt. Corporate treasurers and asset managers will also use credit ratings as an element of their investment policy.

Many financial institutions and regulations require a minimum credit rating for certain types of investments or transactions to ensure a level of risk management.