25-04-2022 | treasuryXL | Treasury Delta | LinkedIn |

RFPs are one of the less attractive parts of projects, although a necessary evil. Treasurers hate them because to set up this huge document and organise the necessary stakeholders it takes time and effort, while remaining highly manual. Let’s break down the myths around tenders and see what alternative solutions exist to facilitate this process and help make the treasurer’s life simpler and more enjoyable, allowing him/her to allocate his/her precious time to higher value-added tasks. One such innovative solution is by Treasury Delta, a fintech which solves a lot of these problems when it comes to an RFP project.

Credits: François Masquelier

Source

What are the benefits of RFP automation? Basics and myths

Automation is now everywhere. We need to address basics and myths to analyze what is possible and should be done. The finance world and treasury are becoming increasingly automated. Moving away from manually managing tedious and time-consuming tasks appeals to almost every treasurer. The processes treasurers should first automate are those which are not yet at all automated and still fully manual. Priorities must be placed on tasks consuming a lot of time, effort, and human resources. It explains why RFP automation is on the rise.

Benefits of an automated RFP process in treasury:

· Time and human resource-saving

· Process standardization drives to faster consolidation of data received and easier comparison

· Treasury appears more professional and rigorous (vis-à-vis banks and IT suppliers), pushing for better responses

· Audit trails available for external/internal controls to prevent risks of fraud and bribery in the selection

· Automated feeding and one single source of feeding (implying more consistency of data)

· Easier to respond for the selected respondents

· Reinforcement of internal controls around procurement processes

· More secured way of transmission and exchanges with the sell-side

Platforms, the solution to all problems?

These days, platforms are used for almost everything. There are solutions to compare offerings that are available on the market. They enable platforms, like Booking.com or Airbnb, to compare offers in an outsourced, secured, and organised model. There are also some digital solutions, like Treasury Delta, to run RFPs and ensure the security of the information exchange and process is simplified and streamlined. Such a digital solution will evolve over time however, it now allows for pre-formatting and a structured process to facilitate the design, based on the classic bases and key questions, even if everything can be adapted and modified. Finally, and more importantly, it offers the “scorecard” to determine the best choice to be made by the treasurer. It is a guide to make sure you are complete and don’t forget anything. When more treasurers use them, they will become a market standard, I have no doubt about their potential as this is where the market is going.

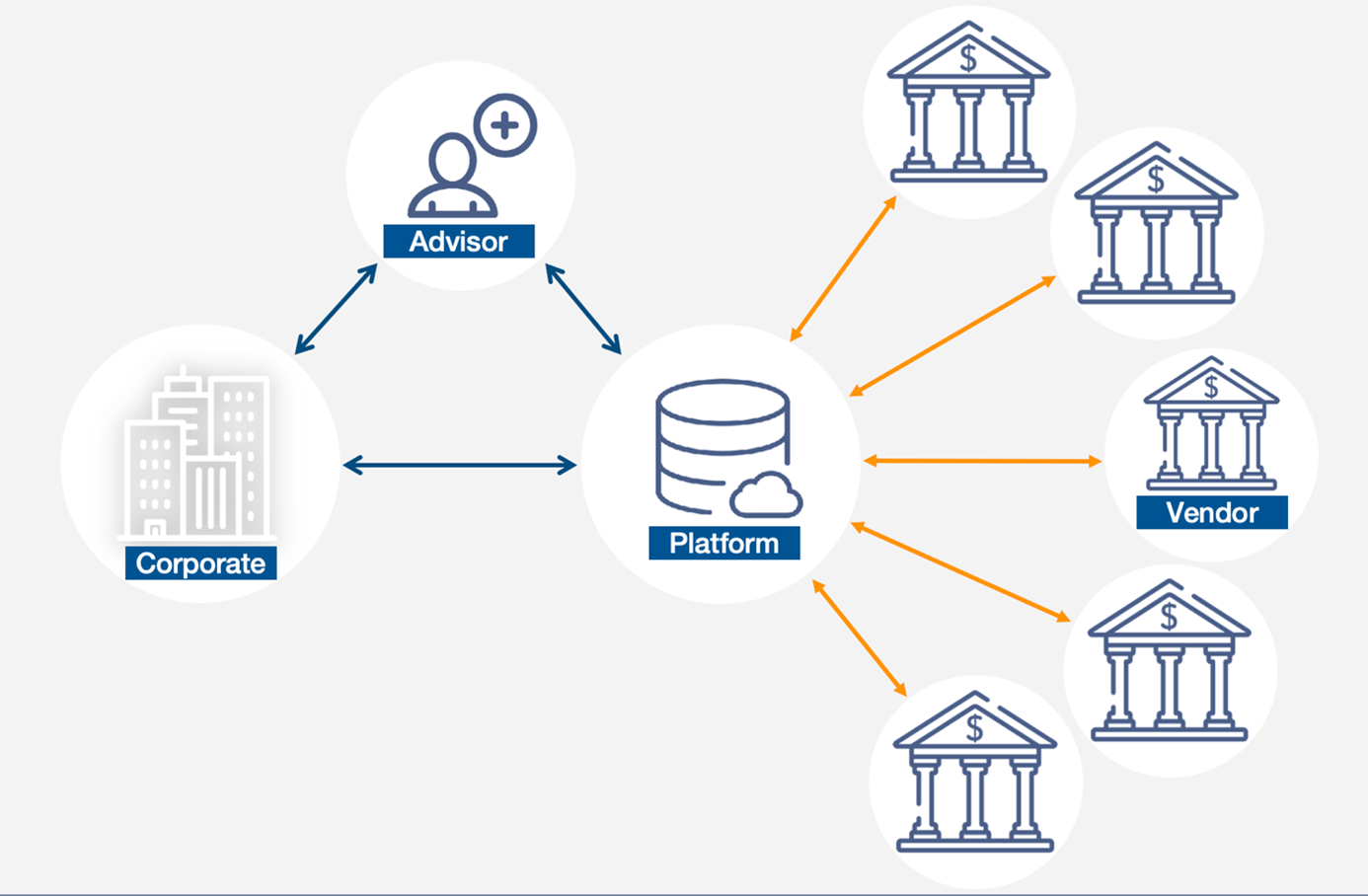

RFP or RFI processes usually involve three main stakeholders: (1) the suppliers (i.e., IT vendors or financial institutions); (2) the advisors (i.e., the advisory firm, which often help the treasury department in the selection process); and obviously (3) the buyers (i.e., the treasury department, potentially supported by procurement and IT departments).

Tri-parties involved in selection process

copyright (c) 2022 Treasury Delta – All rights reserved.

Simplifying the selection process to ensure the best possible choice

The idea of a platform remains to simplify the process of pre-selection and identification of the best choice to make for your organisation. As technology advances, procurement teams and treasurers can benefit from improved efficiency, data insights and better selection process driven by automation. This automation and significant evolution enable a reduction in procurement costs by streamlining strategic treasury sourcing and by making life easier for all stakeholders involved in the project. Here we’ll start with RFP automation basics and background. Then, I’ll share how technology works to make issuing RFPs faster, more optimal and easier. Finally, we can dig into some automation myths that do not ring true. Treasurers, often understaffed and under time pressures, seek maximum automation to allocate their scarce skilled resources to higher value-added tasks and, for example, to analysis or more strategic tasks, requiring brain. What is manual and repetitive must be automated, without any doubt.

The basics: what do we mean by RFP automation?

RFP automation is the use of digital technology to complete the tasks required to create, manage, and evaluate a treasury RFP response. Automation has come a long way in the last decade. Such tools will be able to leverage on AI and machine learning in the near future. Automation is at its best when it takes repetitive tasks that waste time and executes them for you. Once adopted, automation works in the background and frees up your time to focus on other value-added projects that are much more intellectually attractive for young talents. You cannot retain these young talents by asking them to manually process such RFPs. Motivation also comes from what you give to your teammates. Indeed, both you and your company can only benefit from RFP digitisation and operational efficiency. Treasurers always try to adopt best practices and drive efficiency across the organisation. A digital RFP is one of them to ensure best selection process and respect of internal corporate governance.

Affordable technologies make life of sell and buy-sides easier

These new digital technologies, like Treasury Delta’s platform, make RFP automation now more affordable, accessible, and impactful. Treasurers that will take advantage of RFP automation will save time, reduce costs, and improve desired outcomes. By grouping of questions, by structuring the need precisely, comprehensively, and consistently, the RFPs will generate value for the whole organisation and become a model of best practices in terms of corporate governance. Treasurers can save individual questions and categorise them based on the type of services or solutions, to facilitate responses and analysis afterwards. They can also track vendor proposal progress. We all want to know who is responding to our RFP and who did what, where they were strong/weak and so on… I think that RFP solutions and a proprietary platform that is “customisable” are the best solutions for both treasurers and vendors to interact with. They may empower you to just check a dashboard in real-time rather than manually inquiring with each vendor that is invited to bid for the business. With time, you will be able to use these pieces of information and data to optimise and shorten the RFP timeline, again driving operational efficiency using digital technology.

Pricing table calculations

With pricing tables, the calculations are automated so you can review an apples-to-apples comparison of your options albeit vendors have huge flexibility on how they price each bespoke solution. The key benefit of this feature is that it eliminates the risk of an organisation or an advisory firm miscalculating a vendors annual pricing. This is normally done manually via spreadsheets and is prone to error given the complexity and contrasting pricing models’ vendors use. The team needs, of course, to define the scoring and weighting of each criterion and desired feature which is all customisable within the platform. Engaging the right stakeholders and various departments in the RFP scoring process has historically been tedious. The steps are time-consuming as many other priorities and demands are happening within their departments. To start, you must break down each proposal to the relevant sections and send them out to the correct individual scorers. Then, you must collect and collate feedback. Finally, you spend time resolving questions, averaging scores, and clarifying inconsistencies. It remains a painful, time consuming and cumbersome exercise. However, with a few clicks, using a solution like Treasury Delta’s, you can automate the process entirely and review the results with minimal effort. The management of weighted scoring is important as it determines the providers to be short-listed and then later chosen. Prioritising purchase considerations and key features and functionalities are simple with RFP platforms. Just indicate the weights of questions and sections and the technology takes care of the rest. Weighted scoring calculations and visualisations are updated in real time, transparent and easy to understand. As these common RFP tasks, when done manually, may take hours each time, any ways to accelerate processes are welcomed by treasurers, who consider themselves as financial experts rather than procurement support. However, using digitisation makes them almost instantaneous so you can move on to more important things and use technology to do the work for you.

Why recourse to an RFP platform generates value?

1. Time savings and productivity

Time savings and productivity is where procurement managers most feel the impact of automation. Spending less time completing routine, mundane tasks allow treasurers focus on other higher-value projects and tasks. In addition, when the RFP automation can manage questionnaires for RFI’s, RFQ’s, DDQ’s, etc.…, automation can be applied to these projects as well. The hours you save can then be spent tackling that list that treasurers never seem to have time for i.e., the value add for the organisation.

2. Consistency and compliance

Much of the inefficiency in the RFP process is traceable to a single core issue — siloed knowledge. Manually issuing RFPs often involves using countless emails, messages, phone calls, word documents, pdfs and spreadsheets. When processes are siloed and knowledge too, the risk of sending inaccurate RFPs, discouraging vendor participation, and investing in the wrong solution may arise. By centralising knowledge into one single platform makes RFPs more efficient and comprehensive. It also creates a collaborative environment where contributors can work together on the RFP templates, requirements, questions and more.

3. Data capture and analytics

Many specialists believe that data and analytics are the future of procurement, including treasury. Data empowers cost optimisation, process efficiency improvements and more accurate analysis. With Treasury Delta’s solution vendors receive the right information, in the right format which presents a clear overview of the organisation’s treasury operations and more importantly their buying requirement and rationale for the RFP. Furthermore, banks will receive data on the overall corporate treasury wallet to assist them evaluate their bespoke RFP response.

RFPs cumbersome and boring processes, but a necessary evil

The RFP processes are very cumbersome. There are lots of manual interventions when it came to aggregating data. With automated processes, data is more easily captured and analysed. If the data points are more reliably and widely collected it could predict supply chain risks, track trends, better evaluate procurement costs and evaluate vendor’s performance.

Procurement automation is virtuous

RFP software is a tool, not a replacement for people — procurement and supply chain management are still very human. While RFP software can help issue and manage RFPs there are some things it can’t do. For instance, it can’t verify the accuracy of your RFP templates, interpret stakeholder requests, or determine which vendor is the best fit, nor analyze subjective and qualitative elements (if any). Many procurement software solutions use a metric called Time to Value (i.e., TtV) to quantify the speed of adoption. TtV measures ROI and quantifies the time from a user’s initial engagement to reaching the “ah-ha” moment. That moment is when the user realises the value and possibility of the technology. Consequently, this quick-value imperative means that customers regularly enjoy new features, innovative functionalities, updates, and enhancements. Treasurers can have access to the latest, greatest tools at a predictable price. By delaying automation, the process can become more expensive. Employees who are not equipped with the right selection tools and using excel worksheets may be overloaded by workload and becoming significantly less productive.

Why automation matters …

In conclusion, we can say that automation is interesting and useful because it is beneficial for all parties involved in the operation, including the external treasury consultants who are often called in to help and guide the treasurer through the process. They are solicited and even they use classic templates that are worn out and reused repeatedly, and that each client finally pays and re-pays several times. The virtue of these proprietary platforms is therefore complete. Automation makes everyone’s life easier, in the interest of the project and its final cost for the client. I can only advise rethinking one’s approach to RFPs and considering an automated and standardised solution, like that proposed by Treasury Delta, as the panacea of the RFP process for the treasurer. If there is a way out, this is it and I strongly recommend it!

François Masquelier, CEO of Simply Treasury – April 2022

Luxembourg