Executive summary

A Zero Balancing structure mirrors the core activity of a bank. Therefore, managing a Zero Balance Account (ZBA) structure requires a corporate treasury to operate an In-House Bank. This In-House Bank must apply Arms-Length interest to balances in its In-House Bank accounts as well as to InterCompany Lending and Depositing/Investing, both debit and credit.

To comply with OECD BEPS Transfer Pricing regulations, Arms-length must adhere to the logical spread similar to that used in core banking operations. This entails ensuring that the spread on current account interest (debit/credit) is further from the reference rate than the spread on InterCompany Lending/Depositing.

This white paper discusses, in two parts, the background and guidelines of setting Transfer pricing-related interest spreads in Zero Balancing Cash Pools.

Part 1

Many companies are considering or have already adopted Zero Balancing Cash Pool structures to optimize working capital and operating cash. The beauty of Zero Balancing Cash Pools lies in the ability to prevent idle cash from sitting at the operating unit, and automatically fund operating units with cash needs. Consequently, the cash pool leader (often the central Treasury) can manage idle cash centrally while efficiently funding working capital needs.

It is essential to emphasize that cash in a Zero Balancing structure is operating cash, representing short-term working capital.

In this white paper part 1, the importance of setting the right interest rates (both debit and credit) for Zero Balancing structures will be explained; Part 2 discusses the appropriate level of interest spreads to meet OECD BEPS Transfer Pricing guidelines.

To come to this, it’s necessary to explain the basics of banking and how they relate to Zero Balancing structures.

Core banking explained

The primary function of a commercial bank is to attract money from those who have surplus cash and subsequently use those funds to finance those who need money. Banks offer unique bank account numbers where you can deposit money or borrow from (overdrawing a bank account). The bank compensates idle cash with credit interest, usually lower than the “fee” for borrowed money (debit interest). The difference between credit interest and debit interest forms the primary business model of commercial banks.

Banks operate on the legal premise that every penny in a bank account is legally owned by the bank; thus, deposited money becomes the bank’s property; It is legally not your money anymore. Effectively you transfer ownership of your money to the bank. This allows banks to redistribute funds by lending them out, as the money in the bank account is legally considered a liability to the account holder. Consequently, every account holder with “surplus cash” in the bank account must regard this as a loan to the bank and an asset on their balance sheet. Obviously, you can freely tap on this asset when needed (e.g. for making payments, etc.). Vice versa, an overdrawn bank account is effectively money that the bank is lending to you and is therefore a liability on your balance sheet.

I am using the words “lending to/from the bank” as this is an important subject for tax authorities. I will come back to that later in this white paper (see “Commercial bank interest versus In-House Bank interest”).

Understanding the legal aspects of bank accounts explains why the core business model of banks can exist and why depositors may incur losses if a bank faces financial trouble, and eventually files for Chapter 11.

Core banking mechanism versus In-House Bank mechanism

The business model of a bank elucidates the legal aspects of Zero Balancing structures, as this structure mimics core banking mechanisms. In a ZBA structure, excess cash is legally transferred to the cash pool leader, and overdrawn bank accounts are funded by the cash pool leader. This ensures that all participating bank accounts start each day with a “fresh” Zero Balance, allowing the cash pool leader optimal access to the company’s operating cash.

The ZBA structure, by mimicking the core banking mechanism, designates the Cash Pool leader as the “In-House Bank”.

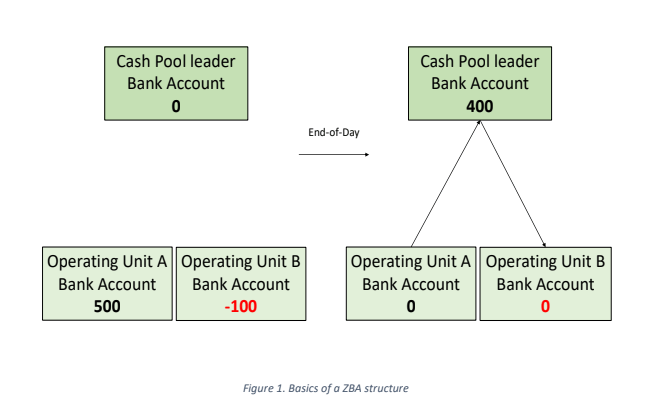

The below diagram shows the basics of a ZBA structure where Operating unit A has a cash balance of 500 and Operating Unit B has an overdrawn balance of -100. At End-Of-Day, after the ZBA sweeps have been applied, the balances of all Operating Units are zero and the net cash balance of 400 sits with the cash pool leader.

Zero-balancing sweeps and the In-House Bank

By default, a Cash Pool leader (referred to as the In-House Bank) possesses the cash of the participating operating units. However, each sweep between the master account of the Cash Pool Leader and the accounts of Operating units will create either a Liability (credit sweep) or an Asset (debit sweep) for the In-House Bank. This is because the In-House Bank mimics the core banking mechanism. Consequently, the In-House Bank must record all these ZBA sweeps to track accumulated balances per Operating Unit over time. Each sweep must be registered at a unique identifier linked to the operating bank account so that both the In-House Bank as well as the owner of the operating bank account can determine the net transferred balance over time. This unique identifier is often referred to as the “In House Bank account”. Thus, a USD 500 balance in an operating account will be swept at the end of the day to the master account of the In-House Bank, simultaneously recorded as a USD 500 liability in the unique In-House Bank account. Therefore, the bank account of the operating unit must logically be linked to the unique In-House Bank account. It is akin to transferring the End-Of-Day operating balance to a “Savings” account with the In-House Bank.

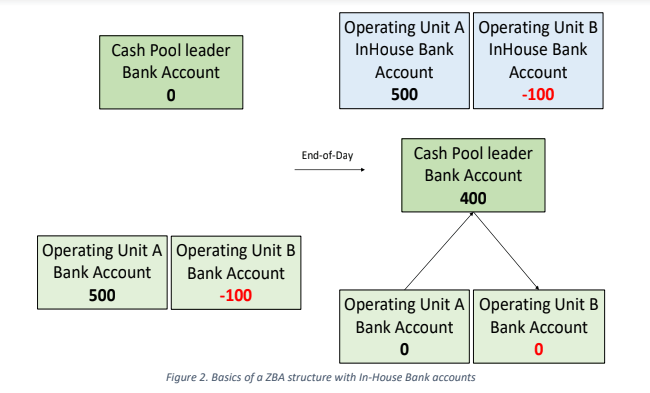

In the below diagram, it shows the same picture as the previous diagram. However, now the In-House Bank has recorded the daily sweeps to the unique In-House Bank account that is linked to individual bank accounts of the Operating units.

Over time the In-House Bank accounts will show the individual accumulated balances of every individual operating unit.

You could see this as a daily process where your local finance person will manage the local operating account and at the end of day transfer either the closing balance of the operating account to the “savings” account with the In-House Bank; or transfers an amount from the “savings’ account at the In-House Bank to cover for the overdrawn balance of the operating account. The target of the finance person is to close off the day with a zero balance on the operating account.

A ZBA structure at a bank is usually a fully automated process. The bank that offers ZBA structures also provides various types of reporting so that every participant in the ZBA structure is aware of the transfers.

Commercial bank interest versus In-House Bank interest

Cash in local bank accounts and Cash Pools is typically considered as company funds, and treasury is mandated to manage it. Therefore, flows from cash pool structures are generally deemed intercompany flows and intercompany cash, which do not impact any consolidated balance sheet. Hence, one might question the necessity of intercompany interest in Cash Pool structures from a corporate standpoint. However, tax authorities tend to view legal entities from a stand-alone perspective rather than a corporate one (for the sake of argument I am not including any tax solutions like fiscal units, etc.). If there are flows between an operating entity and the cash pool leader (the In House Bank), tax authorities consider these flows as lending transactions between two legal entities.

As the In-House Bank mechanism mimics the core banking mechanism, the In-House Bank accounts exhibit a “current accounts” profile. However, earlier in this white paper, a credit balance in the current account was referred to as “lending money to the bank” and a debit balance as “the bank lending money to you”. This implies that tax authorities will expect In-House Banks to calculate debit and credit interest on balances of In-House Bank accounts. Consequently, the ratio between commercial banks’ debit and credit interest must be replicated for In-House Bank accounts, with credit interest lower than debit interest.

Tax authorities acknowledge that ZBA Cash Pool structures with an In-House Bank are primarily to efficiently manage the company’s global “current account” cash; interest efficiency is a secondary goal, but the primary aim is not to maximize interest yield (unless corporate treasury is considered a profit center). Therefore, the difference between credit and debit interest on In-House Bank accounts in a ZBA Cash Pool is not as significant as that on bank accounts with commercial banks; As mentioned earlier in this white paper, the ratio between debit and credit interest applied on bank accounts with commercial banks is the core business model of commercial banks. In this respect, Tax authorities expect interest rates to be applied according to the arms-length principle, ensuring compliance with Transfer Pricing guidelines. I will come back to that in this white paper part 2 to explain what this means.

It’s worth noting that not all countries are accustomed to banks applying debit and credit interest to current accounts. Charging interest is not allowed in the Islamic world, and the USA until 2008 applying interest on current accounts was also prohibited.

However, since most banks offering ZBA structures operate in a jurisdiction that allows interest applied to current accounts, and most companies have the In-House Bank in the jurisdiction of the master accounts of the ZBA structure, tax authorities require interest to be applied to the In-House Bank accounts.

Stay tuned for part 2!

By Paul Buck

List of referenced documents

- White paper “Guidelines for Transfer Pricing Related Interest & Spreads applied in Zero Balancing Cash Pools – Part 2”, 2024 February, Paul Buck