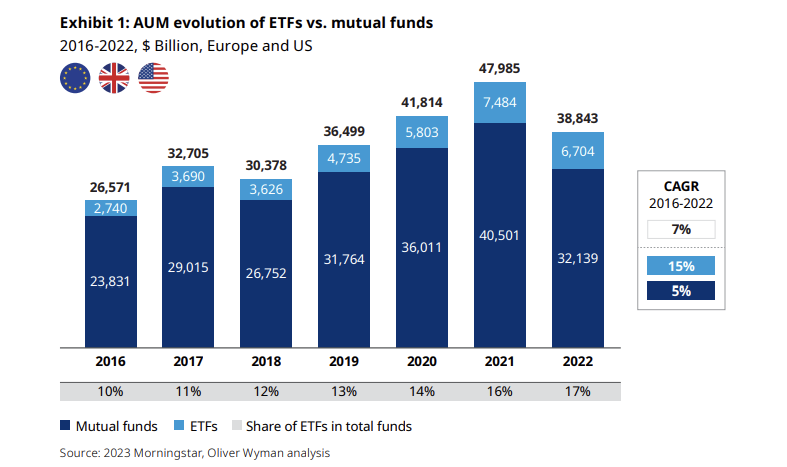

ETFs, in particular, are gaining momentum, capturing a larger share of total fund volume in both the US and Europe. Between 2016 and 2022, ETFs grew at an impressive annual rate of 16%, far outpacing the 5% yearly growth of mutual funds during the same period¹. This shift signals a growing preference for ETFs, with corporate treasurers increasingly drawn to their cost-efficiency, flexibility, and real-time trading advantages.

Wout asked treasuryXL expert Carlo de Meijer to help explain the differences between the two options, which option to choose, and what caused this increased interest in the discussion.

Read it below!

Insights by Carlo de Meijer

ETFs and mutual funds share several key similarities. They do both offer a wide variety of investment options, providing investors with easy access to well-diversified portfolios of investment securities. They can generally be seen as less risky than investing in individual stocks and bonds, and both types of funds come with multiple choices for investors.

A broad range of different mutual funds and ETFs is available for purchase, which allows investors to opt for international or domestic stocks, various industries or market sectors, and specialized investing strategies. Furthermore, both mutual funds and ETFs serve as pooled investment funds, selling shares to investors and investing the proceeds in a basket of stocks, bonds, or other assets.

Both are overseen by professional portfolio managers who leverage their expertise to make informed decisions about which securities to include. Overall, these characteristics make ETFs and mutual funds attractive options for investors seeking diversification and professional management.

The Differences between ETFs & Mutual Funds

While ETFs and mutual funds share several similarities, there are also key differences that investors should be aware of. One major distinction is that ETFs typically have lower investment minimums than mutual funds, making them more accessible for beginner investors.

Additionally, ETFs are usually passively managed, tracking market indexes or specific sector indexes, though a growing range of actively managed ETFs is available. In contrast, most mutual funds tend to be actively managed, with fund managers making decisions about asset allocation.

Another important difference Carlo explains is how ETFs and mutual funds are traded: ETFs trade throughout the day, allowing investors to buy and sell them like stocks. This provides investors with precise control over their transactions, as they can use different order types, such as limit orders, to manage the price at which they buy or sell. On the other hand, mutual funds are priced and traded only at the end of each trading day, meaning that investors do not know their returns until after the markets close.

Cost is another factor where ETFs generally have an advantage; they usually feature lower expense ratios and overall fees compared to mutual funds, which often incur higher operational and trading costs, especially for actively managed funds. Furthermore, mutual funds lack the versatility of ETFs when it comes to shorting, options, and lending, and sales loads can make trading mutual funds quite costly. This limited flexibility makes ETFs a more attractive option for many investors, as they tend to keep trading costs at or near their net asset value.

Where to invest in?

The decision to invest in ETFs or mutual funds depends on several questions that an investor must consider. If an investor prefers lower investment minimums, ETFs may be more suitable, as they can be purchased for as little as the cost of one share, whereas mutual funds typically require a flat minimum investment of around $3,000.

For those who want more hands-on control, ETFs also offer real-time pricing and allow for the use of more sophisticated order types, giving investors greater control over their transaction prices, while mutual fund prices are only calculated after the trading day ends.

On the other hand, if an investor seeks to automate specific transactions, mutual funds may be the better choice, as they allow for automatic investments and withdrawals based on individual preferences, a feature not available with ETFs.

Lastly, if the investor is looking for an index fund, both ETFs and mutual funds can be suitable options, as most of these funds are designed to track specific indexes. Ultimately, the choice between ETFs and mutual funds will depend on the investor’s specific preferences and financial goals.

What should investors do before deciding: on ETFs or Mutual Funds?

Before deciding whether to invest in ETFs or mutual funds, investors should carefully consider their own behavior and take several important steps. First, Carlo explains they should determine their preferred management style. If an investor favors a hands-off approach to investing, passive-managed funds like ETFs may be a better option due to their generally lower costs.

Next, investors should define their financial goals and time horizons. For those with a longer time horizon, broad funds that invest in stocks may be a suitable choice, while those with a shorter time horizon might benefit from more conservative funds that invest in bonds or lower-risk securities.

Finally, investors need to read the fund prospectus. Both ETFs and mutual funds are required to provide a prospectus that outlines the fund’s investment objectives, associated risks, and fees. Taking these steps will help investors make informed decisions that align with their financial situations and goals.

Why such a growing trend?

“The growing trend in both ETFs and mutual funds can be attributed to several factors. Firstly, both investment vehicles are perceived as less risky than investing in individual stocks and bonds, making them attractive options for risk-averse investors. Additionally, mutual funds are seen as offering the potential for better returns compared to other investment options, further increasing their appeal.”

ETFs have also gained traction by providing exposure to a wide range of investment strategies, which has opened the door for a broader group of investors. As a result, ETFs are currently growing faster than mutual funds, reflecting a shift in investor preferences toward these versatile and accessible investment vehicles.

This combination of reduced risk, potential for enhanced returns, and greater investment strategy diversity has contributed to the increasing popularity of both markets.

Read more articles from Carlo de Meijer here

Overview of Exchange Traded Funds

We also want to highlight that our partner LSEG offers a detailed overview of ETFs, providing essential pricing and market data that helps investors and institutions make informed decisions. Their ETF pricing data includes real-time and historical information, enabling users to analyze market trends and optimize their investment strategies.

Get in touch

Are you ready to take your next step in your investment journey?

Contact us today to connect with top investment professionals who can help you choose the best ETFs or mutual funds tailored to your financial goals

We are happy to guide you further.