Embedded Finance: What are the possibilities?

19-04-2022 | François de Witte | treasuryXL | LinkedIn |

Embedded Finance: Setting the Scene

This has brought new providers to come up with new solutions competing with the incumbent banks, which we call “Embedded Finance” Solutions. They leverage a greenfield environment to benefit from innovations such as cloud, microservices and APIs.

Simply put, embedded finance, also known as embedded banking, is the use of financial tools or services — such as lending or payment processing — by a non-financial provider, through its technology platform (proprietary or outsourced).

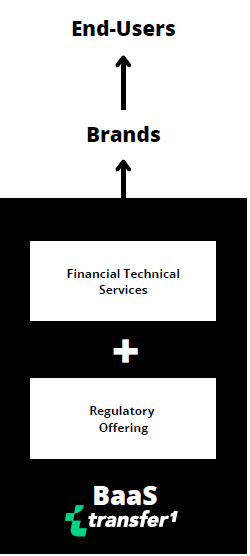

In more technical terms, embedded finance is when Banking-as-a-Service (BaaS) is used to embed a financial API into a website or app. The purpose of this is to integrate financial services within other environments and ecosystems.

In doing so, some providers (e.g. Neo-bank) wish to go further than being a Technical Service Provider, and are also providing their licenses (e.g. Payment Institution, Licensed Deposit Taker, ….). Eventually, someone who offers both technical and regulatory access in a service fashion is a Banking as a Service Provider.

What are the main drivers enabling this?

We have identified three fundamental technological developments that facilitate the re-design of financial services for maximum scalability, efficiency, and resilience:

Cloud, Microservices, and APIs.

Utilizing cloud technologies in the right way enables financial services providers to create and scale their digital services and products at much faster speeds.

Traditionally, significant investments were required to build and operate server parks and data centers. Now, financial services providers can enter the game simply by teaming up with an established cloud provider, such as Amazon Web Services or Google Cloud.

Microservices

While a typical monolithic IT architecture consists of a bulky, intertwined collection of systems and processes, an architecture based on microservices consists of smaller, loosely coupled modules that cover specific functionalities, which communicate through asynchronous messaging.

The underlying architecture has proven to be very resilient, secure, and easier to maintain and upgrade: one failed microservice can easily be isolated and fixed while the whole system keeps running.

Due to the autonomous nature of microservices, the technology actively empowers internal business teams to adapt and build new solutions on their own.

APIs

Technically, APIs (Application Program Interfaces) enable the standardized exchange of data, and hence allow the rise of intra- and intercompany ecosystems. By connecting internal systems and data, APIs streamline tasks and are hence key enablers of automation and straight-through-processing.

APIs allow users to aggregate various data sources, a prerequisite for personalization at scale outside of the organization. APIs drive the rise of entire ecosystems: API platforms and marketplaces

APIs also allow brands to integrate banking data and functionalities into their offerings, such as bookkeeping SaaS (Software as a Service) tools or personal wallets – categorized under the umbrella of “Embedded Finance”.

In addition to these 3 trends, PSD2 and Open Banking have been catalysts of this new trend, by pushing banks to provide access to the accounts by authorized third parties-providers.

Potential impacts of embedded finance on corporate treasury and payments

We see new players coming up using their licenses to sell embedded financial services that matter for brands who face difficulties accessing embedded finance advantages.

Thanks to the “as a Service” model, their strategy is to outsource the IT domains to a Core-Banking provider who will also aggregate other fintech vendors on their behalf. It makes sense in a rapidly changing industry where brands and customers expect extensive services offering, while one can use software vendors at growing maturity levels.

The core-banking software must cover business functions including Accounts, Financials products & Connectivity, CRM, Compliance, Third Parties integration, and Interfaces.

Besides the incumbent players such as FIS, Temenos, Sopra Banking, we see also new Challengers, born native to the cloud and providing “build-your-own-platform” solutions via modular, microservices-based and API-first architectures.

They are both aggregators and orchestrators. A successful orchestrator aims to leverage financial data and capabilities, brand equity and product supply on a group level, while individual ventures remain autonomous and focused enough to innovate and stay close to external or internal client needs, such as wealth management, P2P payments, business banking, etc.

Embedded Finance offers corporates huge opportunities to decrease costs and increased customer loyalty and retention, thanks to amongst others an improved UX and better service.

When considering these new providers, corporates must also consider other factors such as trust: Do you have enough trust in the brand to interact in a financial context? Will you feel comfortable sharing your financial data with this new provider and trust that your privacy will be protected?

Conclusion for Embedded Finance

For corporate and institutional organizations, embedded finance provides huge opportunities in areas such as:

- Embedded payments: Embedded payments examples could include an app that enables customers to save time by using the mobile app to order and pay ahead. It also allows customers to store cash and earn rewards for purchases with a merchant, as Starbucks does.

- Embedded Lending: Embedded lending lets someone apply for and get a loan right at the point of purchase. The BNPL (Buy Now Pay Later) scheme is an example. This removes the need for excessive paperwork and cumbersome processes and enables the customer to get loans at the tap of a button.

- Embedded investments allow users to invest in the stock market, mutual funds, or retirement plans without leaving the platform they are on.

The use of BaaS and API-driven banking and payments services to integrate financial services within other environments and ecosystems offers large possibilities for corporations and banks. The challenge will be for the new players to provide the necessary trust to move away from incumbent players.