16-06-2020 | Michael Ringeling | treasuryXL

Meet our Expert Micheal Ringeling, an experienced Treasurer with a unique combination of corporate treasury, corporate control and banking expertise. A solid base in finance (Stork, TenneT) and banking (ABN AMRO Bank) contributed to his specialisation in treasury. Being hands on, trustworthy and creative with a can-do mentality, Michael worked as independent interim treasurer in the past nine years for various companies like TNT, Vion, TomTom and Unit4.

Knowing all the ins and outs in the world of treasury, he will hit the ground running and provide efficient and effective solutions on every operational and strategic level in the following areas:

Treasury and Cash Management

- Cross border cross currency cash pooling, efficient banking infrastructure

- Finance agreements

- Intercompany loans, in house bank and intercompany netting

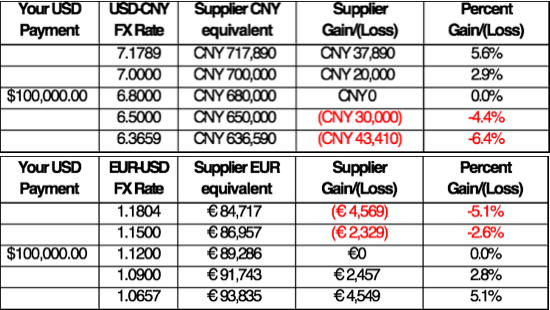

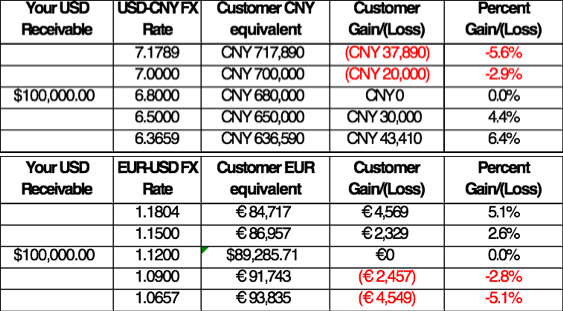

- Interest rate and foreign exchange (FX) risk management and deal execution (hedging)

- Treasury policies

- Cash flow forecasting

- Establish an optimal relationship between organisation and financial institutions

Treasury Control

- IFRS, financial instruments and disclosures in the annual report

- Alignment between Treasury and Control.

We asked him 11 questions, let’s go!

1. How did your treasury journey start?

I started my career in controlling and worked as a corporate controller for the national high voltage grid operator in the Netherlands (TenneT) when the finance director asked me if I would be interested in arranging a bridge loan facility for the acquisition of a company. The answer was obviously yes and that is how my treasury journey started.

2. What do you like about working in Treasury?

The interaction with various people in the business, managing liquidity and funding, finding smart solutions to optimise payment processes, deal with foreign exchange risks. In short, all different aspects of treasury that contribute to the company’s success.

3. What is your Treasury Expertise?

I am an experienced treasurer with a unique combination of corporate treasury, corporate control and banking expertise.

Finance agreements, Liquidity management, Cash pooling, Efficient banking infrastructure, Intercompany loans, In house bank and intercompany netting, Interest rate and FX risk management, Deal execution, Treasury policies, Cash flow forecasting, IFRS, Financial instruments and disclosures in the annual report and establishing an optimal relationship between organisation and financial institutions are the core of my expertise.

4. Do you have examples of risk mitigation, creation of opportunities and/or cost savings?

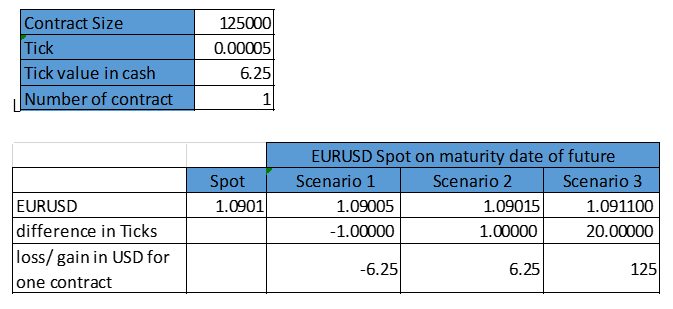

For multiple companies, I have advised and executed numerous FX, interest rate and commodity hedges, mitigating the underlying business risks. I have arranged finance agreements enabling companies to pursue new business growth opportunities and implemented cash pools, optimising the cash positions and reducing finance costs.

5. What has been your best experience in your treasury career until today?

I would say the entire journey is one big experience.

6. What has been your biggest challenge in treasury?

Being an interim treasurer, every assignment has its challenges that need 100% attention. The biggest one was a time critical refinance to safeguard business continuity.

7. What’s the most important lesson that you’ve learned as a treasurer?

As a treasurer you are responsible for safeguarding one of the most valuable assets: cash. So be trustworthy at all times, communicate and make sure to always have access to sufficient liquidity.

8. How have you seen the role of Corporate Treasury evolve over the years?

Yes and no. The most important role of a treasurer is safeguarding liquidity. That has not changed much since the concept of money was invented in ancient history. What did change is that we no longer need well armored knights to physically protect the cash. Today’s defense mechanisms are more and more about automation, digital security and regulatory frameworks.

9. The coronavirus is undoubtedly an unprecedented crisis. In general, can you elaborate on the impact this virus has on treasury from your perspective?

Disruptive events like the COViD-19 crisis increase focus on business continuity. Protect your people and your liquidity! Many companies obtained additional (stand-by) credit facilities to make sure sufficient liquidity is available should the business be negatively impacted by the COVID-19 crisis. Cash is king again.

10. What developments do you expect in corporate treasury in the near and further future?

Increasing importance of automation, digitalisation and regulatory frameworks to safely operate corporate treasuries.

11. What is your best advice for businesses without a Treasurer?

Contact treasuryXL and call me.

Most small and mid-size companies will not have a full-time treasurer on board. That does not mean they don’t have treasury risks. Think about finance agreements and their terms and conditions, interest rate risk, foreign exchange risk, payment processes, electronic banking, bank guarantees and bank relationships. Some of these can be efficiently managed by the controller or finance director. However, some treasury topics can be handled better by a specialist. Ad interim, part-time, on a project basis or in an advisory role to support the finance director. Interested in how I can support? Please contact me, I’m just one phone call or email away.

Michael Ringeling

Treasurer

Does your business need support in Treasury or a Treasury QuickScan?