Going a step further, recent economic and geopolitical events from the past couple of years have presented even more challenges to working capital management. In fact, PwC’s Working Capital Study 21/22 found that net working capital days reached a five-year high in 2020, “driven by the shock and uncertainty of the COVID 19 pandemic.” More recently, the 2022 AFP Strategic Role of Treasury Survey identified working capital improvements as one of the two most challenging tasks faced by treasury professionals today.

In order to manage working capital effectively, companies first need to understand it – you can’t manage what you can’t measure, as the saying goes. With this in mind, let’s dive a bit deeper into the core dynamics of working capital and the subsequent implications for treasury and finance.

What is Working Capital Anyway?

Simply put, working capital is the cash that businesses can use to meet their day-to-day financial obligations, such as for paying rent, employee salaries, and supplier invoices. Calculated as the difference between a firm’s current assets and its current liabilities, a strong working capital position is essential to the smooth running of any company. For this reason, working capital is often described as the lifeblood of a business.

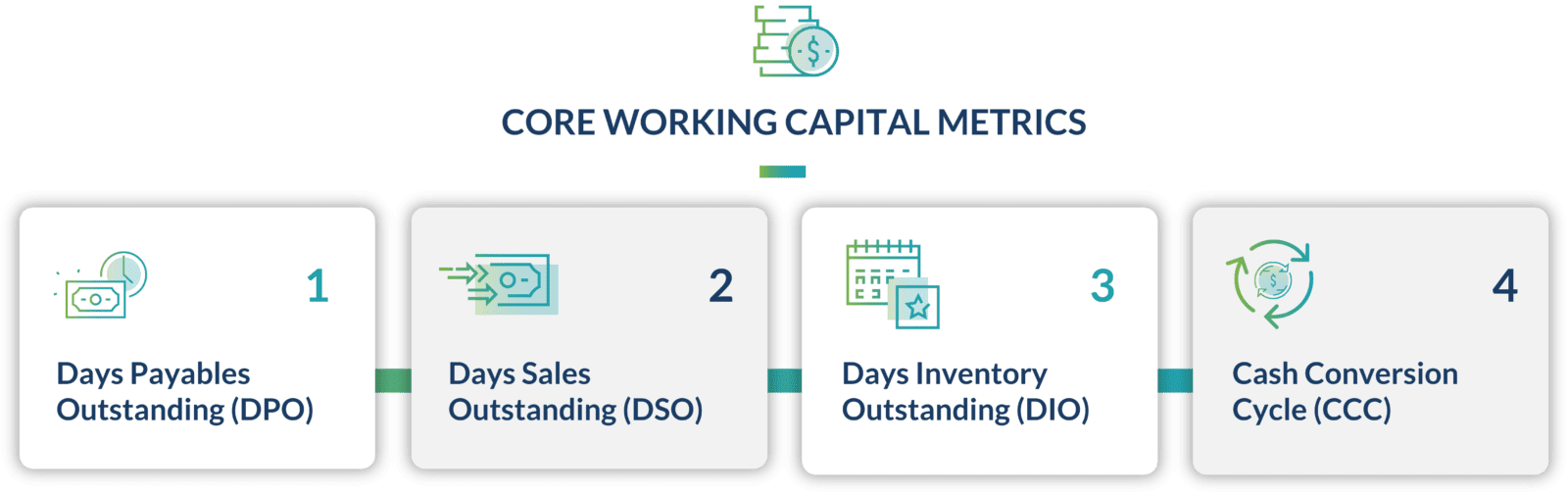

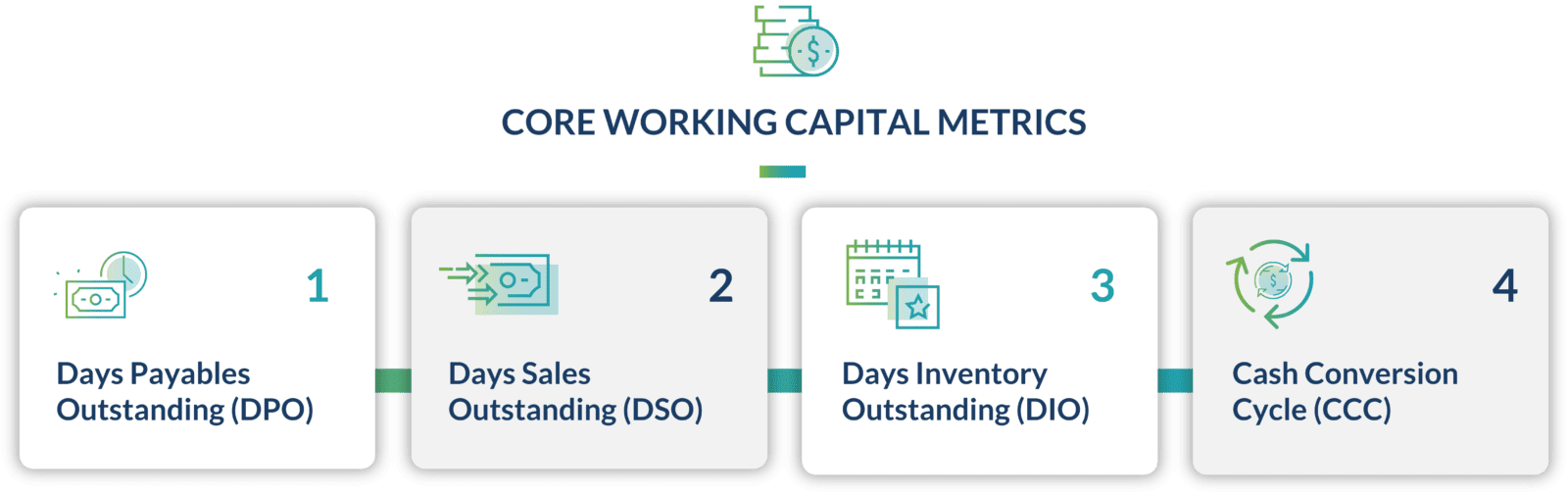

Working capital can be measured using a variety of metrics. The following concepts are key when it comes to understanding the component parts of the working capital cycle:

- Days Sales Outstanding (DSO) measures how long it takes a company to collect cash from customers and clients (i.e. accounts receivable).

- Days Payables Outstanding (DPO) measures how long the company takes to pay its suppliers (i.e. accounts payable).

- Days Inventory Outstanding (DIO) measures how quickly the company sells its inventory.

- Cash Conversion Cycle (CCC) measures how long the company takes to convert the cash spent on raw materials into sales. This is calculated as follows: CCC = DSO + DIO – DPO.

As a rule of thumb, the shorter a company’s cash conversion cycle, the more efficiently it is using its working capital – although typical cash conversion cycle times can vary considerably between different industries, world regions, and company sizes. Any company’s cash conversion cycle can also be adjusted by optimizing one or more of the above components: companies can speed up customer collections, delay/expedite payments to suppliers, and/or alter the timeframe that cash is tied up in inventory.

How Does Working Capital Impact Treasury & Finance?

Treasury and finance teams have an important role to play in optimizing their company’s working capital. Working capital is critical to a company’s financial health: if the business doesn’t have enough cash readily available, it may struggle to pay its obligations on time. It may also seek more external financing than is really needed or may lack the funds needed to invest in innovation or business growth.

In order to effectively manage these cash inflows and outflows, treasury must not only have an accurate and timely view of their “current” working capital status, but they must also have a grip on future cash flows as well. This means that treasury must be proactive in developing cash forecasts that reflect anticipated changes in working capital, including deviations in supplier invoicing or payment behavior, as well as changes to the level of planned spend by procurement and other internal departments.

By working with other departments such as procurement, AP, and AR, the treasury team is well placed to drive improvements to the cash conversion cycle and unlock the company’s working capital. Because treasury typically seeks to maintain global visibility and control over cash positions, payments activity, and general financial workflows, they are in the perfect position to evaluate and influence high-level working capital decisions. For this reason, treasury is sometimes referred to as the “steward” of working capital internally.

However, there are a variety of hurdles that can negatively impact treasury’s view of, and control over, working capital.

Challenges in Managing Working Capital

While the importance of effective working capital management is clear, there are a number of reasons why this can be a challenge:

Disparate Data Sources: By its nature, managing working capital means optimizing activities that span different departments within the organization, including accounts payable (AP), accounts receivable (AR) and procurement, as well as treasury and finance. Working capital needs to be managed holistically, with access to data from these different parts of the business – but this can be constrained by siloes and disparate systems and data sources.

Lack of Alignment & Communication: Effective working capital management can be held back by a lack of awareness or competing priorities across different parts of the business. Because there are a range of departments that need to be on the same page in order to drive working capital optimization, it can be difficult to align the KPIs and drivers of each department to achieve a cohesive strategy. For this reason, a strong focus on working capital is needed from senior management in order to ensure a consistent approach across the organization.

Global Operational Complexity: Payment practices, vendor or customer behavior, and internal business models can vary considerably across different countries and regions, which can make it difficult to manage working capital consistently at a global level.

Supply Chain Relationships: The relationship a company maintains with its vendors and suppliers within the supply chain can have a massive impact on working capital. For example, companies frequently adjust their working capital position by either reducing or extending the time they take to pay invoices to suppliers. However, these strategies can have an adverse impact on vendor relationships, especially if companies choose to delay payment as long as possible. As such, working capital strategies that focus on altering vendor invoicing or payment terms should always be treated carefully.

How Does TIS Help Treasury Manage Working Capital?

In order to drive improvements to working capital, treasury teams first need full visibility over their company’s global cash, payments, and invoicing activity. As noted above, obtaining this data in an accurate and timely manner presents a major challenge for most companies, as does the task of effectively analyzing and leveraging it.

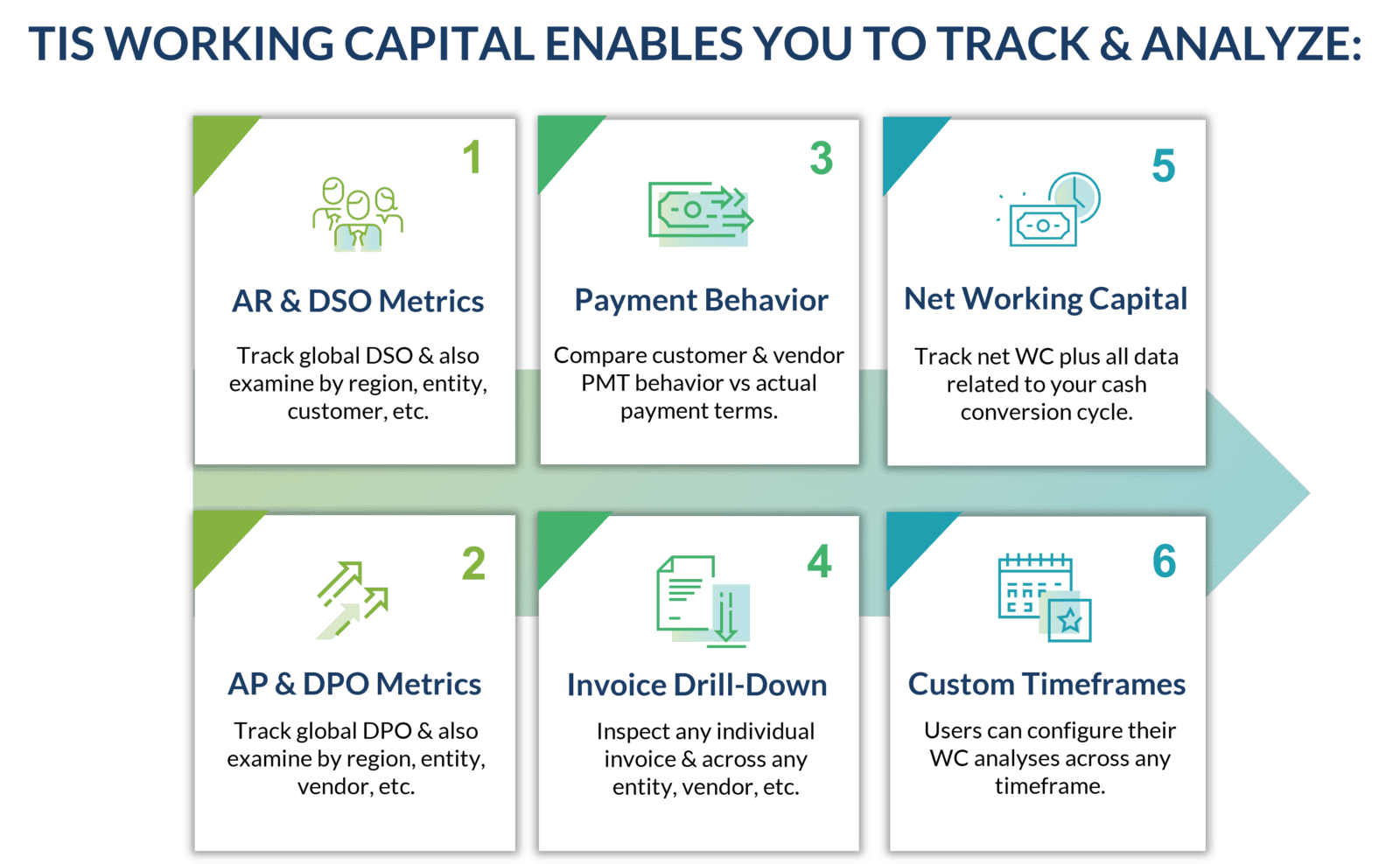

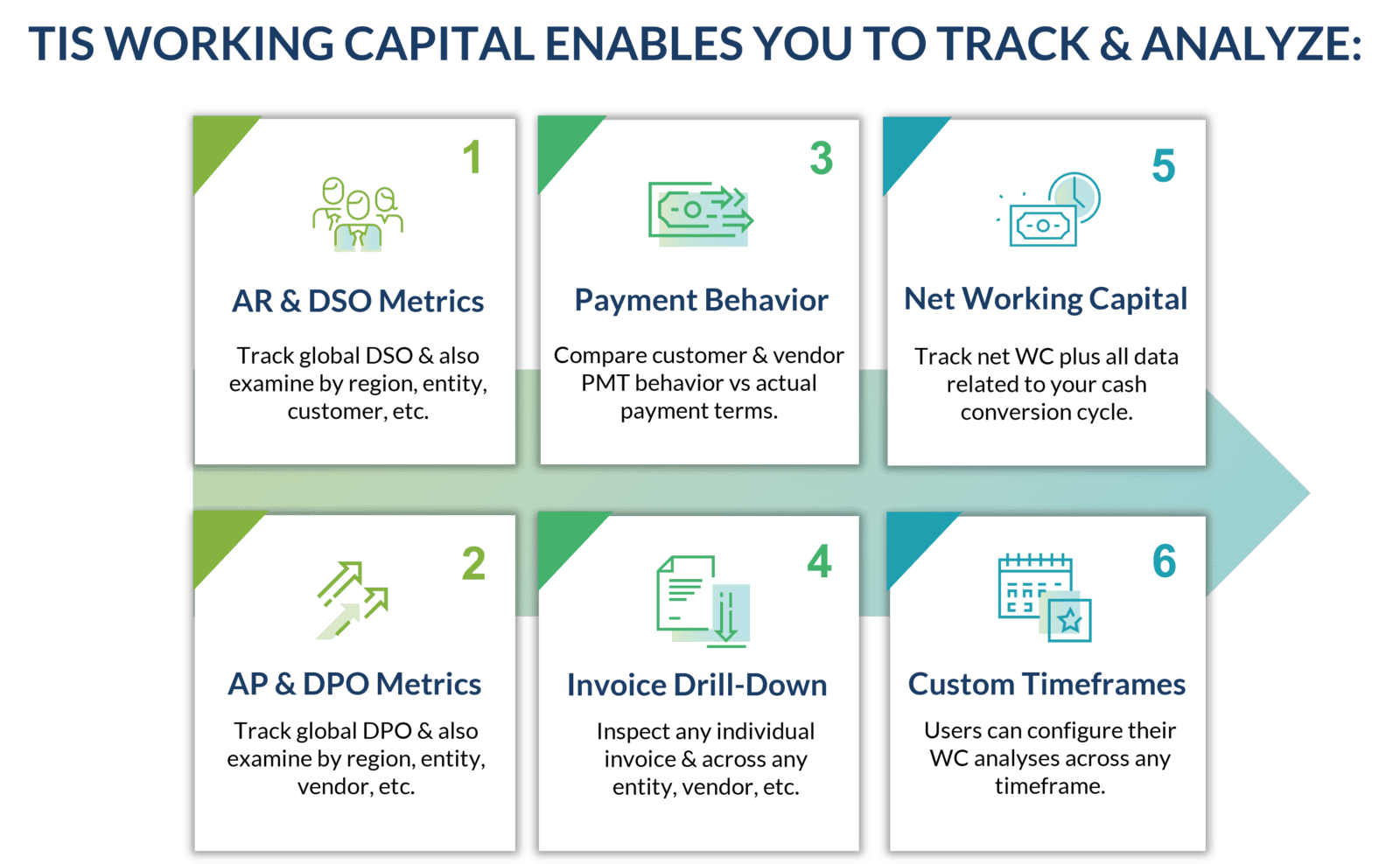

In order to simplify these tasks for treasury, TIS recently launched a new solution, TIS Working Capital Insights, which provides companies with 360-degree visibility over their core working capital metrics and KPIs.

With this suite of capabilities, organizations can seamlessly integrate their ERPs and corresponding AP and AR data with our solution in order to review payment terms and behavior for vendors and customers, analyze invoice and billing activity, and measure all elements related to their net working capital status and cash conversion cycle.

As TIS enables clients to aggregate and classify their data, users can evaluate their metrics globally or granularly according to specific entities, regions, or customers and suppliers. Users can also leverage TIS’ visual dashboards for intuitive reporting and refine their analyses by any timeframe to view activity and cash flows through customizable and flexible parameters.

By leveraging these tools in conjunction with TIS’ other liquidity and payment management solutions, organizations can access all data and information related to their global cash balances, payment statuses, and broader working capital operations for the entire company. The result is total visibility and control over working capital, and a much easier workflow for identifying the best strategies to optimize it.

For more information about TIS Working Capital solutions, download the full factsheet or request to speak with one of our experts!