| 29-09-2016 | TIS (Treasury Intelligence Solutions) | sponsored content |

This article aims to describe the current “eBAM Market Best Practice” that can be achieved by using the TIS (Treasury Intelligence Solutions GmbH) cloud-based electronic Bank Account Management (eBAM) platform.

Corporates and the eBAM project

Many corporates are in need of a comprehensive tool for managing banks and bank account related information and processes. Typically, the main requirements are to have visibility and control over the bank accounts maintained globally and the ability to effectively store bank account related information and documentation, as well as centrally managing the processes on the lifecycle of this information. Furthermore, a typical requirement is for a system that corporates can use for electronic opening, closing and maintenance of bank accounts, including generation of audit reports. In the chapters to follow, TIS provides detailed information about the eBAM Market Best Practice and how the TIS Bank Account Management SaaS (Software as a Service) can fully cover the requirements as well as provide further added-value services to our customers.

The Market

Corporations worldwide face tremendous challenges to cope with an ever increasing volume of information. As more and more internal governance and compliance regulations receive high-level attention, it is essential to have this information at hand, quickly and at the push of a button. Managing bank accounts is one of the main drivers that encourage CFO and Treasurers alike to minimise risks and adopt automated processes. In addition, the accounting teams that manage this data on a daily basis are often under pressure to optimise their own processes as well.

Effective and structured Bank Account Management is understood to be one of the main steps Treasury Departments should take to fulfill governance and compliance regulations. In addition, by implementing a central bank account repository, both data and processes can be optimised and the performance can be measured and monitored. We are also seeing an increasing demand for banks to make use of an electronic exchange of Bank Account Management (eBAM) information.

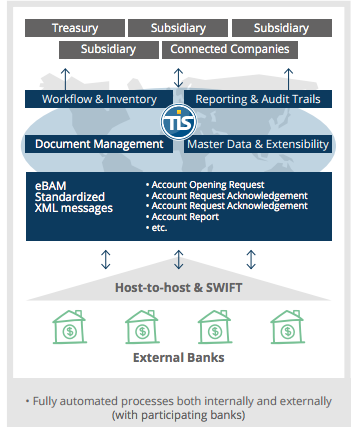

eBAM is based on the exchange of 15 standardised ISO 20022 XML messages, developed by SWIFT, which mainly cover the processes of opening, closing and changing bank accounts and mandates.

The key advantages and acknowledged benefits in adopting an eBAM solution are:

- Complete overview, control and management of all bank relationships, including bank accounts and their legally binding documents

- Compliance fulfillment through automated approval workflows for requests to open, close and change bank accounts and the respective mandates

- Secure processes for exchanging messages with banking partners, including a complete audit trail

- Complete integration with existing back-office infrastructures: ERP, TMS, HR, etc.

- Improved efficiency and cost reduction through automating manual processes and monitoring their performance

- Easy access to real-time information for strategically supporting all involved departments Recognition of the necessity for eBAM has recently picked up speed in the market, especially within large corporations. The business case is now becoming fundamental at a growing number of companies across all sectors in resolving governance and compliance issues as well as minimising risk.

The Challenge

So what is the main problem? What are the biggest challenges corporates are facing? The most painful issues can be summarised as follows:

- No single source of truth for all bank-related data across the entire group

- Non-standardised, non-transparent processes scattered across the corporation, especially regarding bank accounts, signature authorisations or limits

- Signatory information in e-Banking tools often differs from internal data (e.g. after an employee has left the company)

- Risks of legally binding (paper-based) bank account documentation being stored locally at subsidiary or branch level, no central access and control over such documentation

- No guarantee of a strict four-eye-principle, central governance is impossible

- Information about a segregation of duties within each entity or across the whole organisation cannot be easily obtained globally

- Decentralised manual and time-consuming processes, both often non-auditable and non-compliant

- Exchange of information via fax, mail or courier

- Costly archiving, printing and posting to internal (ERP etc.) systems

- Different processes in many countries, based on local customs or even bank specifics

- No central overview of the conditions agreed upon with a bank and the actual costs that are being billed

- Bank account related information and documentation needs to be published in various back-end systems, usually the information is manually maintained with high effort

- No central governance and control over of the information distributed in the company group, including IT systems

Together with the financial crisis of the recent years, this has encouraged many organisations to steer towards a professional – and ideally electronic – Bank Account Management strategy. (e)BAM adoption often accompanies the fundamental new approach corporates must adopt in assessing financial risk today

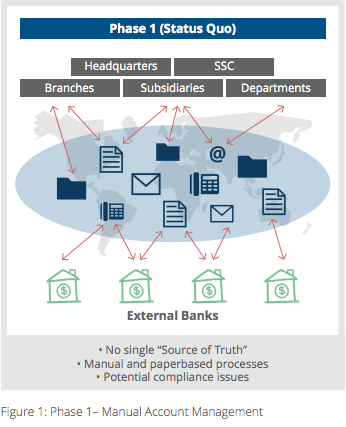

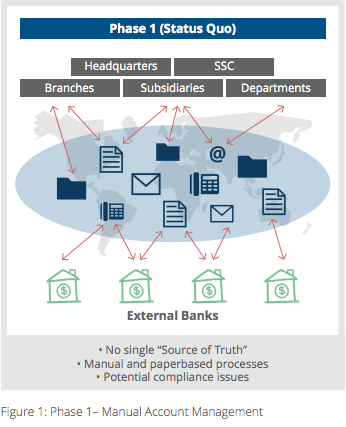

The “Status Quo” graphic in Figure 1 (page 4) represents these challenges.

Bam Evolution

The evolution of a Bank Account Management can be divided into three main phases:

PHASE 1 (Status Quo for majority of corporates):

Manual, paper-based and non-transparent processes for managing bank accounts and mandates

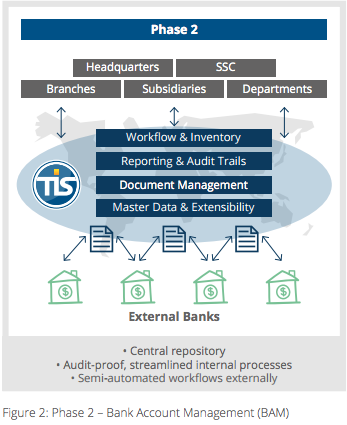

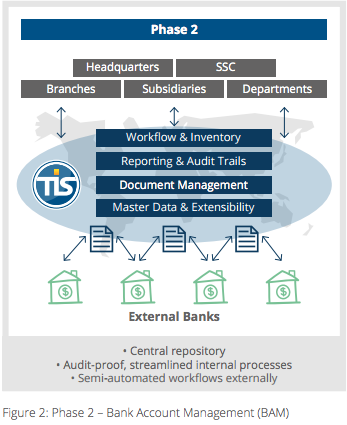

PHASE 2 (Bank Account Management):

Implementation of a web based “Software as a Service” (SaaS) BAM solution to automate and streamline internal processes and make them transparent. This includes a centralised document management internally and externally, towards the banks

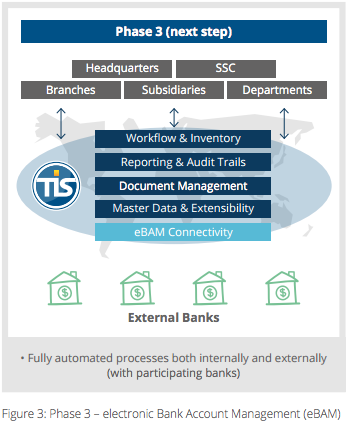

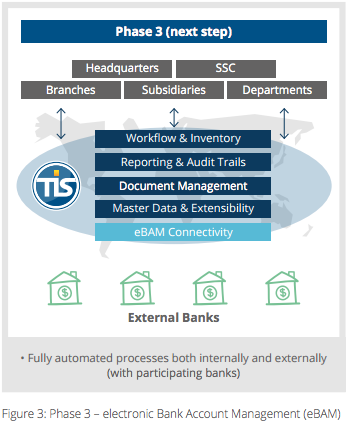

PHASE 3 (eBAM):

Evolving towards an extensive eBAM solution where electronic and automated workflows also used for the external communication with banks.

The manual and paper-based workflows used to communicate with the partner banks regarding bank accounts and mandates have a long and familiar history. One of the main disadvantages is that these are critically slow and error-prone processes, often leading to governance issues. They do not support today’s auditing, compliance and regulatory requirements and include the use of:

- Microsoft Excel as a database for bank account information

- Inventory processes via e-mail and Excel, if existing

- Shared directories for document storing, spread across the enterprise

- E-mail/fax messages adopted as workflows for opening and closing bank accounts On top of that, these processes create enormous amounts of paper that are stored physically (and often locally). A central overview of signatory powers and bank account processes is hardly achievable (also see Chapter 4 “The Challenge”)

Phase 2 – Bank Account Management

Introducing a web-based SaaS Bank Account Management (BAM) solution provides a clear approach to obtaining the required overview of all banks and bank accounts. Globally, this is a centralised and audit-proof solution, including accurate master data management and electronic workflow based processes for requests to open/close/change bank account activities. The main aspects are as follows:

- Master data and inventory – ensuring an up-to-date data base with real-time access as well as the integration of bank and account related information into various backend (ERP) systems

- Workflow and four-eye-principle – gaining control over streamlined internal processes and authorizations

- Insights into the process landscape – allow a tight monitoring and performance analysis

- Reporting and audit trails – adhering to internal compliance and regulatory guidelines

- Document Management – clear overview and workflow of legally binding and account specific documentation

- Extensibility – the solution can be extended to a full “Partner Management” as well as enhanced by a Bank Fee Management solution to monitor costs and processes.

Phase 3 – Electronic Bank Account Management

By moving towards an eBAM solution, additional benefits can be achieved.

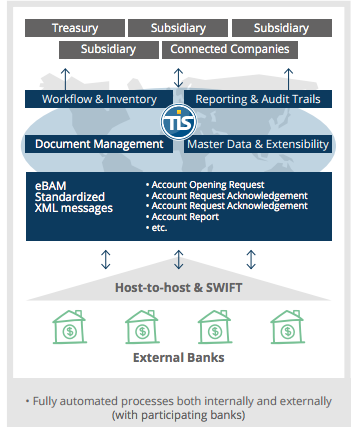

The main added-value is a straight-through-process (STP) with participating banks. A set of 15 standardized ISO XML messages can be exchanged on an eBAM platform to cover all main bank account and mandate workflow (opening, changing, closing, confirming).

In addition to the advantages of phase 2 this enables corporates to also streamline and automate the external communication with their banks. The painful and laborintensive paper-based workflow is substituted by electronic communication. Currently, this only works for existing corporate-to-bank relations. The Know-Your-Customer (KYC) process at the beginning of a relationship cannot be accomplished electronically yet. The key eBAM benefits are described in chapter 6 “Best Practice Processes”.

Best practice processes

In our view and based on customer feedback, the new TIS eBAM solution (as shown below in figure 2) currently represents the best practice in the market.

Our model

The TIS model is based on key elements that are part of efficient, low-risk business workflows also embedding current regulatory requirements. Bank accounts can be managed globally, regionally or on division/entity level, with a clear segregation of duties and a customisable notification/alerting functionality:

Best Practice Governance Processes – Master Data & Inventory

Electronic business workflows provide an overview of group-wide requests for opening, changing or closing bank accounts, keeping all master data up to date in a central repository. This also enables real-time access to any related information at the push of a button. All information is made centrally available and integrated with various back-end (ERP) system which require information, such as account data, authorisation rights and daily limits.

While workflows can be automated and delegated to the responsible employees, the solution provides a constant overview of the master data and user permissions on a central level. With the electronic and customisable inventory process local or entity managers can be obligated to confirm the accuracy of the relevant data.

Centrally Managed Authorisations – Workflow & Authorisation

All relevant bank account processes, including authorised signatory details, can be confirmed and monitored in an audit-proof, compliant and customisable way, including a four-eye principle. By guiding and enforcing the approval and change management processes for bank-and account data, internal audit requirements are also met.

Levels of restrictions, signature cards, digitalised signatures and credentials, legally binding country- and bank-specific documentation are all managed and securely stored in a central repository.

Integration

Centralisation of information, documents and processes delivers great benefits; however, eBAM reaches its full potential if all the information can be integrated with the various business systems used in the company, such as ERP or treasury systems. These systems usually depend on – or even are the source of – the information, which is centrally managed. The integration also facilitates the decentralised maintenance and usage of information and at the same, enables complete central governance. Integration scenarios include central approval of accounts which are created within the ERP systems, distribution of signature authorisations or limits as well as account data.

Certified integration capabilities, such as offered by TIS (e.g. SAP certification), ensure that the functionality meets the quality requirements of the vendors and compatibility of the integration scenarios with new releases.

Benefits

The eBAM advantages meet all challenges outlined in chapter 4. This best practice approach can be summarised as follows: Automated, flexible and consistent STP processes for opening, maintenance and closure of bank accounts, providing clear global visibility, accurate accountability

- Audit-proof and highly secure, ISO 20022 compliant and ISO 27001 certified processes, providing a real-time alerting functionality allowing for timely responses to any issues

- Rapid access to up-to-date master data bank (account) information – including mandates – globally and group- wide, enabling efficient workflows across the entire organisation

- Exchange of standardised ISO XML message with the relevant banks

- Complete integration with existing back-office infrastructures is possible

- Fulfillment of both internal and external audit and regulatory requirements

- Enabling the Treasury Department to delegate processes in an audit-proof manner and monitor them centrally. This also frees up time to focus on more strategic topics

- Reduced complexity and increased process automation on all levels lead to significant cost savings across the group

Requirements

Regarding an eBAM implementation strategy, we recommend that some key elements are taken into consideration in order to realise a flexible and customisable multi-bank and multichannel integration:

- Define eBAM in the context of a group-wide bank and bank account strategy, taking advantage of trusted expertise on best practice project implementation.

- Ensure a strong partnership between the involved parties: corporate, banks and solution provider.

- Project management and subject matter expertise: having the right level of expertise at the table in aiding the management of the eBAM Project

TIS (Treasury Intelligence Solutions)

TIS (Treasury Intelligence Solutions)

The last two Thursdays, the PowertoPay, SWIFT and TreasuryServices Treasury Seminar was held in Montfoort and Antwerp. We’re happy to say that it was a success! We got a lot of positive feedback during and after the seminars. Both had the same content but were hosted on two different days. The first one was held in Antwerp, Belgium on the 2nd of March in an old monastery (Elzenveld). The second one was held in Montfoort, The Netherlands on the 9th of March in the Heeren of Montfoort.

The last two Thursdays, the PowertoPay, SWIFT and TreasuryServices Treasury Seminar was held in Montfoort and Antwerp. We’re happy to say that it was a success! We got a lot of positive feedback during and after the seminars. Both had the same content but were hosted on two different days. The first one was held in Antwerp, Belgium on the 2nd of March in an old monastery (Elzenveld). The second one was held in Montfoort, The Netherlands on the 9th of March in the Heeren of Montfoort.  Leoni, a well-known German manufacturer of cables and harnessing has recently made the news through a new type of fraudulent behavior. The CEO-fraud is a technique, whereby scammers act as ‘member’ of the organization and convince the controlling department to transfer funds under the pretense the company was in a financial emergency. USD 2 billion in losses due to CEO-fraud since January 2015.

Leoni, a well-known German manufacturer of cables and harnessing has recently made the news through a new type of fraudulent behavior. The CEO-fraud is a technique, whereby scammers act as ‘member’ of the organization and convince the controlling department to transfer funds under the pretense the company was in a financial emergency. USD 2 billion in losses due to CEO-fraud since January 2015. With globalisation and an increasingly complex business environment, having an efficient and centralised payment system is vital to any multinational’s success. Recognising this, we at HSBC are proud to have successfully connected to Treasury Intelligence Solutions (TIS) in Asia for automated payment and bank statement processing.

With globalisation and an increasingly complex business environment, having an efficient and centralised payment system is vital to any multinational’s success. Recognising this, we at HSBC are proud to have successfully connected to Treasury Intelligence Solutions (TIS) in Asia for automated payment and bank statement processing.

Brexit is an ongoing issue in not just the financial world, but in the entire world. A topic which had lots of speculations, rumors and uncertainties. Although 2017 is going to bring us more clearness around Brexit, the exact date when Brexit is actually happening is still unknown. Theresa May, Prime Minister of the UK, said she will put Article 50 into motion by the end of March 2017. If she is able to put this article into motion, the actual process of withdrawal must be completed within two years. Anyhow, Brexit has its effects on the economy.

Brexit is an ongoing issue in not just the financial world, but in the entire world. A topic which had lots of speculations, rumors and uncertainties. Although 2017 is going to bring us more clearness around Brexit, the exact date when Brexit is actually happening is still unknown. Theresa May, Prime Minister of the UK, said she will put Article 50 into motion by the end of March 2017. If she is able to put this article into motion, the actual process of withdrawal must be completed within two years. Anyhow, Brexit has its effects on the economy. PowerToPay

PowerToPay

Dear community members, we would like to bring something to your attention: TIPCO and TIS joined forces to organise a noteworthy webinar on the 7th of July: TIPCO & TIS: Streamlining Your Treasury Processes: Trends in Payments and Reporting.

Dear community members, we would like to bring something to your attention: TIPCO and TIS joined forces to organise a noteworthy webinar on the 7th of July: TIPCO & TIS: Streamlining Your Treasury Processes: Trends in Payments and Reporting. Hubert Rappold, CEO and Co-founder, TIPCO

Hubert Rappold, CEO and Co-founder, TIPCO Jörg Wiemer, CSO and Co-founder, TIS

Jörg Wiemer, CSO and Co-founder, TIS