Is Your Foreign Currency Risk Out of Control? 5 FAQs

20-02-2023 | treasuryXL | GTreasury | LinkedIn |

When left unaddressed, foreign currency risk can wreak havoc on your bottom line. But it doesn’t have to be this way. To keep foreign currency fluctuations under control and drive predictability in financial statements, many companies turn to FX hedge programs.

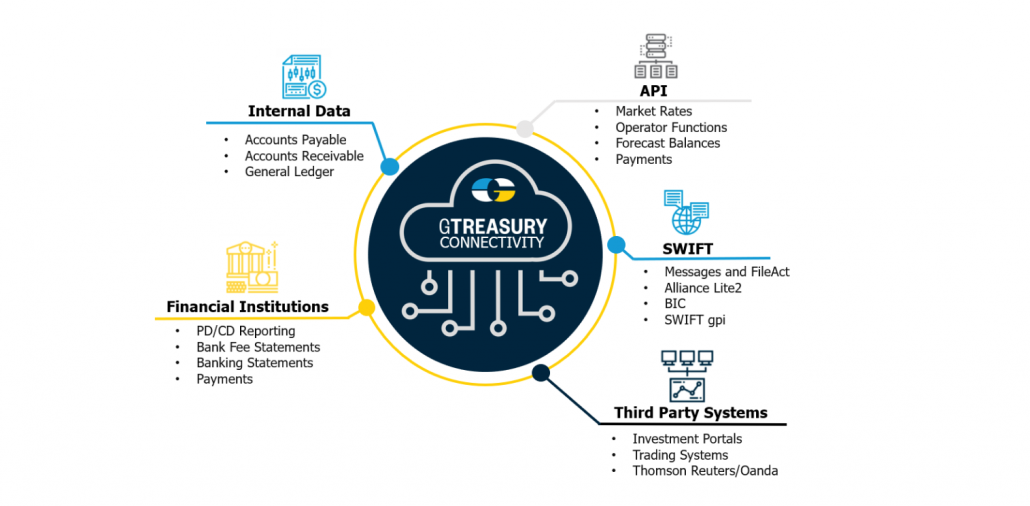

Source: GTreasury

Here are 5 frequently asked questions about foreign currency risk and FX hedge programs.

#1. What is Foreign Currency Risk?

Foreign currency gains and losses occur when a company transacts in a currency other than their home currency.

A foreign currency transaction results in either a payment or receipt of that currency and the amount of U.S. dollars it will take to pay the payment or collect from the receipt changes with exchange rates.

When companies have hundreds or thousands of these types of transactions, the gains and losses due to the exchange rates can add up quickly.

#2. Are Gains from Foreign Currency Fluctuations a Good Thing?

Even though a large gain on your bottom line seems appealing – especially compared to a large loss – it also indicates instability in your financial statements month-over-month and year-over-year. Not to mention, the nature of fluctuating exchange rates means times of gains are temporary and large losses are inevitable.

More often than not, companies value predictability and stability in operations. And that’s what an FX hedge program provides.

#3. What is a Foreign Currency Hedge Program?

An FX hedge program protects the amount of home currency needed to make a foreign payment or receive from a foreign currency collection. In doing so, it eliminates a majority of the foreign currency gain and loss noise in financial statements you may have been experiencing. Large swings in either direction will no longer happen, which means you’re able to explain your true business results more effectively to your Board.

#4. Does a Hedge Program Create Zero FX Gain/Loss?

A hedge program doesn’t mean zero FX, but it does reduce a majority of the fluctuations. What’s left over can be explained by a handful of “buckets” – such as un-hedged currency impacts or under-hedging a currency amount.

#5. Can an FX Hedge Program be Implemented Quickly?

Yes! Starting a hedge program can be done quickly. Many times, a foreign currency risk problem can be fixed in just a few weeks or months – especially when you work with a partner that puts programs together every day. Supported by automation, your FX hedge program can get up and running fast – and continue to run seamlessly from there.

Conclusion

Companies operating internationally are exposed to currency risk – a risk to earnings driven by changes in currency exchange rates. The ones that hedge their currency risk have certain advantages over non-hedgers. For example, instead of just experiencing the changing exchange rate impacts, these companies are afforded predictable results and time to react to changes.

If you’re curious about implementing a hedge program or just got tasked by your Board to fix a problem Hedge Trackers can help – and fast.