When plain crazy just isn’t mad enough

| 19-05-2016 | Pieter Jan van Krevel |

So everybody knows about cat bonds. No, not corporate bonds issued by Caterpillar, but bonds linked to catastrophes. Sounds exciting, right?

Cat bonds were originally devised in the mid-1990s after Hurricane Andrew and the Northridge earthquake, both wreaking (financial) havoc in the U.S.

The financial havoc befell insurers, and the inception of the cat bonds stemmed from these events that cost the insurers a combined estimated USD 39 – 66 bn (1990s dollars). This hurt, so they devised a way to shift this risk in case disaster struck (in lieu of traditional reinsurance).

The principle is simple: investors get a handsome coupon (+300-2,000 bps spread) on a, generally, short-dated sub-investment grade bond (up to 3 yrs BB/B), if and only if, disaster does NOT strike. If it does strike, however, the investors forego their principal (let alone the coupon), and the insurers use this ‘windfall’ to pay the claims emanating from the disaster. These catastrophes, and therefore the cat bonds, are pretty much totally uncorrelated with any other asset class in a portfolio, and thus interesting and effective diversification material.

So far, so good.

But what if we take this a little further: in a way, a CDS can also be considered a cat bond. After all, we’re talking binary pay-off here. While I will not go into the (de-)merits of CDSs here, ‘disaster’ is a word that comes to mind when looking at the bloodied and mangled remains of many a CDS. But let’s leave that for another day

However for the final leap of faith we need to look at the Swiss: Credit Suisse has apparently invented the ultimate capital-relief instrument. Recently, news got out that Credit Suisse intends issuance of a special cat bond, linked to ‘operational risks’ by, amongst others, ‘failed internal processes’. We’re talking about external events, business disruptions (e.g. cybercrime), trade processing errors and, hold on to your seats, failures in regulatory compliance and rogue trading. So, when a Credit Suisse trader screws up its book (or someone else’s for that matter), the cat bond will be triggered and the trading losses will be (partly) absorbed. I fully agree to the premise that a screw-up in proprietary trading spells disaster nowadays – just think of Mr. Kerviel and JPMorgan’s London Whale to name but two.

However, there is one minor detail that sets this kind of catastrophe apart from the natural disasters that cat bonds started out to ‘reinsure’: these are man-made (financial) catastrophes, and can (and should) be mitigated by the checks and balances that financial institutions claim, and are obliged, to employ these days. Not to mention the fact that offloading risks by banks to insurers went a long way to melt down the global financial system in 2008. Who needs Andrew or Katrina when you’ve got quants and prop traders?

Sounds like a ‘Get out of jail free’ card to me. Although I am not quite sure whether Messrs. Leeson and Kerviel agree…

Owner at Slàinte Mhath!

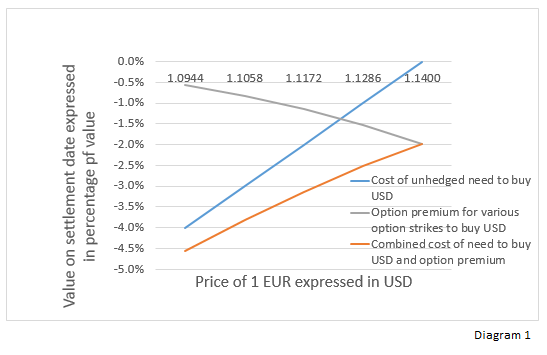

Should we need to exercise the option to get our USD, it still means a combined hedging cost of 3.8%. Which is more than if we had bought the ATM option for 2% premium. Conclusion: Buying an OTM option reduces the up-front cost versus buying an ATM option. But ex-post hedging with an OTM option could result in total hedging cost which are higher than an ATM option.

Should we need to exercise the option to get our USD, it still means a combined hedging cost of 3.8%. Which is more than if we had bought the ATM option for 2% premium. Conclusion: Buying an OTM option reduces the up-front cost versus buying an ATM option. But ex-post hedging with an OTM option could result in total hedging cost which are higher than an ATM option. option is exercised, or the USD must be purchased from the market at the prevailing rate.

option is exercised, or the USD must be purchased from the market at the prevailing rate.

Claire graduated as chemical engineer at the TU Delft. After an internship with JP Morgan she decided to pursue a career in the financial sector. She continued as investment banking trainee with ABN Amro / RBS and for almost six years, half of which in London, she worked in M&A and Corporate Finance. Since 2006 Claire was increasingly involved in renewable energy projects in faraway places (Antarctica, Himalayas) and from there on it was a small step to join Fastned and strengthen the team with her financial expertise.

Claire graduated as chemical engineer at the TU Delft. After an internship with JP Morgan she decided to pursue a career in the financial sector. She continued as investment banking trainee with ABN Amro / RBS and for almost six years, half of which in London, she worked in M&A and Corporate Finance. Since 2006 Claire was increasingly involved in renewable energy projects in faraway places (Antarctica, Himalayas) and from there on it was a small step to join Fastned and strengthen the team with her financial expertise.

KNAB bank start met crowdfunding voor ondernemers (bron:

KNAB bank start met crowdfunding voor ondernemers (bron:

Recently the Dutch Ministry of Finance appointed three independent experts to solve the long-lasting issue of derivatives mis-selling in the Netherlands. This is important for both firms and banks as the dispute puts severe pressure on their relationship. Moreover, judges are reaching more and more verdicts in favour of SME’s. In several cases interest rate swap transactions were declared void and the firm was compensated for its losses. Therefore the stakes are high. Is this last step permanently going to solve the issue?

Recently the Dutch Ministry of Finance appointed three independent experts to solve the long-lasting issue of derivatives mis-selling in the Netherlands. This is important for both firms and banks as the dispute puts severe pressure on their relationship. Moreover, judges are reaching more and more verdicts in favour of SME’s. In several cases interest rate swap transactions were declared void and the firm was compensated for its losses. Therefore the stakes are high. Is this last step permanently going to solve the issue?

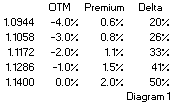

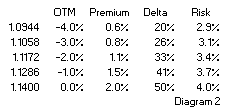

Risk appears fairly stabile across strikes, which makes sense because the premiums are calculated with one volatility on one underlying. The Risk on OTM is lower than that for ATM options. It appears that OTM premiums are relatively more expensive, they give protection against less potential loss.

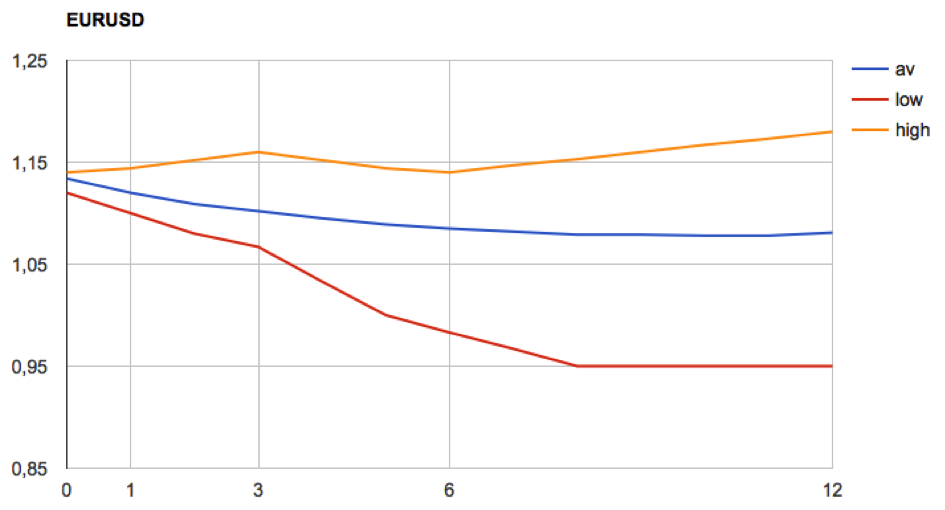

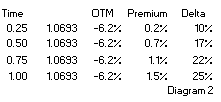

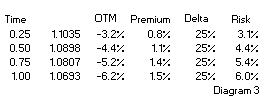

Risk appears fairly stabile across strikes, which makes sense because the premiums are calculated with one volatility on one underlying. The Risk on OTM is lower than that for ATM options. It appears that OTM premiums are relatively more expensive, they give protection against less potential loss. Diagram 3 shows Premiums, Delta and Risk for different tenors. ‘Time’ is the time to expiry of the options in fractions of years. Its shows that for longer tenors, the Risk is higher. But disproportionally. For the same chance on exercise a hedger could double the premium to buy a hedge for a 4x longer tenor.

Diagram 3 shows Premiums, Delta and Risk for different tenors. ‘Time’ is the time to expiry of the options in fractions of years. Its shows that for longer tenors, the Risk is higher. But disproportionally. For the same chance on exercise a hedger could double the premium to buy a hedge for a 4x longer tenor.