The Hidden Cost of “Human APIs”: Why Manual Payments are Draining Your Bottom Line

16-06-2025 | Technically speaking, one can call it applying “human API” to transform digital data into paper-based and back to digital.

16-06-2025 | Technically speaking, one can call it applying “human API” to transform digital data into paper-based and back to digital.

26-05-2025 | Tired of endless Excel sheets and manual payment processes? In a world of incredible tech, why are treasury and finance teams still retyping data?

24-01-2025 | The session underscored the critical need for treasurers to invest in data management systems, foster cross-departmental collaboration and more

15-01-2025 | Join Kantox and treasuryXL for an expert-led webinar to uncover how automation and innovation can transform your FX risk management strategy and protect your business.

05-06-2024 | Our panel of industry experts will not only share their invaluable experiences but also share their vision on key strategies on various topics

11-04-2024 | Registration is now open for our upcoming live session. Join us on April 25 for an expert-led session about the Do’s and Don’ts of a TMS implementation

27-02-2024 | Konstantin Khorev discovers with you the best practice for selecting a Treasury Management System (TMS) in 100 words.

12-01-2023 | treasuryXL | LinkedIn |

A new year, a new edition in which we discuss the latest treasuryXL poll results. It is encouraging that once again many treasurers participated in the vote. We examined the voting patterns of treasurers and gathered the perspectives of experts Jack Gielen and Konstantin Khorev on the topic of APIs in treasury.

It is commonly understood that APIs are prevalent in today’s digital landscape. However, corporate treasurers can also reap benefits from API technology and its advantages. If you are unsure about the importance of APIs in Treasury or need more information, you should definitely watch the recording of the joint webinar together with Cobase on the future of APIs. It is encouraging that once again many treasurers participated in the vote. The current treasuryXL poll remains open and we encourage you to continue to have your voice heard! You can cast your vote on this link.

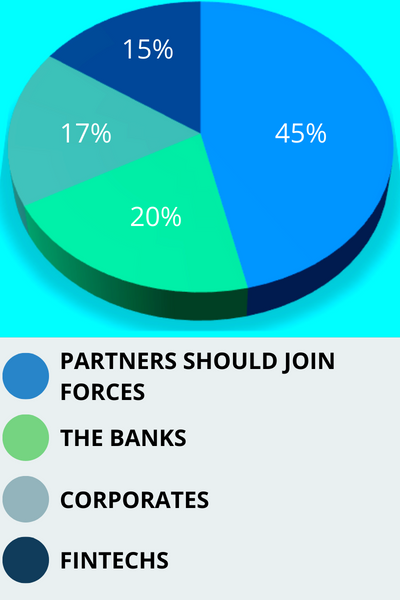

Question: Who should “give a push” and work on APIs?

That looks quite straightforward: partners should join forces. Do the treasuryXL experts agree, or what is their view on this?

Jack voted for the option that partners should join forces.

“APIs and the benefits are clearly on the map but there is also an understanding that there is still work to be done before those benefits will really be realised”

It is good to see that regarding the results of this poll, the market agrees that the success of corporate APIs and OpenBanking requires cooperation and cannot be dictated by 1 party. This means Treasurers clearly understand the complexity of the playing field. At the moment, although there are many initiatives by individual parties, there is a need to create a good partnership where the whole eco-system works together

The main benefits that APIs could realise if banks and companies were to work together are:

These benefits translate into being able to use the systems the treasurer has chosen more efficiently and better, more up-to-date insight into status, exposures and required actions.

Recently, Cobase set up the webinar “The Future of APIs” in collaboration with treasuryXL to discuss this topic. I was particularly impressed by the level of knowledge Treasurers have gained over the past year which was also reflected in the questions. APIs and the benefits are clearly on the map but there is also an understanding that there is still work to be done before those benefits will really be realised. Ultimately, the priority with the end customer, the treasurer, will determine how quickly other market players act.

Konstantin voted for the option that partners should join forces.

“By working together, we can achieve a more efficient and effective treasury management system.”

I agree with the majority view that the implementation of APIs in the treasury field should be a collaborative effort. Banks will play a key role in implementing these changes, but it is also crucial for corporates and TMS providers to set and specify the requirements. This ensures that the solutions being implemented align with the unique needs and goals of each individual corporate, and TMS providers can develop the tools and services necessary to support these needs. By working together, we can achieve a more efficient and effective treasury management system.

Recently, my latest article on this topic was published on treasuryXL. In it, I try to make it plain that APIs are a nice and easy solution, although they come with some limitations and challenges. At the same time, I believe that the future of bank connectivity lies in API technology. What do you think?

10-01-2023 | Konstantin Khorev | treasuryXL | LinkedIn | APIs, or application programming interfaces, have revolutionized the way that corporate treasury departments operate. Getting timely information about cash balances and transactions running through your bank accounts is crucial not only for treasury but also for other corporate functions: A/R, A/P, business operations and other departments

01-11-2022 | treasuryXL | Konstantin Khorev | LinkedIn |

Meet our newest expert for the treasuryXL community, Konstantin Khorev.

Konstantin has 18+ years of experience in corporate treasury, gained in various environments: from public companies with +100BUSD turnover, to PE and privately owned companies, as well as at a prominent treasury consulting firm.

Being exposed to a wide range of different challenges and projects, Konstantin has built a strong expertise in the full spectrum of treasury and risk activities and in cross-functional collaboration and treasury partnership with business operations, tax, accounting, audit, and internal control.

Konstantin holds a Ph.D. degree in financial mathematics and is a CFA charter holder since 2009.

In 2005 I changed my career path from investment management to corporate finance with a leading oil major. Couple of years later, being already a professional with several years of experience in related areas, I decided to join the treasury department within the same company. I made my decision mainly because of a great team and a lot of challenging projects there – we basically were requested to bring best practices into treasury function in multinational corporation with +100BUSD turnover. The first project was setting up an international multicurrency cash pool structure.

Cross-functional collaboration (business, accounting, FP&A, tax), possibility to implement projects that make structural changes, e.g. in how company manages cash and financial risks, make payments, automate processes, etc.

Change and project management, setting up a function from scratch or bringing best treasury practices, with special personal interest in the area of automation and data analysis. Having my first background in mathematics and computer science I also like to develop my own IT solutions (python, VBA, SAP scripting) that can solve certain automation or data problems and thus bridge a gap between client’s needs and available market solutions. Observing the professional growth of team members, I am coaching or used to coach is also a big source of excitement to me.

I would say I can not highlight one single project. I enjoy and I am proud of every moment when I see the change realized, or cost-reduction/value-added created.

Setting up supply chain financing in a country where our team and company have been among pioneers implementing the product. Apart from tax, legal, accounting challenges related to the jurisdiction, as well as bank negotiation it required a lot of effort to explain the benefits and persuade all the stakeholders (from CFO to supply managers and suppliers). The ultimate result was more than rewarding: win-win solution both for the company decreasing working capital needs by 50% and for the suppliers getting access to much cheaper (and sometimes even unavailable at all) bank financing.

Invest time explaining what treasury is about and why certain things are crucial for internal counterparties.

Playing bigger and bigger role as a business partner to other functions. Embedding more opportunities that are provided by IT solutions.

Automation and machine learning to play more role in daily and later strategical treasury operations. Distributed Ledger Technology (blockchain is an example) still to show its full potential. Fintech companies substituting banks in more areas and having bigger market size.

Thanks for reading!

Kendra Keydeniers

Director Community & Partners, treasuryXL