Your new home for fixed income

07-03-2022 | treasuryXL | Refinitiv | LinkedIn | Your new home for fixed income

07-03-2022 | treasuryXL | Refinitiv | LinkedIn | Your new home for fixed income

03-03-2022 | treasuryXL | Treasury Delta | LinkedIn | Treasury Delta, our Irish fintech partner, recently formed an alliance with Blokken, a Dubai-based fintech aggregator. This strategic partnership will bring further innovation and digital technology deployment to the corporate treasury ecosystem within the Middle East. Credits: Blokken Source

01-03-2022 | Patrick Kunz | treasuryXL | LinkedIn |

We are happy to interview treasuryXL expert, Patrick Kunz.

With Patrick’s impressive career within the World of Treasury, you can really say that he lives and breathes Treasury.

Patrick is performance driven. He is an open minded, outgoing, rational person who is comfortable communicating and convincing on all levels of management.

Patrick is owner of Pecunia Treasury & Finance with several independent treasury and finance consultants and founder of treasuryabonnement.nl. Furthermore he owns an online FX trading and payment platform with a connection to a big FX broker.

Patrick has worked with both international corporates from all fields of business as well as national non-profit organisations.

We recommend to visit Patrick’s LinkedIn profile to see his stunning career and activities. But first….

During my study at Maastricht University I knew I wanted to work in the “world of finance” and more specifically trading or investment banking. In my 3rd year of university I got the opportunity to work as an intern for a Swiss Investment bank in Zurich which was a great first experience into wealth management and client exposure with high net worth clients. It also showed me that the client comes first, even though the client was not always right. This made me wonder if it was more fun on “the other side” at the buy side. It slightly frustrated me that a bank would not always provide the best solution.

After graduation I left on a trip around the world backpacking for 1,5 years. Enjoying ultimate freedom and fun before starting a career. When I came back to the Netherlands I applied for treasury roles at multinationals and landed my first job as cash & treasury manager at the German multinational Metro Group (the wholesaler, not the Dutch free newspaper). This was the start of my treasury career which until now I would never leave.

It’s the core of a company. In the end its all about the money. Independent on what products you are selling and how you are selling them. Cash in vs Cash out. Without cash a company has a problem. Cash is king and profit is an opinion so in my opinion managing cash is very important and therefore fun. The more complex the more fun. Managing a multinational company with hundreds of bank accounts in different currencies around the global; finding the optimal treasury setup and solutions is great fun. Lastly, treasury teams are smaller compared to accounting or controlling, which make the lines shorter and the team tighter.

I started in cash management and FX trading which are great basic skills for every treasurer. My first company also had very short treasury lines and I quickly was involved in global treasury solutions, financing solutions and group companies corporate finance. When I moved on to my second role as group treasurer of a regional housing association, I also got exposure to interest rate derivatives and guarantee management. Afterwards when I started my own consultancy and interim management company 8 years ago I got to do the full spectrum of treasury. So without arrogance I can say in treasury I have done it all. The last years I am doing a lot of TMS/Payment hub implementations, which I enjoy doing. After finishing an implementation it is nice to look back and compare the old way of treasury processes and the new and see how it improved after a couple of months. Very rewarding.

Building a treasury from scratch is most rewarding and fun to do. 2 years ago I got the opportunity to build the treasury role at the Dutch born AEX company Takeaway.com. There were treasury processes in place but scattered in different departments. Also some of them were sub-optimal. My role was to bring them together and optimize them. Besides increasing the reporting and importance of treasury to management this also brought significant cash savings on bank and FX costs. A couple of months into the rule, the merger/acquisition of Just Eat was approved and the integration with the existing treasury team in London could start, making the team suddenly 400% bigger. After 5 months my work was far from finished but it was time to hand it over to the existing/new team. Looking back what was done in this short time this was one of my greatest experiences in treasury. And a great company to work for.

Nowadays: Opening a company bank account in a short timeframe without difficult KYC questions, especially for companies with difficult or complex structures. I was with a client last year, a scale-up, that moved fast in several countries in Europe. Treasury processes needed to be implemented from scratch in each country while operations was much further ahead but legal and treasury still needed to start. Working with this fixed go live we had to make sure we could receive payments from day 1 onward. In one country we were actually live on day -1 with no room for error. Stressful but successful.

As a consultant I sometimes face tight deadlines or difficult projects that need to be delivered but are dependent on other stakeholders. That is not always easy but this gives me energy to make it happen.

You can go fast on your own but you go far together. Sounds cliché but it is especially true in treasury as the treasury department is dependent on data from other departments to make it function. You cannot run risk analysis if you have no exposure data. Same for FX. Doing cash flow forecasting? You need data from procurement, AR and FP&A.

Also visibility and transparency is key. Even the other financial departments accounting and controlling sometimes see treasury as this special people that they have no idea what they are exactly doing. Make sure they understand (and vice versa) what each department does and how you can work together and what data can be shared. Also to avoid duplicating work. So leave the ivory tower and go out there and collaborate.

The speed and amount of information has increased and is increasing. Also the complexity of treasury departments. Luckily also the solutions available to manage them has improved. Next to swift solutions we now see advanced TMS solutions or payment hubs that can be implemented within a couple of months giving you full visibility. A treasurer nowadays needs some tech skills to be able to understand the information to implement the TMS or hub. Because the tool will be only be as good as it is being used; garbage in is garbage out. During the many implementations that I have done I have learned a lot about technical connections (sFTP, h2h, API), information exchange formats, XML file types, swift messages etc. This knowledge now helps me a lot in implementations and supporting the IT department determining the information needs and sources.

Instant payments are a big thing in treasury which is cool but will not necessarily bring much added value to the treasury. Instant information processing is more important especially in e-commerce. Clients expects instant service. If they pay online they expect to get the service or goods asap. Treasury can help with this by connecting their PSP’s or bank information to their systems. Not necessarily linking the payment to an invoice which is an accounting reconciliation process. More importantly linking the positive acknowledgment (the customers has paid) to the sales. Customers start demanding this more and more and treasury has to adapt to this instant world. This means more automation.

Clients also demand more payment options, some of them are not available at banks. This means that treasurers will have to move away from the traditional model of banking partners for cash management but to a more hybrid model of cash at bank, cash in transit at PSP’s, virtual credit cards, wallets etc. Maybe even crypto or CBDC deposits/balances. This will all add to the complexity of the cash and risk management.

Isn’t treasury the best department to be in? 😊 I already get excited saying this.

Get in touch with Patrick

Click here for his Expert Profile

Join Patrick and experts from Kyriba and Deloitte at the Panel Discussion: How Can Treasurers Overcome Today’s Security Challenges?

When? March 9

Start: 4.00 pm CET

Thanks for reading!

Kendra Keydeniers

Director Community & Partners, treasuryXL

23-02-2022 | Eurofinance | treasuryXL |

If your company operates in Africa or is thinking about it, then join us at Effective Finance & Treasury in Africa on March 23rd in London. Now in its 9th year, this intimate event brings together more than 150 senior corporate treasury professionals from leading multinationals – all involved in markets across the continent.

With peer-to-peer learning and knowledge-sharing more important than ever before, join other treasury leaders to debate the key issues, share success stories and gain practical guidance on how to overcome your shared challenges.

From treasury technology to managing liquidity risks, financing strategies, FX, payments and more, the concise 1 day agenda will provide all the information you need to redesign your treasury operations for cost and efficiency, power innovation and support business growth.

Speakers include:

Jan Beukes, Group treasurer, MultiChoice Group Ltd

Omofolake Fawibe, Head of finance, IBS, Danone SA

Ricky Brink, Treasury professional, Siemens SA

Titus Owoeye, Head finance, Fan Milk West Africa

Gain all the tools you need to succeed in Africa in 2022 and beyond.

| 20-2-2017 | Boudewijn Schenkels | Sponsored content |

At the end of last year the SEPA Instant Payments requirements from the European Payments Council have been published. Consequently the Dutch requirements 3.0 from the Dutch Payments Association were published last month.

At the end of last year the SEPA Instant Payments requirements from the European Payments Council have been published. Consequently the Dutch requirements 3.0 from the Dutch Payments Association were published last month.

SEPA Instants Payments (also called SCT Inst – SEPA Credit Transfer Instant) will allow sending and receiving money 24/7 in seconds. European banking communities can go live from November 2017, the Dutch community has planned to go live from May 2019 with the first Instant Payments services. The development of the SEPA Instant Payments infrastructures of the banks and processors are in train. In april 2018 the start of the inter-CSM testing is planned, the end-to-end bank tests and the pilot phase from January until April 2019.

From our Instant Payments training classes for business professionals and IT staff, we find that participants are not fully aware of the large impact Instant Payments will have on the complete value chain and the opportunities it will bring. In order for you to understand the impact and opportunities, I will explain how Instant Payments are processed.

To give an impression of all the change aspects for users, the banks and the interbank processing side:

As the launch dates come nearer it certainly triggers managers to now thoroughly evaluate scope and time scales for (required) internal projects and ensure to be ready and steady before launch in 2019 as well as business professionals to anticipate and grasp the potential opportunities.

The key differences between the current SEPA Credit Transfer and the new SCT Inst scheme are:

In our training, we also explain the differences between the normal payment flow (SCT) and the Instant Payments flow (SCT Inst). The process flow is described below in summary and will take place in several seconds.

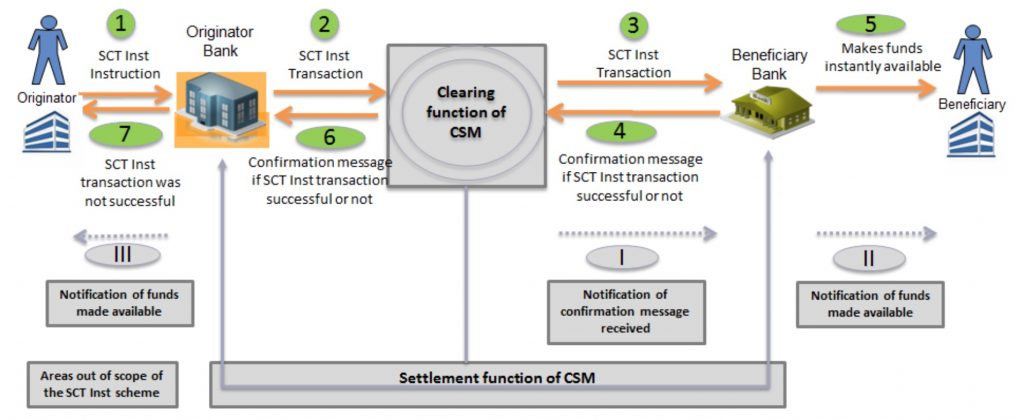

Figure 1. (Source: EPC Rulebook)

Several key actors are involved in the payments process:

The Originator Bank receives an SCT Inst Instruction from the Originator (Step 1). It verifies the instruction and sends the transaction to the CSM (Step 2), which verifies the message, ensures that the Originator bank has enough funds and instantly sends the SCT Inst Transaction message to the Beneficiary Bank. The Beneficiary Bank instantly verifies the payments and if it can be booked on the account of the Beneficiary (Step 3). The Beneficiary Bank confirms to the CSM if it was successful (positive confirmation) or not (negative confirmation with an immediate Reject) (Step 4). The Beneficiary can withdraw the funds (Step 5) instantly if in the previous step the confirmation was positive (and after the Beneficiary Bank has ensured that the CSM received the positive confirmation message). The CSM instantly reports to the Originator Bank if the SCT Inst Transaction had been successful (or not) (Step 6). In case the Originator Bank receives a negative confirmation about the SCT Inst transaction which indicates that the funds had not been made available to the beneficiary, the originator bank is obliged to immediately inform the originator (Step 7) and lift the reservation of the amount made in step 1.

This all means, that beside the flow of money, there is also a flow of messages between the customer and the bank. Both Beneficiary and Originator will be informed (in a few seconds) that the transaction is done (or not).

Are you interested in what the new SEPA Instant Payment will mean for your organization?

Come to our next open training (March 15 in Utrecht) or inquire about the possibilities of an in-house training.

More information at: www.paymentsadvisorygroup.com.

If you have any questions please contact us via: [email protected] .

Senior Consultant Payments @ Payments Advisory Group

16-02-2022 | treasuryXL | Nomentia | LinkedIn |

While the show must go on and treasury and finance teams had a busy life at the start of the year, it’s time to take a look at the ever rapidly changing cash management trends of 2022.

While PWC has predicted that the top priorities for CFOs in 2022 will be advanced cash and liquidity management, technology and digital innovation, fraud and cybersecurity, and business partnering, we also internally discussed what trends we see emerging during the new year.

A year ago, this time, we commissioned a Forrester study, ‘Successful Businesses Excel At Cash Management’, to discover how top decision-makers see the state of cash management. We were ready for some interesting findings but what we found was even more interesting than what we expected.

Clearly, during the past years, a lot has changed as finance and treasury teams had to adjust to the new reality that the global pandemic has brought on all of us. While digitalization has been on the agenda of everybody for some time, it’s been time to speed up the transformation.

While the digital transformation has started in many enterprises already years ago, the work continues to reap the benefits of cloud-based cash and treasury management technology to improve organizational flexibility, cash management processes, and security.

Better digitalized processes do not only make the life of employees easier, but companies can also untap hidden cash, inject accurate forecasting into decision making while improving their day-to-day treasury and finance operations with automation.

While last year enabling home working and ensuring business continuity was a significant driver, for sure, we are moving towards a world where the next items on the cash management wish list will climb up the priority ladder.

Payments are the core of every business process, but compliance is often the main driver for many to improve existing processes. It’s often the same when companies adopt a payment tool for their global payments to improve the efficiency of their global B2B payments. Having a single tool allows more control over how payments are processed, approved, and released to the banks.

Payment efficiency is also the first step for many other cash management priorities, such as better liquidity management and cash visibility

In the process of setting up a payment solution, the hardest part of working with ERPs, existing TMS, and multiple banks is also tackled and can be utilized for implementing new solutions along the way.

Adapting a tool for payment tool can also make centralized user rights management easier.

When we are talking about payments, we must discuss security. During last year, financial fraud cases have been making headlines globally. For compliance, organizations must have the basic security measures in place, but finance and treasury are departments that need more advanced risk mitigation capabilities to tackle financial crime and fraudulent attempts to safeguard the company’s funds and financial stability. To tackle security concerns, partnering up with the information security team and finding the right vendors can provide you with the necessary precautions.

Companies are starting to utilize artificial intelligence and machine learning for catching suspicious fraudulent activity or to spot manual errors.

As all companies could be subject to financial crime, investing in fraud prevention should be a no-brainer. It’s almost like insurance for minimizing the risk of an actual incident.

You will rarely meet someone that would say that bank connectivity is not a challenge. Yet, it’s something that everybody must have in place. In the Forrester study, 76% of the respondents believed that bank connectivity for fetching statements and intraday material is valuable for their treasury and cash management activities.

Connecting to banks is a challenge due to the different communication protocols and file formats. When banks make changes on their end, the existing connectivity should reflect on that too.

This is only part of the challenge. On the other end, there should be a connection to ERP systems (like SAP or other) or to a TMS to fetch all the accounts payable data instantly. This requires working with another communication protocol and another data format.

Between the two different data formats, there must be a data mapping to make sure that the communication between the bank and the organization works flawlessly.

It is challenging enough to set up a bank connection with a single bank. Imagine doing this process with multiple banks

That’s why most organizations are opting for bank connectivity as a service where companies like Nomentia have already over 10 800 bank connections established and expertise to take care of the rest.

Ps.: We have also created a cool video on how easy it can be to outsource the management of your bank connections:

Let’s be honest, cash forecasting with excel is challenging:

Two of the main reasons that are holding back companies from purchasing a solution for liquidity management is the cost and the perception that it’s easy to create cash flow forecasts with spreadsheets and that is how it’s been always done. However, the trend is shifting and more companies start to realize that an actual liquidity management tool would have more benefits.

Using a tool for liquidity makes collecting forecasts and actuals automated and the data can be collected from multiple source systems to help to understand the organization’s current, past, and future liquidity positions to optimize cash flows and FX positions to optimize internal and external funding.

Liquidity management software today is extremely user-friendly and intuitive to use so that users can create reports easily to create accurate reports.

Comparing bank statements against your accounting to make sure the amounts match each other is not too difficult for small firms where their clients and cash flows come from fewer sources and banks. In enterprises, reconciliation may not be so straightforward. In our Forrester survey, 61% of decision-makers say it’s challenging or very challenging to reconcile payments.

Thus, we expect that automation of the reconciliation process will be the star of 2022 so that organizations can streamline the process for faster month-end closing.

According to finance executives, the lack of alignment is the top barrier to better cash management. This is something that at Nomentia we’ve been experiencing firsthand. In a recent interview with TMI, Jukka Sallinen, Nomentia’s CEO said the following:

“Lack of collaboration between different functions within the organization is one of the significant hurdles. There should be more roadmapping and alignment between treasury, finance, and IT. Many solutions provided by software vendors have grown into do-it-all monolithic systems. That, unfortunately, often leads them to be mediocre at best and none of the three departments is entirely happy to work with them. In addition, while there has been lots of talk about open banking and standardization to improve the efficiency of cash management processes, most of these promises have remained unfulfilled.

I believe treasurers want more flexible and fast solutions that can solve their specific challenges and integrate well with their core treasury management system (TMS) and other systems. While it is obviously everyone’s responsibility to look at the big picture, maintaining the growing number of systems and surveying the providers’ landscape is often left to IT. Greater collaboration would be preferable.”

Setting up new solutions, bank connections, or improving security requires cooperation between the different stakeholders and in 2022 they will need to strengthen their alliance for actualizing the strategic benefits of cash management.

Cash management solutions becoming more accessible for businesses of all sizes. As it’s time to digitalize treasury and finance, there are affordable options available for anybody for all the solutions mentioned above. A payment factory, liquidity management, or reconciliation can be easily implemented for a fair price tag in almost any business. The trend has been moving from one-size-fits-all solutions to a hyper-modular approach: you take the solution that you need and integrate it into your existing solution stack so that you can pick the best solutions from different vendors.

Of course, implementation of new cash management solutions will require cooperation and alignment between different departments, prioritization, as well as finding the right strategic vendor that can support the organization’s finance and treasury roadmap.

08-02-2022 | treasuryXL | LinkedIn |

treasuryXL announces the launch of the Treasurer Test 2.0, the new version of the assessment tool for Corporate Treasurers.

01-02-2022 | treasuryXL | Nomentia | LinkedIn |

Microsoft Azure customers worldwide now gain access to Nomentia to take advantage of the scalability, reliability and agility of Azure to drive application development and shape business strategies.

HELSINKI, Finland — February 1, 2022 — Nomentia, a leading European provider of cash and treasury management solutions, today announced the availability of Nomentia Bank Connectivity as a Service in the Microsoft Azure Marketplace, an online store providing applications and services for use on Azure. Nomentia customers can now take advantage of the productive and trusted Azure cloud platform, with streamlined deployment and management.

“Adding Nomentia to Microsoft Azure Marketplace will help IT departments achieve desired connectivity between banks and internal systems, faster than ever before” Anna-Lisa Natchev, Chief Growth Officer of Nomentia

“Nomentia is addressing some of the major challenges treasury, finance and IT teams are facing during the digitalization and transformation of treasury and finance processes. We not only take care of ERP integrations, but also offer unrivaled bank connectivity-as-a-service across the market. Adding Nomentia to Microsoft Azure Marketplace will help IT departments achieve desired connectivity between banks and internal systems, faster than ever before. Using Nomentia’s bank connectivity-as-a-service can significantly reduce IT burden and ensure treasury and finance departments can start building better processes to improve operations, data output quality, security and compliance assurance,” says Anna-Lisa Natchev, Chief Growth Officer of Nomentia.

“Through Microsoft Azure Marketplace, customers around the world can easily find, buy, and deploy partner solutions they can trust, all certified and optimized to run on Azure,” said Jake Zborowski, General Manager, Microsoft Azure Platform at Microsoft Corp. “We’re happy to welcome Nomentia’s solution to the growing Azure Marketplace ecosystem.”

The Azure Marketplace is an online market for buying and selling cloud solutions certified to run on Azure. The Azure Marketplace helps connect companies seeking innovative, cloud-based solutions with partners who have developed solutions that are ready to use.

About Nomentia

Nomentia is a category leader within European treasury and cash management solutions. Nomentia’s mission is to provide unparalleled cloud treasury and cash management solutions for and with our customers. Today, Nomentia is solving the challenges of modern treasurers and cash managers across 2,000+ businesses in over 80 countries, processing more than 800 billion euros annually. Nomentia solutions specialize in global payments, bank connectivity-as-service, cash-forecasting and visibility, bank account management, financial process automation, treasury workflows, FX risk, in-house banking, and trade finance. For more information, visit www.nomentia.com.

For more information, press only:

Anna-Lisa Natchev, Nomentia, Chief Growth Officer, +358 50 413 0704, [email protected]

Barbara Babati, Nomentia, Head of Marketing, +358 40 762 3356, [email protected]

24-01-2022 | treasuryXL | Nomentia |

Date & time: January 27, 2022 at 12:00-12:45 PM CET/ 13:00-13:45 EET | Duration 45 minutes

Nomentia has been the market-leading solution provider in the Nordics for global payment and cash flow forecasting solutions. Finally, our solutions are now available for you in the Benelux in French and Dutch besides English.

In this webinar, we will introduce our Payment module for global, centralized management of B2B payments, the anomaly detection add-on for tackling fraud and errors, cash forecasting & visibility, as well as bank connectivity as a service.

At the end of the webinar, we’ll have time for a short Q&A session to answer your questions.

Click on the banner for registration.

05-01-2021| treasuryXL | marcus evans |

Management of credit risk and models are a top priority for banks.

Amsterdam, Netherlands | Option to attend virtually

21-23 February, 2022 | 08:30 CET

Methodologies to review and refine credit risk models incorporating Basel IV, IRFS9, IRB, climate risk and stress testing regulation

Credit risk modelling and management is an ongoing priority for the banking industry. The true impact of COVID-19 on credit risk is not yet clear. During the pandemic governments across Europe injected a lot of cash into the banking system to support companies and individuals and even though this helped to minimize bankruptcies and defaults, the real economic impact has been masked. Moreover, credit risk models have been tested to the extreme and IFRS 9 models were no exception. If anything surfaced out of this situation for banks, is the need to uncover alternative credit modelling techniques which can help models perform better in various crises scenarios.

The marcus evans 9th Annual Credit Risk Modelling and Management in a post-pandemic environment conference, taking place in Amsterdam, Netherlands and virtually, on 21-23 February, 2022, will provide risk modellers much needed knowledge to improve existing credit risk modelling techniques to make accurate predictions and maintain profitability. Banks will be able to compare and contrast lessons learnt during the pandemic as well as pinpoint key challenges and priorities faced by credit risk modelling managers. Comprehensive solutions regarding modelling techniques, regulatory compliance, climate risk, stress testing and data management will also be offered.

Attending This Premier marcus evans Conference Will Enable You to:

Best Practices and Case Studies from:

Special discounts available to Treasury XL subscribers! For more information please contact: Ria Kiayia, Digital Media and PR Marketing Executive at [email protected] or visit: https://bit.ly/3pTHs6p