Uncovering the benefits of a multicurrency world

03-02-2023 | treasuryXL | Kantox | LinkedIn |

We’re living in a multicurrency world and we’re multicurrency treasurers. You can get a head start on your competitors by simply understanding the benefits of operating with multiple currencies. Start leveraging the multicurrency world we’re in.

Disclaimer: This information is being shared for informational purposes only and was originally published by Kantox (Source)

With so many benefits to operating with the different foreign currencies out there, it is crazy to think that some companies are not taking advantage of this.

In this week’s episode of CurrencyCast we discussed why businesses should consider implementing a multicurrency approach to their FX risk strategy. This article will take a deeper dive into the benefits and give you some insight into how to be a more strategic treasurer.

Why we are in a multi-currency world

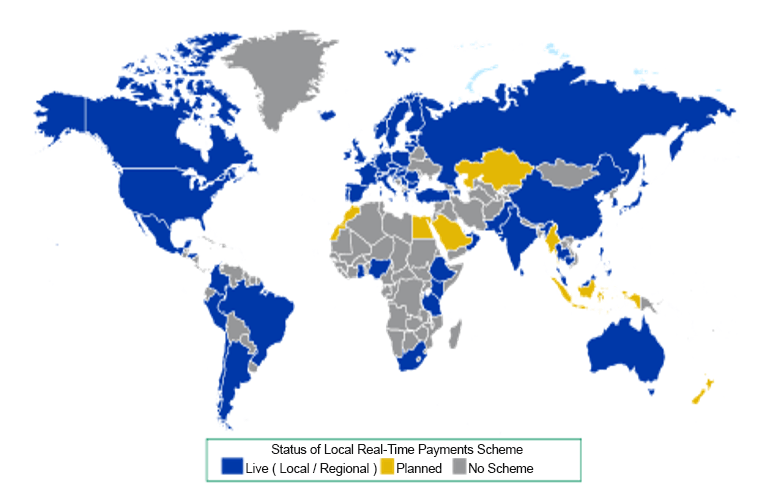

In this episode, we analyse a development that many find surprising, but that stands at the core of our thinking at Kantox: the multi-currency world. The prevailing view of a world dominated by a handful of currencies like the dollar and the euro is being challenged as we speak.

We’ll reveal how you can take advantage of the benefits that lie ahead in this multi-currency world and contribute to enhancing your profit margins.

How is technology pushing forward a multi-currency world

The currencies of a number of small, but well-managed economies (together with the natural rise of CNY) are gaining in importance: SEK, NOK, CAD, AUD, NZD, SGD and KRW among others.

The change is not driven in a top-down manner by macroeconomic forces. Instead, it reflects a bottom-up and microeconomic phenomenon, made possible by technology.

Today’s multi-currency world is mostly driven by corporate treasurers taking advantage of Multi Dealer Platforms such as 360T. These platforms have led to a dramatic compression of spreads, increasing liquidity beyond the major currency pairs and reducing the network effects of the USD.

For example, whereas a CAD-MXN transaction used to require two trades involving USD and CAD on the one hand, and USD and MXN on the other, now CAD-MXN can be directly and competitively traded on Multi-Dealer Platforms.

Advantages of the multi-currency world

Back to the issue of the multi-currency world. Let me mention some of the benefits of selling in more currencies (we discussed the advantages on the contracting side earlier on):

- FX markups. With multi-currency pricing, businesses can monetise existing FX markups.

- High-margin sales. Companies can drive direct, high-margin sales on company websites with many different payment methods.

- Reduced cart abandonment. Online businesses can deploy multi-currency pricing as their secret weapon to reduce cart abandonment.

Let’s take this example if you are a company operating with imports from a foreign country there could be some hesitation regarding whether to work with the local currency or not. In certain cases, using the local currency translates into better deals from a commercial perspective, as FX markups from suppliers are avoided. Also, firms get access to a wider range of suppliers.

From a liquidity management perspective, you may benefit from extended paying terms as well giving you more runway to finalise your sales. Finally, from a strictly financial perspective, there could be a wider forward discount of currency pairs which is a way to generate more positive forward points when hedging.

A strategic issue in the age of innovation

By taking FX risk out of the picture, you put your business in a position to confidently use more currencies in day-to-day operations. Additionally, if you then implement the best automation solution that will help you remove time-consuming and error-prone tasks, you could have a strong currency management strategy that becomes a great strategic asset.

On top of that, there are other bonuses to implementing technology:

- Optimisation of interest rate differentials between currencies

- More time to devote to value-adding tasks

- Openness to further automation

Wrap up

Now you know all the benefits of a multicurrency world for currency managers. By empowering commercial teams to always buy and sell in the most profitable currency, the finance team acts as a strategic business enabler within the enterprise. That is the promise of the multi-currency world that is taking shape as we speak.

You are now prepared to face the future of currency management and reap all the benefits of the multiple currencies available. But to keep the ball rolling and make the most of foreign currencies, you need a tool that allows you to have full control of your FX exposure.

That’s why Kantox offers a unique currency management automation solution that enables treasurers and CFOs like you to optimise your FX workflow. Talk with our currency management experts and find out how today.