How to fix a problem like “IBOR”

| 22-01-2018 | treasuryXL |

In the last year both the ECB in regard of EURIBOR and the FCA in London in regard of LIBOR have come to the same conclusion – the fixing of interest rate indices can not carry on in their present form. The current benchmarks are tainted by allegations of fraud and malpractice. Furthermore, the way that the rates are determined are also criticized – no actual transactions take place at the fixing price when the fix is made daily. But the big problem is that these fixings are intrinsically linked to financial contracts with values measured in 100 of trillions of EUR, USD, GBP etc.

In the last year both the ECB in regard of EURIBOR and the FCA in London in regard of LIBOR have come to the same conclusion – the fixing of interest rate indices can not carry on in their present form. The current benchmarks are tainted by allegations of fraud and malpractice. Furthermore, the way that the rates are determined are also criticized – no actual transactions take place at the fixing price when the fix is made daily. But the big problem is that these fixings are intrinsically linked to financial contracts with values measured in 100 of trillions of EUR, USD, GBP etc.

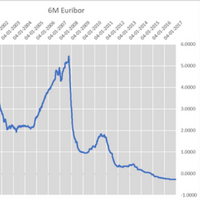

The underlying financial products are not just derivatives – IBOR’s are also used to price floating rate loans, mortgages etc. The major problem beyond the fraud aspect is that the rates are supposed to express the interbank floating rates for various tenors. But with liquidity being very sparse in the interbank market, and the rates only being voluntary expert judgement of actual trading rates, do the rates truly reflect the cost of borrowing? ECB expects to replace EURIBOR by 2020 and the FCA to replace LIBOR by 2021. But what products can be used to replace IBOR?

Initially it appears that secured overnight rates could be the answer. Trades are reported to the relevant authorities and the transactions are based on secured lending. However, the tenor does not complement the existing fixings and financial products. A traditional EUR interest rate swap consists of an annual fixed coupon against floating 6-month coupons. Using an overnight fixing means that you would not know the 6-month floating rate until the end of the 6-month period.

To get around this problem a market could be used for existing basis spread products. As stated an overnight rate relates to secure, risk free transactions whereas IBOR relate to unsecure transactions. This means that with IBOR credit risk is built into the price. Certain additional products could be used to take an overnight rate fix to a 6-month fix – namely basis swaps. But who would supply the prices for basis swaps – the same banks who have been accused of fraud in the current IBOR process.

Another alternative is constructing the fixing from repo transaction with different tenors. But repo’s are sensitive to the credit risk of the collateral issuer. This means trading on the basis of Specials – clearly defined and named collateral issuers. With all the QE that is taking place there is an alarming shortage of high-quality government back paper that is in the free market that the very scarcity would lead to irregular pricing.

So whilst authorities have clearly stated that interest rate fixings can not carry on in their present form, they have yet to offer a valid alternative. In the meantime, contracts measured in 100 of trillions will need to be adjusted for the new method for fixings. The only people who will welcome these changes are the legal profession who get to redesign “all” the existing contracts.

Lionel Pavey – Cash Management and Treasury Specialist

Lionel Pavey – Cash Management and Treasury Specialist

[button url=”https://www.treasuryxl.com/community/experts/lionel-pavey/” text=”View expert profile” size=”small” type=”primary” icon=”” external=”1″]

[separator type=”” size=”” icon=””]