Eurozone economic prospect – Goldilocks meets the bears?

| 12-12-2017 | treasuryXL |

The markets and the ECB feel that the economy is doing very well. It can be compared to Goldilocks – not too hot and not too cold. Is it possible that the Eurozone could be entering a period of continued growth with little or no immediate prospect for rising inflation? A quick scan of the relevant markets would appear to suggest that it is possible. Let us examine where the markets are now.

The markets and the ECB feel that the economy is doing very well. It can be compared to Goldilocks – not too hot and not too cold. Is it possible that the Eurozone could be entering a period of continued growth with little or no immediate prospect for rising inflation? A quick scan of the relevant markets would appear to suggest that it is possible. Let us examine where the markets are now.

Long term Interest rates

Long term interest rates have been in a downward channel since the summer of 2008. 10-year EUR interest rate swaps (an acceptable benchmark) peaked just above 5% in 2008 before falling and steadying around 2% towards the autumn of 2013. After a period of relative calm, the rates continued their descent to a bottom of 0.25% around 15 months ago. Over the last 3 years, 10-year EUR interest rate swaps have averaged a yield of just 0.75% – now the yield is 0.80%.

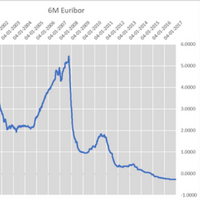

Short term interest rates

3-month Euribor turned negative in April 2015 and has remained negative. Over the last 3 years, the yield has averaged -/- 0.20% – now the yield is -/- 0.33%. 3-month Euribor futures imply that the rate will remain negative until March 2020 and, will rise to just 0.75% by September 2022.

Economic indicators

Unemployment falling to 9.6% in 2017; 9.1% in 2018

GDP growing by 1.6% in 2017; 1.8% in 2018

Government debt to GDP ratio falling to 90.4% in 2017, 89.2% in 2018

Average maturity for new government debt extending to 13 years in 2017; 9 years in 2007

So, what could happen to trigger a reversal in this sentiment?

Share prices are rising – AEX index is up almost 15% since the start of the year

House prices are rising – in the Netherlands prices have increased by 8% over the last year. Turnover is greater with 14% more homes sold than last year.

Global debt is rising – about EUR 190 trillion. This amounts to more than 300% of the world’s annual economic output. (source IIF report)

Interest coverage ratios (ICR) are deteriorating worldwide – in Europe specifically in Germany and France. (source IIF report) This, even though interest rates are low.

Balance sheet of central banks are dangerously expanded – result of Quantitative Easing.

Historical low interest rates – leading to underestimation of risks.

Political change – a rise in “populist” parties in many countries reflecting disenchanted voters

So, what about Goldilocks?

The dilemma for the ECB is that the Eurozone has, essentially, become 2 blocs – the North and the South. In the North, with increases in house prices and stock markets, and drops in unemployment; a rise in interest rates would not be deemed to be negative. However, in the South, the recovery is far behind and they welcome every form of stimulus to aid their economies.

And the moral of story – how your actions/inactions may affect others.

And remember who chased Goldilocks away – the bears (markets!)

If you want more information please feel free to contact us via email [email protected]