As mentioned in the previous article, setting up a Zero Balance Cash Pool at the cash management bank involves mainly lots of bank documentation (and setting technical parameters). All documentation will require that every participating bank account is duly signed by the account holder approving that the relevant bank accounts are going to participate in the Zero Balance Cash Pool. The bigger the pool of participating account holders, the bigger the logistic challenge to collect all signatures within a reasonable time.

To overcome this, a good suggestion is to have all account holders sign off on a Power of Attorney for the Treasurer (or the Treasury project leader) to sign all bank documentation on behalf of the account holders. This will significantly improve the logistics of the Zero Balance Cash Pool implementation project.

Determining the Location of the In-House Bank

The location of the In-House Bank and the Zero Balance Cash Pool is one of the first topics that need to be resolved before establishing an IHB structure. Most large International Cash Management Banks offer multiple locations to host the Cash Pool Master accounts. Your legal and fiscal structure will need to give guidance to you where you want/need to build your In-House Bank structure. Hence, your tax advisor will play an important (if not leading) role in this decision. Also, a number of countries require a certain substance and professionalism of the people managing and operating the In-House Bank. You can not have your IHB management outsourced to a third party and have the janitor and the cleaning lady registered as the management of the IHB. Based on fiscal regulations in some countries (e.g. The Netherlands and the UK) your staff operating and managing the IHB are required to be matter experts and financially trained. Also, some countries require the executive management of the IHB to be “independent” and require a certain quota of domestic statutory directors.

There is no requirement to have the location of the IHB structure to coincide with the country where the treasury staff managing and operating the IHB are based. You can have e.g. your IHB legally sitting in the UK, while your treasury staff is based out of The Netherlands.

Building the Internal Interest Rate Philosophy

As part of the Zero Balance Cash Pool implementation project, it is advised to put at the beginning of the project a topic to build a philosophy on the structure of the internal interest renumeration.

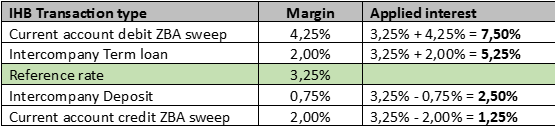

In previous articles from this series, I have been discussing how an interest structure from a commercial bank is set up and how that translates to an interest structure for an In-House Bank. Key in this is to understand the general relationship between reference rate versus current account interest margin and Term loan interest margin. But also, that the margin distance between debit and credit for an IHB is less “competitive” than the margin distance at a commercial bank.

Parts to include in the internal interest rate philosophy are:

- The Reference rate.

For a company that is significantly financed externally, it makes sense to use the average interest rate coming from the syndicated financing. For a company that is not significantly financed externally it makes sense to use an Overnight-IBOR (Inter Bank Offering Rate) for the relevant currency cash pool, as well as the relevant IBOR for intercompany Term loans (e.g. a 6-month Euribor for a 6-month intercompany EUR Term loan.

Any other reference rate that can by satisfactorily justified can also be applied. The key is that it can be justified to any local tax authority.

- The margin applied.

The debit (surcharge) margin and credit (deduction) margin will need to be aligned with the type of transaction. Sweeps from a Zero Balance Cash Pool are considered current account transactions. Therefore, the margin should have a current account profile. This means that the credit margin as applied in the “assets & liabilities” ledger of the IHB is lower than the credit margin as applied to intercompany deposits. Also, the debit margin as applied in the “assets & liabilities” ledger of the IHB is significantly higher than the debit margin as applied to intercompany Term loans

Below sample table is based on a EUR reference rate from October 2024. The margins are illustrative but show clearly what the general relationship is between reference rate versus current account interest margin and Term loan/deposit interest margin.

Verifying the table against margins as applied by commercial banks, you will find out that the margins at commercial banks have a much bigger distance from the reference rate; in particular, current account margins at commercial banks are significantly bigger (e.g. credit margin is usually minus 3% and debit margin is usually in the range of plus 14%). As mentioned before in the previous article, the margin philosophy of a commercial bank is their business model; for an IHB the margin philosophy is a sophisticated cash management tool (mainly to adhere to OESD BEPS regulations).

Balancing Risk with Margin Adjustments

- The subsidiary’s balance sheet impacts the level of the applied margin.

Similar to a commercial bank, the treasury will need to do a risk assessment of the balance sheet of all participants in the Zero Balance Cash Pool to ensure interest rates are aligned with OESD BEPS regulations. A practical suggestion is to define a limited number of balance sheet classifications (such as A = “investment grade”, B = “normal grade”, C = “on the watch grade” and D = “junk grade”). Each balance sheet classification will generate a small uplift or reduction to the applied standard matrix of interest rates for IHB transactions. The rationale behind this is that a subsidiary with a risky balance sheet will need to pay more for any kind of lending, and vice versa a subsidiary with an “investment grade” balance sheet will pay less. The small uplift or reduction to the applied standard matrix can be in the range 5 to 10 basis points.

Periodically (e.g. once a year) Treasury together with Tax and Controlling run a risk review of the balance sheet of every subsidiary. Based on the risk review each subsidiary will be labeled as per the balance sheet classifications and will receive an interest rate margin uplift or reduction as per the applied classification. The classification (and the applied margin uplift or reduction) will remain till the next review period.

Supporting Zero Balance Cash Pool with a TMS

- Managing an extended and complex Zero Balance Cash Pool with an In-House Bank function will benefit when being supported by a Treasury Management System (TMS). Most contemporary TMSs support in their own way the In-House Bank function that comes with a Zero Balance Cash Pool, the internal financing philosophy en the applied interest rate philosophy. Furthermore, a TMS will give insight into the total daily cash position, both for the Cash Pool and for non-Cash Pool participant’s bank accounts. In addition, a number of professional TMSs have extended functionality to centrally execute operational payments. This will give the Treasurer more control over the cash in the company.

Not relevant for this article, but worth mentioning is that professional TMSs have comprehensive functionalities to manage the intercompany loan portfolio and to manage the FX portfolio.

Importance of a Cash Management Agreement

- An important topic that gets undeserved attention when setting up an In-House Bank with a Zero Balance Cash Pool is the so-called Cash Management Agreement. With an agreement like that the Treasury establishes the services and pricing that is being offered by Treasury to every individual participating subsidiary. Local tax authorities will also value the importance of such agreements as it will enable them to test compliance with Transfer Pricing regulations. After all, similar to a commercial bank the In-House Bank will need to agree on various services and prices the IHB is offering to the participating subsidiaries. The Cash Management Agreement(s) is an integral part of the setup of the In-House Bank and its applied philosophy. Not having such an agreement with the participating subsidiaries will trigger local tax authorities to scrutinize an IHB with a Cash Pool Structure (with potential financial consequences as a result).

It is advised to use special and dedicated legal advice to draft such a Cash Management Agreement, tailored to the specific In-House Bank with the individual Cash Pool structure.

Expanding the In-House Bank Functionality

- Once an In-House Bank has been set u, additional services can be added to the IHB concept. It is worth looking into the way intercompany transactions are being settled. Instead of settling intercompany payments through the external bank accounts, of settling through an intercompany netting system, you can set up an IHB as an additional bank in the bank master database of your ERP. This will require a one-time technical setup to your ERP to build a direct link between the ERP and the IHB (using the TMS). This will allow any intercompany payment to be settled directly on the IHB, debiting the paying subsidiary’s IHB account and crediting the receiving subsidiary’s IHB account. The settlement is globally instant without any external banking fees.

Other additional services can be Payments On Behalf Of (POBO) or Receivables On Behalf Of (ROBO).

By Paul Buck