- Unilever: 2023 Adam Smith & EuroFinance Award Winners

- Siemens Gamesa: 2023 Global Finance & EuroFinance Award Winners

- TeamViewer: 2023 Alexander Hamilton (Treasury & Risk) Award Winners

Unilever’s Integrated & Dynamic Cash Flow Forecasting Overhaul

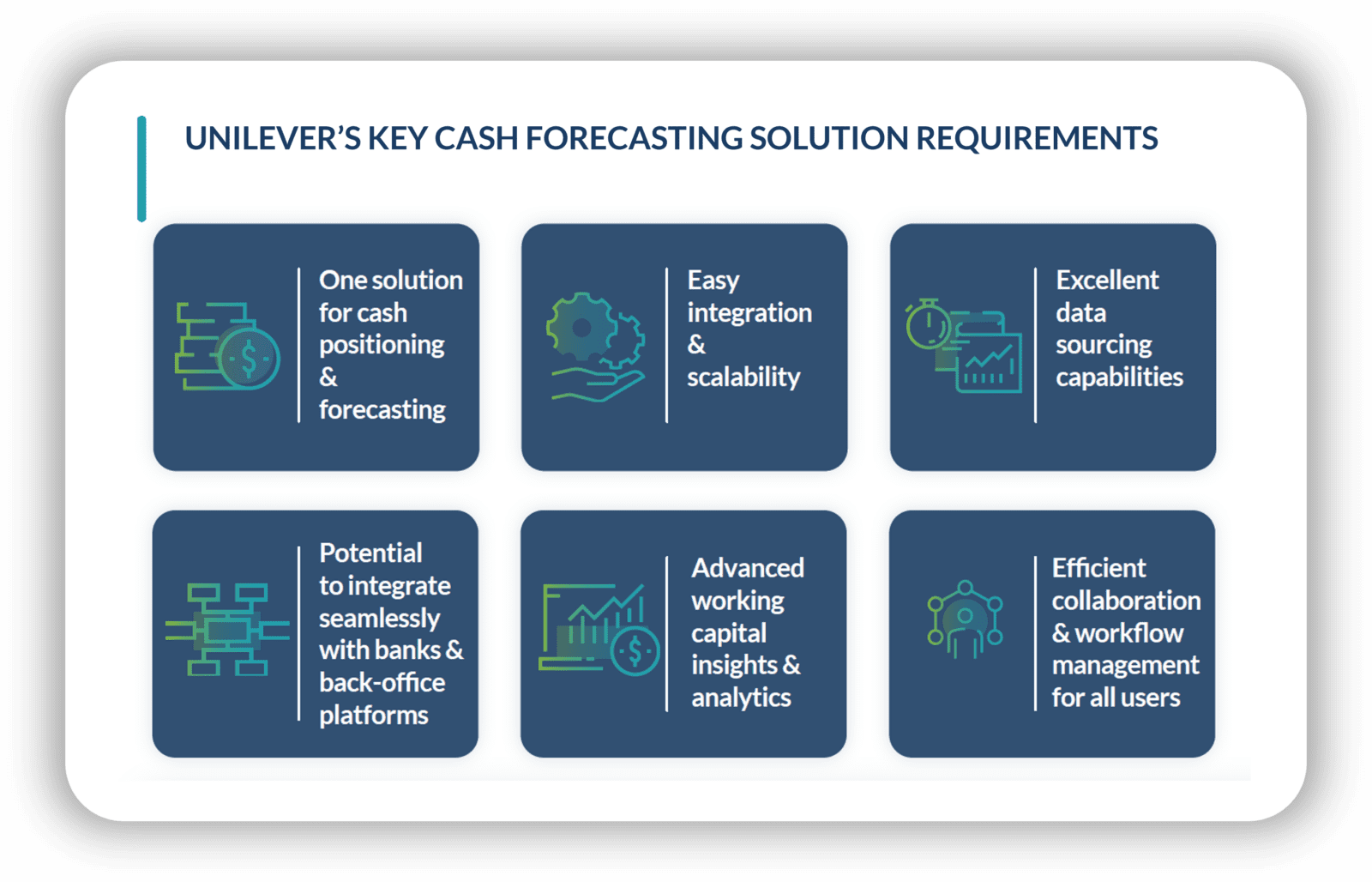

At Unilever, Gerard Tuinenburg – Director of Systems, Innovation, and Banking – was able to overhaul the company’s cash forecasting process and achieve substantial transformation in forecast accuracy and automation. Because Unilever’s former cash forecasting process was cumbersome, slow, and involved a lot of manual work, forecasts were originally focused on countries with high interest rates or where heavy penalties were incurred if bank accounts were overdrawn. To optimize their cash forecasts on a global scale, Gerard and Unilever were looking for a solution capable of efficiently aggregating and analyzing all the information needed from their different data sources, including banks as well as numerous ERP-systems, in an automated way. But, most importantly, Unilever wanted to ensure their new forecasting solution was future-proof and could exist without heavy and ongoing IT projects, as internal bandwidth to maintain the solution would be limited moving forward.

During this project, Gerard and his team worked with a variety of external partners and vendors to effectively harmonize the data landscape across Unilever’s global entities, offices, and back-office systems, which enabled them to better optimize cash and working capital and save millions of dollars. Unilever also boosted their forecast accuracy from 50% to 80%+ on a global scale and reduced the variances to <10% for 30-day forecasts. In large part, Gerard’s implementation of the TIS cash forecasting solution helped simplify data aggregation and classification from Unilever’s multi-ERP and banking environment to refine forecast inputs and improve information quality over time. As a result of their success, Unilever was recognized in the 2023 EuroFinance Awards for “Best Digital Transformation” in cash forecasting. They also received the “Best Cash Forecasting Solution” nomination as part of the 2023 Adam Smith Awards.

Siemens Gamesa’s Global Payments & Bank Connectivity Transformation

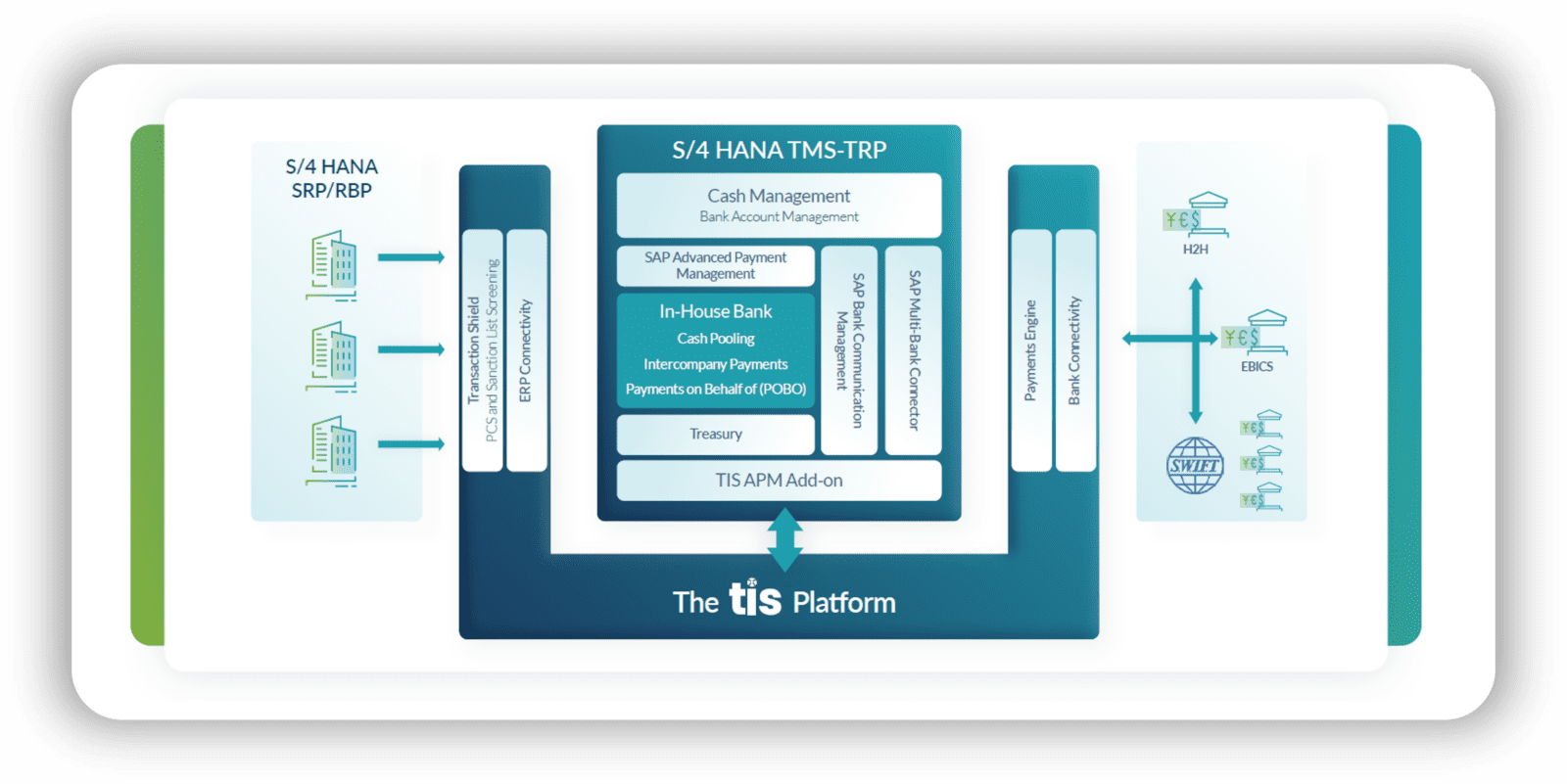

At Siemens Gamesa, the treasury team of Michael Faschang, Head of Treasury Management Systems, has also received two prominent industry awards in 2023. For Siemens Gamesa, both of these awards are centered around the company’s transformational overhaul of global bank connectivity and payments functions. At a high level, their treasury technology project aimed to unify Siemens’ extremely complex and siloed systems landscape on a global scale, across all 235 legal entities and 85 countries. At the same time, Michael and his team wanted to build a new and industry-leading In-house bank based on the latest SAP version, including SAP APM (Advanced Payment Management) as an early adaptor. And while executing these two major projects simultaneously was already very ambitious in itself, progress needed to be achieved within a very tight timeline to avoid breaching a merger agreement and risking penalty fees.

By working with TIS alongside numerous bank partners and ERP personnel, the Siemens Gamesa team was able to quickly and efficiently complete this project on time and within budget, and now maintains 85%+ automation of in-house banking workflows, as well as integrated connectivity with their global ERP and banking environment. This has led to the elimination of ~800 redundant bank accounts, near-100% real-time cash and payments visibility, and much more efficient routing of data and information through TIS to SAP and across the entirety of their back-office environment. As a result of these successes, Michael’s team was recognized for implementing the “Best Treasury Management System” in the 2023 Global Finance Awards, and was also just recognized in the 2023 EuroFinance Awards for “Best Treasury Technology Implementation”.

TeamViewer Achieves Automated & Real-Time Payments & Cash Management

Earlier in 2023, the treasury team at TeamViewer was also recognized for an innovative project spearheaded by Sabine Kießling, Director of Controlling and Treasury. As a rapidly growing company with a global presence, TeamViewer’s widespread expansion created significant challenges for their treasury department. By 2019, TeamViewer’s 2-person treasury team had to manage 10 legal entities, 7 banks, and ~40 individual bank accounts spread across 11 countries. Although 15 of these accounts were managed through a centralized solution, the other 24 accounts had to be accessed via a disparate range of electronic banking systems and portals. This had ultimately resulted in heavily manual workflows and a total lack of automation and visibility across the back-office – particularly where payments and cash were concerned. And with only two employees, the bandwidth for Sabine’s team to manage these operations was stretched painfully thin.

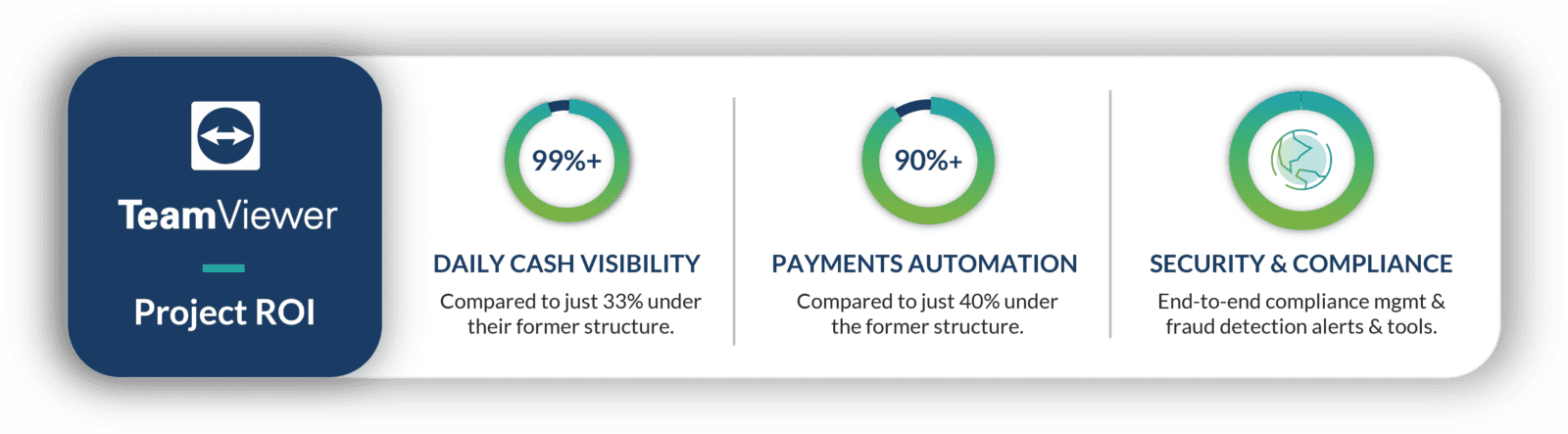

By deploying the TIS cloud platform, TeamViewer was able to completely overhaul their treasury technology landscape and transform the automation, visibility, and control maintained over payments and cash flows. What’s more, their entire project – from the time of their kick-off meeting to the initial go-live of their solution – occurred within the same calendar year. The first rollout included full EBICS connectivity to TeamViewer’s European banks, and in the months that followed, they configured additional H2H and SFTP connections with the rest of TeamViewer’s international institutions through TIS’ unified, cloud-based platform. Additional back-office integrations to TeamViewer’s various entities and systems were included during this phase. As a result, all of Sabine’s major objectives regarding compliance, security, increased efficiency, system unification, workflow automation, and cash visibility were achieved within the timeframe established during the initial planning stage – roughly 7 months.

As a result of the project, TeamViewer went from ~33% daily cash visibility to 96%+ across all their banks and accounts, as well as from ~40% payment workflow automation to 90%+. They also achieved significant standardization of their core payment compliance and security controls, which drastically reduced the risk of systemic fraud and regulatory exposures. Now, TeamViewer has a global payments, connectivity, and cash management solution tailored to their exact needs and that offers a full range of functionalities that improve all stages of their treasury processes. Given the extraordinary accomplishments achieved by Sabine and her team, TeamViewer was recognized in Treasury & Risk’s 2023 Alexander Hamilton Awards as a winner in the category “Treasury Technology Excellence”.

Learn More About the Award-Winning Projects at Each Company

To learn more about the award-winning projects completed by Unilever, Siemens Gamesa, and TeamViewer, you can refer to the below links for more information. To review each company’s success story in the context of their TIS implementation and product deployment, you can refer to the below case study links. For more information about the TIS platform and our suite of cashflow, liquidity, and payment solutions, refer to our solution overview page.

Congratulations again to all the winners, and we cannot wait to see what new benefits and efficiencies are unlocked by our clients in H2 2023 and beyond!

- Unilever EuroFinance Award: Click Here

- Unilever Adam Smith Award: Click Here

- Unilever & TIS Case Study: Click Here

- Siemens Gamesa Global Finance Award: Click Here

- Siemens Gamesa EuroFinance Award: Click Here

- Siemens Gamesa & TIS Case Study: Click Here

- TeamViewer Alexander Hamilton Award: Click Here

- TeamViewer & TIS Case Study: Click Here

About Treasury Intelligence Solutions (TIS)

TIS helps CFOs, Treasurers, and Finance teams transform their global cash flow, liquidity, and payment functions. Since 2010, our award-winning cloud platform and best-in-class service model have empowered the entire office of the CFO to collaborate more effectively and attain maximum efficiency, automation, and control. By streamlining connectivity between our customers’ back-office systems and their worldwide banks, vendors, and business partners, TIS enables users to achieve superior performance in key areas surrounding cash forecasting, working capital, outbound payments, financial messaging, fraud prevention, payment compliance, and more.

With over 11,000 banking options, $80 billion in daily cash managed, and $2.5 trillion in annual transaction volume, TIS has a proven track record of combining our unparalleled market expertise with tailored client and community feedback to drive digital transformation for companies of all sizes and industries. As a result, hundreds of organizations and thousands of practitioners rely on TIS daily to gain strategic advantage, monetize data, improve operational efficiency, and better manage risk.

For more information, visit tispayments.com and begin reimagining your approach to global cash flow, liquidity, and payments.