Short note on interest rate derivatives

16-05-2016 | by Ad van der Plas |

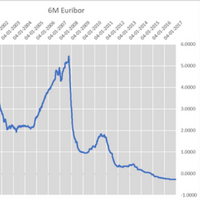

They are often in the news, but what are they and how do they work? Interest rate derivatives are derivatives of the money- and capital markets and are especially designed to give assurance on the interest rate you will have to pay or receive in the future. Best known is the interest rate swap, a swap between the fixed and variable interest rate. All other interest derivatives are calculated on the interest rate swap. How does this swap work?

The interest rate swap is a two party agreement, usually in ISDA model, in which the fixed and variable interest amounts are swapped. The swap period, the fixed and variable (reference) interest rate are defined. The interest is calculated on the agreed notional principal amount and the interest amounts are payable on the payment dates. One party receives the fixed rate amounts and pays the variable rate, and the other party receives the variable rate amounts and pays the fixed rate.

With buying an interest rate swap, you can change the interest rate risk of an underlying loan from an uncertain variable rate to a certain fixed rate. That is….if during the swap period there are no changes in the loan itself. Since you aim to obtain certainty you should be aware of potential uncertainties during the swap period, such as:

- A change of the reference rate in terms of content or effective representation (Libor).

- A change in the interest rate calculation of the loan caused by regulatory changes in the financial markets (Solvency) or due to balance sheet effects of the lending company itself like a liquidity surcharge.

- The lender changes the surcharge because he has revised the credit rate of your company.

- The underlying loan is canceled or restructured.

- The counterparty in the swap agreement requires an additional payment if the swap has a negative value.

- Possible P&L and Balance sheet effects due to changes in the valuation of the swap because of changes in regulations, for example IFRS.

- A different interpretation of the regulations when changing your auditor.

Please also note that the outstanding swap agreements will have effect on your total financing capacity. And finally, a warning: improper use of derivatives can be a big risk. Be sure to have a professional opinion when using derivates.

Ad van der Plas

Independent Treasury Consultant & Interim Manager